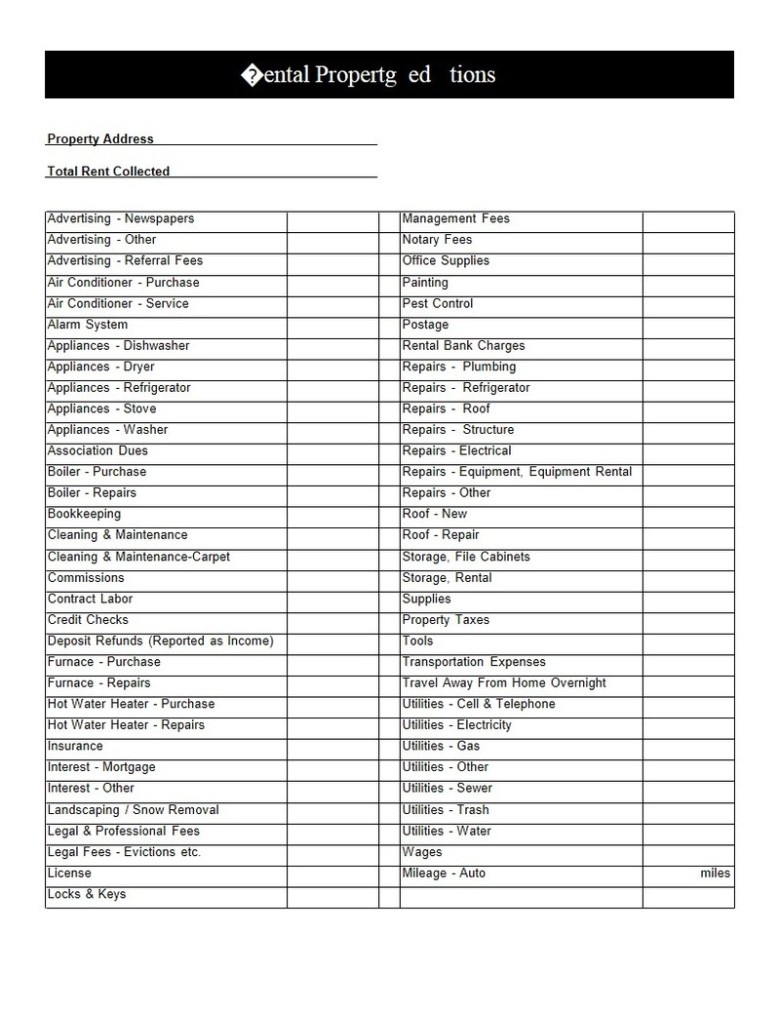

Rental Property Tax Deductions Worksheet - Web the nine most common rental deductions are: Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Mortgage interest most homeowners use a to purchase their own home, and the same goes for rental. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you. Track your rental finances by entering the. Web in general, you can deduct expenses of renting property from your rental income. This limit is reduced by the amount by which the cost of section 179. Web what deductions can i take as an owner of rental property? Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Real estate rentals you can generally use schedule e (form 1040),.

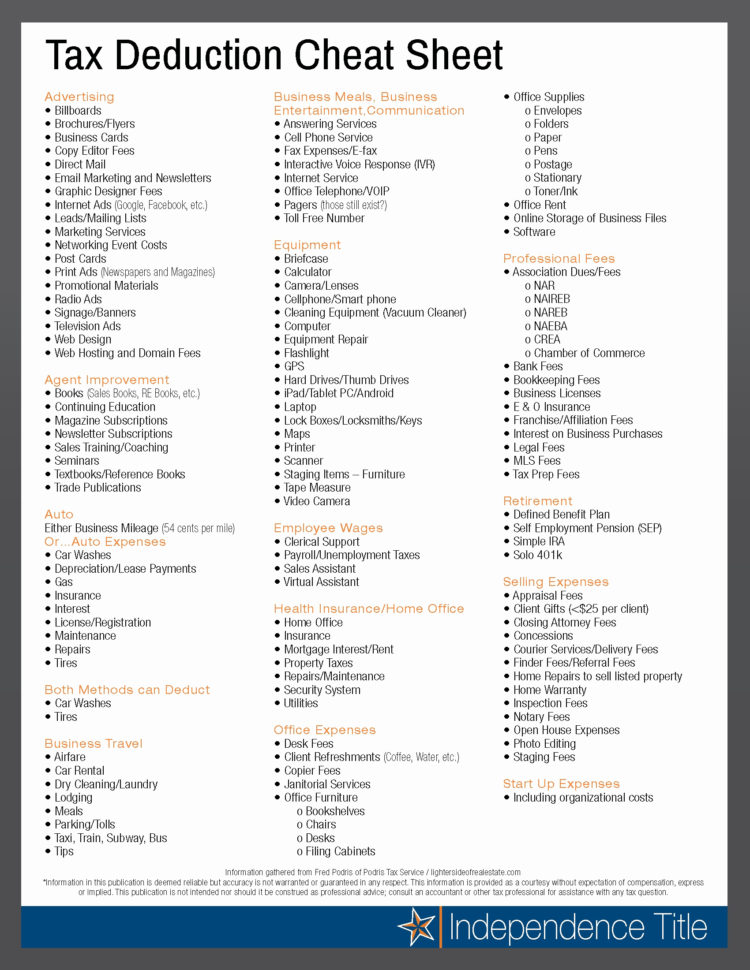

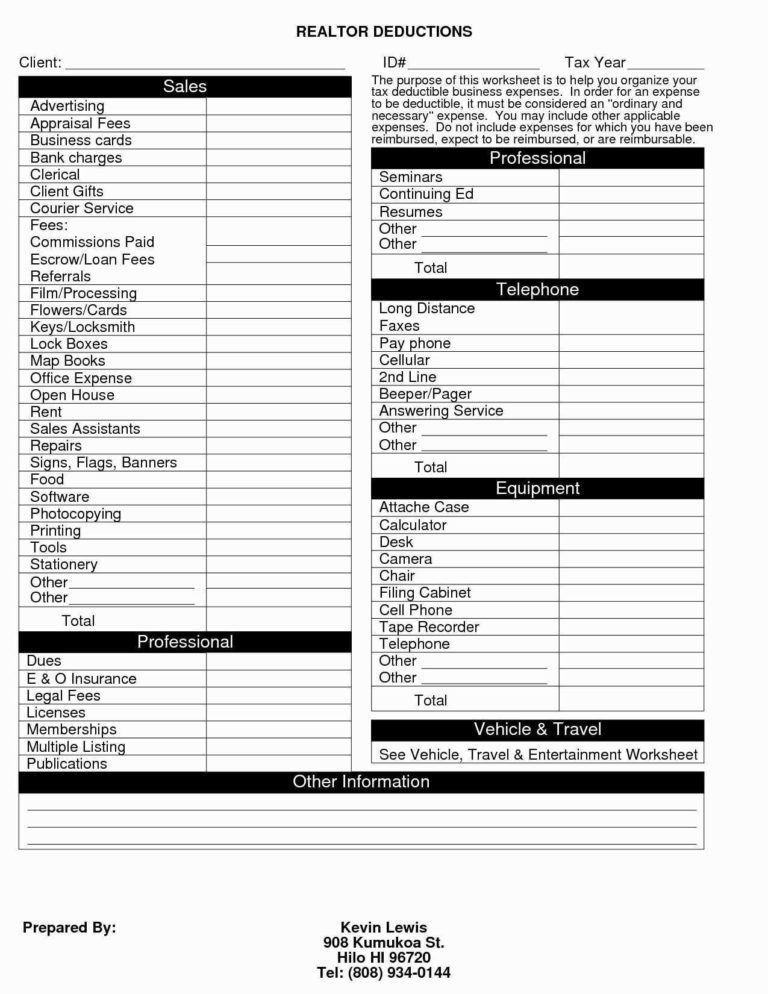

Realtor Tax Deductions And Tips You Must Know These tips will help you

Track your rental finances by entering the. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you. Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web the nine most common rental deductions are: This limit is reduced by the amount by which the cost of.

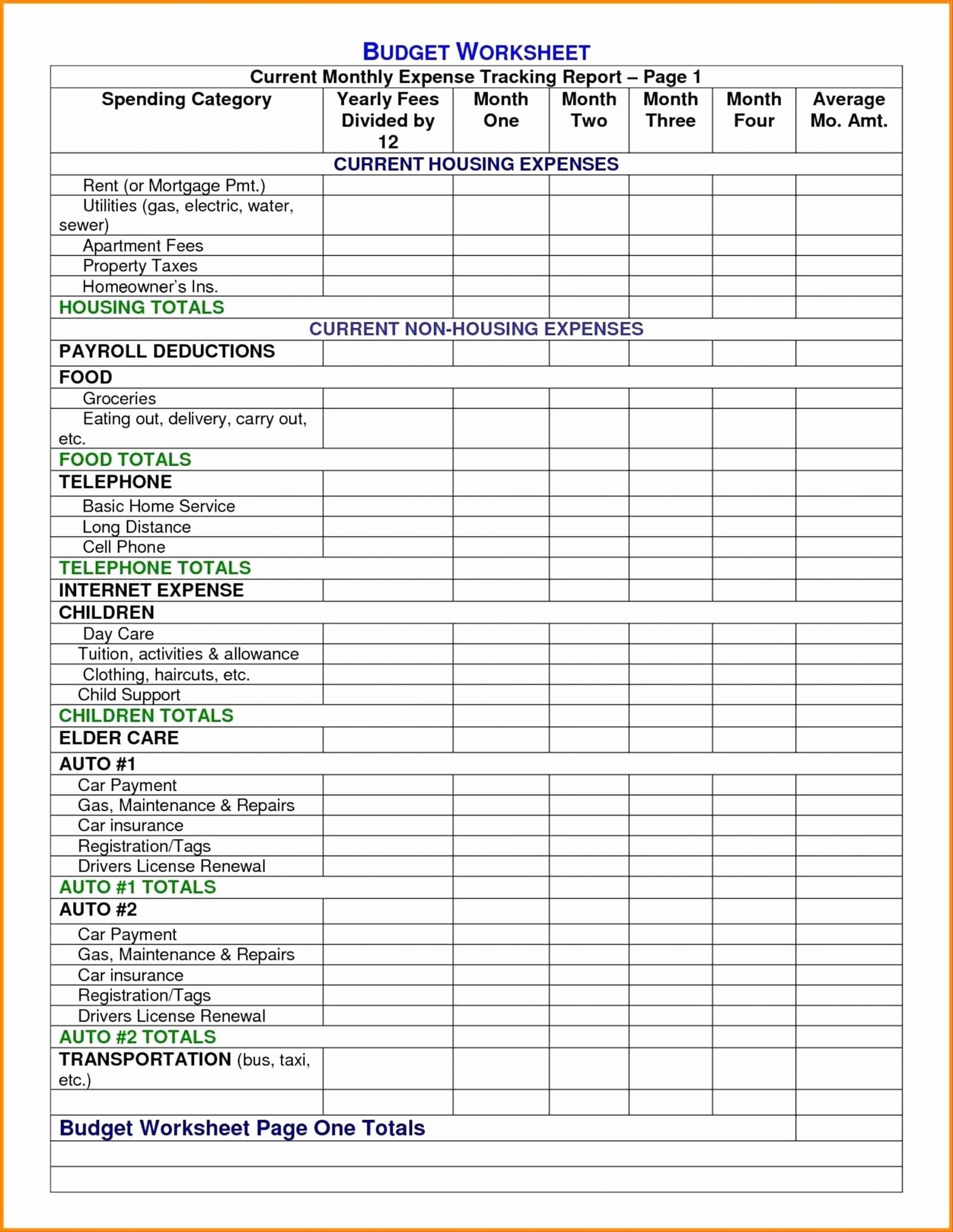

Tax Deduction Spreadsheet Spreadsheet Downloa tax deduction sheet. tax

This limit is reduced by the amount by which the cost of section 179. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Mortgage interest most homeowners use a to purchase their own home, and the same goes for rental. If you receive rental income from the rental.

Rental Property Tax Deductions Worksheet Yooob —

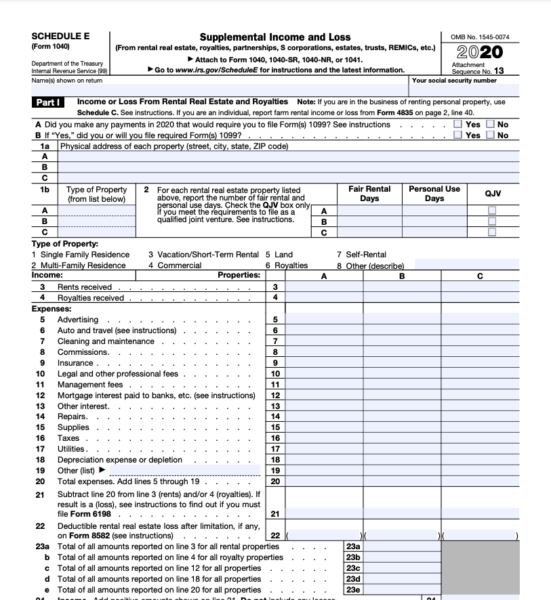

If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you. Mortgage interest most homeowners use a to purchase their own home, and the same goes for rental. Real estate rentals you can generally use schedule e (form 1040),. Web for tax years beginning in 2022, the maximum section 179 expense deduction is.

Top 12 Rental Property Tax Benefits & Deductions 2018 [+ Free Worksheet]

Real estate rentals you can generally use schedule e (form 1040),. Web what deductions can i take as an owner of rental property? This limit is reduced by the amount by which the cost of section 179. Web the nine most common rental deductions are: Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000.

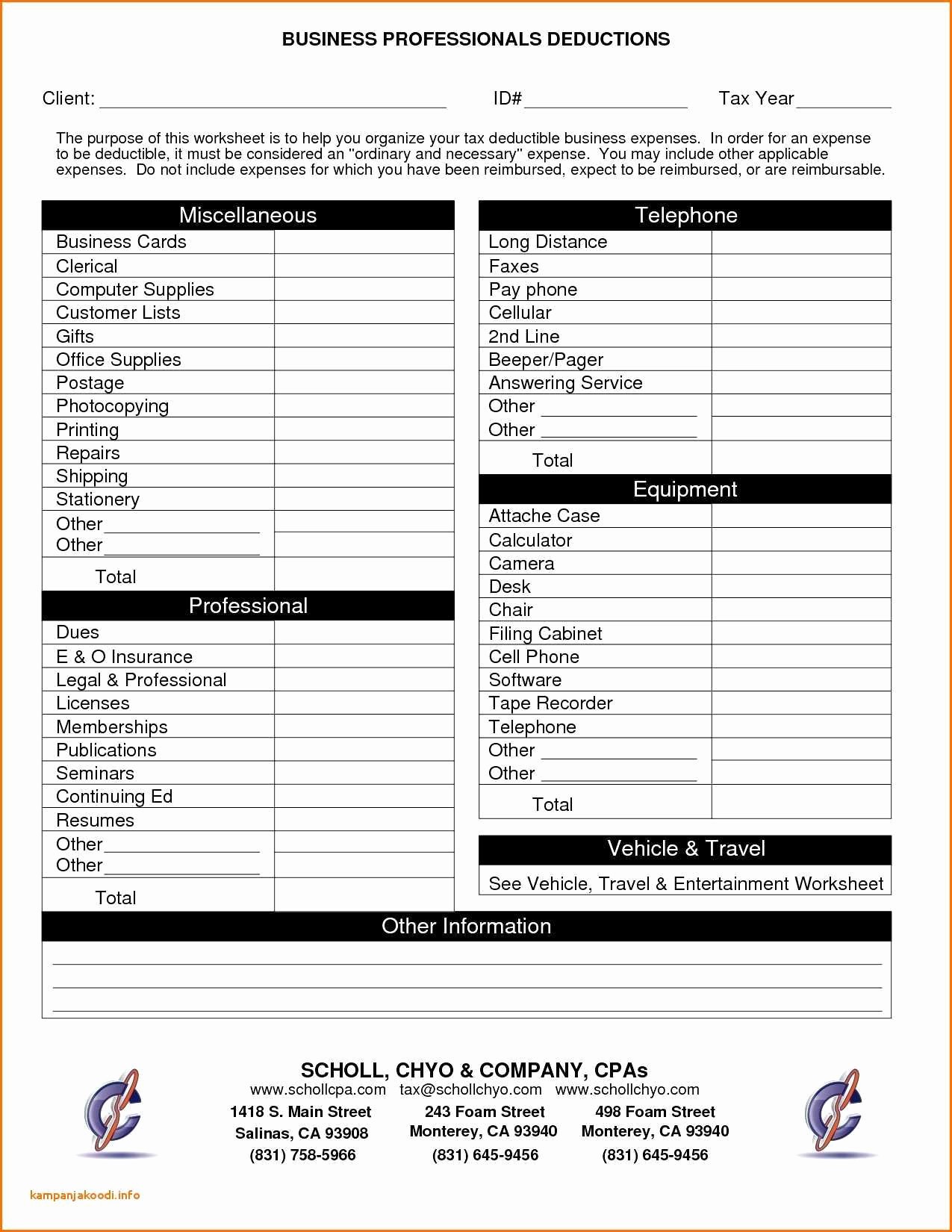

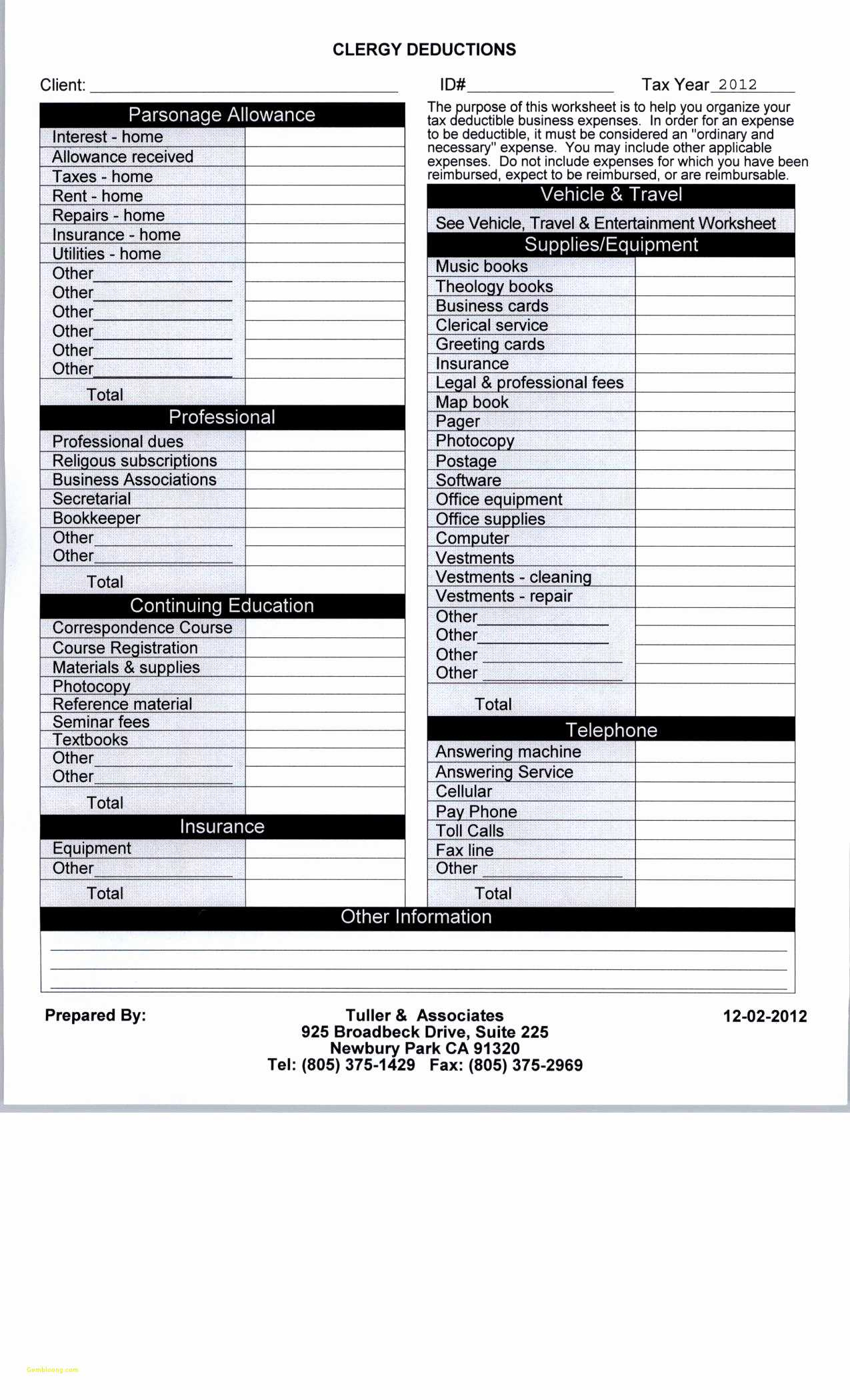

Business Itemized Deductions Worksheet Beautiful Business Itemized for

Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Mortgage interest most homeowners use a to purchase their own home, and the same goes for rental. Track your rental finances by entering the. Web what deductions can i take as an owner of rental property? Web for tax.

Rental And Expense Worksheet Pdf Fill Online, Printable

Web what deductions can i take as an owner of rental property? This limit is reduced by the amount by which the cost of section 179. Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web to download the free rental income and expense worksheet template, click the green button at the top of.

Anchor Tax Service Rental Deductions

Web what deductions can i take as an owner of rental property? Web in general, you can deduct expenses of renting property from your rental income. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Web the nine most common rental deductions are: Web for tax years beginning.

Rental Property Tax Deductions A Comprehensive Guide Credible

Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web the nine most common rental deductions are: If you receive rental income from the rental of a dwelling unit, there are certain rental.

Rental Property Tax Deductions Worksheet —

Web what deductions can i take as an owner of rental property? Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. This limit is reduced by the amount by which the cost of section 179. Mortgage interest most homeowners use a to purchase their own home, and the same goes for rental. Real estate.

Small Business Deductions Worksheet petermcfarland.us

Web the nine most common rental deductions are: Web in general, you can deduct expenses of renting property from your rental income. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Real estate rentals you can generally use schedule e (form 1040),. This limit is reduced by the.

Mortgage interest most homeowners use a to purchase their own home, and the same goes for rental. Web what deductions can i take as an owner of rental property? Web the nine most common rental deductions are: Real estate rentals you can generally use schedule e (form 1040),. This limit is reduced by the amount by which the cost of section 179. Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you. Web in general, you can deduct expenses of renting property from your rental income.

Web What Deductions Can I Take As An Owner Of Rental Property?

If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you. Mortgage interest most homeowners use a to purchase their own home, and the same goes for rental. This limit is reduced by the amount by which the cost of section 179. Web to download the free rental income and expense worksheet template, click the green button at the top of the page.

Web In General, You Can Deduct Expenses Of Renting Property From Your Rental Income.

Track your rental finances by entering the. Web the nine most common rental deductions are: Real estate rentals you can generally use schedule e (form 1040),. Web for tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000.

![Top 12 Rental Property Tax Benefits & Deductions 2018 [+ Free Worksheet]](https://fitsmallbusiness.com/wp-content/uploads/2018/02/Maint-vs-Impr.jpg)