Qualified Education Expenses Worksheet - Web education expenses payments received for qualified tuition and related expenses (total from column b above) 1. Qualified higher education expenses include tuition, fees, books,. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Check the box for either taxpayer or the spouse. Web qualified higher education expense: Web on the flip side, the following expenses are not considered qualified education expenses: Web what are qualifying expenses? Web get the k 12 education expense credit worksheet accomplished. 2 total scholarships enter the total amount of all scholarships. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses.

Receipt for qualified education expenses Fill out & sign online DocHub

Download your updated document, export it to the cloud,. Web the maximum annual aotc is $2,500 per student, which is calculated as 100% of your first $2,000 of qualified. Web get the k 12 education expense credit worksheet accomplished. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). Web a qualified tuition program.

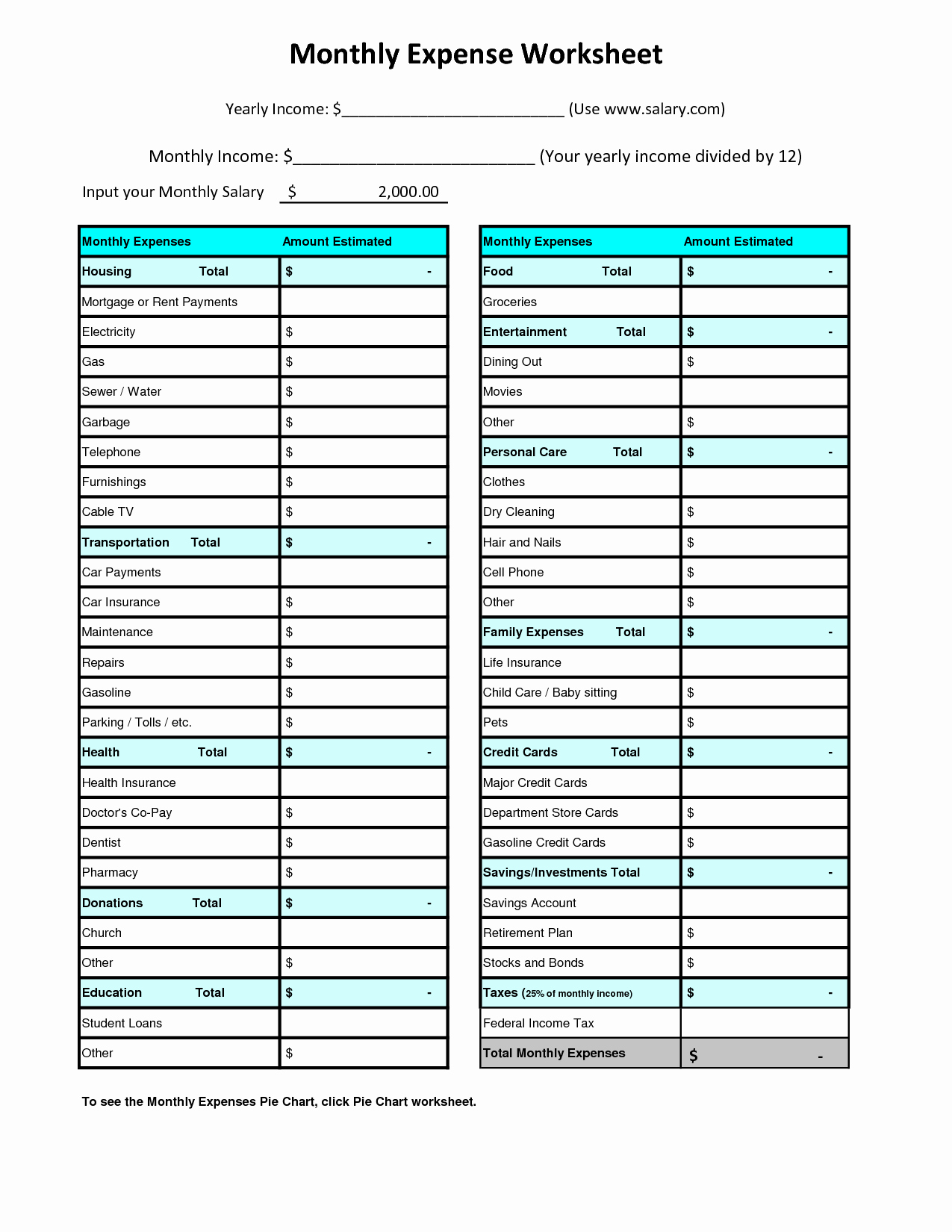

20 Business Monthly Expenses Spreadsheet Ndash 5 Best Of —

Web scroll down until you see the education expenses checkboxes. Check the box for either taxpayer or the spouse. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). Download your updated document, export it to the cloud,. Qualified higher education expenses include tuition, fees, books,.

Taxes and Infertility A Howto Guide

Web qualified higher education expenses. Web 1 qualified expenses enter the total amount of your qualified educational expenses. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). Web the maximum annual aotc is $2,500 per student, which is calculated as 100% of your first $2,000 of qualified. Web get the k 12 education.

Education Credit 4 Form 8863 Lifetime Learning Credit

Web to calculate the eligible expenses for their credit, take the $7,000 ($3,000 grant + $4,000 loan) paid in. Qualified higher education expenses include tuition, fees, books,. Web qualified higher education expense: Web get the k 12 education expense credit worksheet accomplished. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established.

Schedule A Medical Expenses Worksheet —

Web what are qualifying expenses? Web the maximum annual aotc is $2,500 per student, which is calculated as 100% of your first $2,000 of qualified. Web on the flip side, the following expenses are not considered qualified education expenses: Web qualified higher education expense: Web to calculate the eligible expenses for their credit, take the $7,000 ($3,000 grant + $4,000.

Publication 970 (2017), Tax Benefits for Education Internal Revenue

Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Web the maximum annual aotc is $2,500 per student, which is calculated as 100% of your first $2,000 of qualified. Web scroll down until you see the education expenses checkboxes. Web what are qualifying expenses? Web to calculate.

Adjusted Qualified Education Expenses Worksheet Breadandhearth

Education expenses the following are qualified. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). 2 total scholarships enter the total amount of all scholarships. Qualified higher education expenses include tuition, fees, books,. Download your updated document, export it to the cloud,.

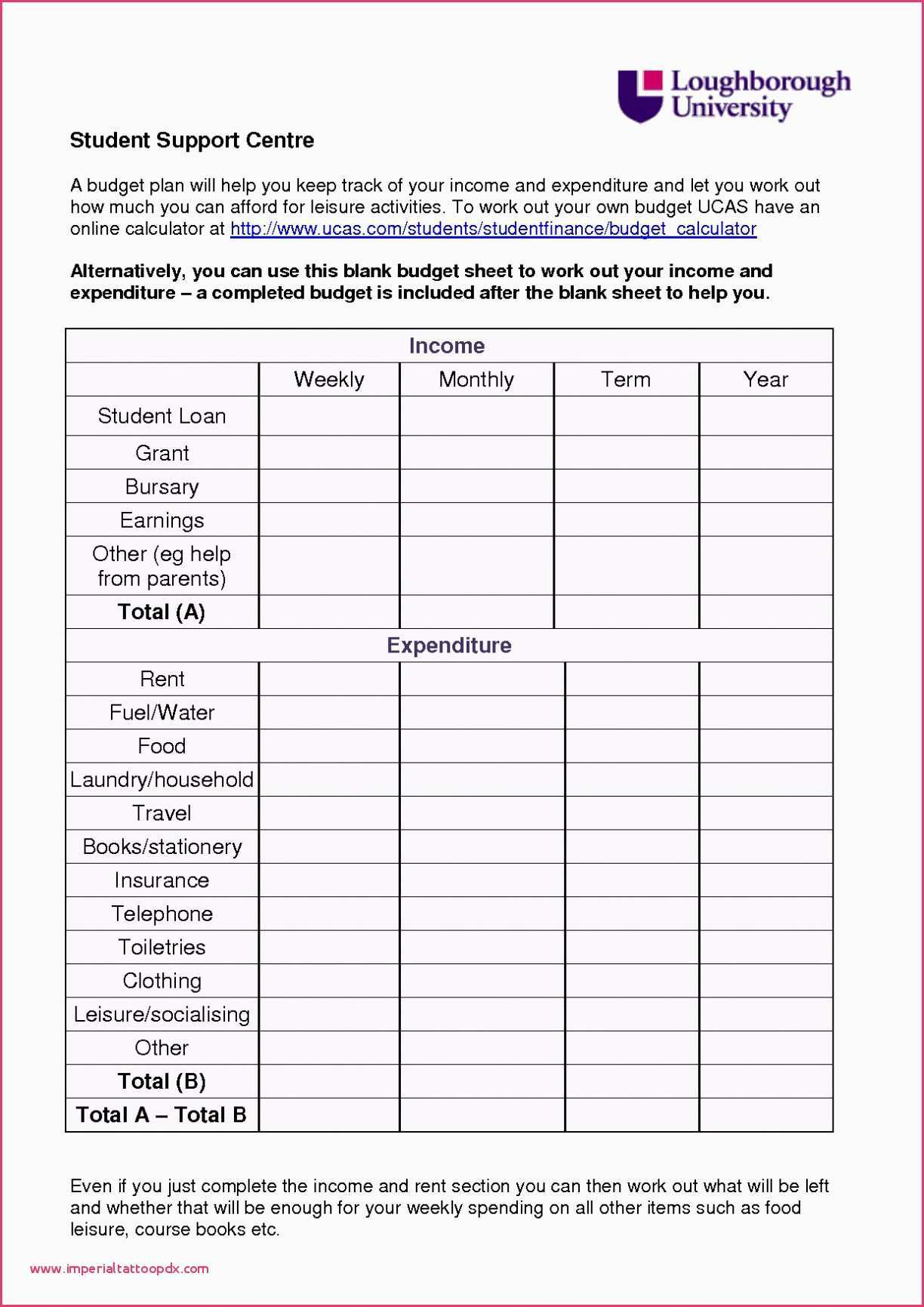

College Student Budget Worksheet Free Printable Worksheet from

2 total scholarships enter the total amount of all scholarships. Web education expenses payments received for qualified tuition and related expenses (total from column b above) 1. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits). Expenses such as tuition and tuition related expenses that an individual,. Web the maximum annual aotc is.

Qualified Education Expenses TECHNONEWPAGE

Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses. Qualified education expenses include amounts paid for tuition, fees, and course materials, which. Web department of the treasury internal revenue service education.

Student Budget Spreadsheet intended for Student Budget Spreadsheet

Check the box for either taxpayer or the spouse. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Education expenses the following are qualified. Web education expenses payments received for qualified tuition and related expenses (total from column b above) 1. Download your updated document, export it.

Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Check the box for either taxpayer or the spouse. Education expenses the following are qualified. Expenses such as tuition and tuition related expenses that an individual,. Web qualified higher education expense: Web scroll down until you see the education expenses checkboxes. Web to calculate the eligible expenses for their credit, take the $7,000 ($3,000 grant + $4,000 loan) paid in. Web what are qualifying expenses? Web get the k 12 education expense credit worksheet accomplished. Qualified higher education expenses include tuition, fees, books,. Web qualified higher education expenses. Web 1 qualified expenses enter the total amount of your qualified educational expenses. Download your updated document, export it to the cloud,. 2 total scholarships enter the total amount of all scholarships. Qualified education expenses include amounts paid for tuition, fees, and course materials, which. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Room and board, travel, research,. Web on the flip side, the following expenses are not considered qualified education expenses: Web the maximum annual aotc is $2,500 per student, which is calculated as 100% of your first $2,000 of qualified. Web department of the treasury internal revenue service education credits (american opportunity and lifetime learning credits).

Download Your Updated Document, Export It To The Cloud,.

Web education expenses whether for yourself or a child, you can use a roth ira to pay for school. Education expenses the following are qualified. Expenses such as tuition and tuition related expenses that an individual,. Web the maximum annual aotc is $2,500 per student, which is calculated as 100% of your first $2,000 of qualified.

Web Qualified Higher Education Expenses.

Web get the k 12 education expense credit worksheet accomplished. Web to calculate the eligible expenses for their credit, take the $7,000 ($3,000 grant + $4,000 loan) paid in. Web what are qualifying expenses? Web scroll down until you see the education expenses checkboxes.

2 Total Scholarships Enter The Total Amount Of All Scholarships.

Web on the flip side, the following expenses are not considered qualified education expenses: Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a. Qualified higher education expenses include tuition, fees, books,. Room and board, travel, research,.

Web Qualified Higher Education Expense:

Check the box for either taxpayer or the spouse. Web education expenses payments received for qualified tuition and related expenses (total from column b above) 1. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses.