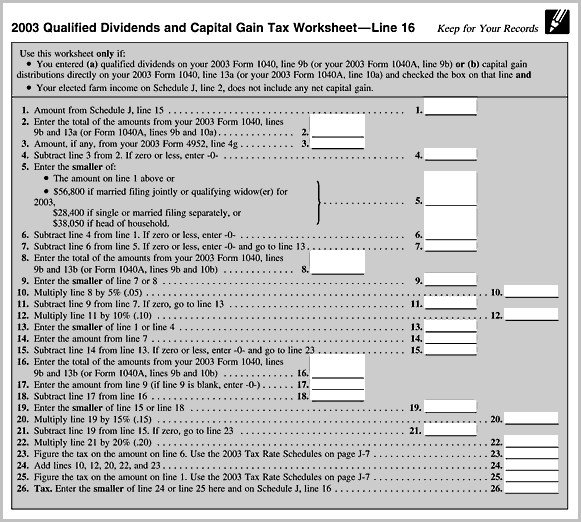

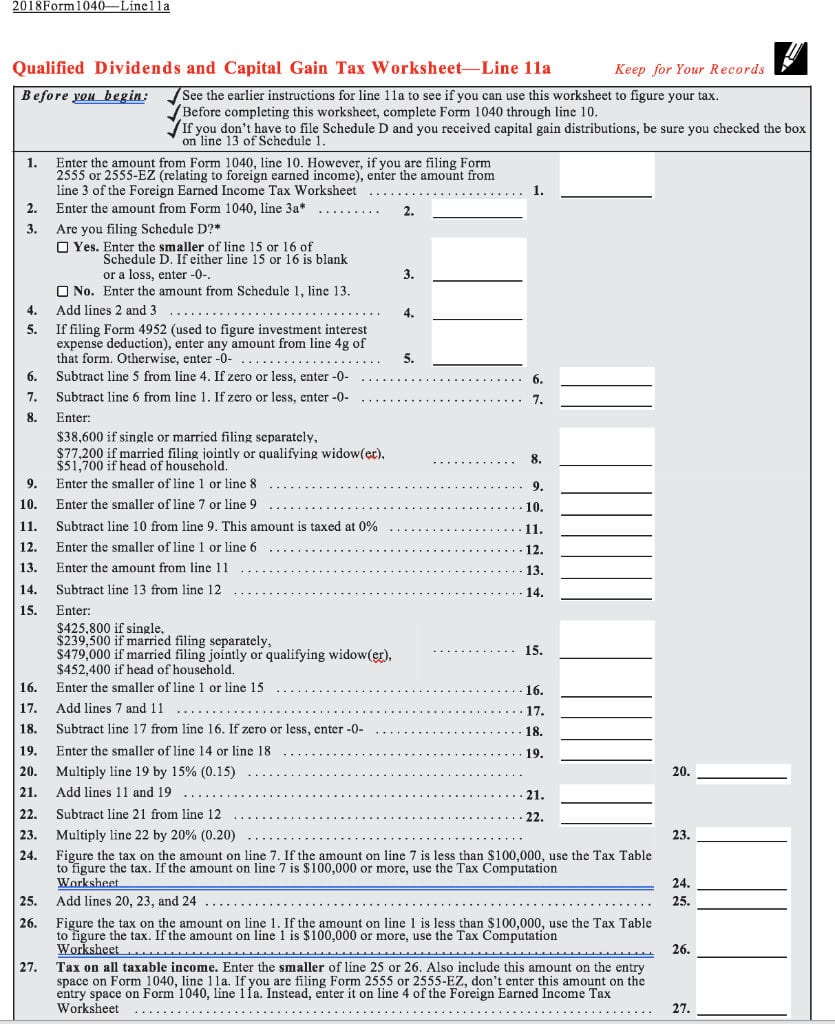

Qualified Dividends Worksheet - Web report your qualified dividends on line 9b of form 1040 or 1040a. Use the qualified dividends and capital gain tax worksheet in the instructions for. Turbo tax describes one method for your dividends to be. Web nonqualified dividends include: Web qualified dividends and capital gain tax worksheet: Web in the united states, a dividend eligible for capital gains tax rather than income tax. Although many investors use schedule d. Web shows total ordinary dividends that are taxable. Web qualified dividends or a net capital gain for 2023. Web how do you know if your dividend is qualified?

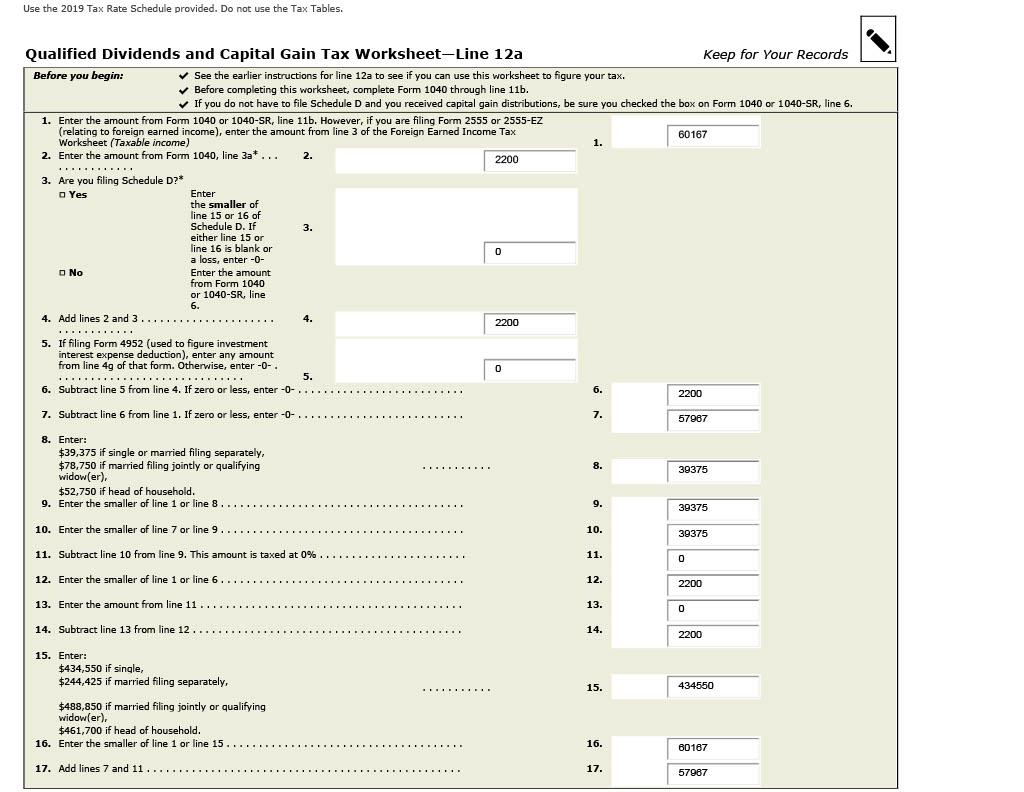

Qualified Dividends and Capital Gain Tax Worksheet 2019

Web shows total ordinary dividends that are taxable. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Use the qualified dividends and capital gain tax worksheet in the instructions for. Web what is the qualified dividend and capital gain tax worksheet? Web a qualified dividend is an ordinary dividend that meets.

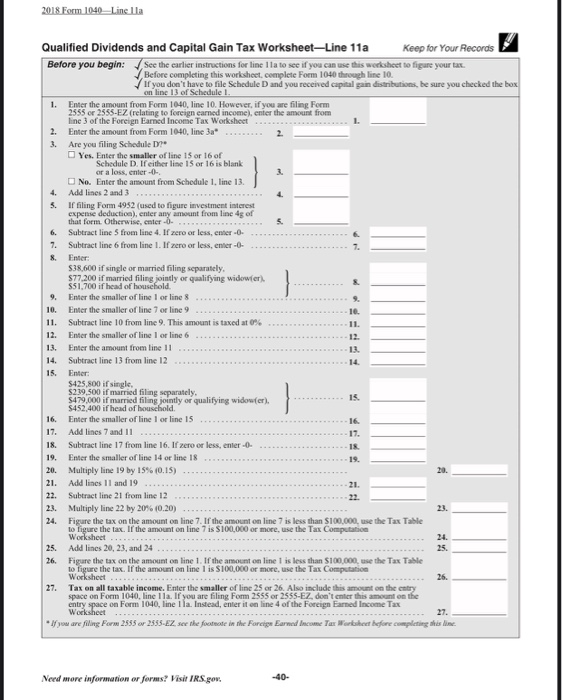

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Web qualified dividends and capital gain tax worksheet—line 11a. Web in the united states, a dividend eligible for capital gains tax rather than income tax. Figuring out the tax on your qualified dividends can be. Prior to completing this file, make sure you fill out. You can find them in the form.

Solved Please help me with this 2019 tax return. All

Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Web how do you know if your dividend is qualified? Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which are lower than income tax. Web qualified dividends and capital.

Qualified Dividends and Capital Gain Tax Worksheet

Although many investors use schedule d. Web what is the qualified dividend and capital gain tax worksheet? Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web nonqualified dividends include: Web in the united states, a dividend eligible for capital gains tax rather than income tax.

Qualified Dividends And Capital Gains Worksheet 2010 —

Web these are the rates that apply to qualified dividends, based on taxable income, for the tax return that was due. Web how do you know if your dividend is qualified? Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which are lower than income tax. Web what is.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web these are the rates that apply to qualified dividends, based on taxable income, for the tax return that was due. Turbo tax describes one method for your dividends to be. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web qualified dividends and capital gain tax worksheet—line.

Qualified Dividends And Capital Gains Worksheet 2018 —

Web qualified dividends and capital gain tax worksheet: Use the qualified dividends and capital gain tax worksheet in the instructions for. Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to. Web shows total ordinary dividends that are taxable. You can find them in the form.

Qualified Dividends And Capital Gains Worksheet 2018 —

Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to. Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which are lower than income tax. Web complete this worksheet only if line 18 or line 19 of schedule d.

Qualified Dividends And Capital Gains Worksheet 2018 —

Prior to completing this file, make sure you fill out. Figuring out the tax on your qualified dividends can be. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Use the qualified.

2021 Qualified Dividends And Capital Gains Worksheet Line12A

Figuring out the tax on your qualified dividends can be. Web qualified dividends and capital gain tax worksheet—line 11a. Web enter your total qualified dividends on line 3a. Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to. Web a qualified dividend is an ordinary dividend that meets the criteria.

Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Prior to completing this file, make sure you fill out. Web how do you know if your dividend is qualified? Web qualified dividends and capital gain tax worksheet—line 11a. Web a qualified dividend is an ordinary dividend that meets the criteria to be taxed at capital gains tax rates, which are lower than income tax. Dividends paid by certain foreign companies may or may not be qualified. Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a. You can find them in the form. Web qualified dividends and capital gain tax worksheet: Web nonqualified dividends include: An alternative to schedule d. Web these are the rates that apply to qualified dividends, based on taxable income, for the tax return that was due. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web enter your total qualified dividends on line 3a. Web qualified dividends or a net capital gain for 2023. Although many investors use schedule d. Figuring out the tax on your qualified dividends can be. Turbo tax describes one method for your dividends to be.

Web Qualified Dividends Or A Net Capital Gain For 2023.

Use the qualified dividends and capital gain tax worksheet in the instructions for. Although many investors use schedule d. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. You can find them in the form.

Web Enter Your Total Qualified Dividends On Line 3A.

Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to. Prior to completing this file, make sure you fill out. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Dividends paid by certain foreign companies may or may not be qualified.

Web Qualified Dividends And Capital Gain Tax Worksheet:

Web in the united states, a dividend eligible for capital gains tax rather than income tax. Web shows total ordinary dividends that are taxable. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web how do you know if your dividend is qualified?

Web Report Your Qualified Dividends On Line 9B Of Form 1040 Or 1040A.

Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Figuring out the tax on your qualified dividends can be. Web what is the qualified dividend and capital gain tax worksheet? Web the strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a.