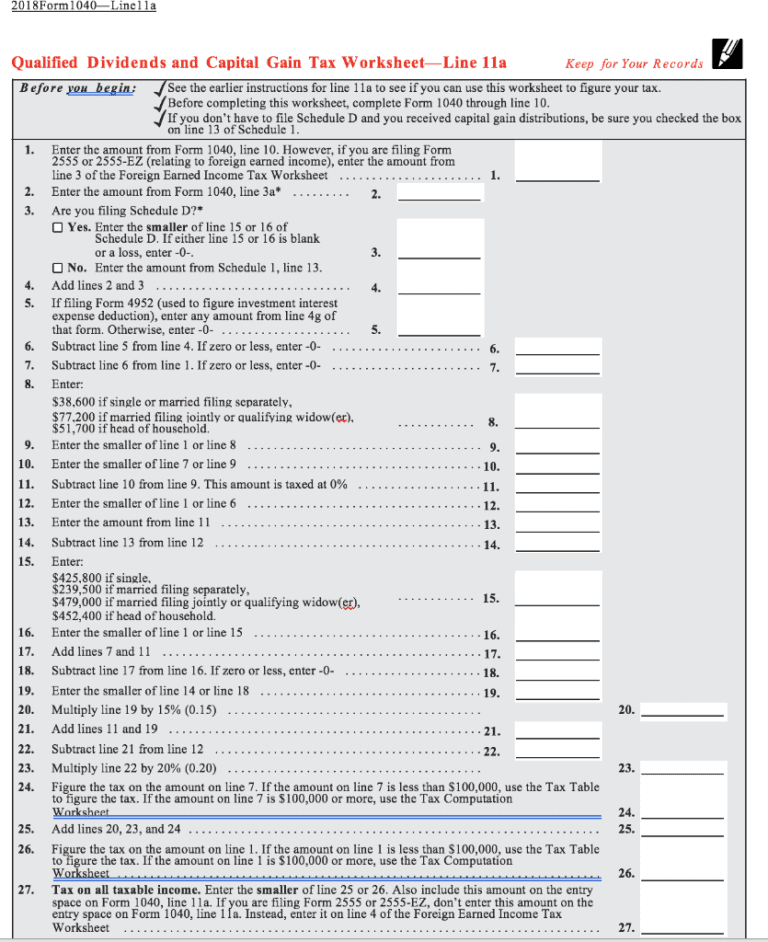

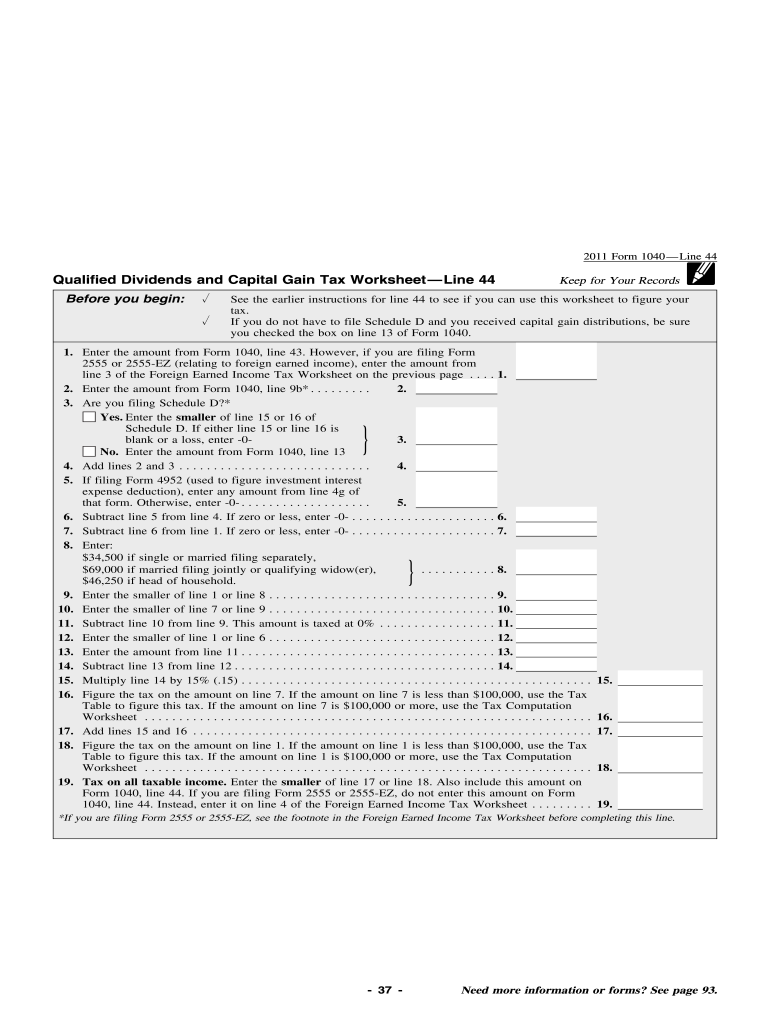

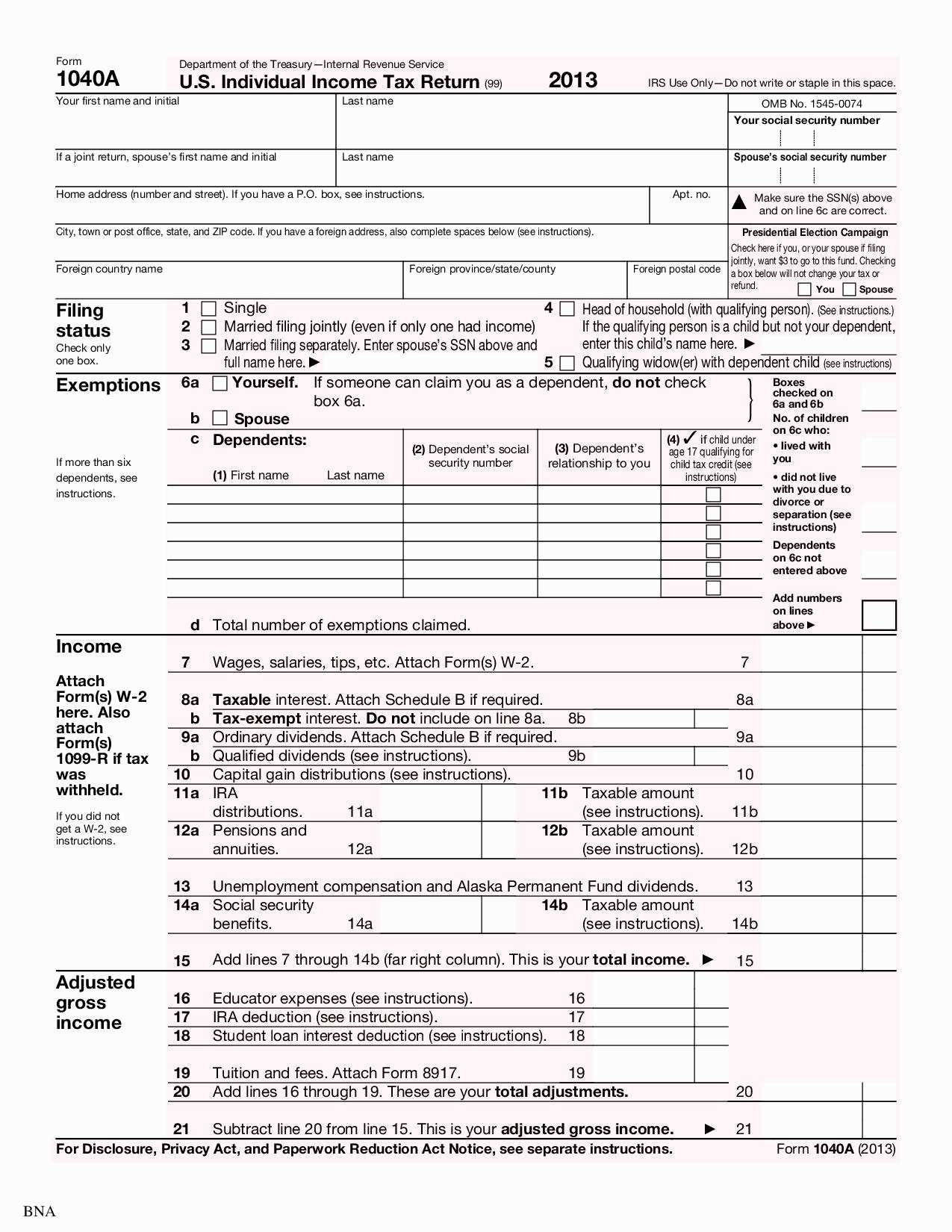

Qualified Dividends And Capital Gains Worksheet - See the instructions for line 16 for. If “yes,” attach form 8949 and see its instructions for additional. Line 15 or line 16 of schedule d is zero or less and you. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividends and capital gain tax worksheet—line 11a. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? See the earlier instructions for line 11a to see if you can use this worksheet to figure. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if:

Capital Gains Tax Worksheet —

See the earlier instructions for line 11a to see if you can use this worksheet to figure. Line 15 or line 16 of schedule d is zero or less and you. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: If “yes,” attach form 8949 and see its instructions for additional..

Qualified Dividends And Capital Gain Tax Worksheet —

See the instructions for line 16 for. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. If “yes,” attach form 8949 and see its instructions for additional. Web qualified dividends and capital gain tax worksheet—line 11a. Web did you dispose of any investment(s) in a qualified opportunity.

Qualified Dividends And Capital Gains Worksheet Calculator —

If “yes,” attach form 8949 and see its instructions for additional. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: See the instructions for line 16 for. Web qualified dividends and capital gain tax worksheet—line.

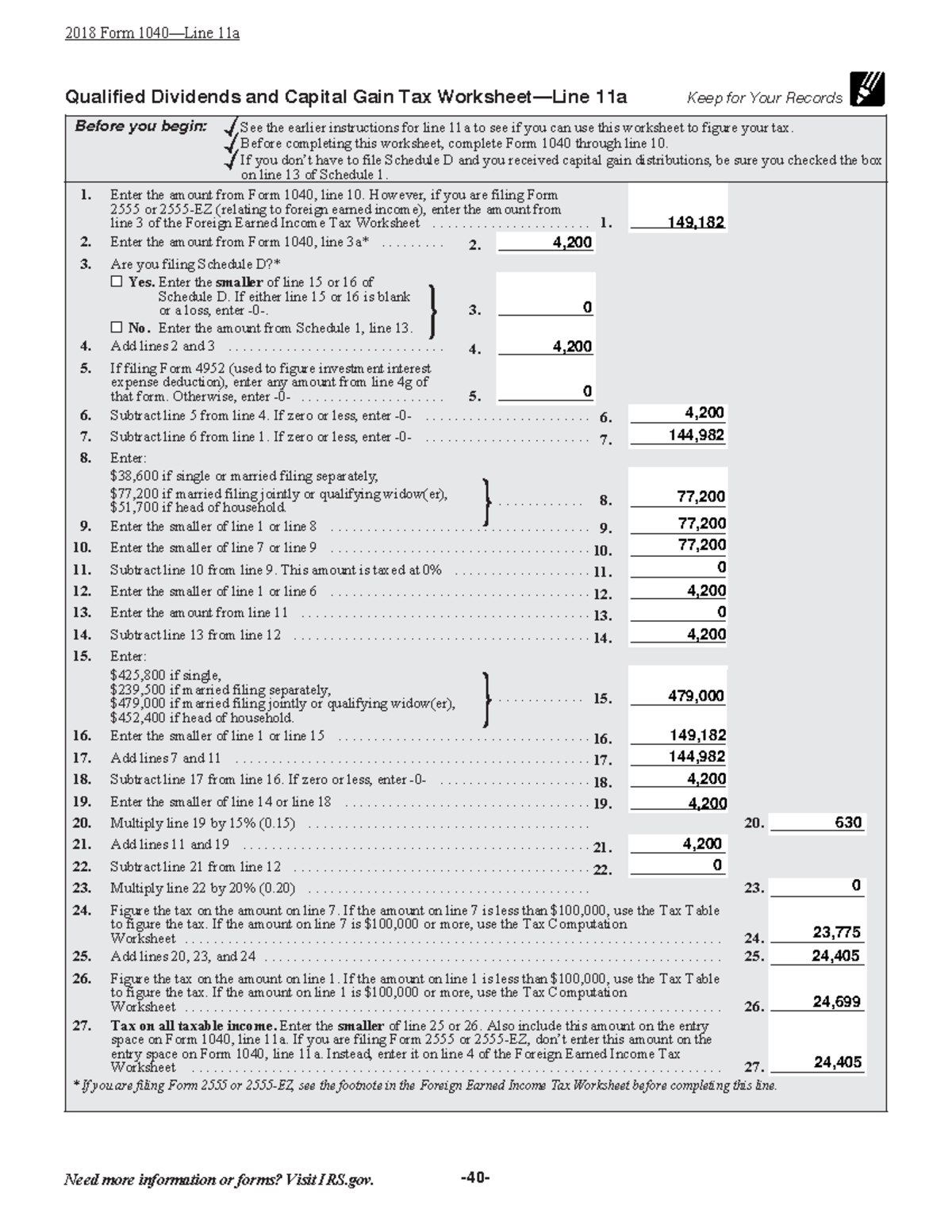

Qualified Dividends And Capital Gains Worksheet 2018 —

See the instructions for line 16 for. Line 15 or line 16 of schedule d is zero or less and you. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: See the earlier instructions for.

Irs Capital Gains Worksheet Form Fill Out and Sign Printable PDF

If “yes,” attach form 8949 and see its instructions for additional. See the earlier instructions for line 11a to see if you can use this worksheet to figure. Web qualified dividends and capital gain tax worksheet—line 11a. See the instructions for line 16 for. Line 15 or line 16 of schedule d is zero or less and you.

Qualified Dividends And Capital Gain Tax Worksheet —

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividends and capital gain tax worksheet—line 11a. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If “yes,” attach form 8949 and see its instructions for additional. Line 15.

2017 Qualified Dividends and Capital Gain Tax Worksheet

See the instructions for line 16 for. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. See the earlier instructions for line 11a to see if you can use this worksheet to figure. If “yes,” attach form 8949 and see its instructions for additional. Line 15 or.

Capital Gains Tax Spreadsheet Shares Payment Spreadshee capital gains

Web qualified dividends and capital gain tax worksheet—line 11a. If “yes,” attach form 8949 and see its instructions for additional. See the instructions for line 16 for. Line 15 or line 16 of schedule d is zero or less and you. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. See the instructions for line 16 for. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If “yes,” attach form 8949 and see its instructions for additional. See the earlier instructions.

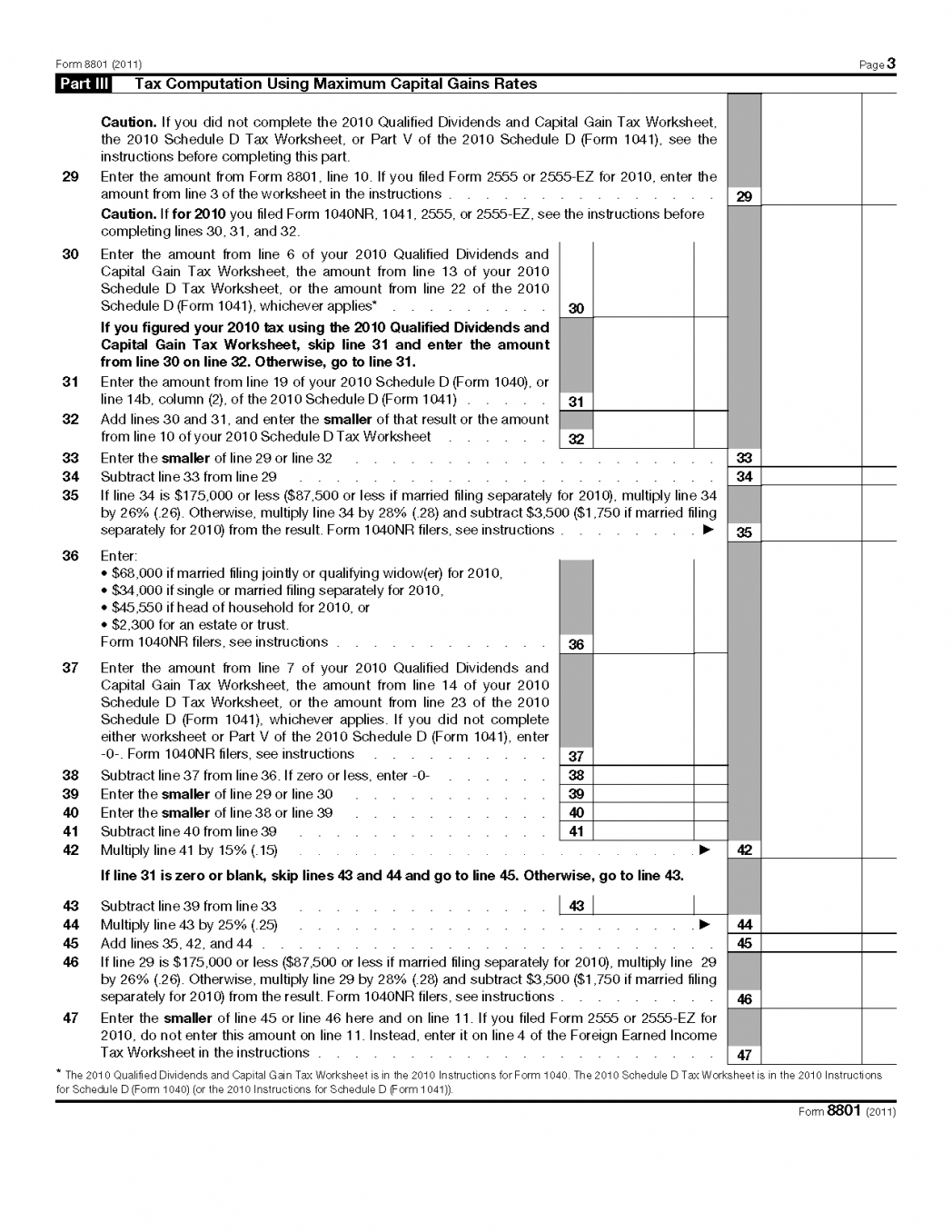

Qualified Dividends And Capital Gains Worksheet 2010 —

Line 15 or line 16 of schedule d is zero or less and you. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. See the instructions for line 16 for. Don’t.

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. If “yes,” attach form 8949 and see its instructions for additional. See the earlier instructions for line 11a to see if you can use this worksheet to figure. Web qualified dividends and capital gain tax worksheet—line 11a. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? See the instructions for line 16 for. Line 15 or line 16 of schedule d is zero or less and you.

See The Earlier Instructions For Line 11A To See If You Can Use This Worksheet To Figure.

Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. If “yes,” attach form 8949 and see its instructions for additional. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if:

See The Instructions For Line 16 For.

Line 15 or line 16 of schedule d is zero or less and you. Web qualified dividends and capital gain tax worksheet—line 11a.