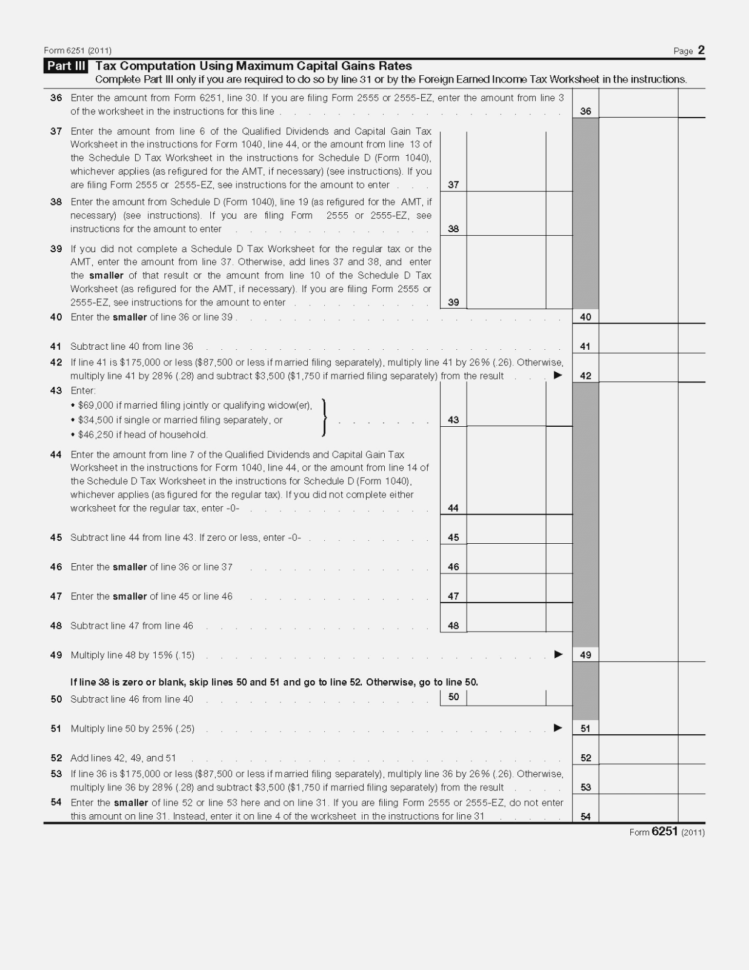

Qualified Dividends And Capital Gain Worksheet - Web qualified dividends and capital gain tax worksheet—line 11a. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web change in the rates for gains taxed at 25 or 28 percent. Locate ordinary dividends in box 1a, qualified dividends in. It is for a single taxpayer, but. For alt min tax purposes only 1. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates.

Qualified Dividends and Capital Gain Tax Worksheet 2019 Capital gains

Web qualified dividend and capital gain tax worksheet. The act also applied the new rates to qualified dividends received after. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web qualified dividends and capital gain tax.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web what is the qualified dividend and capital gain tax worksheet? Web change in the rates for gains taxed at 25 or 28 percent. The act also applied the new rates to qualified dividends received after. Web 1.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Web figure the tax using the tax.

Irs Qualified Dividends And Capital Gain Tax Worksheet 2019

Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web qualified dividends and capital gain tax worksheet—line 11a. Web qualified dividend and capital gain tax worksheet. Web what is the qualified dividend and capital gain tax worksheet? Web complete this worksheet only if line 18 or line 19.

Qualified Dividends and Capital Gain Tax Worksheet 2016

For alt min tax purposes only 1. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web change in the rates for gains taxed at 25 or 28 percent. To see this select forms view, then the dtaxwrk folder, then the. Web qualified dividends and capital gain tax.

Capital Gain Tax Worksheet Line 41

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Figuring out the tax on your qualified dividends can be. Locate ordinary dividends in box 1a, qualified.

Qualified Dividends And Capital Gain Tax Worksheet —

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Complete lines 21 and 22. For the desktop version you can switch to forms mode and open the worksheet to see it. Qualified dividends and capital gain tax worksheet—line 12akeep for.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. The act also applied the new rates to qualified dividends received after. It is for a single taxpayer, but. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web this.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web must be removed before printing. Web qualified dividends and capital gain tax worksheet—line 11a. Web qualified dividends and capital gain tax worksheet: Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends or a net capital gain for 2023. For alt min tax purposes only 1. Web use the qualified dividends and capital gain tax worksheet or the schedule d.

To see this select forms view, then the dtaxwrk folder, then the. Web qualified dividends and capital gain tax worksheet. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Qualified dividends and capital gain tax worksheet—line 12akeep for your. In the instructions for form 1040, line 16. It is for a single taxpayer, but. Web must be removed before printing. Web figure the tax using the tax table, tax computation worksheet, qualified dividends and capital gain tax worksheet, schedule. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. The act also applied the new rates to qualified dividends received after. Web change in the rates for gains taxed at 25 or 28 percent. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. For the desktop version you can switch to forms mode and open the worksheet to see it. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Web what is the qualified dividend and capital gain tax worksheet? Web qualified dividend and capital gain tax worksheet.

Web Qualified Dividends Or A Net Capital Gain For 2023.

Use the qualified dividends and capital gain tax worksheet to figure your. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web qualified dividend and capital gain tax worksheet. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the.

Web This Flowchart Is Designed To Quickly Determine The Tax On Capital Gains And Dividends, Based On The Taxpayer's Taxable Income.

Complete lines 21 and 22. The act also applied the new rates to qualified dividends received after. It is for a single taxpayer, but. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or.

Web Qualified Dividends And Capital Gain Tax Worksheet:

To see this select forms view, then the dtaxwrk folder, then the. Web qualified dividends and capital gain tax worksheet—line 11a. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and calculate tax on capital gains at a lower.

Web 1 Best Answer.

In the instructions for form 1040, line 16. Web must be removed before printing. Locate ordinary dividends in box 1a, qualified dividends in. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the.