Qualified Dividend And Capital Gain Tax Worksheet - Web qualified dividend and capital gain tax worksheet. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web qualified dividends and capital gain tax worksheet. Ordinary income is everything else or taxable income minus qualified income. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. It is for a single taxpayer, but. Gain or loss from sales of stocks or bonds : Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Use the qualified dividends and capital gain tax worksheet to figure your. Web click forms in the upper right (upper left for mac) and look through the forms in my return list and open the.

How To Pay Tax On A Dividend RISTOCK

Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Ordinary income is everything else or taxable income minus qualified income. Figuring out the tax on your qualified dividends can be. Web qualified dividend and capital gain tax worksheet.

ACC 330 61 Final Project Practice Tax Return Qualified Dividends and

Web qualified dividends and capital gain tax worksheet: Web qualified dividends and capital gain tax worksheet: Figuring out the tax on your qualified dividends can be. Web qualified dividends and capital gains tax worksheet or schedule d worksheet there have been several posts. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever.

Create a Function for calculating the Tax Due for

Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Ordinary income is everything else or taxable income minus qualified income. Web what is the qualified dividend and.

qualified dividends and capital gain tax worksheet 2019 Fill Online

Locate ordinary dividends in box 1a, qualified dividends in. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web use the qualified dividends and capital gain tax.

Qualified Dividend And Capital Gain Worksheet

Locate ordinary dividends in box 1a, qualified dividends in. Web the capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or..

Instructions Schedule Schedule 5 Qualified Dividends

Web qualified dividend and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet. Use the qualified dividends and capital gain tax worksheet to figure your. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web this flowchart.

Qualified Dividends and Capital Gain Tax Worksheet 2019 Capital gains

Locate ordinary dividends in box 1a, qualified dividends in. To see this select forms view, then the dtaxwrk folder, then. Web click forms in the upper right (upper left for mac) and look through the forms in my return list and open the. Gain or loss from sales of stocks or bonds : Web what is the qualified dividend and.

Qualified Dividends And Capital Gain Tax Worksheet —

Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web the capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held. Web qualified dividends and capital gains tax worksheet or schedule d worksheet there have been several posts..

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

To see this select forms view, then the dtaxwrk folder, then. Use the qualified dividends and capital gain tax worksheet to figure your. Gain or loss from sales of stocks or bonds : Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the. Web click forms in the.

Qualified Dividends And Capital Gain Tax Worksheet —

Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web qualified dividends and capital gain tax worksheet: Web qualified dividends and capital gain tax worksheet: Figuring out the tax on your qualified dividends can be. Locate ordinary dividends in box 1a, qualified dividends in.

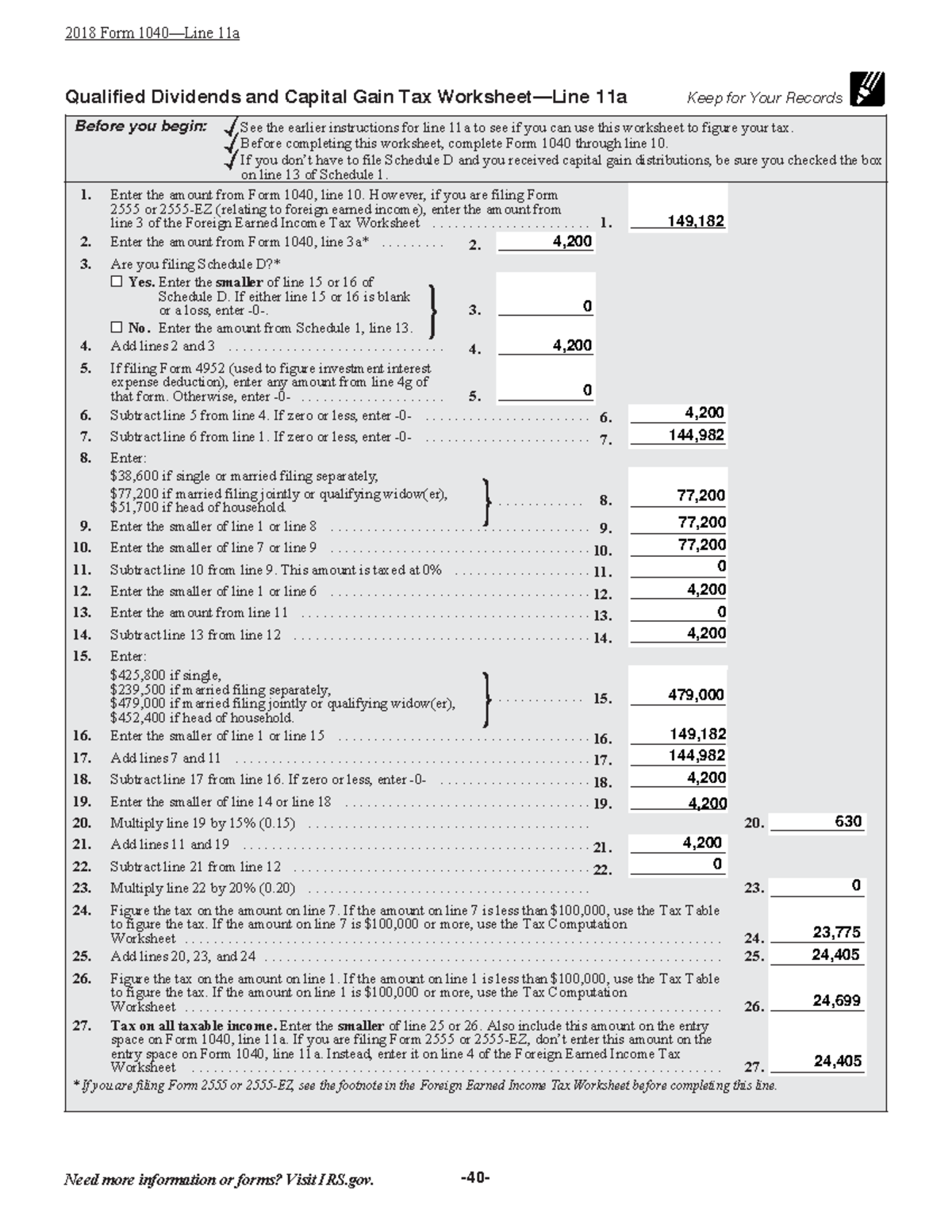

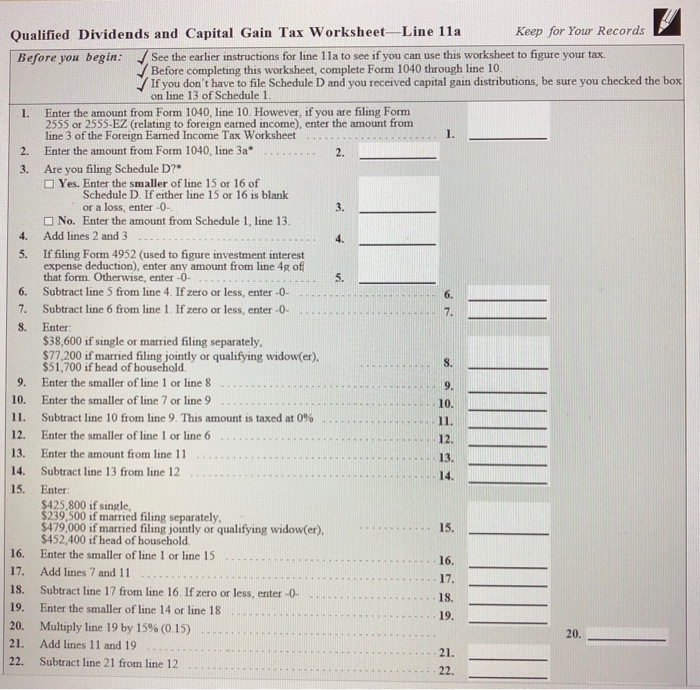

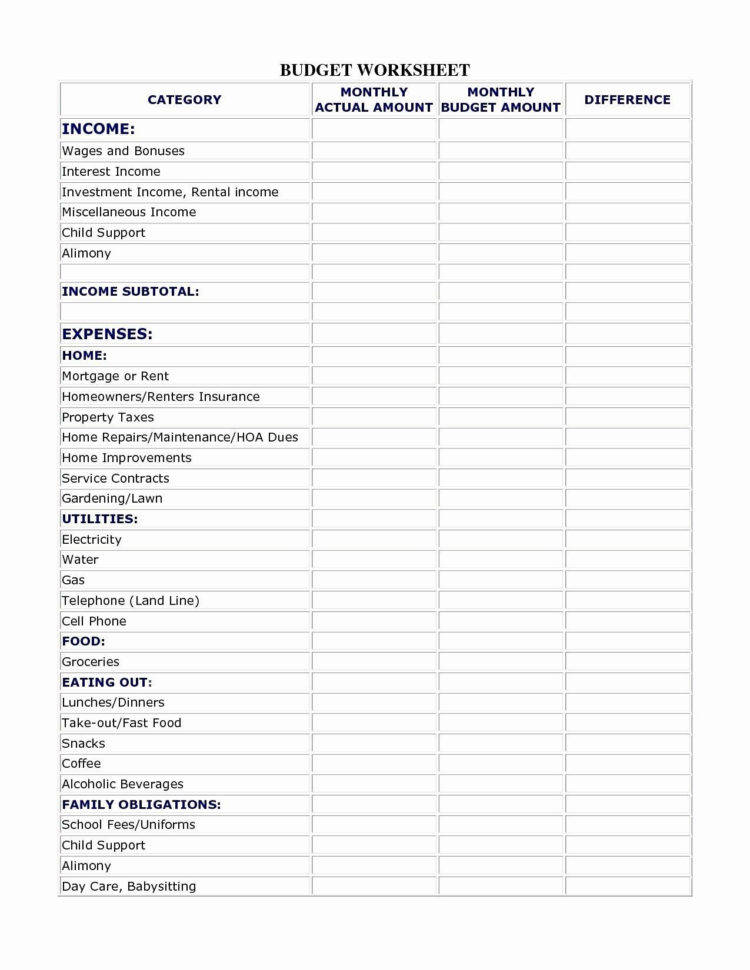

Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the. Use the qualified dividends and capital gain tax worksheet to figure your. Web qualified dividends and capital gain tax worksheet. Web what is the qualified dividend and capital gain tax worksheet? Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. It is for a single taxpayer, but. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Gain or loss from sales of stocks or bonds : Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. To see this select forms view, then the dtaxwrk folder, then. Figuring out the tax on your qualified dividends can be. Web qualified dividends and capital gain tax worksheet: Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Ordinary income is everything else or taxable income minus qualified income. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Web click forms in the upper right (upper left for mac) and look through the forms in my return list and open the. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividend and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the.

Web Irs Introduced The Qualified Dividend And Capital Gain Tax Worksheet As An Alternative To Schedule D And Added The.

To see this select forms view, then the dtaxwrk folder, then. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends and capital gains tax worksheet or schedule d worksheet there have been several posts. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before.

Web What Is The Qualified Dividend And Capital Gain Tax Worksheet?

Web qualified dividends and capital gain tax worksheet. Figuring out the tax on your qualified dividends can be. Ordinary income is everything else or taxable income minus qualified income. Use the qualified dividends and capital gain tax worksheet to figure your.

Web Qualified Dividends And Capital Gain Tax Worksheet (2022) See Form 1040 Instructions For Line 16 To See If The.

Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the. Locate ordinary dividends in box 1a, qualified dividends in. Web the capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held. Web qualified dividend and capital gain tax worksheet.

Web Qualified Dividends And Capital Gain Tax Worksheet (2020) • See Form 1040 Instructions For Line 16 To See If The.

Web qualified dividends and capital gain tax worksheet: Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Gain or loss from sales of stocks or bonds :