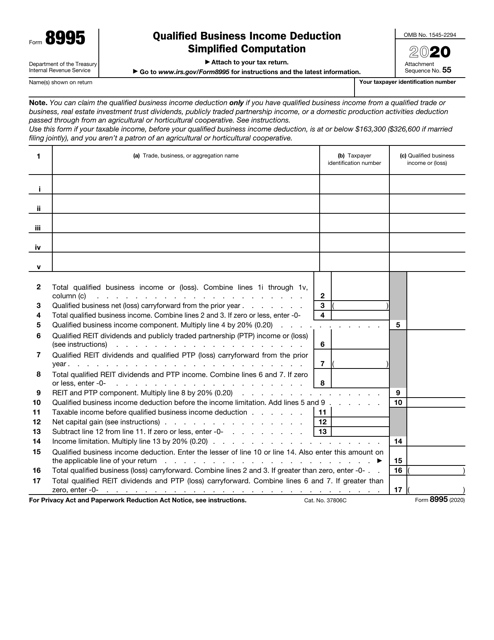

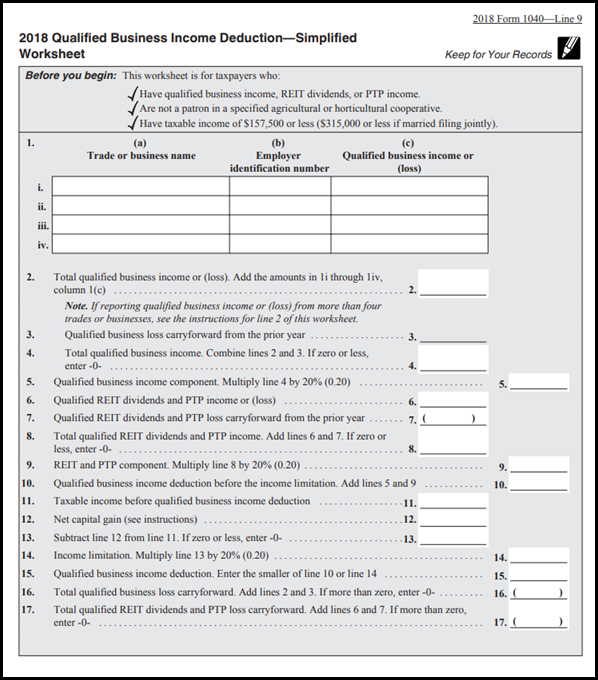

Qualified Business Income Deduction Worksheet - Web 2020 qualified business income deduction worksheet detail by business schedule/form business name. Web access the asset module within the activity, go to setup > activity, and answer yes to the qualifies as trade or business for section. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. This worksheet is for taxpayers who: Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Web there are two ways to calculate the qbi deduction: Using the simplified worksheet or the complex. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. If you’re ready to save.

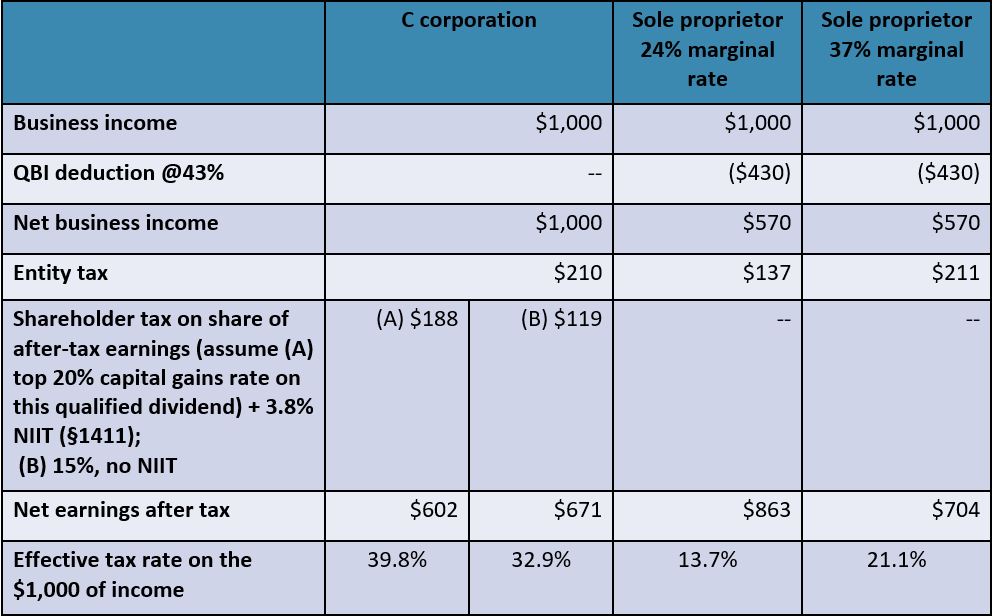

Analysis of a Section 199A Qualified Business Deduction Proposal

Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Located in the qbid folder in form view, this worksheet prints. Web there's a good chance that you will qualify for a new tax benefit when you file your 2018. Trade, business, or aggregation information (a) name (b) check.

Tax Reform Qualified Business (QBI) Deduction Accountants

Using the simplified worksheet or the complex. Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. Web 2020 qualified business income deduction worksheet detail by business schedule/form business name. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web access the asset module within the activity, go to setup.

How to use the new Qualified Business Deduction Worksheet for

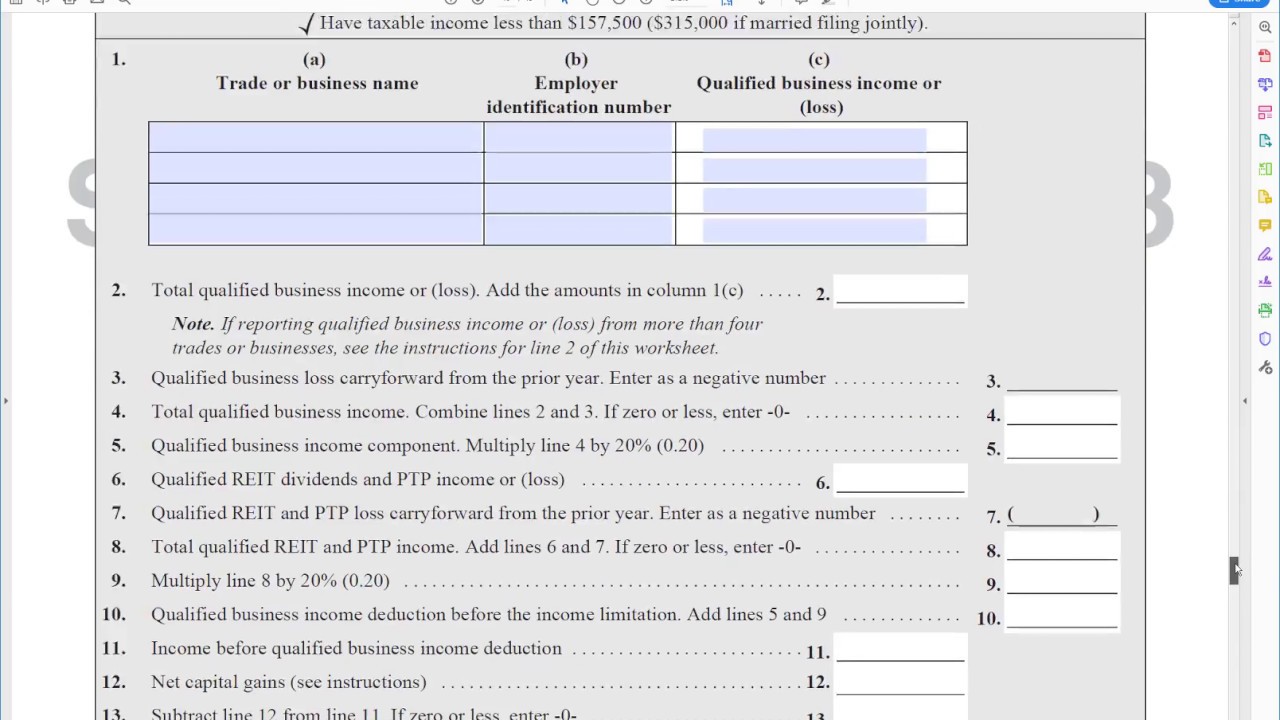

Web qualified business income deduction. Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married. Trade, business, or aggregation information (a) name (b) check if specified service. Web comprehensive qualified business income deduction worksheet part i: Web the computed 20% deduction amount will be limited to the higher.

Qualified Business Deduction Worksheet teacherfasr

Web the computed 20% deduction amount will be limited to the higher of 50% of wages paid by the business, or 25% of the. Web comprehensive qualified business income deduction worksheet part i: Web qualified business income deduction worksheets are available in forms view, and supporting statements will print with the. Web qualified business income deduction. Web information about form.

Update On The Qualified Business Deduction For Individuals

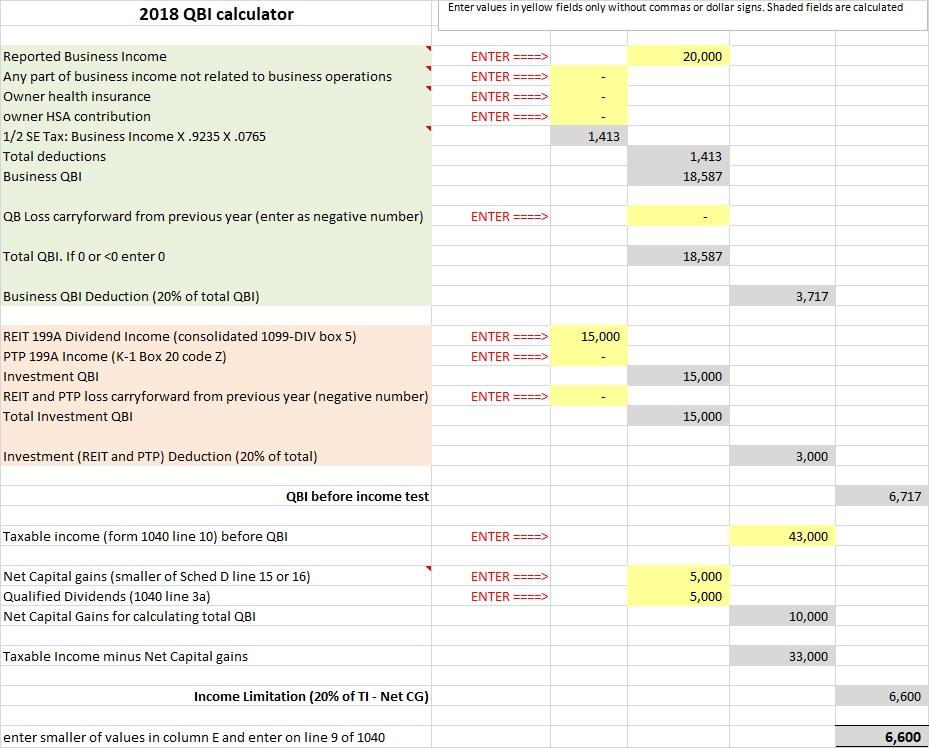

Web there's a good chance that you will qualify for a new tax benefit when you file your 2018. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate. Web qualified business income deduction. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of.

What is Qualified Business Deduction Worksheet Fundyourpurpose

Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Web access the asset module within the activity, go to setup > activity, and answer yes to the qualifies as trade or business for section. Web qualified business income deduction. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

This worksheet is for taxpayers who: Using the simplified worksheet or the complex. Web access the asset module within the activity, go to setup > activity, and answer yes to the qualifies as trade or business for section. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be.

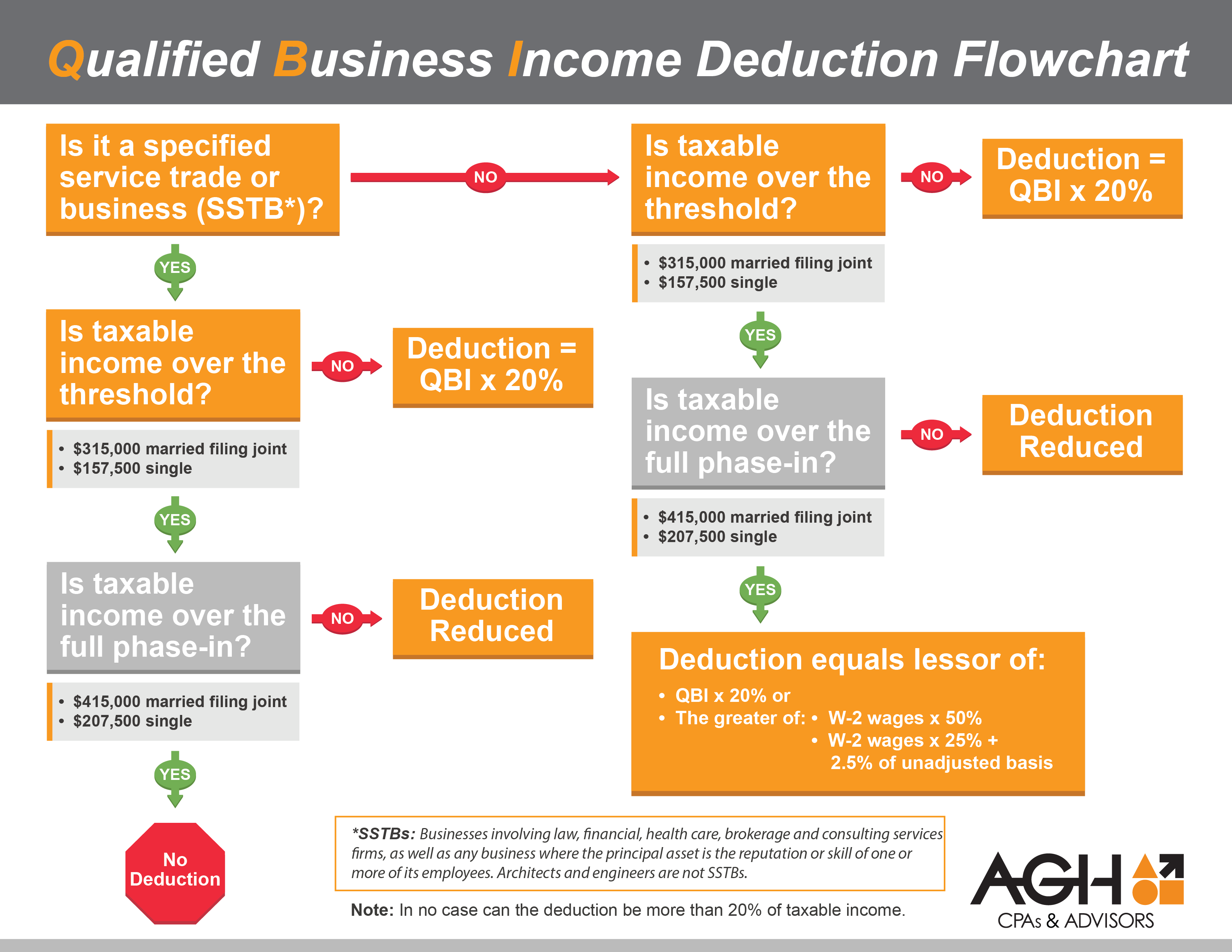

Qualified Business Deduction Flowchart

Web access the asset module within the activity, go to setup > activity, and answer yes to the qualifies as trade or business for section. Web the computed 20% deduction amount will be limited to the higher of 50% of wages paid by the business, or 25% of the. Web a worksheet is added to provide a reasonable method to.

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy

Web qualified business income deduction. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions.

Lacerte Simplified Worksheet Section 199A Qualified Business I

Web the qualified business income deduction simplified worksheet. Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Web qualified business income deduction worksheets are available in forms view, and supporting statements will print with the. This worksheet is for taxpayers who: Web the computed 20% deduction amount will be limited to the higher of 50%.

Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Trade, business, or aggregation information (a) name (b) check if specified service. Web there's a good chance that you will qualify for a new tax benefit when you file your 2018. Web the computed 20% deduction amount will be limited to the higher of 50% of wages paid by the business, or 25% of the. Web access the asset module within the activity, go to setup > activity, and answer yes to the qualifies as trade or business for section. Web qualified business income deduction. Web there are two ways to calculate the qbi deduction: Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Using the simplified worksheet or the complex. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate. Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married. Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Located in the qbid folder in form view, this worksheet prints. This worksheet is for taxpayers who: If you’re ready to save. Web comprehensive qualified business income deduction worksheet part i: Web 2020 qualified business income deduction worksheet detail by business schedule/form business name.

Many Owners Of Sole Proprietorships, Partnerships, S Corporations And Some Trusts And.

Web the computed 20% deduction amount will be limited to the higher of 50% of wages paid by the business, or 25% of the. Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Trade, business, or aggregation information (a) name (b) check if specified service. Web 2020 qualified business income deduction worksheet detail by business schedule/form business name.

Web 78 Rows This Worksheet Is Designed For Tax Professionals To Evaluate The Type Of Legal Entity A Business Should Consider,.

Web the qualified business income deduction simplified worksheet. Using the simplified worksheet or the complex. Web his qualified business income for 2021 was $180,000 and his taxable income is $225,000. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate.

Located In The Qbid Folder In Form View, This Worksheet Prints.

Web qualified business income deduction. This worksheet is for taxpayers who: Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Web there are two ways to calculate the qbi deduction:

Web Comprehensive Qualified Business Income Deduction Worksheet Part I:

Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business. Web access the asset module within the activity, go to setup > activity, and answer yes to the qualifies as trade or business for section. Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. Web there's a good chance that you will qualify for a new tax benefit when you file your 2018.