Qbi Calculation Worksheet - Web electing small business trusts (esbt). Web qualified business income deduction worksheets are available in forms view, and supporting statements will print with the. Web calculations where does my qbi calculation appear in the return? Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. With qualified business income deduction (qbi), the deduction that can be claimed must be the lower of: Located in the qbid folder in. Web the specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without. Using the simplified worksheet or the complex. Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,.

QBI Deduction (simplified calculation) YouTube

Web qbi calculator 2022 this calculator will calculate your applicable qualified business income deduction, also known as the pass. Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. Web there are.

ProConnect Tax Online Complex Worksheet Section 199A Qualified

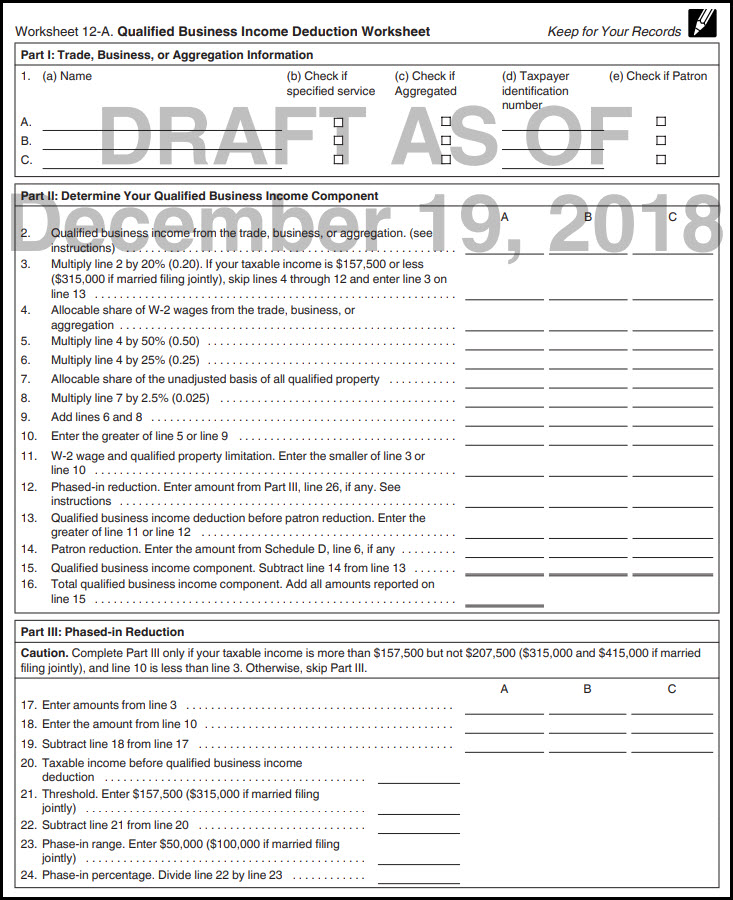

Using the simplified worksheet or the complex. Trade, business, or aggregation information (a) name (b) check if specified service. Web qualified business income deduction worksheets are available in forms view, and supporting statements will print with the. Include the following schedules (their specific. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your.

Update On The Qualified Business Deduction For Individuals

Partnership’s section 199a information worksheet. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Web electing small business trusts (esbt). Web calculations where does my qbi calculation appear in the return?

Qbi deduction calculator YuweiRio

Web there are two ways to calculate the qbi deduction: Include the following schedules (their specific. Web the qualified business income component worksheet and qualified income deduction worksheet. Web qbi calculator 2022 this calculator will calculate your applicable qualified business income deduction, also known as the pass. Web qualified business income deduction worksheets are available in forms view, and supporting.

Quiz & Worksheet Determining QBI Deductions

Trade, business, or aggregation information (a) name (b) check if specified service. Web electing small business trusts (esbt). Include the following schedules (their specific. Web calculations where does my qbi calculation appear in the return? Web information about form 8995, qualified business income deduction simplified computation, including recent updates,.

Optimal choice of entity for the QBI deduction

Combine lines 2 and 3. Web qualified business income deduction worksheets are available in forms view, and supporting statements will print with the. Determine whether your income is related to a qualified trade or. Web comprehensive qualified business income deduction worksheet part i: Located in the qbid folder in.

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy

Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Web the qualified business income component worksheet and qualified income deduction worksheet. Trade, business, or aggregation information (a) name (b) check if specified service. Web total qualified business income. Combine lines 2 and 3.

Business Calculation Worksheet Rental Property And

Web calculations where does my qbi calculation appear in the return? Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Include the following schedules (their specific. Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Web electing small business trusts (esbt).

Section 199a Information Worksheet

Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. Web the qualified business income component worksheet and qualified income deduction worksheet. Web total qualified business income. Web how to calculate the qbi deduction. Web comprehensive qualified business income deduction worksheet part i:

Demystifying Finance How Do I Calculate the QBI Calculation? YouTube

Determine whether your income is related to a qualified trade or. Web the specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without. Web there are two ways to calculate the qbi deduction: Partnership’s section 199a information worksheet. Web qualified business income deduction worksheets are available in forms view, and supporting statements will print with.

Combine lines 2 and 3. Web section 199a information worksheet. Web qbi calculator 2022 this calculator will calculate your applicable qualified business income deduction, also known as the pass. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Trade, business, or aggregation information (a) name (b) check if specified service. Web the specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without. Determine whether your income is related to a qualified trade or. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web comprehensive qualified business income deduction worksheet part i: Web how to calculate the qbi deduction. Partnership’s section 199a information worksheet. Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. With qualified business income deduction (qbi), the deduction that can be claimed must be the lower of: Web total qualified business income. Web calculations where does my qbi calculation appear in the return? Web information about form 8995, qualified business income deduction simplified computation, including recent updates,. Include the following schedules (their specific. Located in the qbid folder in. Web electing small business trusts (esbt).

Web Electing Small Business Trusts (Esbt).

Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. Trade, business, or aggregation information (a) name (b) check if specified service. Partnership’s section 199a information worksheet. Web how to calculate the qbi deduction.

Web There Are Two Ways To Calculate The Qbi Deduction:

Web lesser of qbi (or defined taxable income) and wage/asset calculation for specified service business if in phaseout range. Web calculations where does my qbi calculation appear in the return? Using the simplified worksheet or the complex. Include the following schedules (their specific.

With Qualified Business Income Deduction (Qbi), The Deduction That Can Be Claimed Must Be The Lower Of:

Web section 199a information worksheet. Web comprehensive qualified business income deduction worksheet part i: Combine lines 2 and 3. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi.

Web There Are Two Ways To Calculate The Qbi Deduction:

Web qualified business income deduction worksheets are available in forms view, and supporting statements will print with the. Located in the qbid folder in. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web the qualified business income component worksheet and qualified income deduction worksheet.