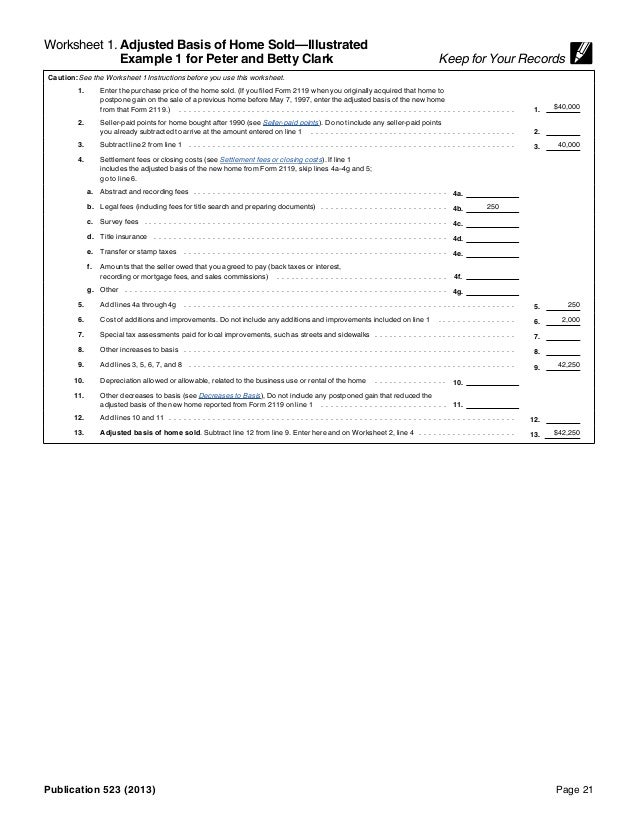

Publication 523 Worksheet - What's new special rules for capital gains. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. If you meet certain conditions, you may exclude the first. You don’t have to navigate your. Get your online template and fill it in using progressive features. 523, such as legislation enacted after it was published, go to irs.gov/pub523. Adjusted basis of home sold. She uses worksheet 2 to figure. Web emily uses worksheet 1 to figure the adjusted basis of the home she sold ($52,459). See if any of the situations listed in table 1 apply to you before you use this worksheet.

Naming Alkanes Worksheet With Answers Naming Alkanes Worksheet 1

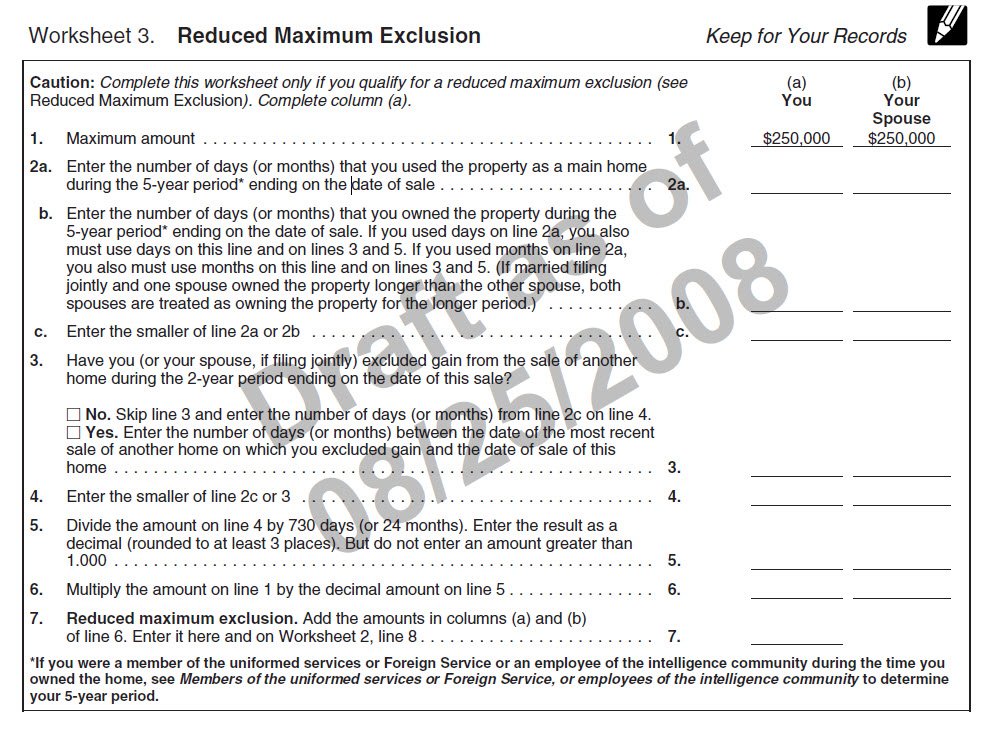

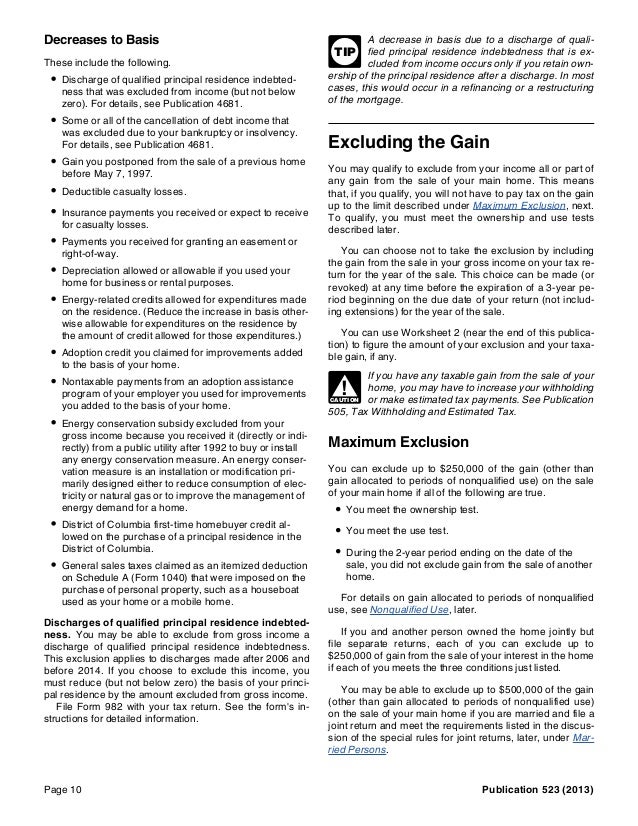

Web the amount realized on the sale of your home is the selling price minus selling expenses. If the home you sold had multiple owners, your gain or loss. Selling your home at www.irs.gov. Web pub 523 is an irs publication that explains the rules for claiming a home exclusion. Find your exclusion limit use this worksheet only if no.

Publication 523 Worksheets

Web to learn more, see publication 523: 4895, tax treatment of property acquired from a decedent dying. Web your jointly owned home had an adjusted basis of $50,000 on the date of your spouse's death, and the fair market value on that. Web the amount realized on the sale of your home is the selling price minus selling expenses. Find.

IRS Pub 523

Web to learn more, see publication 523: See if any of the situations listed in table 1 apply to you before you use this worksheet. Web pub 523 is an irs publication that explains the rules for claiming a home exclusion. Died in 2010, see pub. Web drafts of publication 523 worksheet 1.

Business Use Of Home Irs Publication YUBISN

If you meet certain conditions, you may exclude the first. You can access the worksheet for how to figure. Web department of the treasury internal revenue service publication 523 cat. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web the tax code recognizes the.

Reduced Sec 121 Exclusion Worksheet « Tax Guru Kertetter Letter

523, such as legislation enacted after it was published, go to irs.gov/pub523. Get your online template and fill it in using progressive features. If the home you sold had multiple owners, your gain or loss. Get tax help with tax on property sales. You can access the worksheet for how to figure.

Printable Traceable Letters For Toddlers / Letters To Numbers

Find your exclusion limit use this worksheet only if no automatic. Web emily uses worksheet 1 to figure the adjusted basis of the home she sold ($52,459). Web pub 523 is an irs publication that explains the rules for claiming a home exclusion. You don’t have to navigate your. Web the tax code recognizes the importance of home ownership by.

IRS Pub 523

Adjusted basis of home sold. Selling your home at www.irs.gov. Get tax help with tax on property sales. Web emily uses worksheet 1 to figure the adjusted basis of the home she sold ($52,459). 4895, tax treatment of property acquired from a decedent dying.

Publication 523, Selling Your Home; Chapter 2 Rules for Sales in 2001

Web department of the treasury internal revenue service publication 523 cat. Web the tax code recognizes the importance of home ownership by allowing you to exclude gain when you sell your main home. You can access the worksheet for how to figure. Per irs publication 523 selling. Web this publication explains the tax rules that apply when you sell or.

20++ Adjusted Basis Of Home Sold Worksheet Worksheets Decoomo

Get tax help with tax on property sales. You can access the worksheet for how to figure. If you meet certain conditions, you may exclude the first. What's new special rules for capital gains. Web adjusted basis amount of gain or loss other dispositions determining basis cost as basis basis other than cost adjusted.

Publication 523 Selling Your Home; Excluding the Gain

Web to learn more, see publication 523: Web pub 523 is an irs publication that explains the rules for claiming a home exclusion. If you meet certain conditions, you may exclude the first. Died in 2010, see pub. 523, such as legislation enacted after it was published, go to irs.gov/pub523.

Web if single or married filing separately, figure gain or loss as an individual. Web pub 523 is an irs publication that explains the rules for claiming a home exclusion. What's new special rules for capital gains. Web the amount realized on the sale of your home is the selling price minus selling expenses. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. If you meet certain conditions, you may exclude the first. Web adjusted basis amount of gain or loss other dispositions determining basis cost as basis basis other than cost adjusted. See if any of the situations listed in table 1 apply to you before you use this worksheet. Web emily uses worksheet 1 to figure the adjusted basis of the home she sold ($52,459). Get your online template and fill it in using progressive features. Web how to fill out and sign publication 523 online? 15044w selling your home for use in preparing. Find your exclusion limit use this worksheet only if no automatic. Selling your home at www.irs.gov. You don’t have to navigate your. Web publication 523 worksheet 1. Per irs publication 523 selling. Gain (or loss), exclusion, and. Enjoy smart fillable fields and interactivity. Web to learn more, see publication 523:

Web How To Fill Out And Sign Publication 523 Online?

Get tax help with tax on property sales. Web to learn more, see publication 523: Enjoy smart fillable fields and interactivity. Selling your home at www.irs.gov.

Web This Publication Explains The Tax Rules That Apply When You Sell Or Otherwise Give Up Ownership Of A Home.

Web the amount realized on the sale of your home is the selling price minus selling expenses. Web the tax code recognizes the importance of home ownership by allowing you to exclude gain when you sell your main home. Find your exclusion limit use this worksheet only if no automatic. Web publication 523 worksheet 1.

Web Drafts Of Publication 523 Worksheet 1.

4895, tax treatment of property acquired from a decedent dying. Get your online template and fill it in using progressive features. 15044w selling your home for use in preparing. If you meet certain conditions, you may exclude the first.

Web Department Of The Treasury Internal Revenue Service Publication 523 Cat.

Gain (or loss), exclusion, and. Adjusted basis of home sold. You don’t have to navigate your. Web adjusted basis amount of gain or loss other dispositions determining basis cost as basis basis other than cost adjusted.