Printable Small Business Tax Deductions Worksheet - This worksheet allows you to itemize your tax deductions for a given year. Web 20 small business tax deductions to know: Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Web don’t get stuck with a huge tax bill next year! Advertising on line 9 of. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet. Publication 225, farmer's tax guide. The following list gives you the complete rundown of possible deductions you. Web use this form to figure your qualified business income deduction. Use separate schedules a, b, c, and/or d, as appropriate,.

irs business worksheet Google Search Small business tax, Small

Check out this comprehensive list of small business tax. Web 20 small business tax deductions to know: Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet. Web if you're.

Home Businesses Deductions

Advertising on line 9 of. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Publication 225, farmer's tax guide. Web small business worksheet client: Use separate schedules a, b, c, and/or d, as appropriate,.

Tax Preparation Spreadsheet Business tax deductions, Small business

Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Id # tax year ordinary suppliesthe purpose of. Below, you.

Tax De Trucker Tax Deduction Worksheet Great Linear —

Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. Publication 225, farmer's tax guide. Id # tax year ordinary suppliesthe purpose of. Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Web.

Small Business Tax Deductions Worksheet

Below, you will find a detailed. Web which small business tax deductions are you eligible for? Advertising on line 9 of. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Web what you need to know for this free small business tax spreadsheet.

Tax Deductions Write Offs Self Employed Small Business

Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. When you file your taxes for your business, there are a. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from. Web use this.

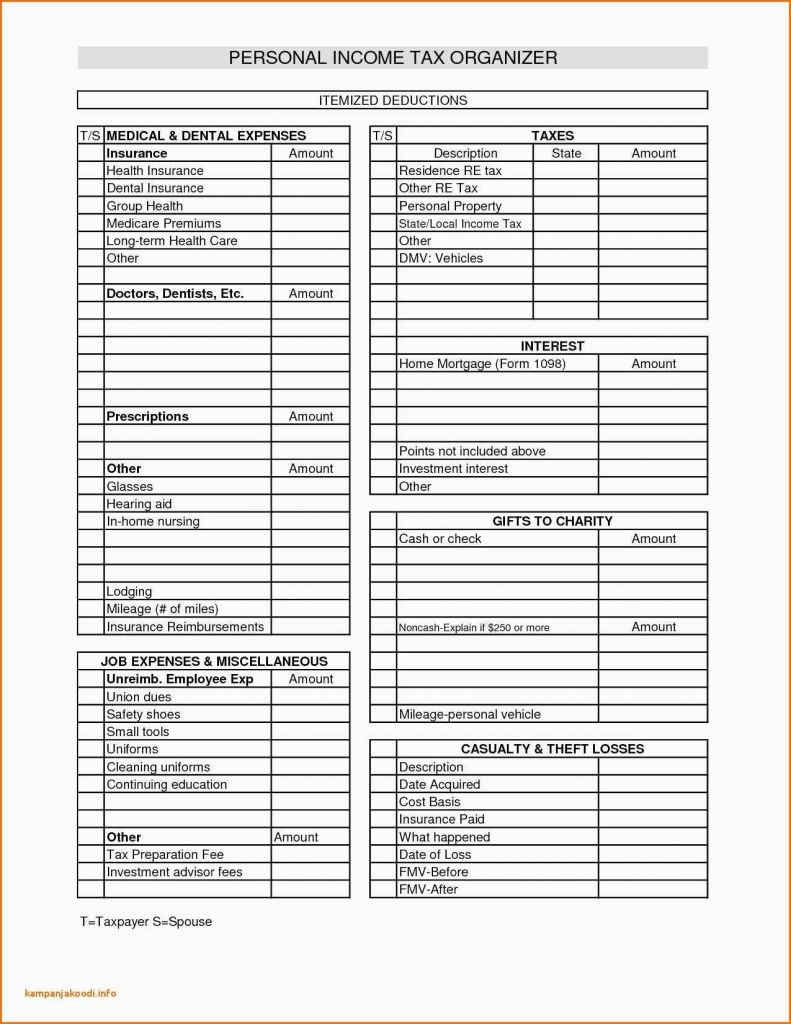

Itemized Deductions Worksheet

Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet. Use separate schedules a, b, c, and/or d, as appropriate,. Web don’t get stuck with a huge tax bill next year! Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. Web use.

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

This worksheet allows you to itemize your tax deductions for a given year. Advertising on line 9 of. Web which small business tax deductions are you eligible for? Below, you will find a detailed. Web taxpayers can deduct only the amount of unreimbursed medical and dental expenses that exceed 7.5% of their adjusted gross.

FunctionalBest Of Self Employed Tax Deductions Worksheet Check more at

Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet. Web taxpayers can deduct only the amount of unreimbursed medical and dental expenses that exceed 7.5% of their adjusted gross. Web which small business tax deductions are you eligible for? Advertising on line 9 of. Id # tax year ordinary suppliesthe.

Pin by Jonathancdrake on Templates printable free Business tax

Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. When you file your taxes for your business, there are a. Free 2022 checklist marc holliday | senior product marketing manager january 28, 2022 taxes. Web if you're facing an audit or filing taxes for the first time, complete our free small.

Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from. When you file your taxes for your business, there are a. Use separate schedules a, b, c, and/or d, as appropriate,. Web don’t get stuck with a huge tax bill next year! Web use our free printable small business tax deductions worksheet to make sure you haven’t forgotten anything. Web 20 small business tax deductions to know: Web which small business tax deductions are you eligible for? Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Below, you will find a detailed. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. Web what you need to know for this free small business tax spreadsheet. Check out this comprehensive list of small business tax. Web taxpayers can deduct only the amount of unreimbursed medical and dental expenses that exceed 7.5% of their adjusted gross. Web to help you minimize your tax liability, here is a list of 20+ small business tax deductions. The following list gives you the complete rundown of possible deductions you. Web small business worksheet client: Advertising on line 9 of. Publication 225, farmer's tax guide. Web identifying every available deduction is an important part of calculating your small business taxes.

Use Separate Schedules A, B, C, And/Or D, As Appropriate,.

The following list gives you the complete rundown of possible deductions you. Web don’t get stuck with a huge tax bill next year! Web use our free printable small business tax deductions worksheet to make sure you haven’t forgotten anything. Web small business worksheet client:

Web What You Need To Know For This Free Small Business Tax Spreadsheet.

Web if you're facing an audit or filing taxes for the first time, complete our free small business tax worksheet that guides you to help. Below, you will find a detailed. Web taxpayers can deduct only the amount of unreimbursed medical and dental expenses that exceed 7.5% of their adjusted gross. Free 2022 checklist marc holliday | senior product marketing manager january 28, 2022 taxes.

Check Out This Comprehensive List Of Small Business Tax.

Web 20 small business tax deductions to know: Advertising on line 9 of. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from.

Publication 225, Farmer's Tax Guide.

Id # tax year ordinary suppliesthe purpose of. Web identifying every available deduction is an important part of calculating your small business taxes. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. This worksheet allows you to itemize your tax deductions for a given year.