Partnership Basis Calculation Worksheet - Information about the partnership.7 part ii. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web partnership election to adjust basis of partnership property. Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i.

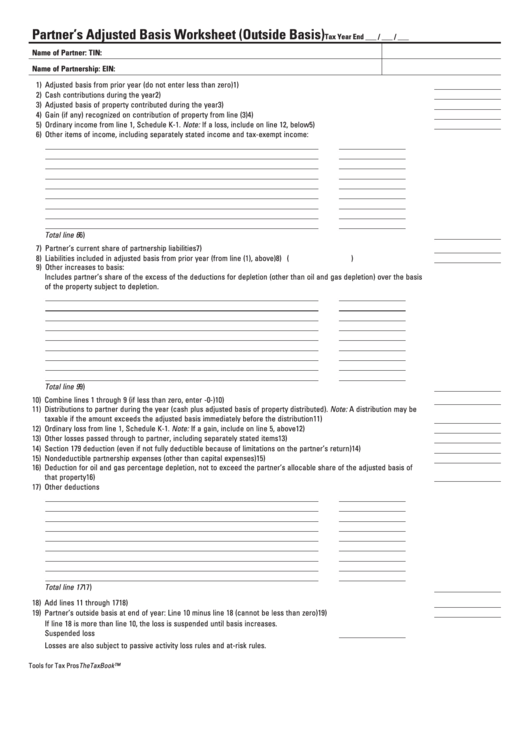

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

Web partnership election to adjust basis of partnership property. Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Web to assist the partners in determining.

Partner Basis Worksheet Instructions

Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i. Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Web partnership election to adjust basis of partnership property. Web you can figure the adjusted basis of your partnership interest by adding items that increase.

Access Free partnership basis calculation worksheet ? vcon.duhs.edu.pk

Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web you can figure the adjusted basis of your partnership interest by adding.

Solved The following balance sheet is for a local

Web partnership election to adjust basis of partnership property. Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Information about the partnership.7 part ii. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found.

Partnership Basis Calculation Worksheet Studying Worksheets

Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i. Web partnership election to adjust basis of partnership property. Information about the partnership.7 part ii. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in.

Partnership Basis Calculation Worksheet Studying Worksheets

Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the.

Solved Assessment 4 Partnerships 2 Exercise 1 Worksheet

Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web partnership election to adjust basis of partnership property. Web you can.

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership.

21+ 2020 Capital Loss Carryover Worksheet ShilpaDaanya

Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Web worksheet for adjusting.

Tax Basis Capital Account Worksheet

Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Web worksheet for adjusting.

Web partnership election to adjust basis of partnership property. Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting items that decrease your basis. Information about the partnership.7 part ii.

Web You Can Figure The Adjusted Basis Of Your Partnership Interest By Adding Items That Increase Your Basis And Then Subtracting Items That Decrease Your Basis.

Information about the partnership.7 part ii. Web worksheet for adjusting the basis of a partner's interest in the partnership.4 specific instructions.7 part i. Generally, a partnership's basis in its assets is not affected by a transfer of an interest in the. Web partnership election to adjust basis of partnership property.