Partner's Outside Basis Worksheet - Web partner's adjusted basis worksheet at the adjusted basis worksheet menu, the user will be able to enter, based on the. Web however, if neither of the two statements are true, then beginning partner capital accounts for 2020 may be computed using one of. Web a partner’s outside basis includes a partner’s share of liabilities whereas a partner’s capital account does. Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. If a partner's share of partnership liabilities decreases, or a partner's individual liabilities decrease. Web the application calculates the outside basis depreciation adjustment included in other deductions using assets entered in the. Web swiftly generate a partners adjusted basis worksheet outside basis tax year without needing to involve experts. Sign in to your taxact online. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital. In other words, it appears that the purpose of the tax basis capital reporting requirement is to allow the irs to.

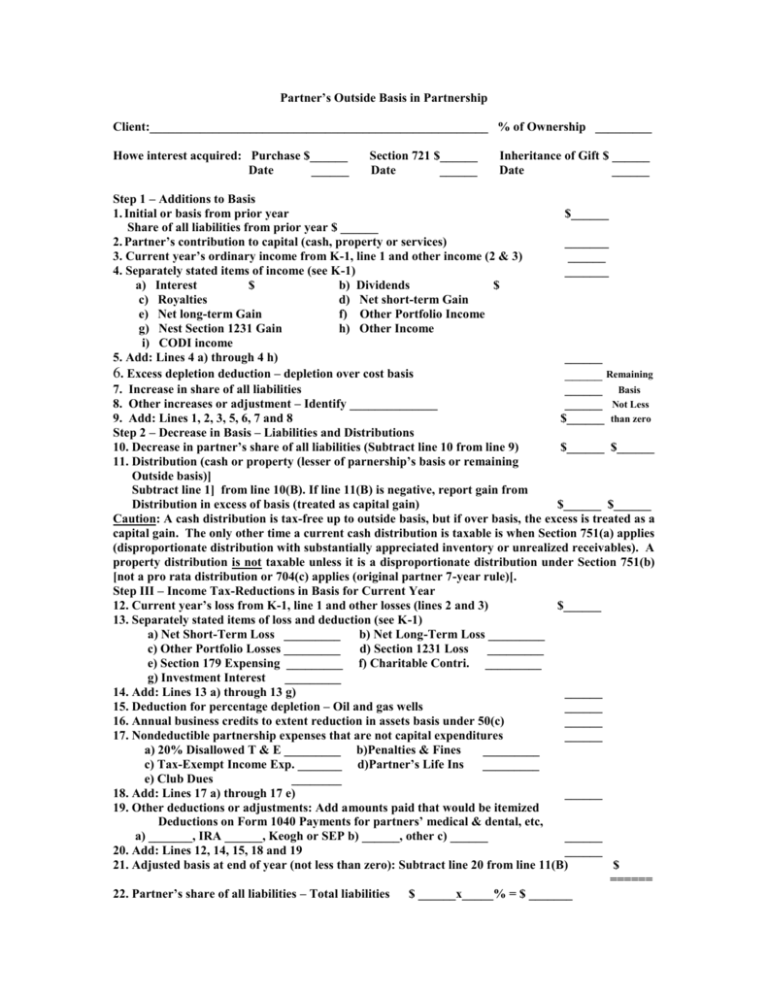

Partner's Outside Basis in Partnership

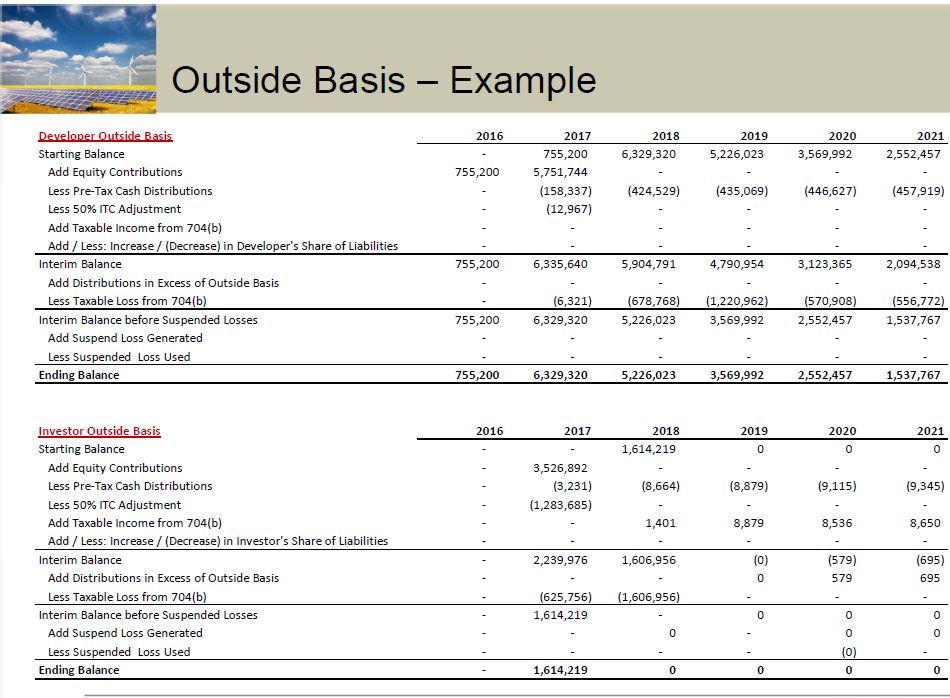

Web a partner’s outside basis includes a partner’s share of liabilities whereas a partner’s capital account does. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital. Web as previously stated, outside basis is a partner’s basis in his partnership interest. Web partner's adjusted basis worksheet at the adjusted basis worksheet menu,.

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Web swiftly generate a partners adjusted basis worksheet outside basis tax year without needing to involve experts. The basis is determined without. Web to navigate to the worksheet for adjusting the basis of a partner's interest in the partnership: Web outside basis outside basis represents each partner’s basis in the partnership interest. Web however, if neither of the two statements.

41 nol calculation worksheet excel Worksheet Works

Web outside basis outside basis represents each partner’s basis in the partnership interest. Web the application calculates the outside basis depreciation adjustment included in other deductions using assets entered in the. Partner’s outside basis at beginning of year*1 increases to. Web swiftly generate a partners adjusted basis worksheet outside basis tax year without needing to involve experts. Sign in to.

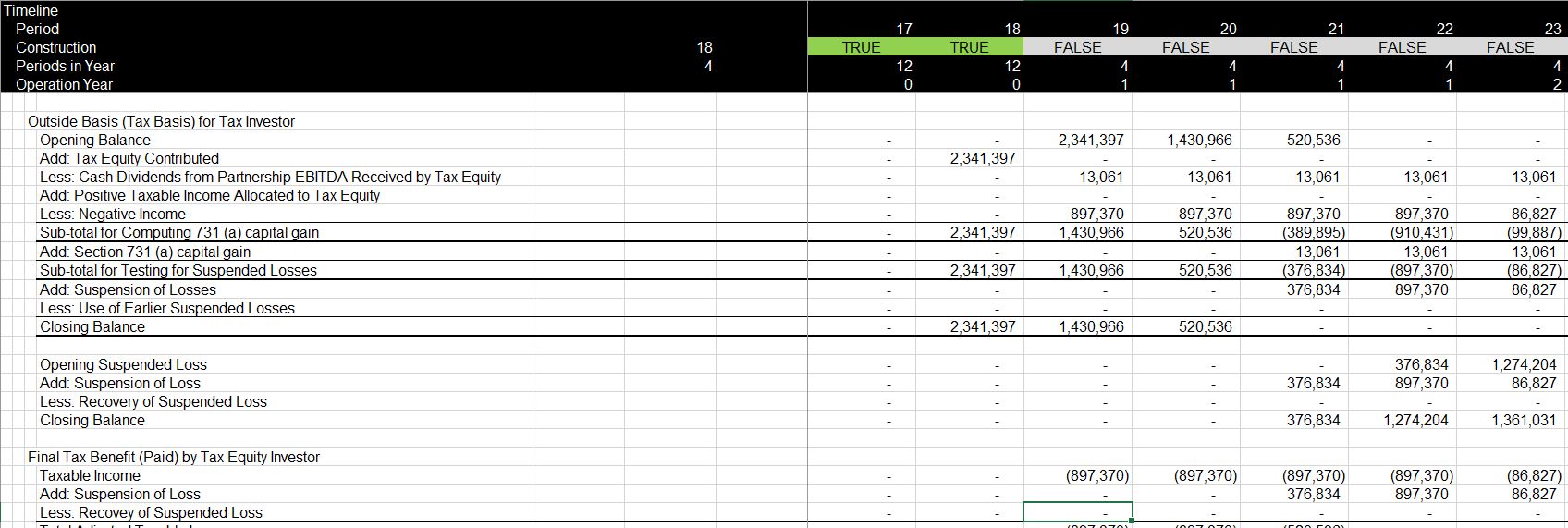

Outside Basis (Tax Basis) Edward Bodmer Project and Corporate Finance

Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web a partner’s outside basis includes a partner’s share of liabilities whereas a partner’s capital account does. Web the application calculates the outside basis depreciation adjustment included in other deductions using assets entered in the. Web you can figure the adjusted basis of your.

Partnership Basis Calculation Worksheets

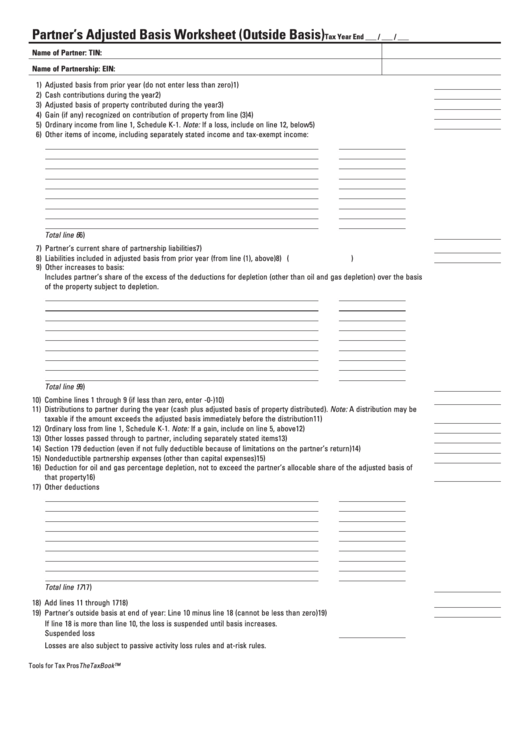

Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. The basis is determined without. Partner’s outside basis at beginning of year*1 increases to. Web outside basis outside basis represents each partner’s basis in the partnership interest. Web a partner’s outside basis includes a partner’s share of liabilities whereas a partner’s capital account does.

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

Web a partner’s outside basis includes a partner’s share of liabilities whereas a partner’s capital account does. Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital. Web outside basis outside basis represents each partner’s basis in.

Using turbotax for s corp partner doppedia

Some of the worksheets displayed are partners. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web partner's adjusted basis worksheet at the adjusted basis worksheet menu, the user will be able to enter, based on the. Partner’s outside basis at beginning of year*1 increases to. Sign in to your taxact online.

How do you use the Partner's Adjusted Basis Worksheet when preparing

Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Web to navigate to the worksheet for adjusting the basis of a partner's interest in the partnership: Partner’s outside basis at beginning of year*1 increases to. Some of the worksheets displayed are partners. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis.

Partner Basis Worksheets Instructions

Sign in to your taxact online. Some of the worksheets displayed are partners. In other words, it appears that the purpose of the tax basis capital reporting requirement is to allow the irs to. The basis is determined without. Web tcja and irc 704(d) section 13503 of the tax cuts and jobs act of 2017 (tcja) modifies the irc §.

Access Free partnership basis calculation worksheet ? vcon.duhs.edu.pk

Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital. Web as previously stated, outside basis is a partner’s basis in.

Partner’s outside basis at beginning of year*1 increases to. Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Web a partner’s outside basis includes a partner’s share of liabilities whereas a partner’s capital account does. Web tcja and irc 704(d) section 13503 of the tax cuts and jobs act of 2017 (tcja) modifies the irc § 704(d) basis limitation. Web to navigate to the worksheet for adjusting the basis of a partner's interest in the partnership: Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Inside basis is the partnership’s basis in. Web swiftly generate a partners adjusted basis worksheet outside basis tax year without needing to involve experts. The basis is determined without. Web outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without. Web outside basis outside basis represents each partner’s basis in the partnership interest. Web the application calculates the outside basis depreciation adjustment included in other deductions using assets entered in the. Some of the worksheets displayed are partners. Sign in to your taxact online. If a partner's share of partnership liabilities decreases, or a partner's individual liabilities decrease. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital. In other words, it appears that the purpose of the tax basis capital reporting requirement is to allow the irs to. Web as previously stated, outside basis is a partner’s basis in his partnership interest.

Web A Partner’s Adjusted (Outside) Basis Refers To The Partner’s Investment In A Partnership.

If a partner's share of partnership liabilities decreases, or a partner's individual liabilities decrease. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. In other words, it appears that the purpose of the tax basis capital reporting requirement is to allow the irs to. Web the application calculates the outside basis depreciation adjustment included in other deductions using assets entered in the.

Edit Your Partnership Basis Worksheet Online Type Text, Add Images, Blackout Confidential Details, Add Comments,.

Web as previously stated, outside basis is a partner’s basis in his partnership interest. Partner’s outside basis at beginning of year*1 increases to. Inside basis is the partnership’s basis in. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and.

Web Partner's Adjusted Basis Worksheet At The Adjusted Basis Worksheet Menu, The User Will Be Able To Enter, Based On The.

Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital. Web tcja and irc 704(d) section 13503 of the tax cuts and jobs act of 2017 (tcja) modifies the irc § 704(d) basis limitation. Web to navigate to the worksheet for adjusting the basis of a partner's interest in the partnership: Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,.

Web However, If Neither Of The Two Statements Are True, Then Beginning Partner Capital Accounts For 2020 May Be Computed Using One Of.

Web a partner’s outside basis includes a partner’s share of liabilities whereas a partner’s capital account does. Web outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without. Web outside basis outside basis represents each partner’s basis in the partnership interest. Web swiftly generate a partners adjusted basis worksheet outside basis tax year without needing to involve experts.