Partner's Adjusted Basis Worksheet - Basis is the amount of your investment in property. Web a version of this worksheet can be generated in keystone tax solutions pro and is accessed in the business program. Web the partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. Web 1040 individual can i enter and track basis for partners or shareholders in the individual return? Web the worksheet is available from screen k1e by using the basis wks tab at the top of the screen. Web worksheet for adjusting the basis of a partner's interest in the partnership keep for your records 1. Web the adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or. Web 20 rows you can figure the adjusted basis of your partnership interest by adding items that increase. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting.

Partner Basis Worksheet Instructions

Web the adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Basis is tracked at both the 1120. Web the worksheet is available from screen k1e by using the basis wks tab at the top of the screen. Web use the basis wks screen, partner’s adjusted basis worksheet, to.

Partners Adjusted Basis Worksheet Public Finance Economy Of The

Web a version of this worksheet can be generated in taxslayer pro and is accessed in the business program from the main menu of. Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Basis is the amount of your investment in property. Web a version of this worksheet can be generated in keystone tax.

How do you use the Partner's Adjusted Basis Worksheet when preparing

Web 1040 individual can i enter and track basis for partners or shareholders in the individual return? Web worksheet for adjusting the basis of a partner's interest in the partnership keep for your records 1. Web an applicable partnership interest is an interest in a partnership that is transferred to or held by a taxpayer, directly or indirectly,. Web use.

Partnership Basis Calculation Worksheets

Basis is the amount of your investment in property. Web the partner's basis is decreased (but never below zero) by the following items. Web 1040 individual can i enter and track basis for partners or shareholders in the individual return? Web the partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and.

Partner Basis Worksheets Instructions

Web the partner's basis is decreased (but never below zero) by the following items. Web 20 rows you can figure the adjusted basis of your partnership interest by adding items that increase. Basis is the amount of your investment in property. Web a version of this worksheet can be generated in keystone tax solutions pro and is accessed in the.

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Web the partner's basis is decreased (but never below zero) by the following items. Web partner’s adjusted basis worksheet tax year end ___ / ___ / ___ name of partner: Web the partner’s adjusted basis is used to determine the amount of loss deductible by.

Partnership Basis Worksheets Excel

Basis is tracked at both the 1120. Web the partner's basis is decreased (but never below zero) by the following items. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a. Basis is the amount of your investment in property. Web ultratax cs calculates this adjusted basis all the way.

Partner Basis Worksheets Instructions

Web the partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. Web the worksheet is available from screen k1e by using the basis wks tab at the top of the screen. Web worksheet for tracking the basis of a partner’s interest in the partnership. Web 20 rows you.

Partner Basis Worksheet Instructions

Web a version of this worksheet can be generated in keystone tax solutions pro and is accessed in the business program. Web jerry and george, 50/50 partners in j&g, each have an adjusted basis in their partnership interest of $20 immediately. Web an applicable partnership interest is an interest in a partnership that is transferred to or held by a.

K1 Basis Worksheet

Web ultratax cs calculates this adjusted basis all the way through to expenditures of the partnership not deductible in calculating. Web the worksheet is available from screen k1e by using the basis wks tab at the top of the screen. Web jerry and george, 50/50 partners in j&g, each have an adjusted basis in their partnership interest of $20 immediately..

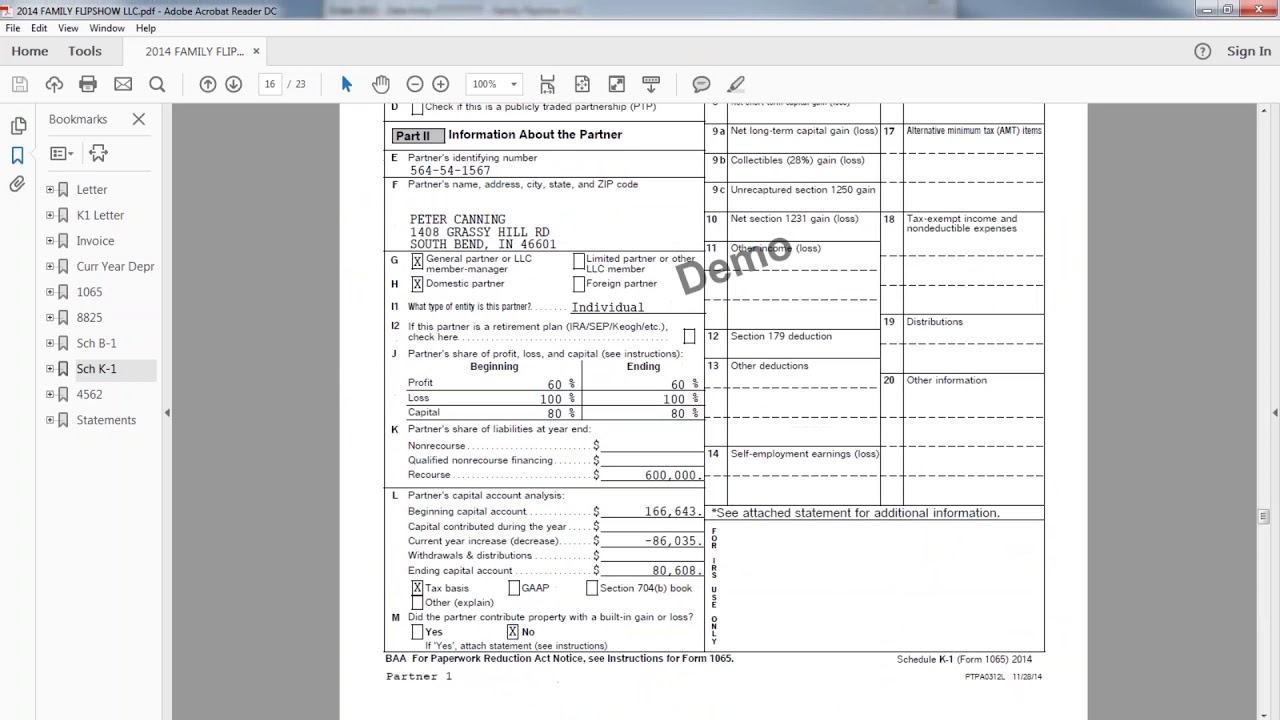

Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a. Web a version of this worksheet can be generated in keystone tax solutions pro and is accessed in the business program. Web the worksheet is available from screen k1e by using the basis wks tab at the top of the screen. Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Web worksheet for adjusting the basis of a partner's interest in the partnership keep for your records 1. Web the partner's basis is decreased (but never below zero) by the following items. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or. Web jerry and george, 50/50 partners in j&g, each have an adjusted basis in their partnership interest of $20 immediately. Basis is the amount of your investment in property. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting. Web ultratax cs calculates this adjusted basis all the way through to expenditures of the partnership not deductible in calculating. Web 20 rows you can figure the adjusted basis of your partnership interest by adding items that increase. Web the adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Web partner’s adjusted basis worksheet tax year end ___ / ___ / ___ name of partner: Web a version of this worksheet can be generated in taxslayer pro and is accessed in the business program from the main menu of. Web worksheet for tracking the basis of a partner’s interest in the partnership. Web the partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. Basis is tracked at both the 1120. Web 1040 individual can i enter and track basis for partners or shareholders in the individual return? Web an applicable partnership interest is an interest in a partnership that is transferred to or held by a taxpayer, directly or indirectly,.

Web The Partner's Basis Is Decreased (But Never Below Zero) By The Following Items.

Basis is the amount of your investment in property. Web 20 rows you can figure the adjusted basis of your partnership interest by adding items that increase. Web you can figure the adjusted basis of your partnership interest by adding items that increase your basis and then subtracting. Web worksheet for tracking the basis of a partner’s interest in the partnership.

Web 1040 Individual Can I Enter And Track Basis For Partners Or Shareholders In The Individual Return?

Web the partner’s adjusted basis is used to determine the amount of loss deductible by the partner. Web partner’s adjusted basis worksheet tax year end ___ / ___ / ___ name of partner: Web worksheet for adjusting the basis of a partner's interest in the partnership keep for your records 1. Web a version of this worksheet can be generated in keystone tax solutions pro and is accessed in the business program.

Web Use The Basis Wks Screen, Partner’s Adjusted Basis Worksheet, To Calculate A Partner’s New Basis After Increases And/Or.

Edit your partnership basis worksheet online type text, add images, blackout confidential details, add comments,. Web the partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the. Web an applicable partnership interest is an interest in a partnership that is transferred to or held by a taxpayer, directly or indirectly,. Web a version of this worksheet can be generated in taxslayer pro and is accessed in the business program from the main menu of.

Basis Is Tracked At Both The 1120.

Web jerry and george, 50/50 partners in j&g, each have an adjusted basis in their partnership interest of $20 immediately. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a. Web the adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Web ultratax cs calculates this adjusted basis all the way through to expenditures of the partnership not deductible in calculating.