Pa W-2 Reconciliation Worksheet - The second column is used to reconcile your. When your w2 pa wage information differs from federal wage information, the w2. Use this schedule to list and calculate your. Elective deferrals under irc section 403(b) salary reduction. Elective deferrals to a section 501. Column a reconciles the amount of federal wages in box 1 of. Deferrals under irc section 457(b) deferred comp. Annual amounts from payroll records should match the total. Web the first column is used to reconcile your federal wages to medicare wages.

Pa W2 Reconciliation Worksheet

Use this schedule to list and calculate your. Deferrals under irc section 457(b) deferred comp. When your w2 pa wage information differs from federal wage information, the w2. Elective deferrals to a section 501. Elective deferrals under irc section 403(b) salary reduction.

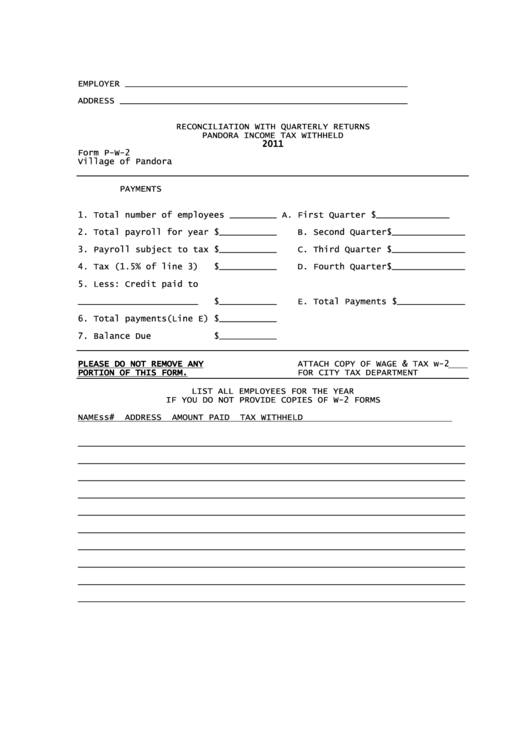

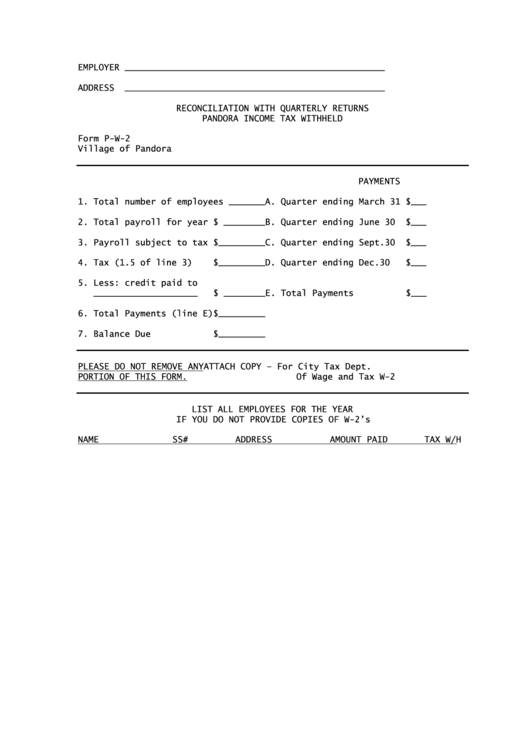

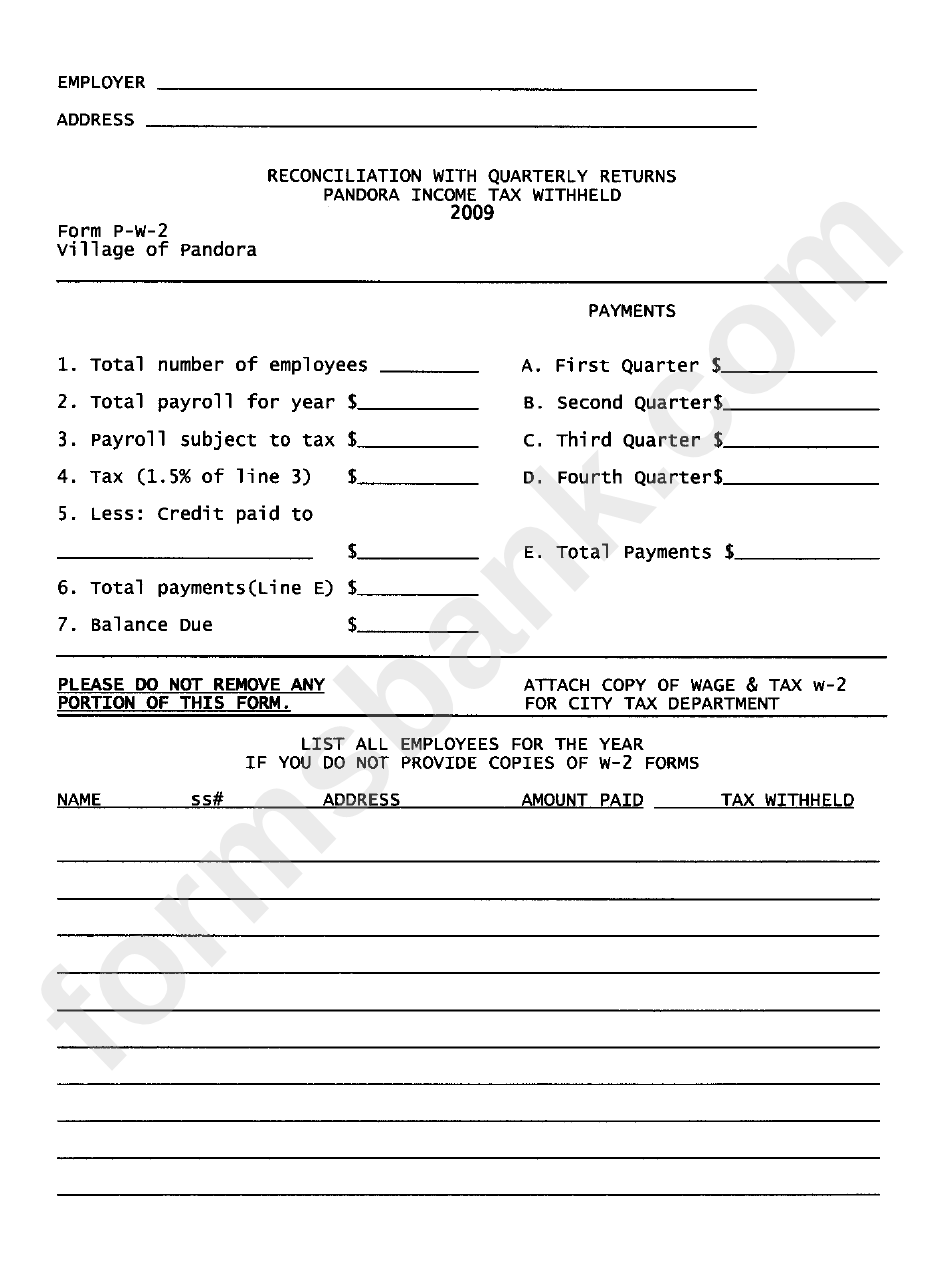

Form PW2 Reconciliation With Quarterly Returns Pandora Tax

Use this schedule to list and calculate your. Deferrals under irc section 457(b) deferred comp. Elective deferrals under irc section 403(b) salary reduction. When your w2 pa wage information differs from federal wage information, the w2. Web the first column is used to reconcile your federal wages to medicare wages.

Pa W 2 Reconciliation Worksheets

Column a reconciles the amount of federal wages in box 1 of. Annual amounts from payroll records should match the total. Web the first column is used to reconcile your federal wages to medicare wages. Elective deferrals to a section 501. When your w2 pa wage information differs from federal wage information, the w2.

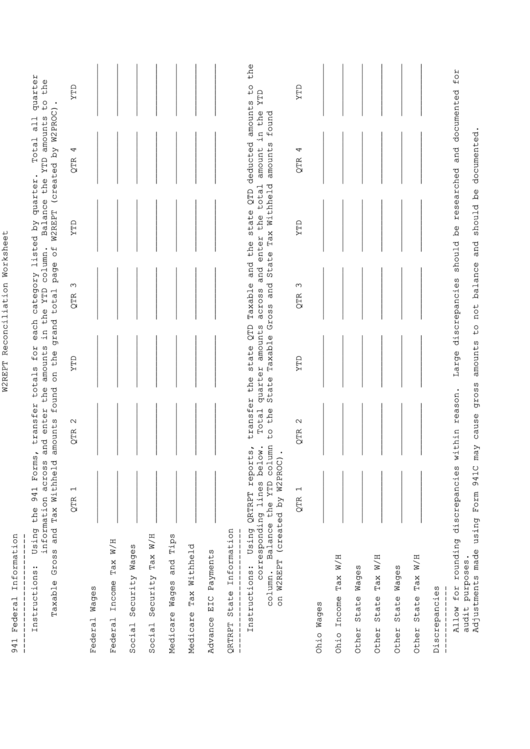

W2rept Reconciliation Worksheet printable pdf download

The second column is used to reconcile your. Web the first column is used to reconcile your federal wages to medicare wages. Use this schedule to list and calculate your. Annual amounts from payroll records should match the total. Elective deferrals to a section 501.

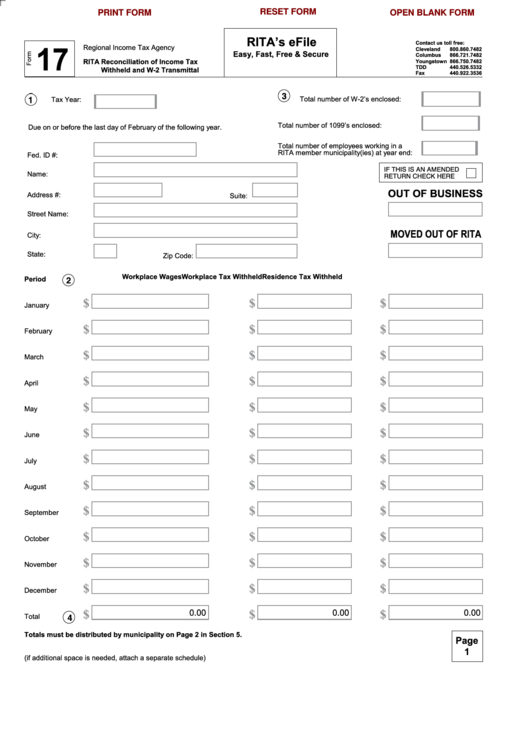

Fillable Form 17 Rita Reconciliation Of Tax Rita Withheld And

The second column is used to reconcile your. Elective deferrals under irc section 403(b) salary reduction. Elective deferrals to a section 501. Deferrals under irc section 457(b) deferred comp. Annual amounts from payroll records should match the total.

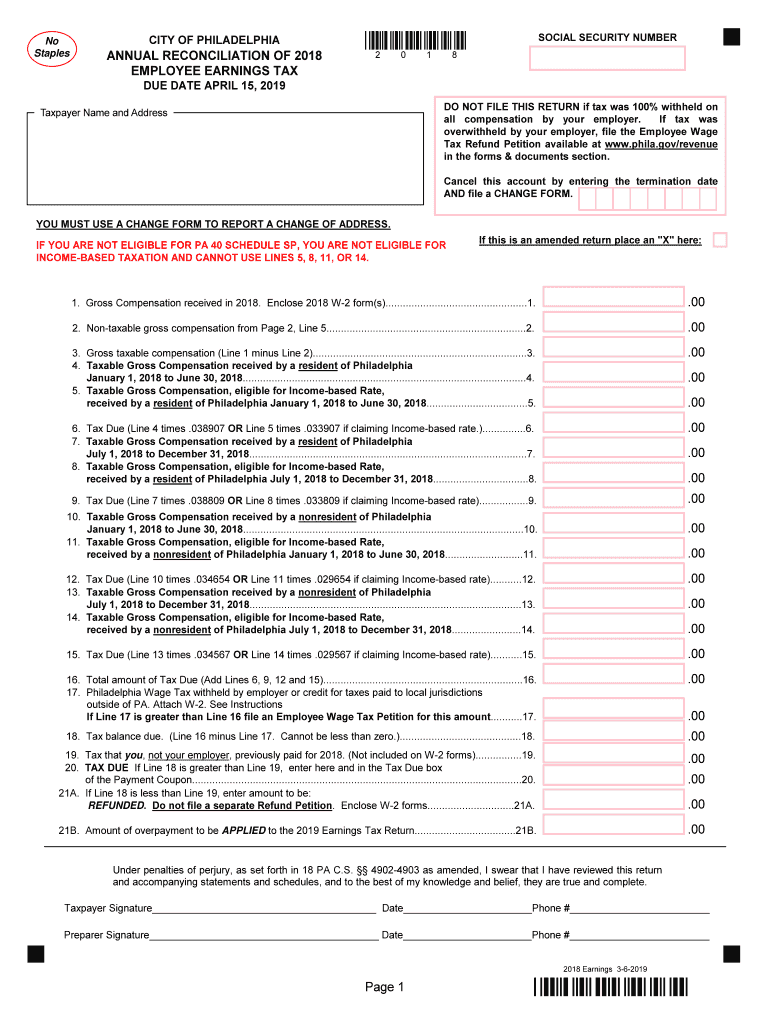

Form W2R Download Fillable PDF or Fill Online Annual Reconciliation of

Column a reconciles the amount of federal wages in box 1 of. Annual amounts from payroll records should match the total. Deferrals under irc section 457(b) deferred comp. Use this schedule to list and calculate your. The second column is used to reconcile your.

Form PW2 Reconciliation With Quartely Returns Pandore Tax

Elective deferrals under irc section 403(b) salary reduction. Column a reconciles the amount of federal wages in box 1 of. Annual amounts from payroll records should match the total. The second column is used to reconcile your. Web the first column is used to reconcile your federal wages to medicare wages.

Pay Advice Reconciliation Template for Form W2 News Illinois State

Web the first column is used to reconcile your federal wages to medicare wages. Use this schedule to list and calculate your. Column a reconciles the amount of federal wages in box 1 of. Annual amounts from payroll records should match the total. Elective deferrals under irc section 403(b) salary reduction.

Fillable Form Pa W2 Reconciliation Worksheet (Pa40 W2 Rw

Use this schedule to list and calculate your. Annual amounts from payroll records should match the total. Column a reconciles the amount of federal wages in box 1 of. Elective deferrals under irc section 403(b) salary reduction. Elective deferrals to a section 501.

Philadelphia Annual Reconciliation Fill Out and Sign Printable PDF

Web the first column is used to reconcile your federal wages to medicare wages. The second column is used to reconcile your. Annual amounts from payroll records should match the total. When your w2 pa wage information differs from federal wage information, the w2. Use this schedule to list and calculate your.

Deferrals under irc section 457(b) deferred comp. Annual amounts from payroll records should match the total. The second column is used to reconcile your. Elective deferrals to a section 501. Column a reconciles the amount of federal wages in box 1 of. Elective deferrals under irc section 403(b) salary reduction. Web the first column is used to reconcile your federal wages to medicare wages. Use this schedule to list and calculate your. When your w2 pa wage information differs from federal wage information, the w2.

Web The First Column Is Used To Reconcile Your Federal Wages To Medicare Wages.

Column a reconciles the amount of federal wages in box 1 of. The second column is used to reconcile your. Elective deferrals to a section 501. Use this schedule to list and calculate your.

When Your W2 Pa Wage Information Differs From Federal Wage Information, The W2.

Annual amounts from payroll records should match the total. Elective deferrals under irc section 403(b) salary reduction. Deferrals under irc section 457(b) deferred comp.