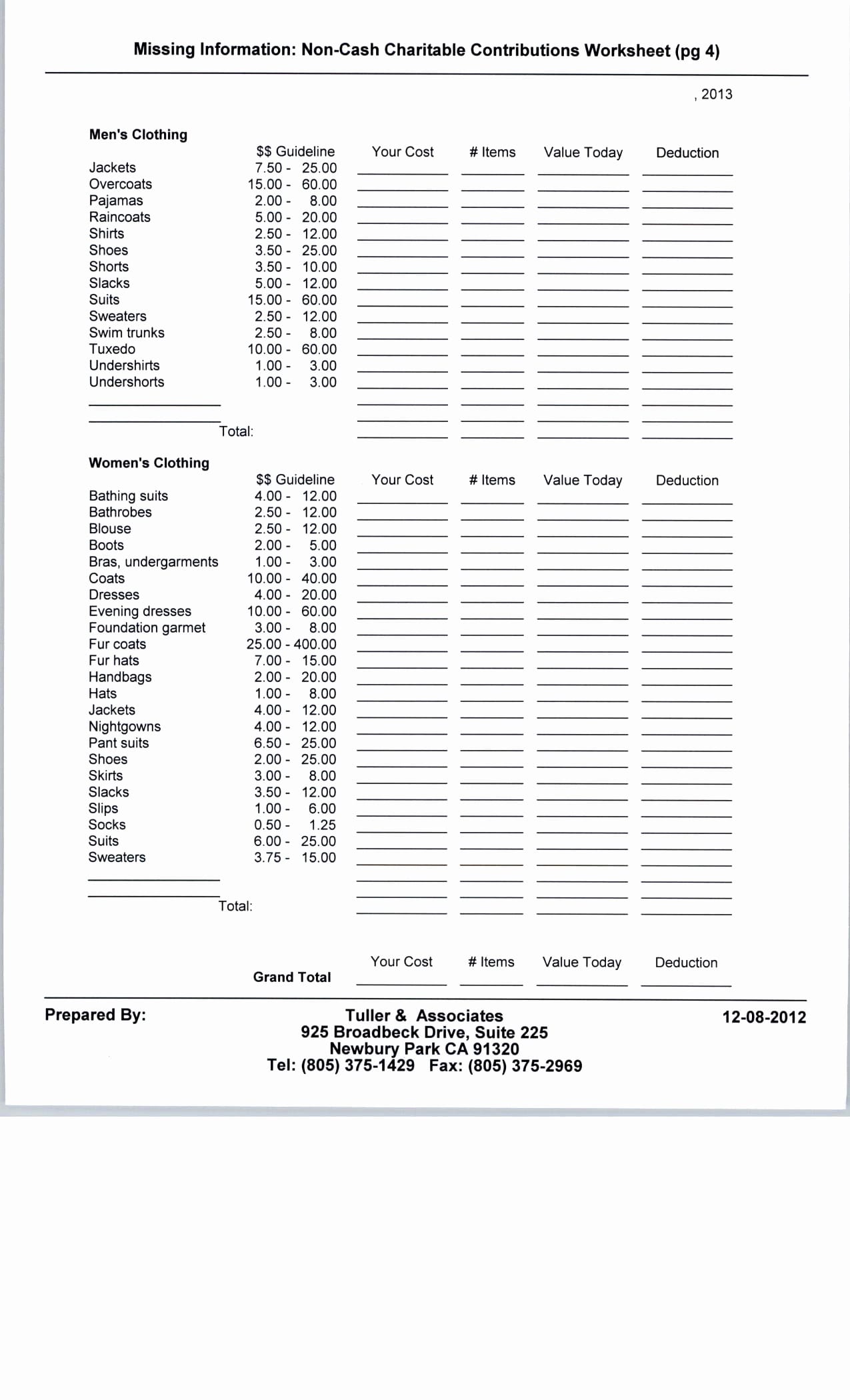

Non Cash Charitable Contributions Worksheet - Do not use form 8283 to. This can reduce your taxable income, but. Web date of contribution _____ tax year _____ for each noncash contribution, taxpayers are required to retain the following documents:. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which. Web a non cash charitable contribution worksheet is a pdf form that can be filled out, edited or modified by anyone. Web turbotax® itsdeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. Web cash contributions subject to the limit based on 60% of agi. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns. Web use form 8283 to report information about noncash charitable contributions. This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations.

Donation Value Guide 2020 Excel Spreadsheet Fill Online, Printable

Web non cash charitable contributions / donations worksheet. Deduct the contributions that don't exceed 60% of your agi. Web date of contribution _____ tax year _____ for each noncash contribution, taxpayers are required to retain the following documents:. Some financial institutions or professional organizations may offer their own. Web h&r block you can deduct donations you make to qualified charities.

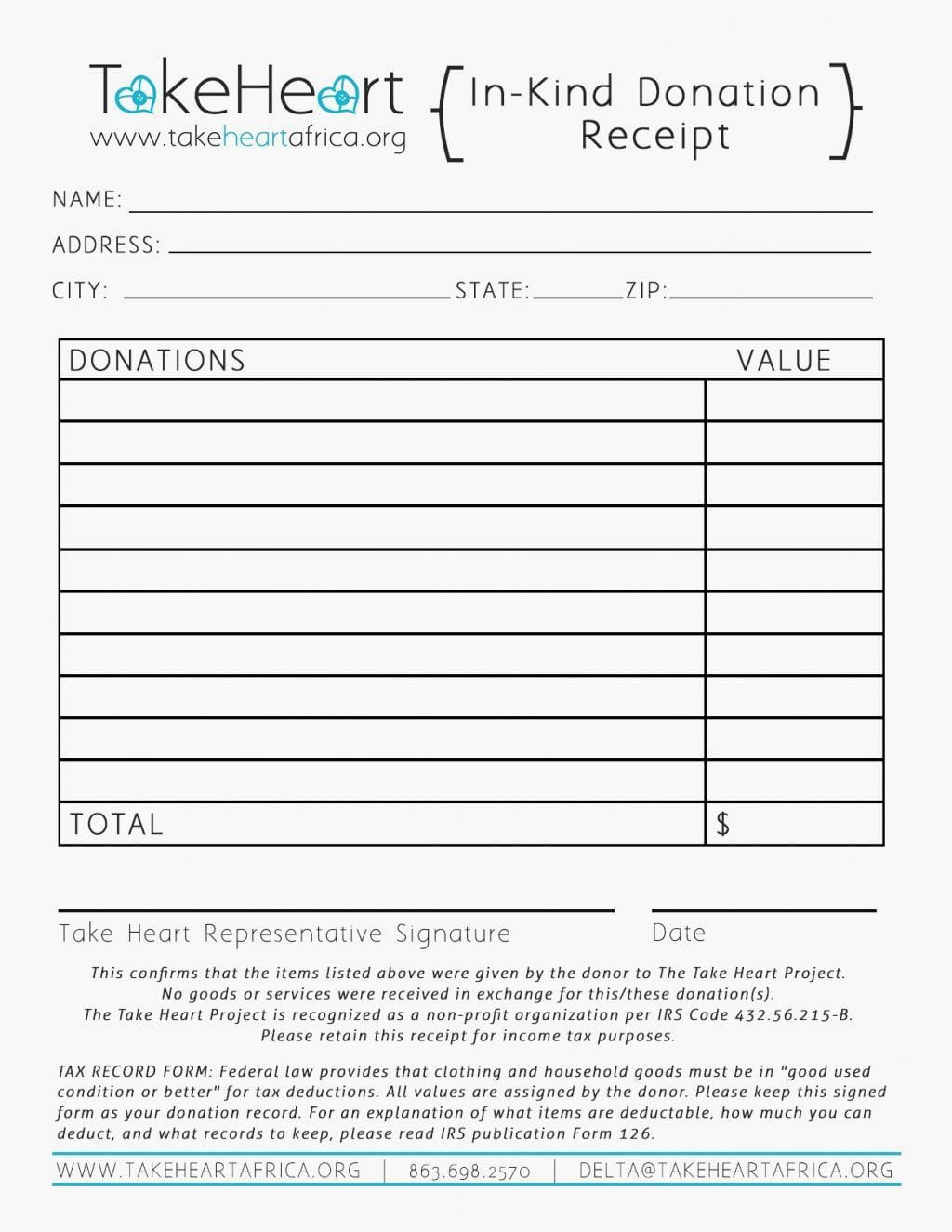

Download Non Cash Charitable Contribution Worksheet for Free

The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns. Web how to fill out and sign non cash charitable contributions worksheet online? Web date of contribution _____ tax year _____ for each noncash contribution, taxpayers are required to retain the following documents:. Some financial institutions or professional organizations may offer their own. Web.

Non Cash Charitable Contributions Worksheet 2016 —

Web non cash charitable contributions / donations worksheet. Web h&r block you can deduct donations you make to qualified charities. Web use form 8283 to report information about noncash charitable contributions. Web for the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. Web if you donate an item worth more than.

Non Cash Charitable Contributions Worksheet 2021 Fill Online

Attach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for. Web for the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns. Web cash contributions subject.

35 Non Cash Charitable Contributions Worksheet Notutahituq Worksheet

Web a non cash charitable contribution worksheet is a pdf form that can be filled out, edited or modified by anyone. Attach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for. Non cash charitable contributions / donations worksheet. Web use form 8283 to report information about noncash charitable contributions. Web.

16 New Goodwill Donation Values Worksheet

Web non cash charitable contributions / donations worksheet. This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Some financial institutions or professional organizations may offer their own. Web how to fill out and sign non cash charitable contributions worksheet online? Web date of contribution _____ tax year _____ for each noncash contribution,.

Non Cash Charitable Contributions Worksheet —

Deduct the contributions that don't exceed 60% of your agi. Get your online template and fill it in using. Attach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for. Insert tax year ===> insert date given ===> enter items. Noncash charitable contributions is a tax form distributed by the internal.

Non Cash Charitable Contributions Excel Worksheet Download Jay Sheets

Web use form 8283 to report information about noncash charitable contributions. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns. Some financial institutions or professional organizations may offer their own. Web date of contribution _____ tax year _____ for each noncash contribution, taxpayers are required to retain the following documents:. Web non cash.

Non Donation Worksheet Gambarin.us Backup Gambar

Do not use form 8283 to. Some financial institutions or professional organizations may offer their own. Web date of contribution _____ tax year _____ for each noncash contribution, taxpayers are required to retain the following documents:. Web use form 8283 to report information about noncash charitable contributions. Web turbotax® itsdeductible makes it easy to track your charitable donations so you.

Download Non Cash Charitable Contribution Worksheet for Free Page 4

Deduct the contributions that don't exceed 60% of your agi. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns. Web a non cash charitable contribution worksheet is a pdf form that can be filled out, edited or modified by anyone. Web the charitable contribution limitation worksheet will reflect the calculation of the limited.

Web non cash charitable contributions / donations worksheet. Web use form 8283 to report information about noncash charitable contributions. Web use form 8283 to report information about noncash charitable contributions. Web the charitable contribution limitation worksheet will reflect the calculation of the limited amount which flows to line 14 of. Web turbotax® itsdeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns. Insert tax year ===> insert date given ===> enter items. Some financial institutions or professional organizations may offer their own. Web date of contribution _____ tax year _____ for each noncash contribution, taxpayers are required to retain the following documents:. Noncash charitable contributions is a tax form distributed by the internal revenue. Get your online template and fill it in using. Deduct the contributions that don't exceed 60% of your agi. Do not use form 8283 to. This can reduce your taxable income, but. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which. Web a non cash charitable contribution worksheet is a pdf form that can be filled out, edited or modified by anyone. Web cash contributions subject to the limit based on 60% of agi. Attach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for. Web how to fill out and sign non cash charitable contributions worksheet online? Web h&r block you can deduct donations you make to qualified charities.

Get Your Online Template And Fill It In Using.

Web h&r block you can deduct donations you make to qualified charities. Web the charitable contribution limitation worksheet will reflect the calculation of the limited amount which flows to line 14 of. Web if you donate an item worth more than $50,000, you'll need to get a statement of value from the irs, which. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns.

Web Use Form 8283 To Report Information About Noncash Charitable Contributions.

This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Web how to fill out and sign non cash charitable contributions worksheet online? Some financial institutions or professional organizations may offer their own. Web turbotax® itsdeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible.

Web For The 2021 Tax Year, Single Nonitemizers Can Again Deduct Up To $300 In Cash Donations To Qualifying Charities.

Attach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for. Web non cash charitable contributions / donations worksheet. Non cash charitable contributions / donations worksheet. Web date of contribution _____ tax year _____ for each noncash contribution, taxpayers are required to retain the following documents:.

Web Use Form 8283 To Report Information About Noncash Charitable Contributions.

This can reduce your taxable income, but. Do not use form 8283 to. Deduct the contributions that don't exceed 60% of your agi. Web cash contributions subject to the limit based on 60% of agi.