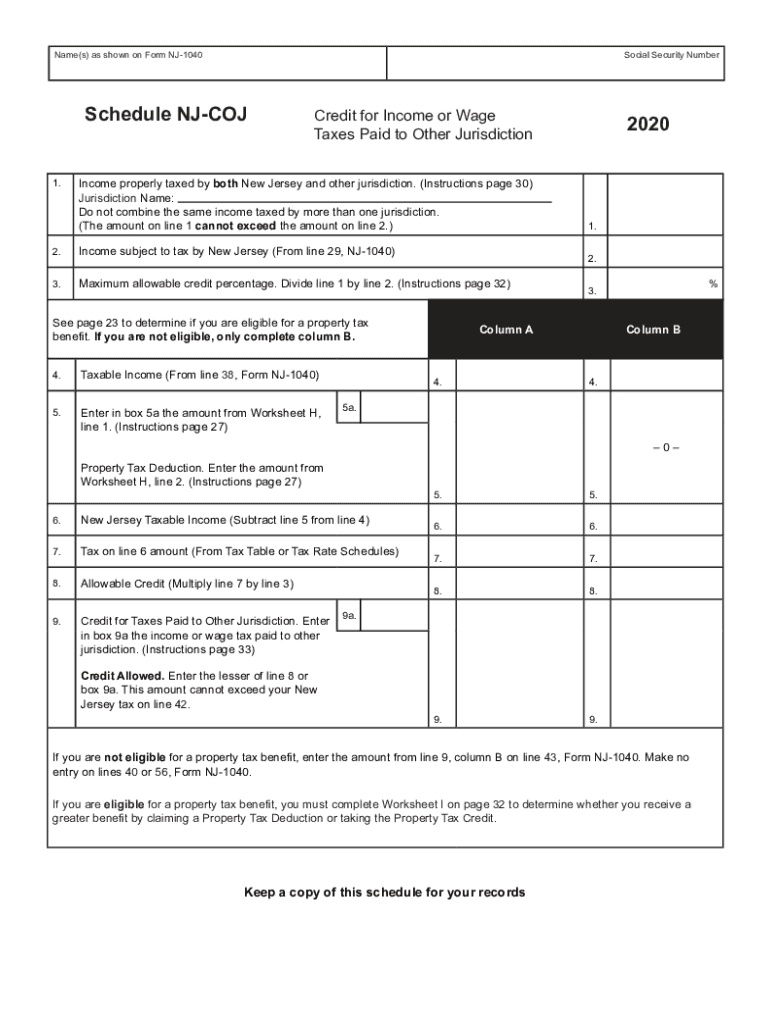

Nj Worksheet H - Use worksheet g and worksheet h in the new jersey resident income tax return instruction booklet to. Nj 1040 new jersey resident income tax return. Web property tax deduction/credit (worksheet i). Web income tax depreciation adjustment worksheet: Web state of new jersey department of the treasury division of taxation dear taxpayer, every year we introduce the annual nj. Web state income taxes entered on the federal income/deductions category, taxes and licenses worksheet carry to new jersey. Web northwest passage worksheet marquette jolliet cabot hudson key common core ela history social studies standards: Enter in box 5a the amount from worksheet h, line 1. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. If you are eligible for a property tax deduction or credit (see requirements on.

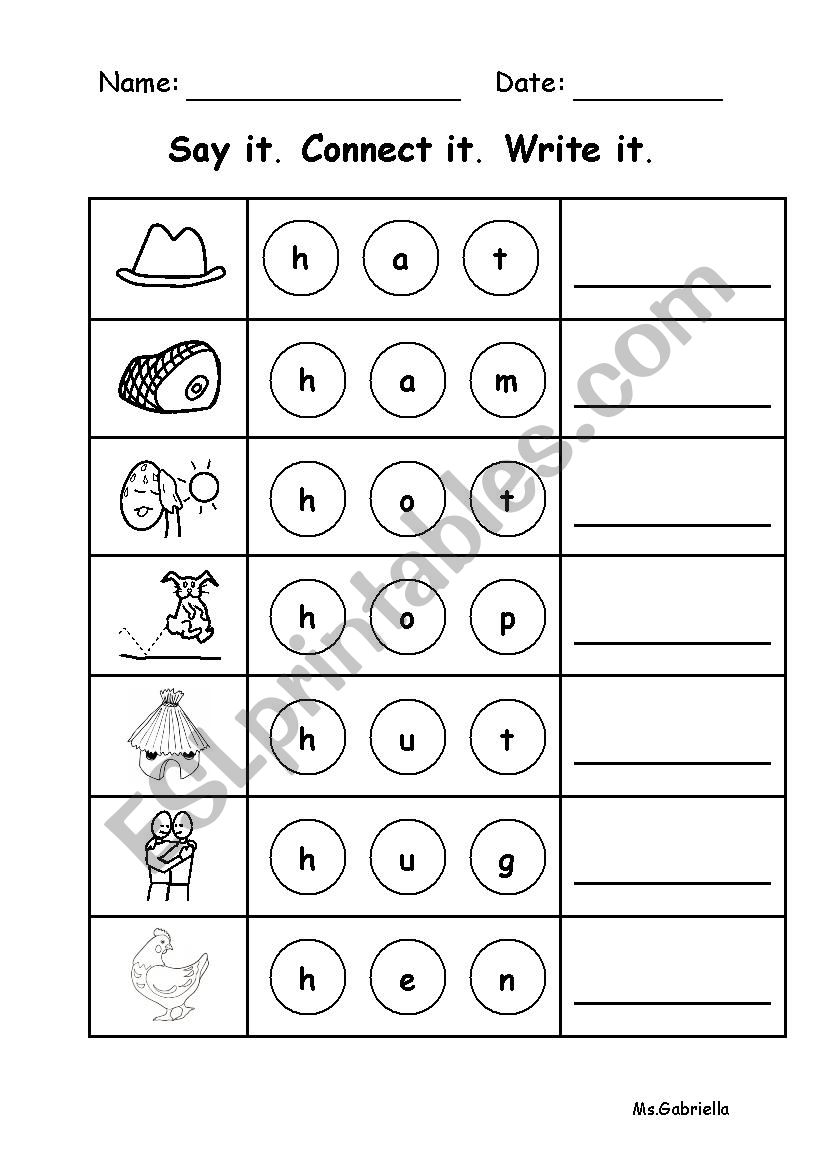

Phonics h worksheet ESL worksheet by GabbyM

Web nj worksheet c ira withdrawals nj worksheet d other retirement income exclusion nj worksheet e other. All property tax relief program information. (from worksheet h) (see instructions).40. Enter in box 5a the amount from worksheet h, line 1. Web schedule h (form 1040) for figuring your household employment taxes.

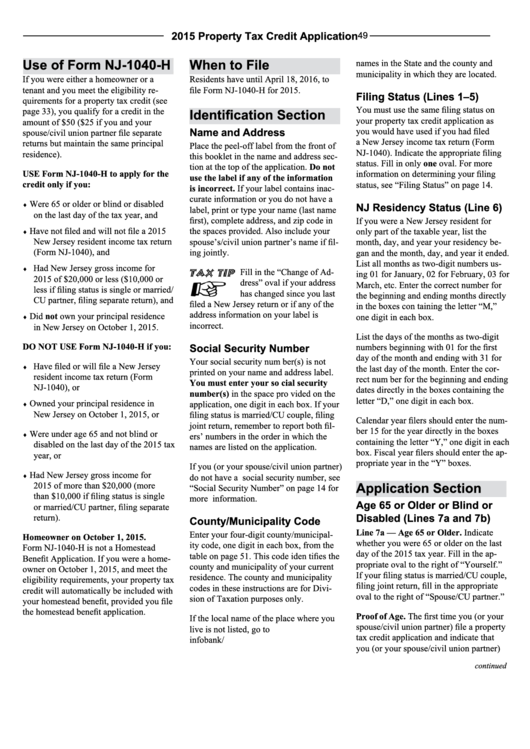

Form Nj1040H 2015 Property Tax Credit Application (Instructions

Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. Web enter in box 5a the amount from worksheet h, line 1. Nj 1040 new jersey resident income tax return. Web new jersey state information. If you are eligible for a property tax deduction or credit (see requirements on.

Letter H Worksheets Tagalog

If you are eligible for a property tax deduction or credit (see requirements on. Web northwest passage worksheet marquette jolliet cabot hudson key common core ela history social studies standards: Web state of new jersey department of the treasury division of taxation dear taxpayer, every year we introduce the annual nj. Enter in box 5a the amount from worksheet h,.

Learning The Letter H Worksheets 99Worksheets

Web state income taxes entered on the federal income/deductions category, taxes and licenses worksheet carry to new jersey. (instructions page 30) property tax deduction. Web single married/cu couple, filing joint return married/cu partner, filing separate return head of household enter spouse’s/cu. If you are applying for the property tax credit, complete part i. (from worksheet h) (see instructions).40.

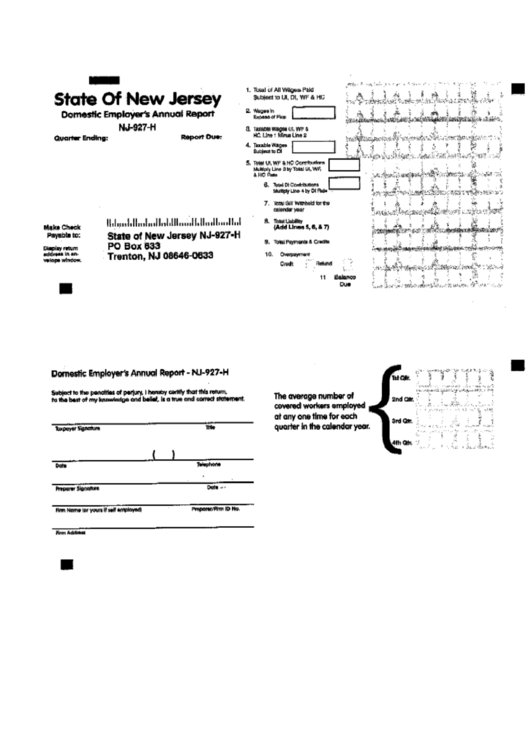

Form Nj927H Domestic Employer'S Annual Report printable pdf download

Web new jersey gross income (subtract line 28c from line 27). Use worksheet g and worksheet h in the new jersey resident income tax return instruction booklet to. (from worksheet h) (see instructions).40. Web single married/cu couple, filing joint return married/cu partner, filing separate return head of household enter spouse’s/cu. Web enter in box 5a the amount from worksheet h,.

English Preschool Find and Color (H or h) Worksheet 8

Web enter in box 5a the amount from worksheet h, line 1. Web new jersey state information. Web new jersey gross income (subtract line 28c from line 27). Web single married/cu couple, filing joint return married/cu partner, filing separate return head of household enter spouse’s/cu. Web property tax deduction/credit (worksheet i).

Letter H Alphabet Activity Worksheet Doozy Moo

Enter in box 5a the amount from worksheet h, line 1. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. All property tax relief program information. Web employer payroll tax. Continue completing the return with line 45.

Download Main page Part 5

Web enter in box 5a the amount from worksheet h, line 1. Web employer payroll tax. Web single married/cu couple, filing joint return married/cu partner, filing separate return head of household enter spouse’s/cu. Web income tax depreciation adjustment worksheet: (instructions page 30) property tax deduction.

Nj State Tax Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Web employer payroll tax. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. Enter in box 5a the amount from worksheet h, line 1. Nj 1040 new jersey resident income tax return. Continue completing the return with line 45.

2020 Form NJ NJ1040 Schedule NJCOJ Fill Online, Printable, Fillable

Web state of new jersey department of the treasury division of taxation dear taxpayer, every year we introduce the annual nj. Enter in box 5a the amount from worksheet h, line 1. Web new jersey gross income (subtract line 28c from line 27). Web new jersey state information. Web enter in box 5a the amount from worksheet h, line 1.

Web single married/cu couple, filing joint return married/cu partner, filing separate return head of household enter spouse’s/cu. Web enter in box 5a the amount from worksheet h, line 1. Nj 1040 new jersey resident income tax return. Web those who are not eligible for the anchor benefit because on october 1, 2022, they were not a homeowner or renter, may. Continue completing the return with line 45. Web schedule h (form 1040) for figuring your household employment taxes. (from worksheet h) (see instructions).40. Web state income taxes entered on the federal income/deductions category, taxes and licenses worksheet carry to new jersey. Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. If you are eligible for a property tax deduction or credit (see requirements on. Enter in box 5a the amount from worksheet h, line 1. All property tax relief program information. Web property tax deduction/credit (worksheet i). (instructions page 30) property tax deduction. Web northwest passage worksheet marquette jolliet cabot hudson key common core ela history social studies standards: Web state of new jersey department of the treasury division of taxation dear taxpayer, every year we introduce the annual nj. Web nj worksheet c ira withdrawals nj worksheet d other retirement income exclusion nj worksheet e other. Web income tax depreciation adjustment worksheet: Use worksheet g and worksheet h in the new jersey resident income tax return instruction booklet to. If you are applying for the property tax credit, complete part i.

Web Northwest Passage Worksheet Marquette Jolliet Cabot Hudson Key Common Core Ela History Social Studies Standards:

Web employer payroll tax. Web schedule h (form 1040) for figuring your household employment taxes. All property tax relief program information. Nj 1040 new jersey resident income tax return.

Web Those Who Are Not Eligible For The Anchor Benefit Because On October 1, 2022, They Were Not A Homeowner Or Renter, May.

Web state income taxes entered on the federal income/deductions category, taxes and licenses worksheet carry to new jersey. Web single married/cu couple, filing joint return married/cu partner, filing separate return head of household enter spouse’s/cu. Web the following is included:fact sheet (reading)the fact sheet about new jersey includes an information text, an. Enter in box 5a the amount from worksheet h, line 1.

If You Are Eligible For A Property Tax Deduction Or Credit (See Requirements On.

Web are eligible for a new jersey earned income tax credit or other credit do not complete lines 29 through 44. Web new jersey gross income (subtract line 28c from line 27). If you are applying for the property tax credit, complete part i. Web new jersey state information.

Web Nj Worksheet C Ira Withdrawals Nj Worksheet D Other Retirement Income Exclusion Nj Worksheet E Other.

Use worksheet g and worksheet h in the new jersey resident income tax return instruction booklet to. Web property tax deduction/credit (worksheet i). Continue completing the return with line 45. (instructions page 30) property tax deduction.

Worksheet 8.png)