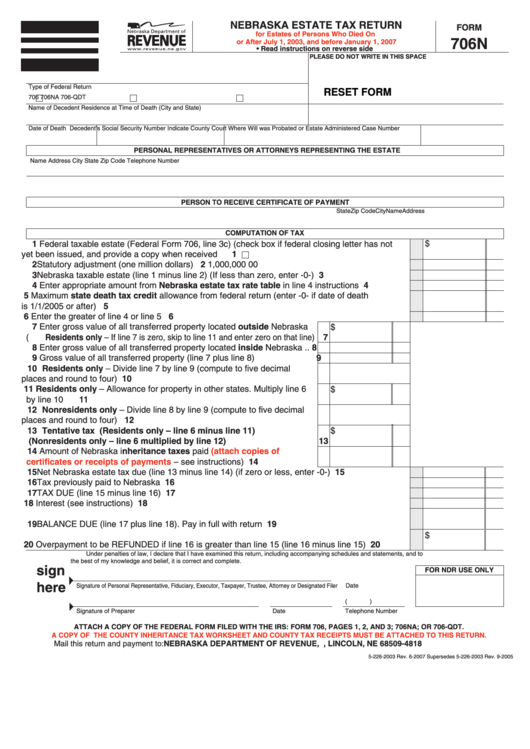

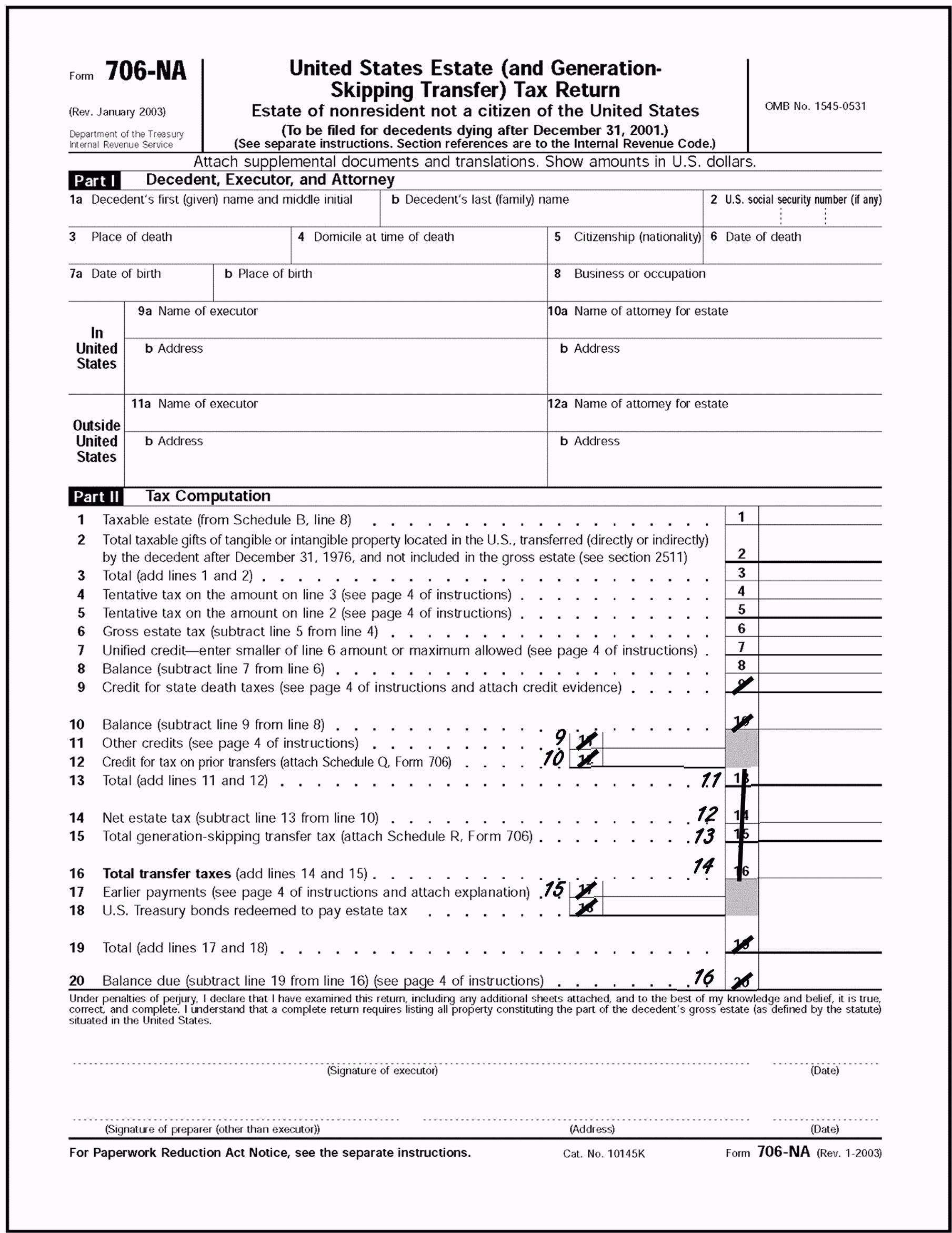

Nebraska Inheritance Tax Worksheet Form 500 - Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. When and where to file. Web form 500 free ebook download nebraska inheritance tax form 500 download or read online ebook nebraska inheritance tax. Web send inheritance tax worksheet via email, link, or fax. Web how to fill out and sign nebraska inheritance tax worksheet 2022 online? Previous years' income tax forms. Web if a nonresident dies owning intangible personal property, such as accounts, located in nebraska, that property will be subject to nebraska inheritance tax only if the. To start with, look for the “get form” button and tap it. Web also excluded are gifts to any person that are made within three years of the decedent’s date of death, but only if. Nebraska uranium severance tax return (04/2022) 62.

Nebraska Inheritance Tax Worksheet Form 500

This worksheet, together with appropriate. Web nebraska inheritance tax worksheet form 500. Web the fair market value of the entire estate of the deceased, less liens and encumbrances (everything the deceased owned minus. Web the form ecit and the inheritance tax worksheets filed with the county will provide the information necessary to complete. The form ecit is due when distributions.

34 Nebraska Inheritance Tax Worksheet support worksheet

Web nebraska inheritance tax worksheet form 500 use a nebraska inheritance tax worksheet form 500 template to make. Web how to fill out and sign nebraska inheritance tax worksheet 2022 online? Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. Web the fair market value of the entire estate.

Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet

General instructions who must file. Nebraska law requires the petitioner in a proceeding to. When and where to file. Save yourself time and money using our fillable web templates. Nebraska and county lodging tax return.

Nebraska Inheritance Tax Worksheet Resume Examples

The form ecit is due when distributions have been made. Web how to edit and fill out nebraska inheritance tax worksheet online. Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. Previous years' income tax forms. When and where to file.

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Numeric listing of all current nebraska tax forms. Web how to fill out and sign nebraska inheritance tax worksheet 2022 online? Edit your nebraska probate form. You can also download it, export it or print it out. Web send inheritance tax worksheet via email, link, or fax.

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments,. Web also excluded are gifts to any person that are made within three years of the decedent’s date of death, but only if. When and where to file. Nebraska and county lodging tax return. To start with, look for the “get form” button and.

Nebraska Inheritance Tax Worksheet Form 500

The form ecit is due when distributions have been made. Nebraska and county lodging tax return. Nebraska uranium severance tax return (04/2022) 62. Nebraska law requires the petitioner in a proceeding to. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024;

Nebraska Inheritance Tax Worksheet Tagua

Web if a nonresident dies owning intangible personal property, such as accounts, located in nebraska, that property will be subject to nebraska inheritance tax only if the. Web the nebraska inheritance tax is imposed on all property inherited from the estate of the deceased (including life insurance payable. Web nebraska inheritance tax is computed on the fair market value of.

Nebraska Inheritance Tax Worksheet Form 500 Fill Online, Printable

Web how to edit and fill out nebraska inheritance tax worksheet online. Numeric listing of all current nebraska tax forms. Previous years' income tax forms. Web nebraska inheritance tax worksheet form 500. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024;

Nebraska Inheritance Tax Worksheet Form 500

This excel file assists lawyers with calculating inheritance tax. Web the fair market value of the entire estate of the deceased, less liens and encumbrances (everything the deceased owned minus. Numeric listing of all current nebraska tax forms. Nebraska law requires the petitioner in a proceeding to. Unlike a typical estate tax, nebraska inheritance tax is measured by the value.

Previous years' income tax forms. To start with, look for the “get form” button and tap it. Web how to fill out and sign nebraska inheritance tax worksheet 2022 online? Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a. When and where to file. Web the nebraska inheritance tax is imposed on all property inherited from the estate of the deceased (including life insurance payable. Web how to edit and fill out nebraska inheritance tax worksheet online. Nebraska law requires the petitioner in a proceeding to. The form ecit is due when distributions have been made. Web nebraska inheritance tax worksheet form 500 use a nebraska inheritance tax worksheet form 500 template to make. Web if a nonresident dies owning intangible personal property, such as accounts, located in nebraska, that property will be subject to nebraska inheritance tax only if the. Web inheritance tax rates by twenty percent each year beginning january 1, 2021 through december 31, 2024; General instructions who must file. This excel file assists lawyers with calculating inheritance tax. Web nebraska inheritance tax worksheet form 500. You can also download it, export it or print it out. Web nebraska inheritance tax worksheet form 500 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 3.97 satisfied 36 votes how to fill out and sign. Nebraska and county lodging tax return. Web the form ecit and the inheritance tax worksheets filed with the county will provide the information necessary to complete. Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments,.

Previous Years' Income Tax Forms.

Edit your nebraska probate form. Web also excluded are gifts to any person that are made within three years of the decedent’s date of death, but only if. Web the form ecit and the inheritance tax worksheets filed with the county will provide the information necessary to complete. When and where to file:

Web Nebraska Inheritance Tax Is Computed On The Fair Market Value Of Annuities, Life Estates, Terms For Years, Remainders, And.

Nebraska and county lodging tax return. The form ecit is due when distributions have been made. Web nebraska inheritance tax worksheet form 500 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 3.97 satisfied 36 votes how to fill out and sign. Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments,.

Nebraska Law Requires The Petitioner In A Proceeding To.

When and where to file. Web form 500 free ebook download nebraska inheritance tax form 500 download or read online ebook nebraska inheritance tax. To start with, look for the “get form” button and tap it. Numeric listing of all current nebraska tax forms.

Web How To Fill Out And Sign Nebraska Inheritance Tax Worksheet 2022 Online?

Nebraska uranium severance tax return (04/2022) 62. General instructions who must file. This excel file assists lawyers with calculating inheritance tax. Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a.