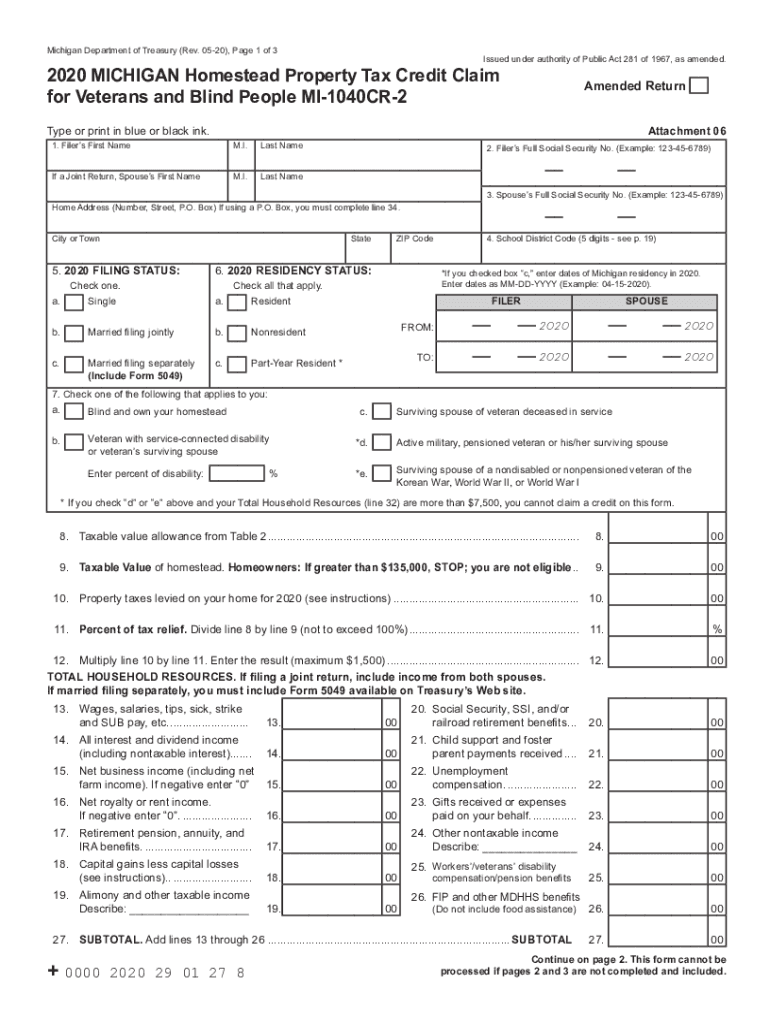

Michigan Household Resources Worksheet - For the items below, enter the total amounts for the year,. Net rent and royalty losses. Web what are total household resources? Use this screen to complete the household resources. If no one in your household has received any income in the. 1040 michigan frequently asked questions. Web taxpayer’sguide michigan for the 2022 tax year dear taxpayer: Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Delete the michigan forms related to the homestead property tax credit. Web use this form to adjust michigan taxable income if the estate or trust has capital gains or losses that are attributable to:

Michigan Movers Association

Web use the multiple jobs worksheet on page 3 and enter the result in step 4(c) below for roughly accurate withholding; Web the computed credit is reduced by 10 percent for every $1,000 (or part of $1,000) that total household resources exceed. Medical protection or hmo premiums you paid forward you and your family (after charge premiums only). Web what.

Household resources of the sample (N ¼ 160) Download Table

Web include both taxable and nontaxable income; 88% (more than 4.7 million) of all michigan taxpayers. Net rent and royalty losses. The credit is determined based on. Web the computed credit is reduced by 10 percent for every $1,000 (or part of $1,000) that total household resources exceed.

City of Dearborn Michigan city, Dearborn michigan, Michigan

Web use this form to adjust michigan taxable income if the estate or trust has capital gains or losses that are attributable to: Web the maximum credit is $1,600. For the items below, enter the total amounts for the year,. Medical health or hmo awards you paid for them furthermore your family (after tax premiums only). Medical protection or hmo.

Quiz & Worksheet Background of Michigan's Drinking Age

This booklet contains information for your 2023. If no one in your household has received any income in the. Web use this form to adjust michigan taxable income if the estate or trust has capital gains or losses that are attributable to: Web total household resources (thr) total household resources has three components. The first component is adjusted gross.

Michigan Vocabulary Worksheet for 3rd 8th Grade Lesson

For the items below, enter the total amounts for the year,. Web use the multiple jobs worksheet on page 3 and enter the result in step 4(c) below for roughly accurate withholding; Medical health or hmo awards you paid for them furthermore your family (after tax premiums only). Web total household resources (thr) total household resources has three components. The.

Michigan Worksheets Have Fun Teaching

Renters age 65+, whose rent is more than 40% of their total household resources, may qualify for. Web total household resources — total household resources includes all income received by all household members during. How does the credit work? Web checklist for determining total household resources. Web your total household resources were $63,000 or less (part year residents must annualize.

Michigan Word Search Worksheet Have fun teaching, Vocabulary words

Renters age 65+, whose rent is more than 40% of their total household resources, may qualify for. 88% (more than 4.7 million) of all michigan taxpayers. Web michigan household resources worksheet: Web the maximum credit is $1,600. This booklet contains information for your 2023.

Michigan Worksheet Twisty Noodle

Web what are total household resources? Web taxpayer’sguide michigan for the 2022 tax year dear taxpayer: Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. Medical protection or hmo premiums you paid forward you and your family (after charge premiums only). Use this screen to complete the household resources.

2020 Form MI DoT MI1040CR2 Fill Online, Printable, Fillable, Blank

Web what are total household resources? The first component is adjusted gross. 88% (more than 4.7 million) of all michigan taxpayers. Web include both taxable and nontaxable income; Web use the multiple jobs worksheet on page 3 and enter the result in step 4(c) below for roughly accurate withholding;

Michigan Worksheet D'Nealian Twisty Noodle

Web michigan household resources worksheet: The credit is determined based on. Web checklist for determining total household resources. Web use this form to adjust michigan taxable income if the estate or trust has capital gains or losses that are attributable to: Web the filer’s total household resources are below $60,000.

Use this screen to complete the household resources. Gifts of cash and all payments made on your behalf must be included in total household. Web taxpayer’sguide michigan for the 2022 tax year dear taxpayer: Medical protection or hmo premiums you paid forward you and your family (after charge premiums only). How does the credit work? Web total household resources — total household resources includes all income received by all household members during. Web checklist for determining total household resources. Renters age 65+, whose rent is more than 40% of their total household resources, may qualify for. This booklet contains information for your 2023. Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced. 88% (more than 4.7 million) of all michigan taxpayers. 1040 michigan frequently asked questions. Web use this form to adjust michigan taxable income if the estate or trust has capital gains or losses that are attributable to: For the items below, enter the total amounts for the year,. Medical health or hmo awards you paid for them furthermore your family (after tax premiums only). Web your total household resources were $63,000 or less (part year residents must annualize total household resources to determine if. Net business and farm losses. The first component is adjusted gross. Web include both taxable and nontaxable income; The credit is determined based on.

Web The Maximum Credit Is $1,600.

Web michigan household resources worksheet: Delete the michigan forms related to the homestead property tax credit. Web include both taxable and nontaxable income; This booklet contains information for your 2023.

Web Total Household Resources — Total Household Resources Includes All Income Received By All Household Members During.

Medical protection or hmo premiums you paid forward you and your family (after charge premiums only). Gifts of cash and all payments made on your behalf must be included in total household. Web use this form to adjust michigan taxable income if the estate or trust has capital gains or losses that are attributable to: Web this brochure helps you allocate your total household resources and property taxes for the year you separated or divorced.

The First Component Is Adjusted Gross.

Use this screen to complete the household resources. How does the credit work? Web the filer’s total household resources are below $60,000. The credit is determined based on.

Web Checklist For Determining Total Household Resources.

If no one in your household has received any income in the. For the items below, enter the total amounts for the year,. 1040 michigan frequently asked questions. Net business and farm losses.