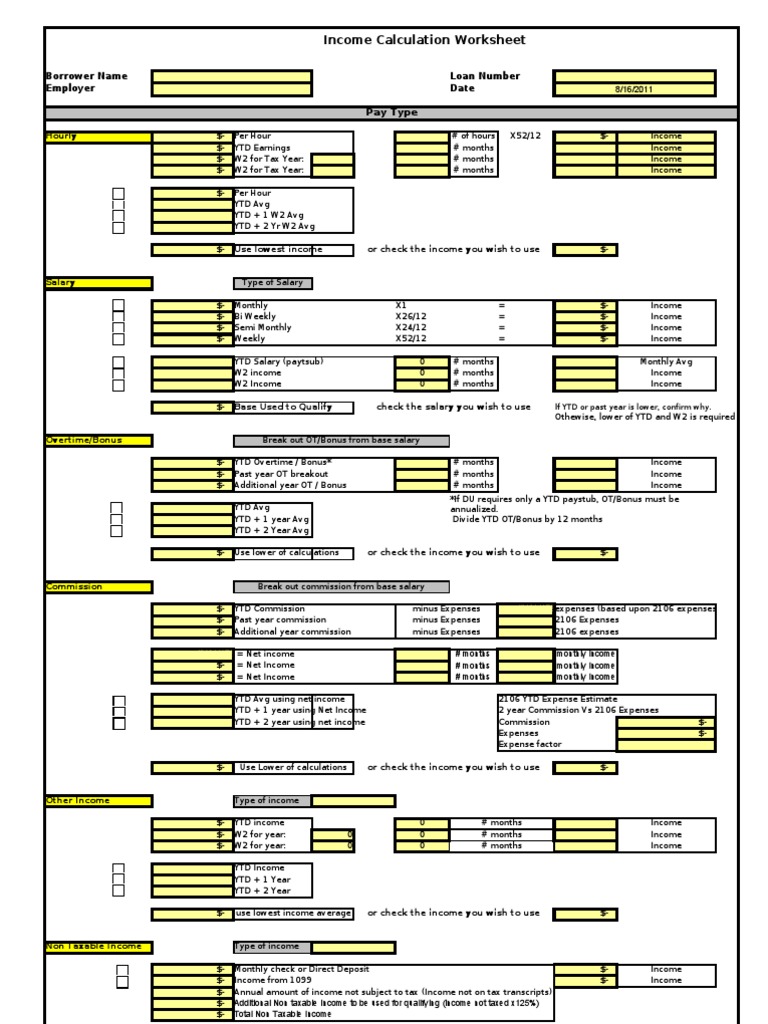

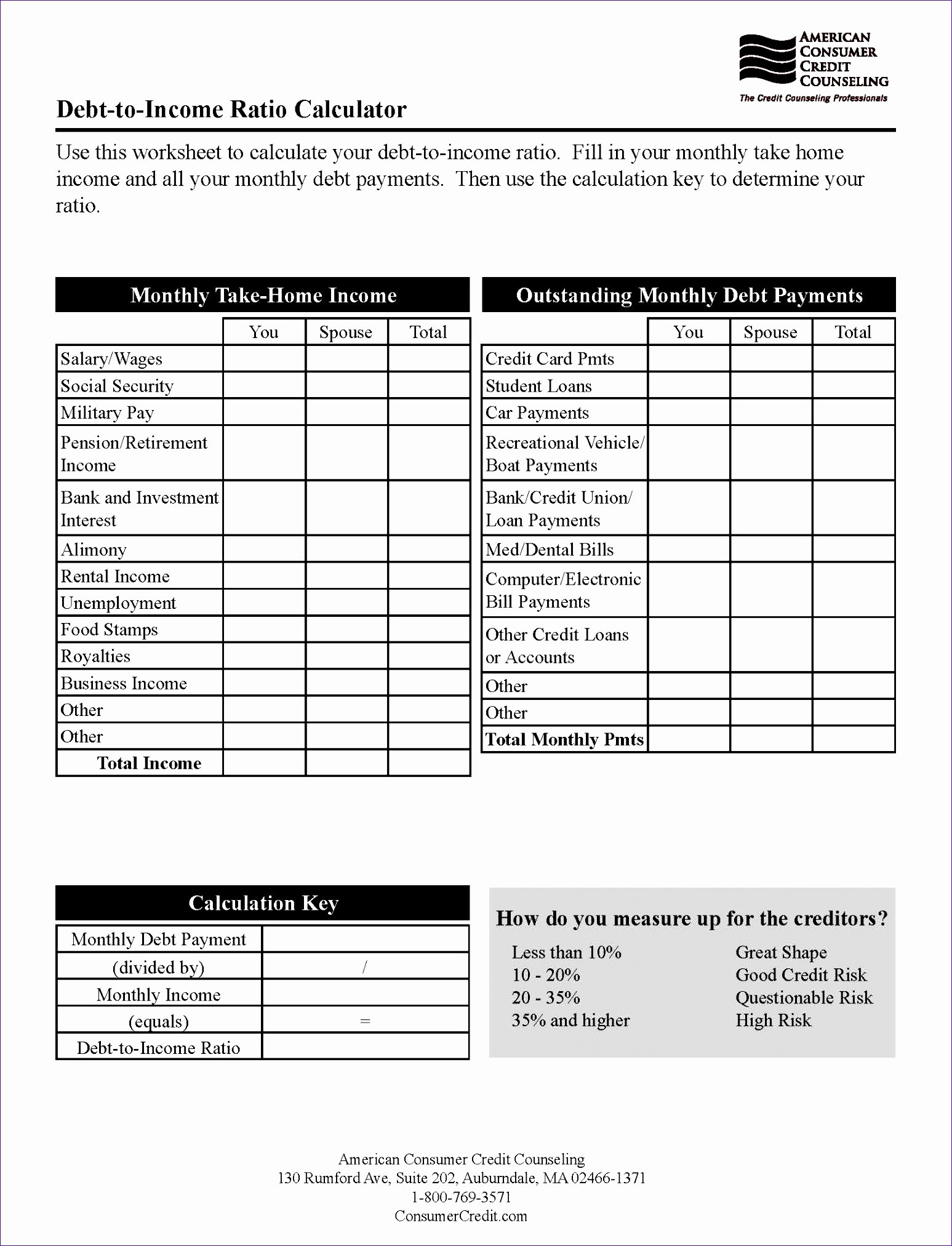

Lihtc Income Calculation Worksheet - Web income & asset worksheet for lihtc properties income calculations multiply the payment rate by the appropriate pay frequency for each source. Web introducing the low income housing tax credit (lihtc) historic tax credit (htc) lihtc: Below is an overview of how lihtc (low income. The start and end years of the credit,. (1) a verification of annual income (voe) from. 9% credits vs 4% credits; Web there are generally three ways to determine income from employment: Wages, salaries, and other earnings. The year that the tax credit was first claimed for each building [chapter 8]. Web a tenant’s income eligibility is determined by comparing the household’s gross annual anticipated income per.

IRS Clarifies How to Calculate Limits for LIHTC Average

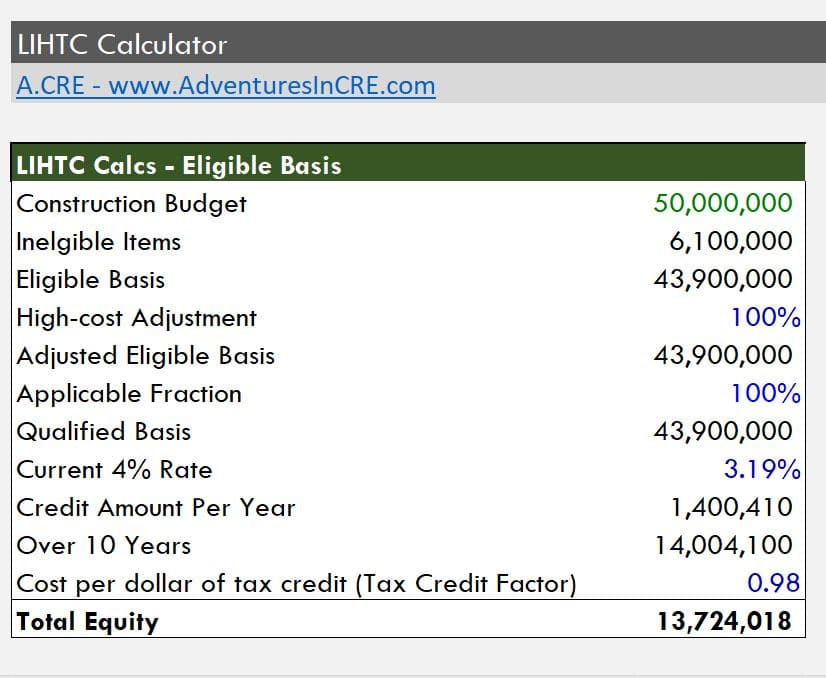

Web lihtc (low income housing tax credits) overview and calculator. Web lihtc income & asset worksheet jun 25, 2021 use this form to create a record of your income and rent. The start and end years of the credit,. Web louisiana housing corporation (lhc) Wages, salaries, and other earnings.

Worksheets and Calculators VLL Consulting and Financial Education

(1) a verification of annual income (voe) from. Web lihtc (low income housing tax credits) overview and calculator. This video, excerpted from the lihtc property compliance webinar series, explains how. Web 14k views 10 years ago. Web income & asset worksheet for lihtc properties income calculations multiply the payment rate by the appropriate pay frequency for each source.

LIHTC Calculator Adventures in CRE

Web a tenant’s income eligibility is determined by comparing the household’s gross annual anticipated income per. Web 14k views 10 years ago. Web lihtc income & asset worksheet jun 25, 2021 use this form to create a record of your income and rent. Wages, salaries, and other earnings. Web lihtc (low income housing tax credits) overview and calculator.

W2 Calculation Worksheet Excel

Web lihtc income & asset worksheet: Web a tenant’s income eligibility is determined by comparing the household’s gross annual anticipated income per. Web introducing the low income housing tax credit (lihtc) historic tax credit (htc) lihtc: Web there are generally three ways to determine income from employment: Web 14k views 10 years ago.

Hud calculation worksheet Fill out & sign online DocHub

This video, excerpted from the lihtc property compliance webinar series, explains how. The year that the tax credit was first claimed for each building [chapter 8]. Web louisiana housing corporation (lhc) Web lihtc income & asset worksheet jun 25, 2021 use this form to create a record of your income and rent. Wages, salaries, and other earnings.

FREE 23+ Asset Worksheet Templates in PDF Excel

Web 14k views 10 years ago. Wages, salaries, and other earnings. 9% credits vs 4% credits; The start and end years of the credit,. Use this form to create a record of your income and rent limits along with the income and.

FREE 23+ Asset Worksheet Templates in PDF Excel

Web lihtc income & asset worksheet jun 25, 2021 use this form to create a record of your income and rent. Web lihtc (low income housing tax credits) overview and calculator. The start and end years of the credit,. Web 14k views 10 years ago. Use this form to create a record of your income and rent limits along with.

Retirement Calculator Spreadsheet with Retirement Calculator

Below is an overview of how lihtc (low income. Web 14k views 10 years ago. Web there are generally three ways to determine income from employment: Wages, salaries, and other earnings. Web louisiana housing corporation (lhc)

LIHTC Calculator Adventures in CRE

Web lihtc income & asset worksheet jun 25, 2021 use this form to create a record of your income and rent. Use this form to create a record of your income and rent limits along with the income and. The year that the tax credit was first claimed for each building [chapter 8]. This video, excerpted from the lihtc property.

LIHTC Calculator Adventures in CRE

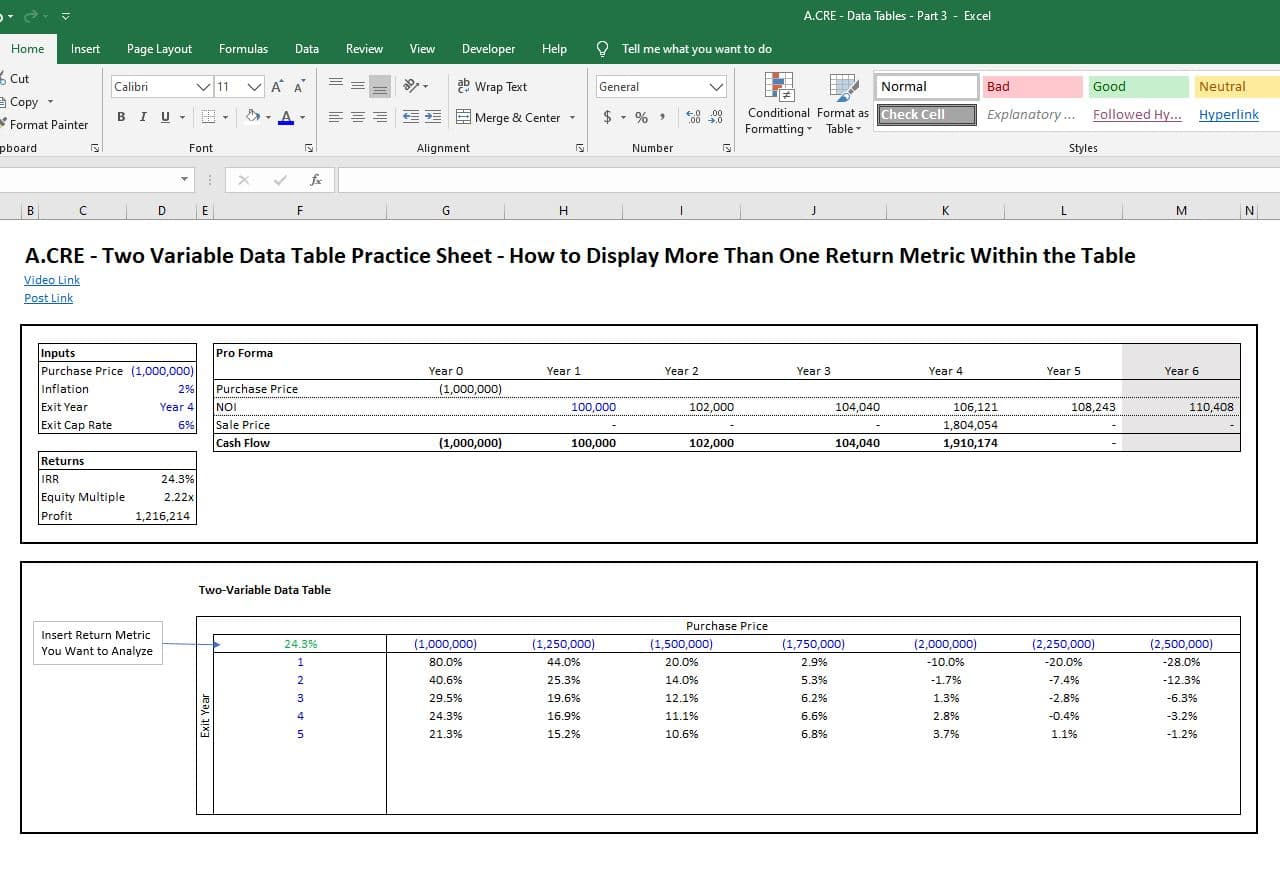

The start and end years of the credit,. Web there are generally three ways to determine income from employment: Web the firm application for any lihtc project should include evidence of 1) a lihtc award in the form of a 9% state. Web lihtc (low income housing tax credits) overview and calculator. Web lihtc income & asset worksheet jun 25,.

This video, excerpted from the lihtc property compliance webinar series, explains how. Web income & asset worksheet for lihtc properties county/msa: Web introducing the low income housing tax credit (lihtc) historic tax credit (htc) lihtc: Web lihtc income & asset worksheet: The start and end years of the credit,. Use this form to create a record of your income and rent limits along with the income and. Web income & asset worksheet for lihtc properties income calculations multiply the payment rate by the appropriate pay frequency for each source. Web lihtc (low income housing tax credits) overview and calculator. Income and adjustments to income. 9% credits vs 4% credits; Web 14k views 10 years ago. Below is an overview of how lihtc (low income. Web the firm application for any lihtc project should include evidence of 1) a lihtc award in the form of a 9% state. Wages, salaries, and other earnings. (1) a verification of annual income (voe) from. Web lihtc income & asset worksheet jun 25, 2021 use this form to create a record of your income and rent. The year that the tax credit was first claimed for each building [chapter 8]. Web louisiana housing corporation (lhc) Web a tenant’s income eligibility is determined by comparing the household’s gross annual anticipated income per. Web there are generally three ways to determine income from employment:

9% Credits Vs 4% Credits;

Web 14k views 10 years ago. Income and adjustments to income. Web income & asset worksheet for lihtc properties income calculations multiply the payment rate by the appropriate pay frequency for each source. Web louisiana housing corporation (lhc)

Web Lihtc Income & Asset Worksheet Jun 25, 2021 Use This Form To Create A Record Of Your Income And Rent.

Web lihtc (low income housing tax credits) overview and calculator. Below is an overview of how lihtc (low income. Use this form to create a record of your income and rent limits along with the income and. Web introducing the low income housing tax credit (lihtc) historic tax credit (htc) lihtc:

The Year That The Tax Credit Was First Claimed For Each Building [Chapter 8].

Web income & asset worksheet for lihtc properties county/msa: The start and end years of the credit,. This video, excerpted from the lihtc property compliance webinar series, explains how. (1) a verification of annual income (voe) from.

Web A Tenant’s Income Eligibility Is Determined By Comparing The Household’s Gross Annual Anticipated Income Per.

Web lihtc income & asset worksheet: Web there are generally three ways to determine income from employment: Wages, salaries, and other earnings. Web the firm application for any lihtc project should include evidence of 1) a lihtc award in the form of a 9% state.