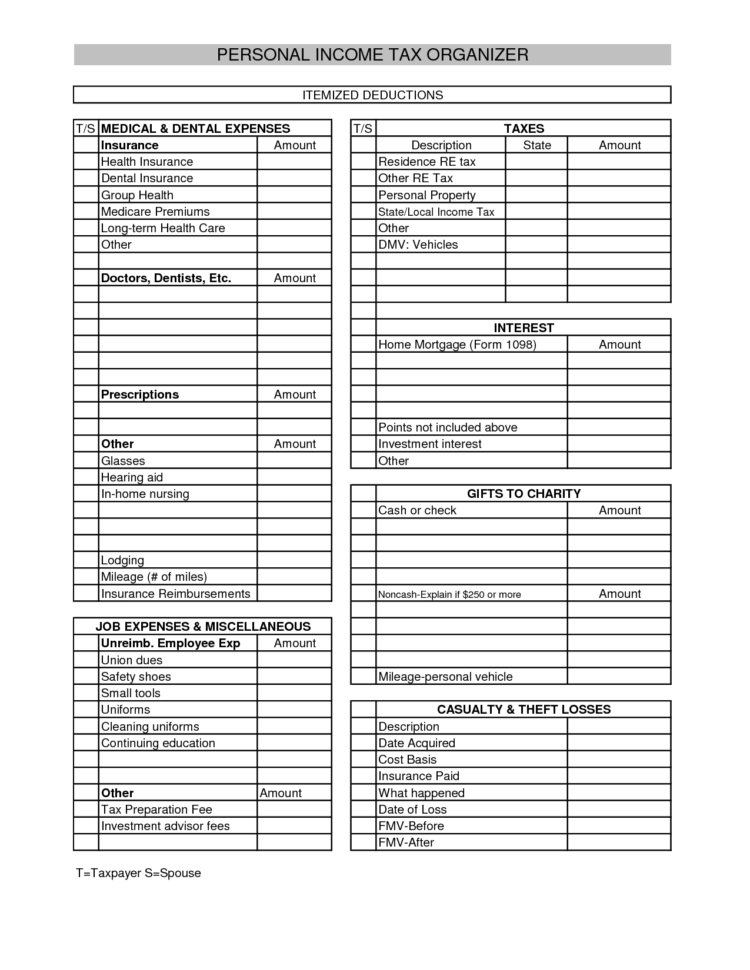

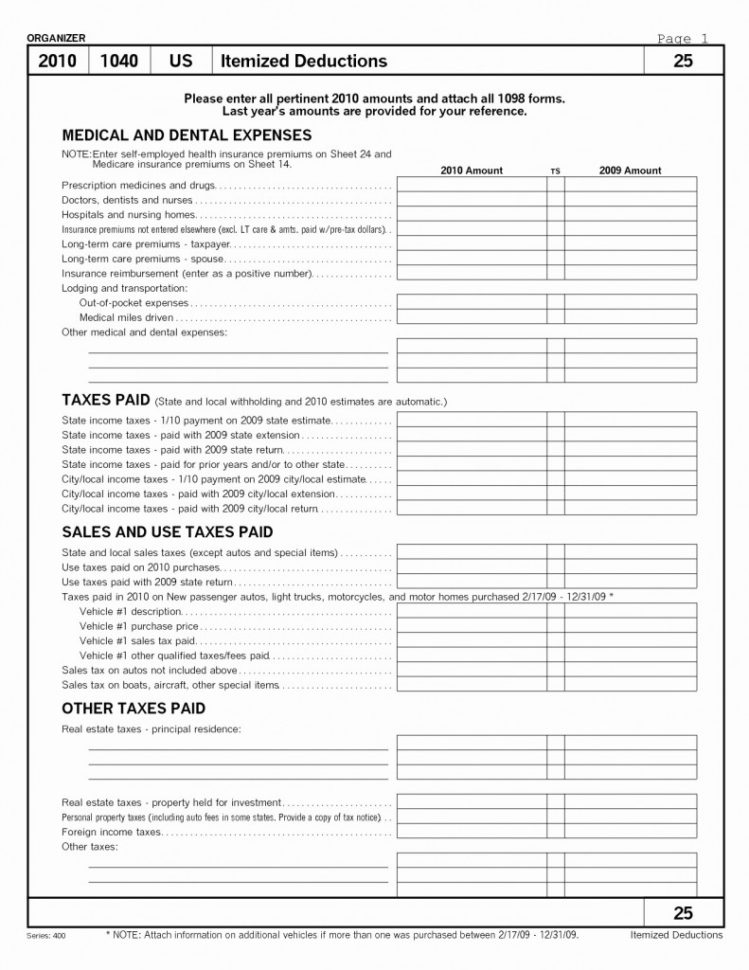

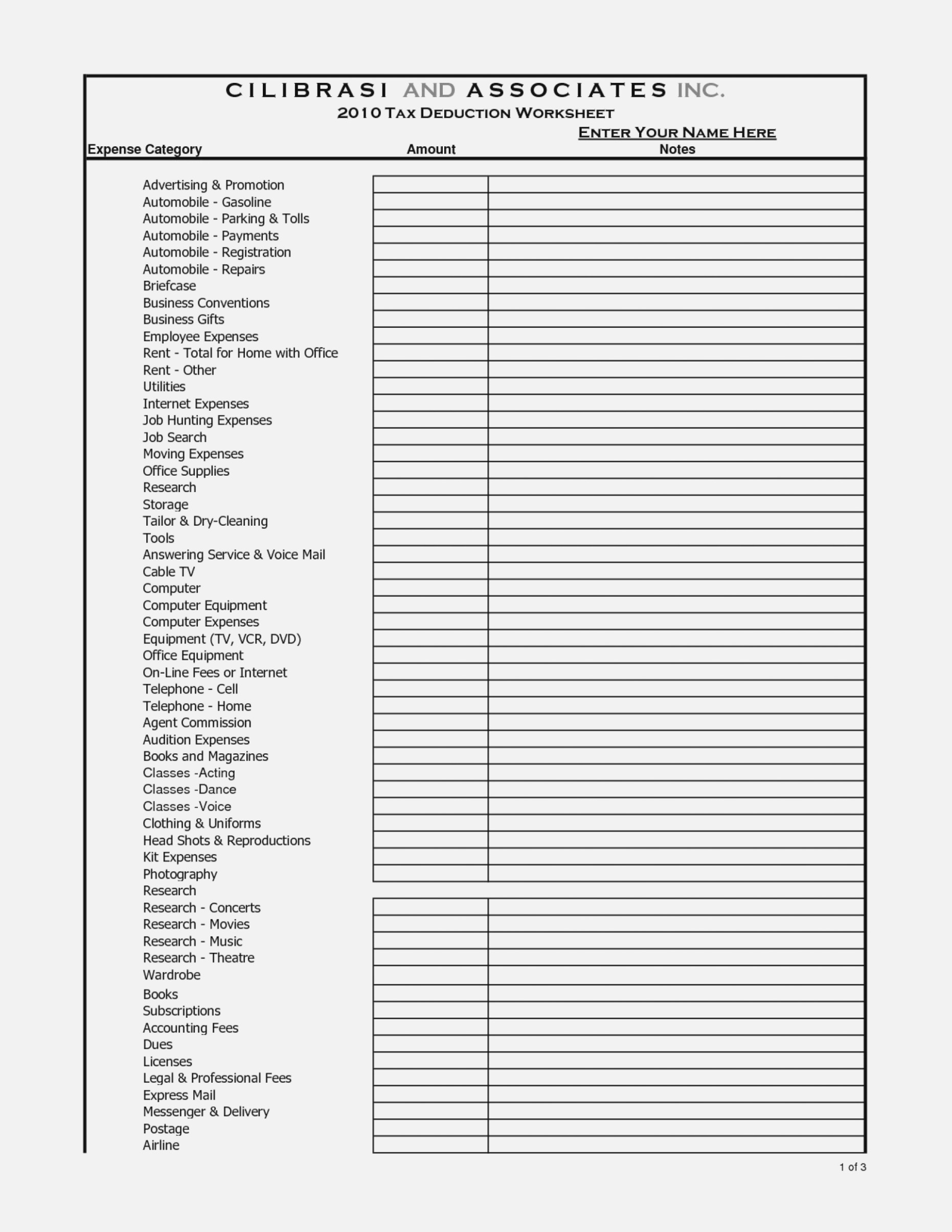

Itemized Deduction Small Business Tax Deductions Worksheet - Web the standard deduction starts at $12,400 for single taxpayers younger than 65 and increases depending on filing status and other factors. Id # tax year ordinary suppliesthe purpose of. After downloading the free template to your computer, you will automatically start on the first tab of the. You can generally deduct the amount you pay or reimburse employees for business. Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on. Web small business worksheet client: Web itemized deductions are subtractions from a taxpayer’s adjusted gross income (agi) that reduce. If you didn’t use all of your home mortgage.

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

After downloading the free template to your computer, you will automatically start on the first tab of the. You can generally deduct the amount you pay or reimburse employees for business. If you didn’t use all of your home mortgage. Web turbotax will automatically select the type of deduction that brings you the most tax benefit based off of your..

Printable Tax Deduction Worksheet —

See how to fill it out, how to itemize tax deductions and. Web for 2022, this deduction maxes out at $2,500 for every student. After downloading the free template to your computer, you will automatically start on the first tab of the. Web small business worksheet client: If you didn’t use all of your home mortgage.

and Expense Statement Template Beautiful Monthly In E Statement

Federal section>deductions>itemized deductions>medical and dental expenses. See how to fill it out, how to itemize tax deductions and. Id # tax year ordinary suppliesthe purpose of. After downloading the free template to your computer, you will automatically start on the first tab of the. Web reimbursements for business expenses.

Itemized Deductions Spreadsheet —

Web expenses are deductible only if related to producing or collecting taxable income. Federal section>deductions>itemized deductions>medical and dental expenses. Web itemize your deductions: Web turbotax will automatically select the type of deduction that brings you the most tax benefit based off of your. Web for 2022, this deduction maxes out at $2,500 for every student.

Business Itemized Deductions Worksheet Beautiful Business Itemized for

Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web itemize your deductions: If you didn’t use all of your home mortgage. Id # tax year ordinary suppliesthe purpose of. Web for 2022, this deduction maxes out at $2,500 for every student.

Itemized Deductions Worksheet —

Web deduction may be limited. See how to fill it out, how to itemize tax deductions and. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web schedule a is an irs form used to claim.

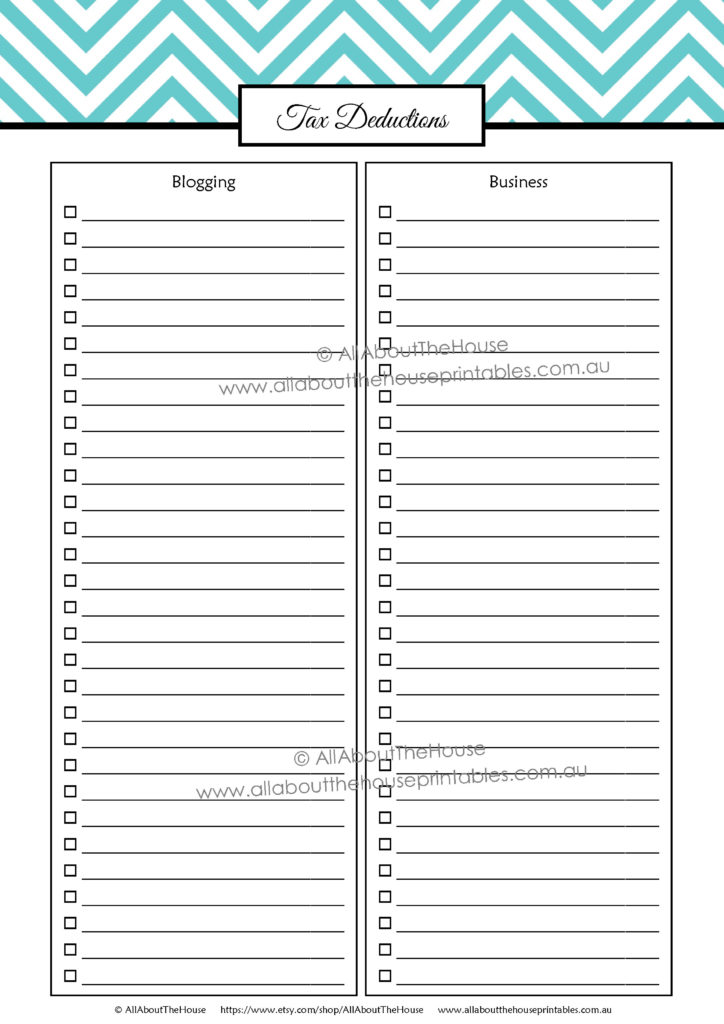

How to organize your taxes with a printable tax planner

Web itemize your deductions: Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web reimbursements for business expenses. Web this worksheet allows you to itemize your tax deductions for a given year. If you didn’t use all of your home mortgage.

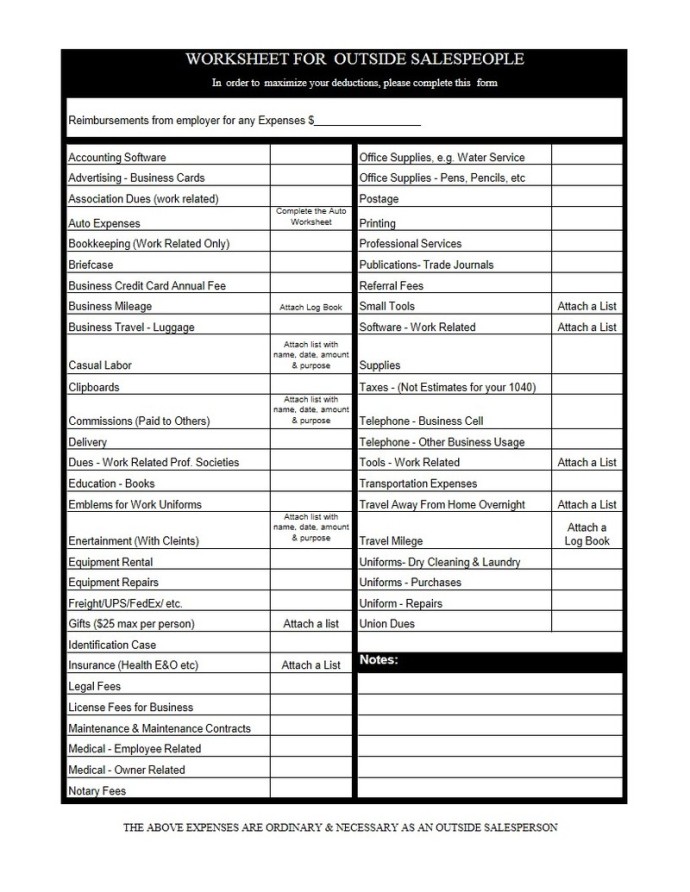

Anchor Tax Service Outside sales rep

Web for 2022, this deduction maxes out at $2,500 for every student. Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web itemize your deductions: Web small business worksheet client: The total amount of these adjustments should be.

Small Business Deductions Worksheet petermcfarland.us

Web the standard deduction starts at $12,400 for single taxpayers younger than 65 and increases depending on filing status and other factors. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Expenses to enable individuals, who are. Id # tax year ordinary suppliesthe purpose of. Web for 2023, the standard mileage rate is.

List Of Tax Deductions Fill Online, Printable, Fillable, Blank

Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. The total amount of these adjustments should be. Web this worksheet allows you to itemize your tax deductions for a given year. You can generally deduct the amount you pay or reimburse employees for business. See how to fill it out, how to itemize.

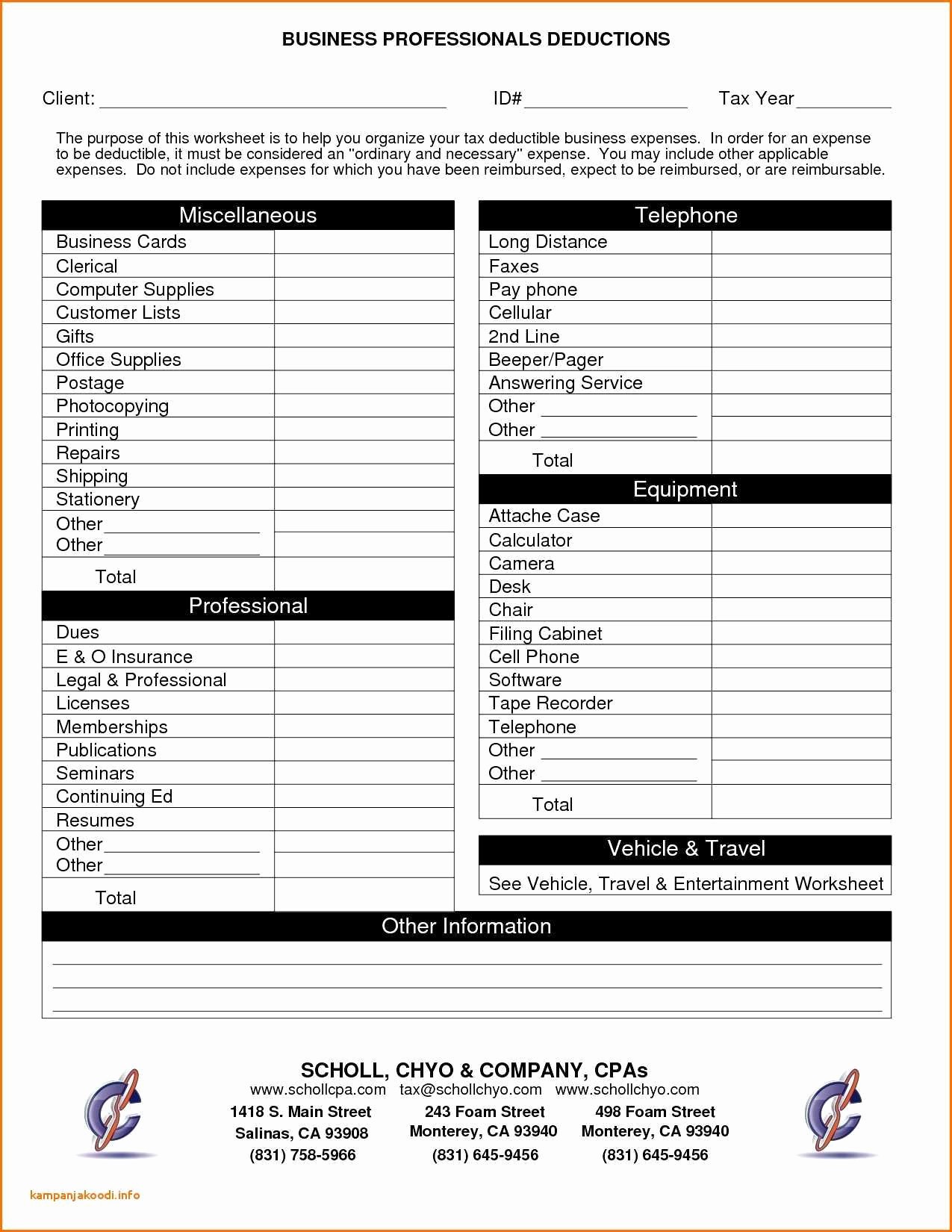

Web itemize your deductions: Expenses to enable individuals, who are. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Federal section>deductions>itemized deductions>medical and dental expenses. Web for 2022, this deduction maxes out at $2,500 for every student. After downloading the free template to your computer, you will automatically start on the first tab of the. Web the standard deduction starts at $12,400 for single taxpayers younger than 65 and increases depending on filing status and other factors. See how to fill it out, how to itemize tax deductions and. Web deduction may be limited. Web turbotax will automatically select the type of deduction that brings you the most tax benefit based off of your. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole. Home mortgage interest and points. Web how to use the itemized deductions checklist. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Id # tax year ordinary suppliesthe purpose of. Web expenses are deductible only if related to producing or collecting taxable income. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on. Web just enter your totals for each expense line even if it doesn’t seem like you will have enough to itemize. Web small business worksheet client:

The Total Amount Of These Adjustments Should Be.

Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. See how to fill it out, how to itemize tax deductions and. Web just enter your totals for each expense line even if it doesn’t seem like you will have enough to itemize. Web for 2022, this deduction maxes out at $2,500 for every student.

If You Didn’t Use All Of Your Home Mortgage.

Web deduction may be limited. Web reimbursements for business expenses. Web small business worksheet client: Home mortgage interest and points.

Web Turbotax Will Automatically Select The Type Of Deduction That Brings You The Most Tax Benefit Based Off Of Your.

Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole. Federal section>deductions>itemized deductions>medical and dental expenses. Web how to use the itemized deductions checklist. Id # tax year ordinary suppliesthe purpose of.

Web The Standard Deduction Starts At $12,400 For Single Taxpayers Younger Than 65 And Increases Depending On Filing Status And Other Factors.

Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web expenses are deductible only if related to producing or collecting taxable income. Tax deductions for calendar year 2 0 ___ ___. Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income.