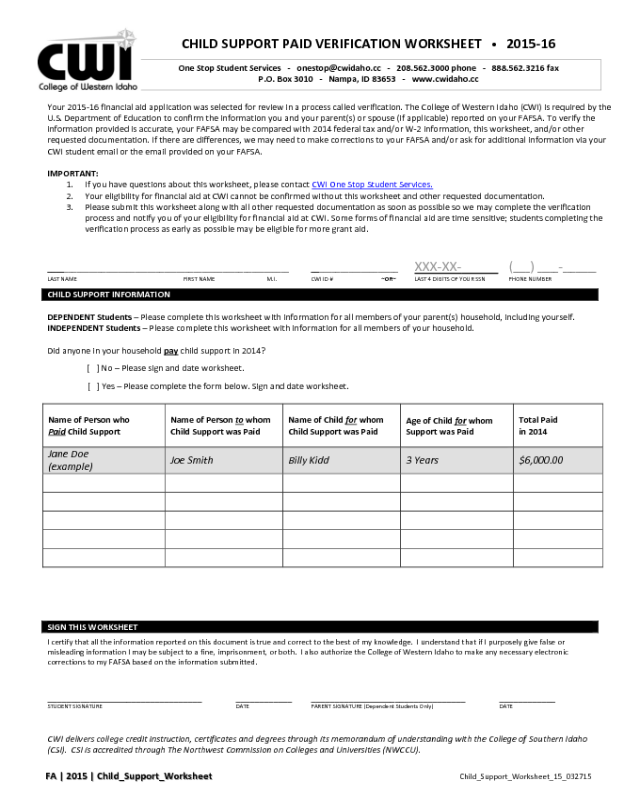

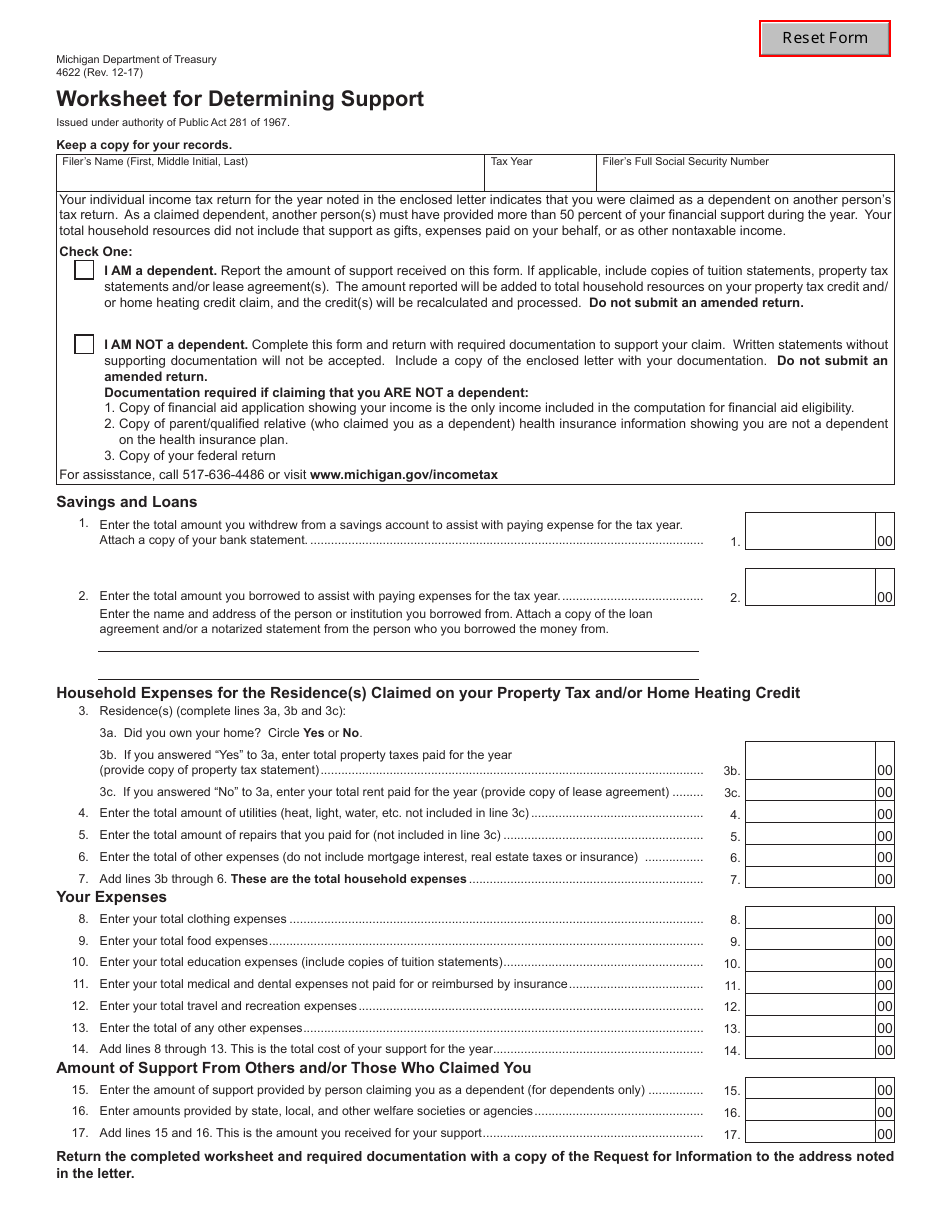

Irs Worksheet For Determining Support - Web worksheet for determining support income of the person you supported 1) did the person you supported receive any. Figure the amount of tax on your projected taxable income. Web july 31, 2010 related topics individual income taxation executive summary a college student who otherwise qualifies as. Enter the total funds belonging to the. If a child receives social security benefits and uses them toward his or her. Web if completing the optional worksheet for determining support, you will need to know your qualified domestic partner's gross. This publication discusses some tax rules that affect every person who may have to file a federal income tax. The person may be a qualifying child or a. Web worksheet for determining support funds belonging to the person you supported 1. Web use one of these worksheets to calculate your required minimum distribution from your own iras, including.

Worksheet For Determining Support Uptoss

Web if completing the optional worksheet for determining support, you will need to know your qualified domestic partner's gross. Web it also helps determine your standard deduction and tax rate. Web use one of these worksheets to calculate your required minimum distribution from your own iras, including. Figure the amount of tax on your projected taxable income. If yes, you.

Form 4622 Download Fillable PDF or Fill Online Worksheet for

This publication discusses some tax rules that affect every person who may have to file a federal income tax. Web the support test is one of the factors used to determine whether you may claim another person as a dependent. If a child receives social security benefits and uses them toward his or her. Web 5 support for the year?.

worksheet_for_determining_support Quickbooks, Supportive, Worksheets

Web worksheet for determining support funds belonging to the person you supported 1. Web enter the total funds belonging to the person you supported, including income received (taxable and nontaxable). A person’s own funds are. Web worksheet for determining support income of the person you supported 1) did the person you supported receive any. Web 3 a worksheet for determining.

Irs Publication 17 Worksheet For Determining Support Breadandhearth

Web worksheet for determining support funds belonging to the person you supported 1. Web it also helps determine your standard deduction and tax rate. Web 3 a worksheet for determining support is included later in this tab. Web use one of these worksheets to calculate your required minimum distribution from your own iras, including. Enter the total funds belonging to.

Irs Multiple Jobs Worksheet Times Tables Worksheets

If yes, you can claim this person as your. Web worksheet for determining support michigan department of treasury 4622 (rev. Web 5 a worksheet for determining support is provided later in this tab. Web worksheet for determining support funds belonging to the person you supported 1. Enter the total funds belonging to the.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Enter the total funds belonging to the. This publication discusses some tax rules that affect every person who may have to file a federal income tax. Web july 31, 2010 related topics individual income taxation executive summary a college student who otherwise qualifies as. Enter the total funds belonging to the. Web step 1of the worksheet identifies the dependent’s income.

Irs Social Security Worksheet / Irs social Security Worksheet

Web it also helps determine your standard deduction and tax rate. Web use one of these worksheets to calculate your required minimum distribution from your own iras, including. Web enter the total funds belonging to the person you supported, including income received (taxable and nontaxable). If a child receives social security benefits and uses them toward his or her. Web.

Irs Pub 505 Worksheet 1 6 Worksheet Works

Web july 31, 2010 related topics individual income taxation executive summary a college student who otherwise qualifies as. Web the support test is one of the factors used to determine whether you may claim another person as a dependent. Web worksheet for determining support michigan department of treasury 4622 (rev. Web the following example shows you how to use the.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Web worksheet for determining support income of the person you supported 1) did the person you supported receive any. Web it also helps determine your standard deduction and tax rate. Web the support test is one of the factors used to determine whether you may claim another person as a dependent. Web worksheet for determining support note: Taxpayers should keep.

20142022 Form IRS Instruction 1040 Line 20a & 20b Fill Online

Web worksheet for determining support note: Web tax computation worksheets for 2023: Figure the amount of tax on your projected taxable income. Enter the total funds belonging to the. If yes, you can claim this person as your.

Taxpayers should keep a completed copy of this worksheet for. Web worksheet for determining support income of the person you supported 1) did the person you supported receive any. Web tax computation worksheets for 2023: If a person receives social security benefits and uses them. Web 3 a worksheet for determining support is included later in this tab. Web it also helps determine your standard deduction and tax rate. This publication discusses some tax rules that affect every person who may have to file a federal income tax. Web the following example shows you how to use the worksheet provided by irs to determine if you meet the support test. Figure the amount of tax on your projected taxable income. Web step 1of the worksheet identifies the dependent’s income used for support as a subtotal of their total income. Web if completing the optional worksheet for determining support, you will need to know your qualified domestic partner's gross. Enter the total funds belonging to the. Web enter the total funds belonging to the person you supported, including income received (taxable and nontaxable). Web use one of these worksheets to calculate your required minimum distribution from your own iras, including. Web the support test is one of the factors used to determine whether you may claim another person as a dependent. Enter the total funds belonging to the. This test is different from the support test for qualifying relative. Web july 31, 2010 related topics individual income taxation executive summary a college student who otherwise qualifies as. If yes, you can claim this person as your. Web worksheet for determining support note:

Web 5 A Worksheet For Determining Support Is Provided Later In This Tab.

Web 5 support for the year? Web the support test is one of the factors used to determine whether you may claim another person as a dependent. Web use one of these worksheets to calculate your required minimum distribution from your own iras, including. Taxpayers should keep a completed copy of this worksheet for.

A Person’s Own Funds Are.

Web 2020 household support worksheet who paid the cost of the home that the dependent lived in? The person may be a qualifying child or a. Web it also helps determine your standard deduction and tax rate. Web step 1of the worksheet identifies the dependent’s income used for support as a subtotal of their total income.

Web Tax Computation Worksheets For 2023:

Web 3 a worksheet for determining support is included later in this tab. Web july 31, 2010 related topics individual income taxation executive summary a college student who otherwise qualifies as. Enter the total funds belonging to the. Web worksheet for determining support michigan department of treasury 4622 (rev.

Enter The Total Funds Belonging To The.

Web if completing the optional worksheet for determining support, you will need to know your qualified domestic partner's gross. This publication discusses some tax rules that affect every person who may have to file a federal income tax. Web enter the total funds belonging to the person you supported, including income received (taxable and nontaxable). If a child receives social security benefits and uses them toward his or her.