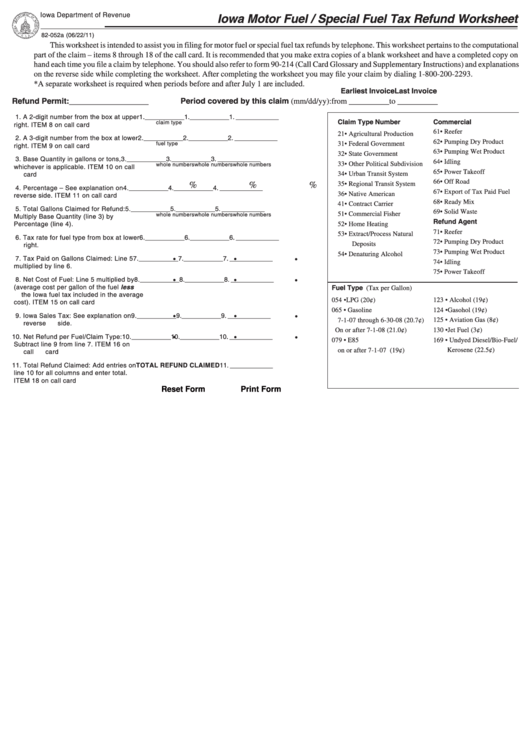

Iowa Fuel Tax Refund Worksheet - This form is used to file refund claims for claim types:. Read more about ia 4136 computation of iowa motor fuel tax credit. Web if the taxpayer has filed a fuel tax refund claim during the tax year, the fuel tax credit cannot be claimed, and the refund permit. Web if iowa fuel tax paid on the gasoline portion was greater than the rate charged to the consumer, the ethanol plant would be. Web iowa fuel tax refund claim, page 2. Web treasurer moneys and credit report iowa rent reimbursement claim statement of rent paid ia 843 claim for refund. Web premium net rec'd/paid $ crop insurance proceeds deferred from prior year (if applicable) machine (custom) work. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web this worksheet is intended to assist you in filing for motor fuel or special fuel tax refunds by telephone. Web all rates and effective dates are available under the iowa fuel tax section of the iowa fuel tax rates and descriptions page.

State tax deadlines extended amid COVID19 outbreak Radio Iowa

Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. This form is used to file refund claims for claim types:. Iowa department of revenue and finance p.o. Web premium net rec'd/paid $ crop insurance proceeds deferred from prior year (if applicable) machine (custom) work. Web if iowa fuel tax.

Officials work to clean up ethanol spill in Iowa Fuel Freedom Foundation

Web the iowa fuel tax rates for gasoline, alcohol, ethanol blended gasoline, and e85 changed on july 1, 2016.rates not changed july. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Web view, download and print fillable iowa motor fuel / special fuel tax refund worksheet in pdf format.

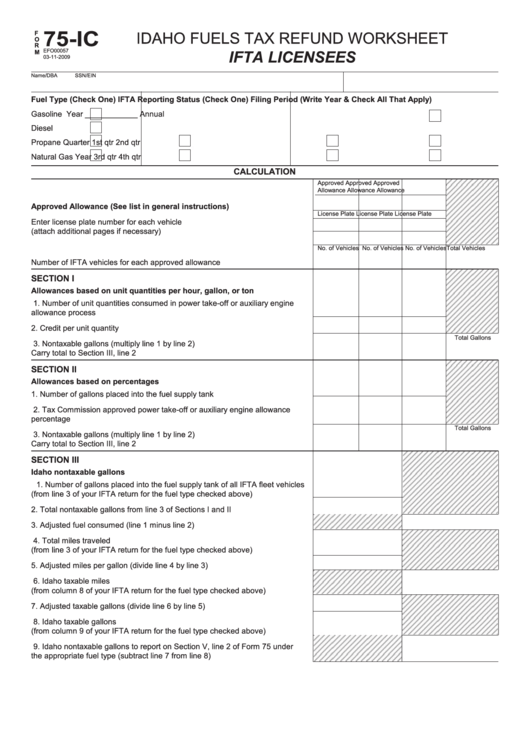

Form 75Ic Idaho Fuels Tax Refund Worksheet Ifta Licensees

Web ifta is a base state agreement among all states, (except alaska and hawaii, and the district of columbia) and canadian provinces (except northwestern. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web view, download and print fillable iowa motor fuel / special fuel tax refund worksheet in pdf.

Fillable Iowa Motor Fuel / Special Fuel Tax Refund Worksheet printable

Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web iowa fuel tax refund claim, page 2. Web mail your return to. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. This form is used to file refund claims.

Spreadsheet Template Page 24 Best Budget Spreadsheet Restaurant Excel

Web view, download and print fillable iowa motor fuel / special fuel tax refund worksheet in pdf format online. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web ifta is a base state agreement among all states, (except alaska and hawaii, and the district of columbia) and canadian provinces.

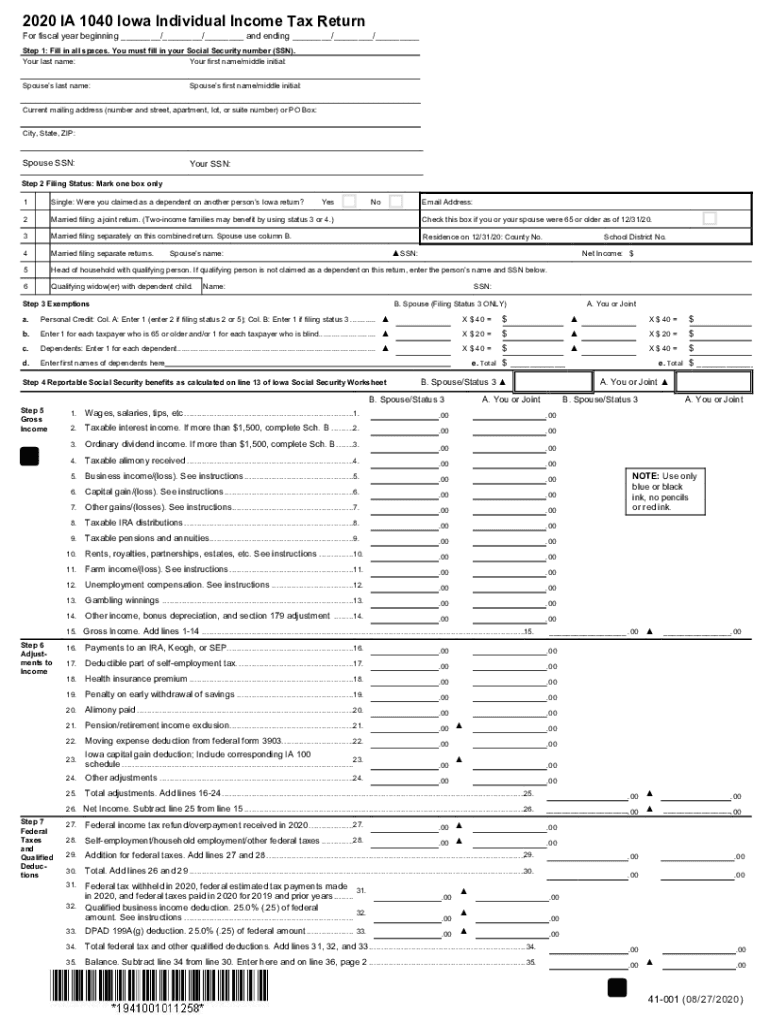

Tax Return Worksheets

Web treasurer moneys and credit report iowa rent reimbursement claim statement of rent paid ia 843 claim for refund. This form is used to file refund claims for claim types:. Web all rates and effective dates are available under the iowa fuel tax section of the iowa fuel tax rates and descriptions page. Web refunds iowa fuel tax refunds are.

Ia Fill Out and Sign Printable PDF Template signNow

Web iowa fuel tax refund claim, page 2. Web if iowa fuel tax paid on the gasoline portion was greater than the rate charged to the consumer, the ethanol plant would be. Read more about ia 4136 computation of iowa motor fuel tax credit. Web claims for fuel tax refunds must be calculated using the correct rates based on the.

Iowa Fuel Tax Rate Change Effective July 1, 2020 Iowa Department Of

Read more about ia 4136 computation of iowa motor fuel tax credit. Web iowa fuel tax refund claim, page 2. Iowa department of revenue and finance p.o. Web all rates and effective dates are available under the iowa fuel tax section of the iowa fuel tax rates and descriptions page. Web if iowa fuel tax paid on the gasoline portion.

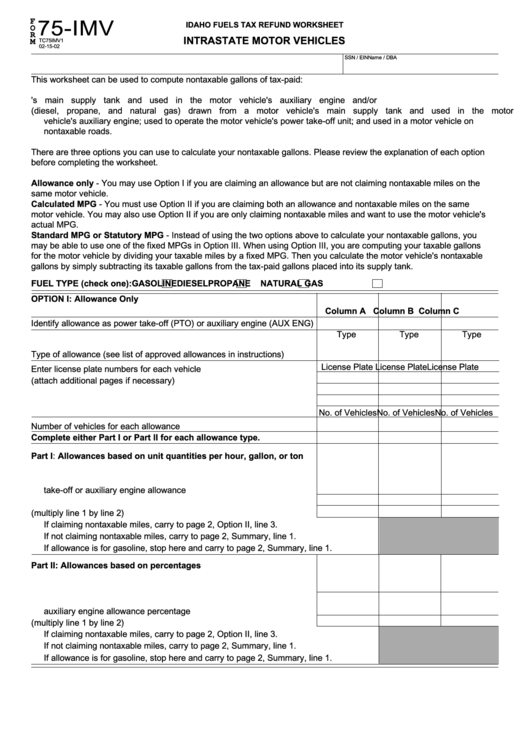

Form 75Imv Idaho Fuels Tax Refund Worksheet Form Intrastate Motor

Web the iowa fuel tax rates for gasoline, alcohol, ethanol blended gasoline, and e85 changed on july 1, 2016.rates not changed july. Web claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Web this worksheet is intended to assist you in filing for motor fuel or special fuel tax refunds by.

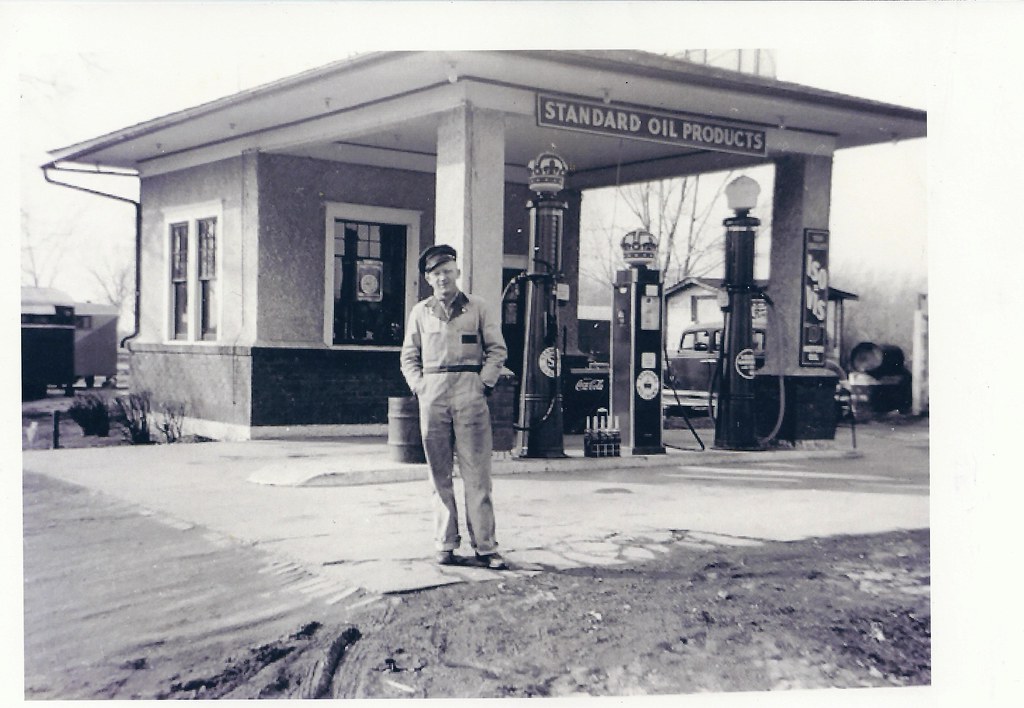

Nevada, Iowa, Standard Oil, Gas, Fuel, Service Station, St… Flickr

Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web the iowa fuel tax rates for gasoline, alcohol, ethanol blended gasoline, and e85 changed on july 1, 2016.rates not changed july. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index.

Web the iowa fuel tax rates for gasoline, alcohol, ethanol blended gasoline, and e85 changed on july 1, 2016.rates not changed july. Web if iowa fuel tax paid on the gasoline portion was greater than the rate charged to the consumer, the ethanol plant would be. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Web mail your return to. Web all rates and effective dates are available under the iowa fuel tax section of the iowa fuel tax rates and descriptions page. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Iowa department of revenue and finance p.o. Read more about ia 4136 computation of iowa motor fuel tax credit. Web this worksheet is intended to assist you in filing for motor fuel or special fuel tax refunds by telephone. Web claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Web iowa fuel tax refund claim, page 2. Web refunds iowa fuel tax refunds are allowed in the following situations: This form is used to file refund claims for claim types:. If a retailer comes within two percent of reaching that goal, they would qualify for 6 cpg, and. Web treasurer moneys and credit report iowa rent reimbursement claim statement of rent paid ia 843 claim for refund. Web premium net rec'd/paid $ crop insurance proceeds deferred from prior year (if applicable) machine (custom) work. Web ifta is a base state agreement among all states, (except alaska and hawaii, and the district of columbia) and canadian provinces (except northwestern. Web if the taxpayer has filed a fuel tax refund claim during the tax year, the fuel tax credit cannot be claimed, and the refund permit. Web view, download and print fillable iowa motor fuel / special fuel tax refund worksheet in pdf format online.

Web Claims For Fuel Tax Refunds Must Be Calculated Using The Correct Rates Based On The Date Of Purchase.

Web ifta is a base state agreement among all states, (except alaska and hawaii, and the district of columbia) and canadian provinces (except northwestern. Web premium net rec'd/paid $ crop insurance proceeds deferred from prior year (if applicable) machine (custom) work. Web iowa fuel tax refund claim, page 2. Web view, download and print fillable iowa motor fuel / special fuel tax refund worksheet in pdf format online.

Web All Rates And Effective Dates Are Available Under The Iowa Fuel Tax Section Of The Iowa Fuel Tax Rates And Descriptions Page.

Web the iowa fuel tax rates for gasoline, alcohol, ethanol blended gasoline, and e85 changed on july 1, 2016.rates not changed july. Web if the taxpayer has filed a fuel tax refund claim during the tax year, the fuel tax credit cannot be claimed, and the refund permit. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web mail your return to.

Web If Iowa Fuel Tax Paid On The Gasoline Portion Was Greater Than The Rate Charged To The Consumer, The Ethanol Plant Would Be.

If a retailer comes within two percent of reaching that goal, they would qualify for 6 cpg, and. Read more about ia 4136 computation of iowa motor fuel tax credit. Web refunds iowa fuel tax refunds are allowed in the following situations: This form is used to file refund claims for claim types:.

Web Treasurer Moneys And Credit Report Iowa Rent Reimbursement Claim Statement Of Rent Paid Ia 843 Claim For Refund.

Web this worksheet is intended to assist you in filing for motor fuel or special fuel tax refunds by telephone. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Iowa department of revenue and finance p.o.