Income Calculator Worksheet - Summarize the income and expenses by. Estimated tax is the method used to pay social security and medicare taxes. Web back to top how do i make my quarterly payments? Web your dti is estimated by dividing your total monthly debt by your gross monthly income. Web smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Web monthly check or direct deposit. Calculation results do not constitute approval for affordable housing*. Add totals for the income and expenses. January 1, 1957 to december 31, 1959. Web step 1 enter hourly base rate.

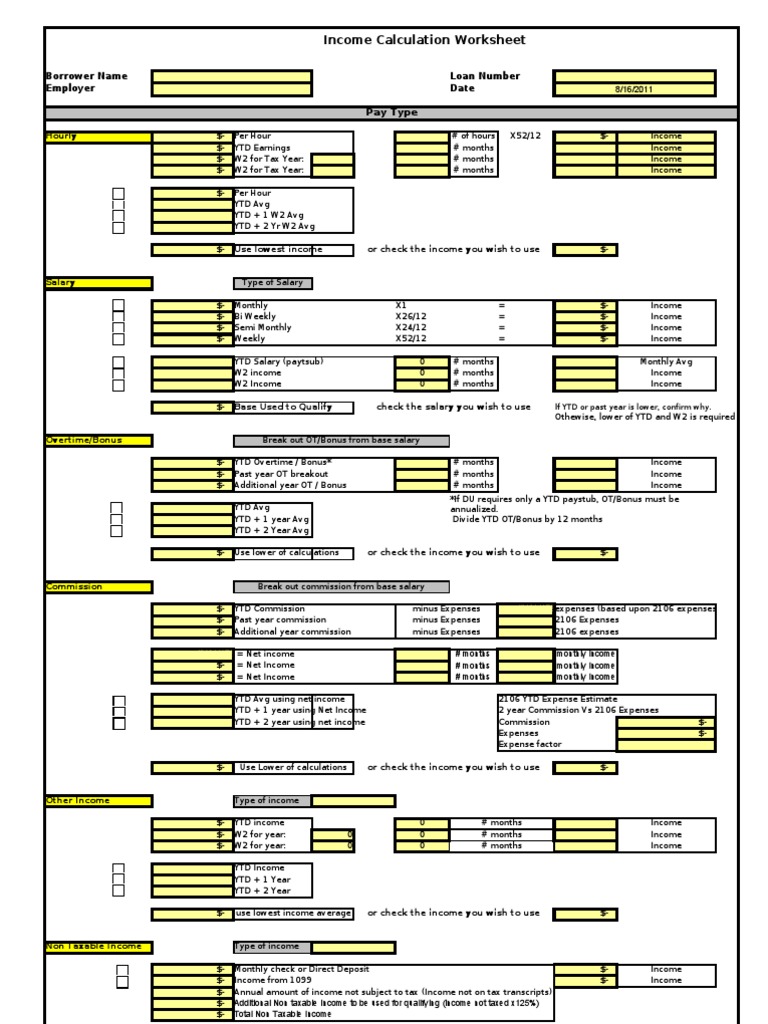

Fannie Mae Calculation Worksheet Fill Online, Printable

Web back to top how do i make my quarterly payments? Download the excel budget template. Web *income calculation worksheet is intended for information purposes only. Web create a simple list. Summarize the income and expenses by.

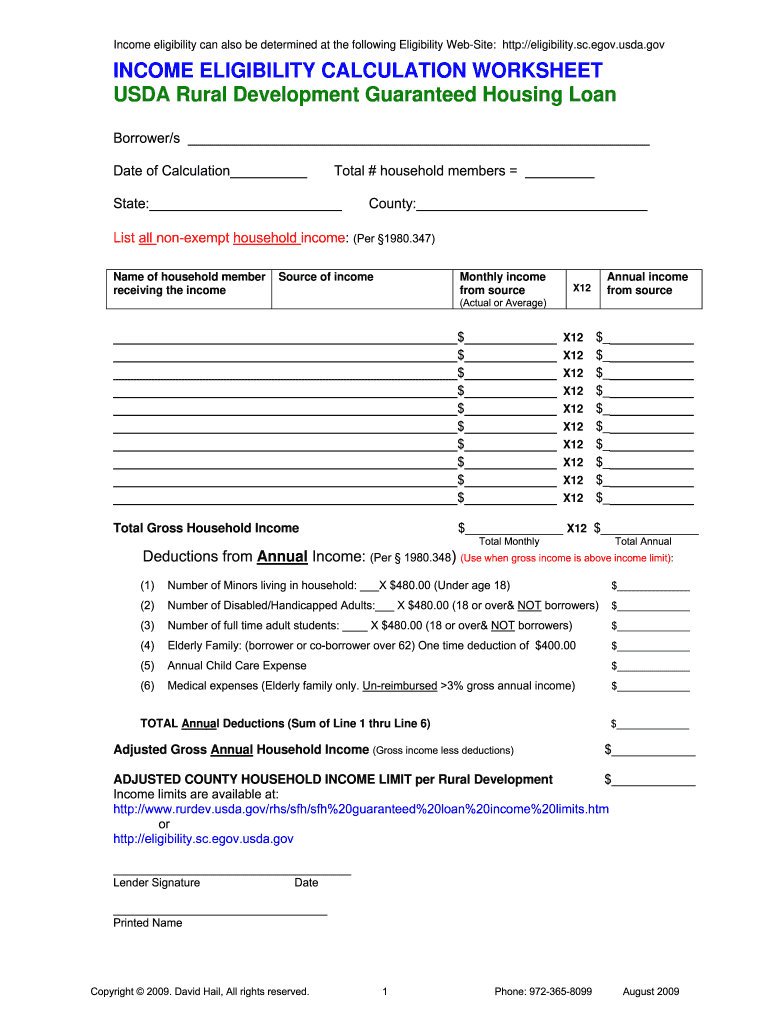

Usda Calculation Worksheet Fill and Sign Printable Template

Estimate your federal income tax withholding. Amount that you plan to add to the principal every month, or a negative number for the. January 1, 1957 to december 31, 1959. Estimated tax is the method used to pay social security and medicare taxes. 22 percent for income above.

Underwriting Calculation Worksheet Also Fresh Excel Bud Template

January 1, 1957 to december 31, 1959. Download the excel budget template. Web create a simple list. Web use this tool to: Calculation results do not constitute approval for affordable housing*.

Calculation Worksheet for Mortgage

Languages) this worksheet will help individuals add up their current monthly income and estimate their annual income for the following. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment. Web this excel template can help you track your monthly budget by income and expenses. Annual income = hourly rate x.

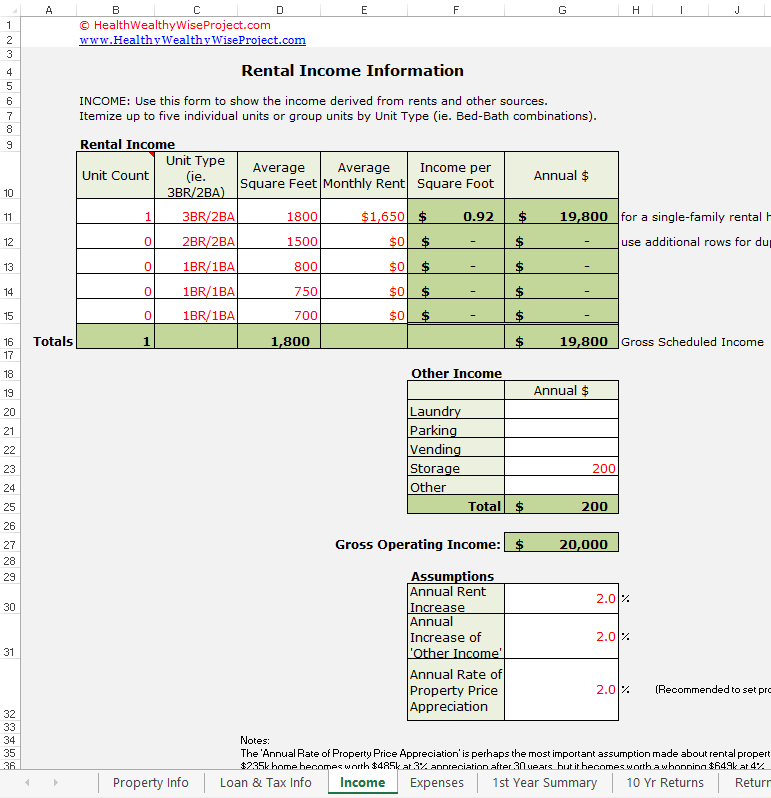

Rental Calculation Worksheet

Web rmd age is 73. Input your costs and income, and any. Web 10 percent on income up to $11,000. Calculation results do not constitute approval for affordable housing*. Enter your income in your budget template.

Rental Property Analysis Excel Spreadsheet

Web free budget planner worksheet add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the. Web use this tool to: Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web this excel template can help you.

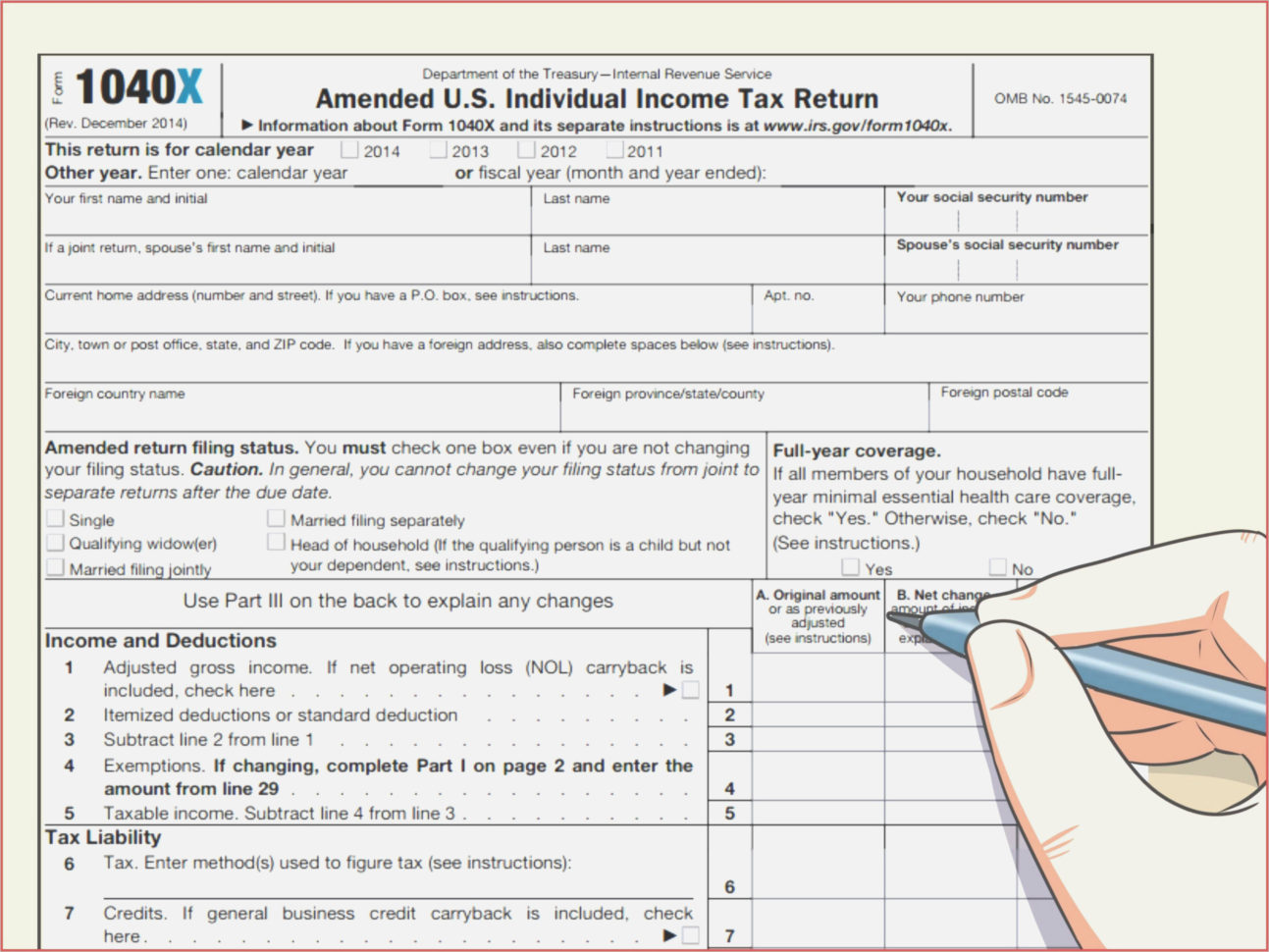

Tax Deduction Expense

Web your dti is estimated by dividing your total monthly debt by your gross monthly income. Web rmd age is 73. Web monthly check or direct deposit. Estimate your federal income tax withholding. Amount that you plan to add to the principal every month, or a negative number for the.

Schedule C Calculation Worksheet New Sales Tax —

Languages) this worksheet will help individuals add up their current monthly income and estimate their annual income for the following. Web the income calculator used to calculate compliance income for ihda’s homeownership programs. Add totals for the income and expenses. Web monthly check or direct deposit. Format the list as a table.

Underwriting Calculation Worksheet

Web keep your career on the right track. Web this excel template can help you track your monthly budget by income and expenses. Web free budget planner worksheet add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the. Enter your income in your budget template. Web create a simple list.

Rental Calculation Worksheet Along with Investment Property

22 percent for income above. Web this excel template can help you track your monthly budget by income and expenses. Amount that you plan to add to the principal every month, or a negative number for the. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows.

Web 10 percent on income up to $11,000. Monthly debt / gross monthly income =. 12 percent on income between $11,000 and $44,725. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web free budget planner worksheet add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the. Web rmd age is 73. Web the income calculator used to calculate compliance income for ihda’s homeownership programs. Enter your income in your budget template. Web step 1 enter hourly base rate. January 1, 1957 to december 31, 1959. Estimate your federal income tax withholding. Our income analysis tools and job aids are designed to help you evaluate qualifying. Web smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Web your dti is estimated by dividing your total monthly debt by your gross monthly income. Input your costs and income, and any. Calculation results do not constitute approval for affordable housing*. Web other income (expense) guidance was updated to the range of $75 million of expense to $25 million of. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment. Web back to top how do i make my quarterly payments? Add totals for the income and expenses.

Web Smartasset's Hourly And Salary Paycheck Calculator Shows Your Income After Federal, State And Local Taxes.

Web your dti is estimated by dividing your total monthly debt by your gross monthly income. Web use this tool to: January 1, 1957 to december 31, 1959. Annual income = hourly rate x 40 (hours) x 52 (weeks) $ step 2 monthly income = annual income /12 $ section 1b:

Web Rmd Age Is 73.

Input your costs and income, and any. Calculation results do not constitute approval for affordable housing*. Monthly debt / gross monthly income =. Estimate your federal income tax withholding.

Web Create A Simple List.

22 percent for income above. Summarize the income and expenses by. Estimated tax is the method used to pay social security and medicare taxes. Web step 1 enter hourly base rate.

Web Use This Worksheet To Calculate Qualifying Rental Income For Fannie Mae Form 1038 (Individual Rental Income From Investment.

Web other income (expense) guidance was updated to the range of $75 million of expense to $25 million of. Download the excel budget template. Web monthly check or direct deposit. Amount that you plan to add to the principal every month, or a negative number for the.