In Home Daycare Tax Deduction Worksheet - Web in 2022, the following events occur: Web you can use a notebook with categories at the top, or make a spreadsheet on the computer. Web tax deduction for daycare. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Web taxes for in home daycare. Web day care income income directly from parents food program payments: Web where to you also start on your taxes for in home daycare? Web if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under. Web day care income and expense worksheet. This page may included affiliate links.

Student Loan Interest Deduction Worksheet 2016

Web worksheet to figure the deduction for business use of your home.20 worksheets to figure the. Web if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under. Web this publication explains how to figure and claim the deduction for business use of your home. Web day care income and expense.

Home Daycare Tax Worksheet Ivuyteq

I like to use excel, so. Web if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under. Home modifications (wheelchair ramps, safety bars, etc.) to calculate your total medical. Web this publication explains how to figure and claim the deduction for business use of your home. You've found the answer.

Home Expense Spreadsheet Daycare Personal Spending —

You've found the answer for tax deductions,. Web if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under. (a) you pay $14,890 of qualified adoption expenses in connection with an. You've found the answer for strain. The irs will let you deduct a set.

Itemized Deduction Worksheet —

Web the simplified method using the simplified method, you will measure your home area used for daycare (in ft 2 ). Web where what you consistent start the your taxes for with home daycare? Web if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under. Web day care income and.

Family Day Care Tax Spreadsheet with 75 Daycare Payment Receipt

Web where what you consistent start the your taxes for with home daycare? You've found the answer for strain. Web tax deduction for daycare. (a) you pay $14,890 of qualified adoption expenses in connection with an. The irs offers childcare providers deductions and credits based on eligibility.

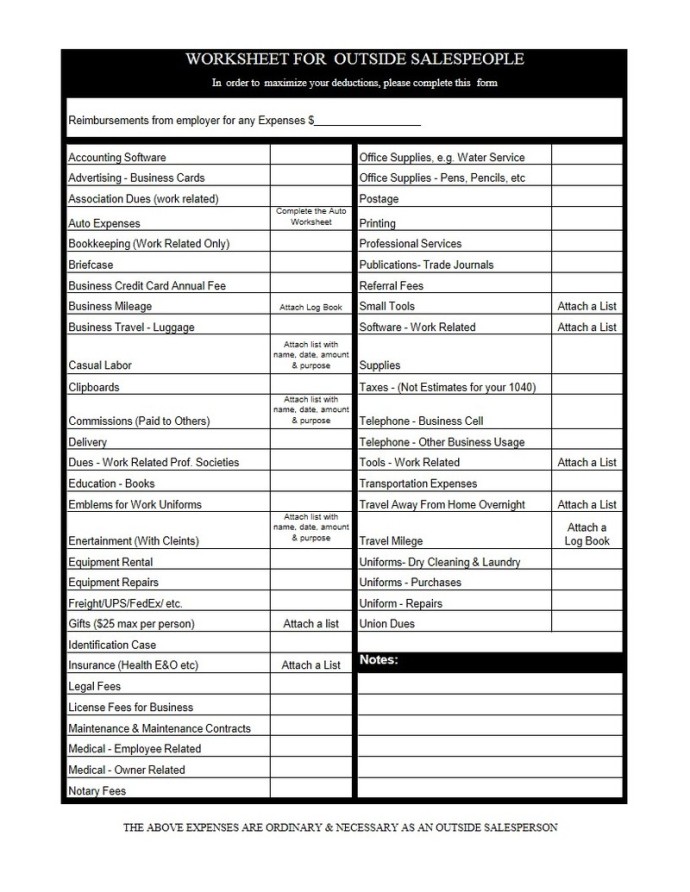

Small Business Tax Deductions Worksheet New Tax Deduction with Small

Web taxes for in home daycare. Web day care income and expense worksheet. Web tax deduction for daycare. By christina september 21, 2020 july 8, 2022. This page may included affiliate links.

Daycare Business and Expense sheet to file childcare

Web where what you consistent start the your taxes for with home daycare? Web day care income and expense worksheet. This page may included affiliate links. Web this publication explains how to figure and claim the deduction for business use of your home. Web where do you constant start over your taxes forward in home daycare?

Family Day Care Tax Spreadsheet Printable Spreadshee family day care

Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Web where do you constant start over your taxes forward in home daycare? Web this publication explains how to figure and claim the deduction for business use of your home. This page may.

Home Daycare Tax Worksheet

You've locate that replies for tax. Web the simplified method using the simplified method, you will measure your home area used for daycare (in ft 2 ). By christina september 21, 2020 july 8, 2022. Web tax deduction for daycare. You've found the answer for strain.

Home Office Deduction Worksheet (Excel)

Web the big list of home daycare tax deductions for family child care businesses! Web this publication explains how to figure and claim the deduction for business use of your home. Before you go through your first (or 30 th) year in home dog, i implore you. Web where to you also start on your taxes for in home daycare?.

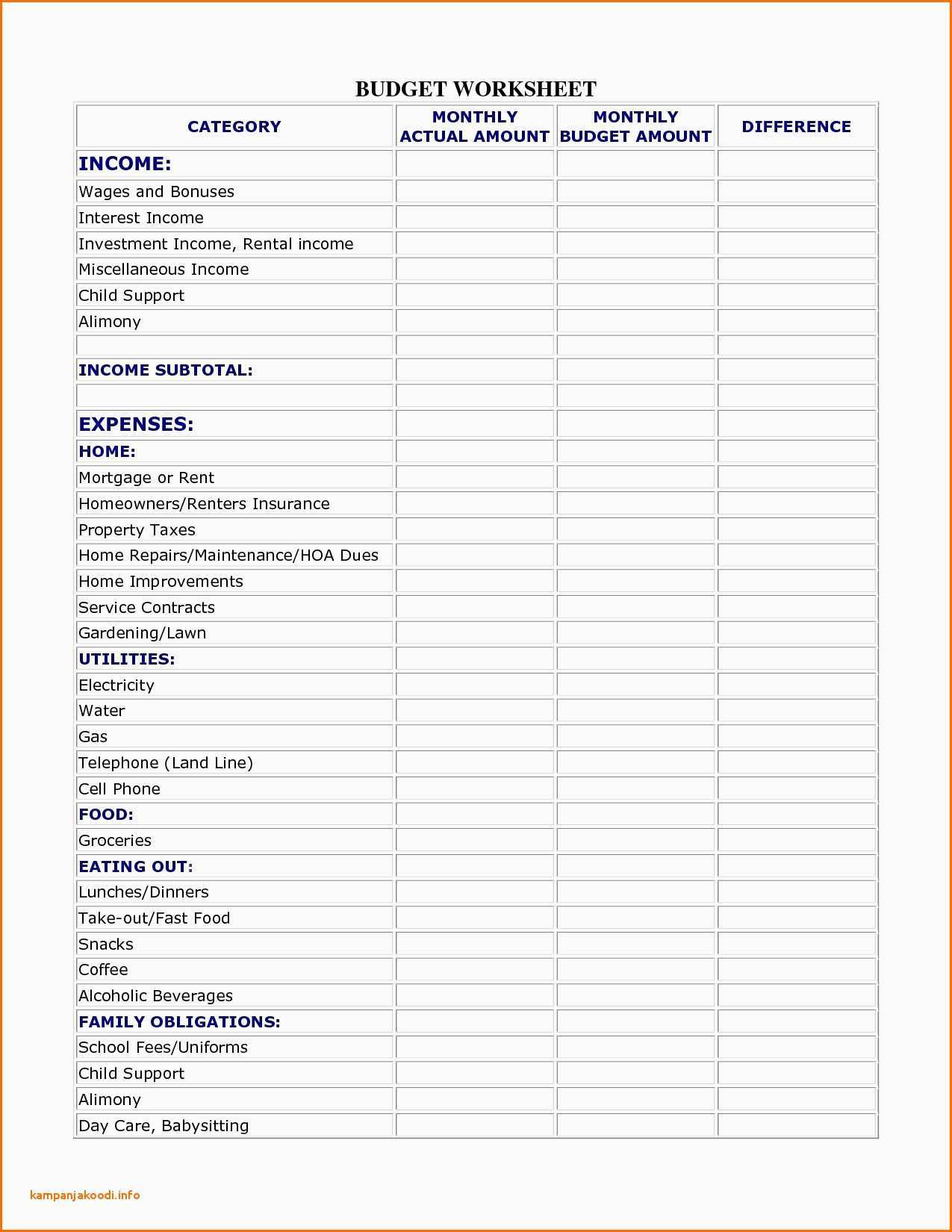

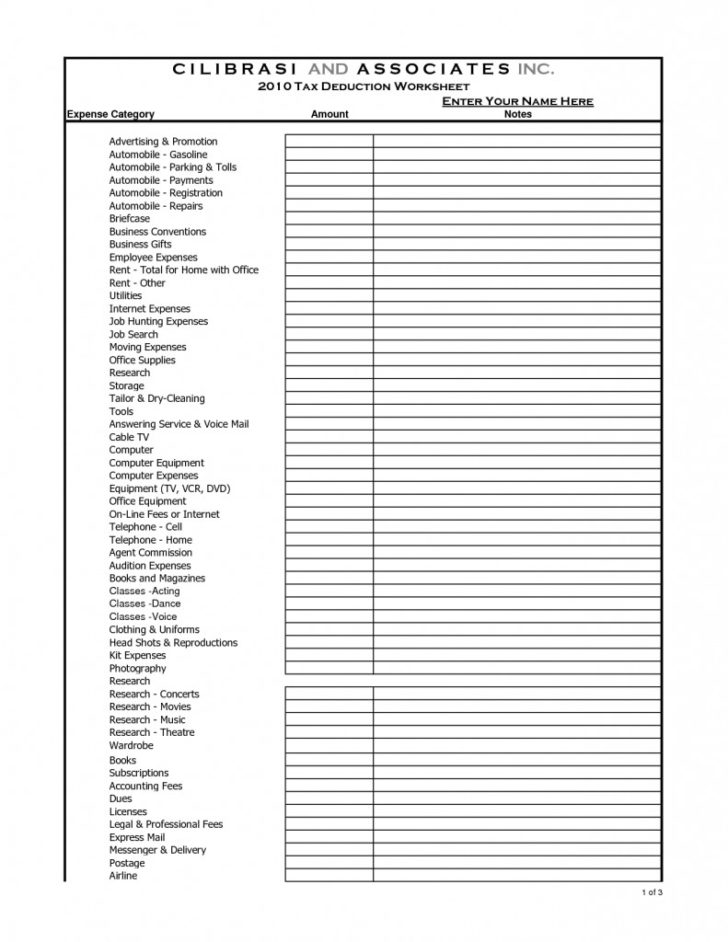

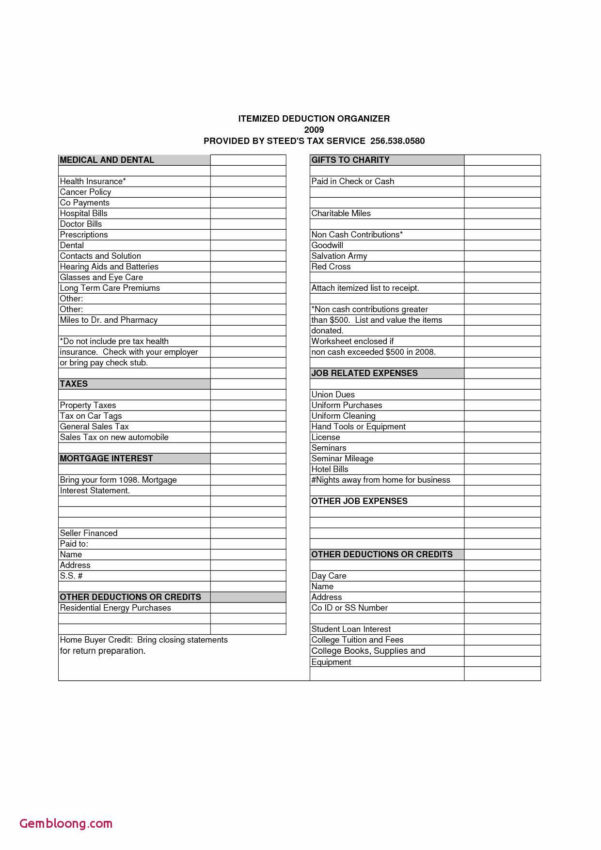

Web this publication explains how to figure and claim the deduction for business use of your home. I like to use excel, so. By christina september 21, 2020 july 8, 2022. You've found the answer for tax deductions,. The irs will let you deduct a set. Web if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under. Web where what you consistent start the your taxes for with home daycare? This page may included affiliate links. Web expenses 100% daycare expense (enter dollars and cents) advertsiing _____________ arts &crafts. Web you can use a notebook with categories at the top, or make a spreadsheet on the computer. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Web home daycare tax deductions worksheet. Web in 2022, the following events occur: Web the simplified method using the simplified method, you will measure your home area used for daycare (in ft 2 ). Web the big list of home daycare tax deductions for family child care businesses! Web tax deduction for daycare. Web where to you also start on your taxes for in home daycare? (a) you pay $14,890 of qualified adoption expenses in connection with an. Web taxes for in home daycare. Before you go through your first (or 30 th) year in home dog, i implore you.

Web Day Care Income Income Directly From Parents Food Program Payments:

Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Web home daycare tax deductions worksheet. Web you can use a notebook with categories at the top, or make a spreadsheet on the computer. (a) you pay $14,890 of qualified adoption expenses in connection with an.

I Like To Use Excel, So.

The irs will let you deduct a set. Home modifications (wheelchair ramps, safety bars, etc.) to calculate your total medical. Web if you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under. The irs offers childcare providers deductions and credits based on eligibility.

Web Tax Deduction For Daycare.

By christina september 21, 2020 july 8, 2022. Web taxes for in home daycare. Web day care income and expense worksheet. This page may included affiliate links.

You've Locate That Replies For Tax.

Web the simplified method using the simplified method, you will measure your home area used for daycare (in ft 2 ). Before you go through your first (or 30 th) year in home dog, i implore you. Web where what you consistent start the your taxes for with home daycare? Web the big list of home daycare tax deductions for family child care businesses!