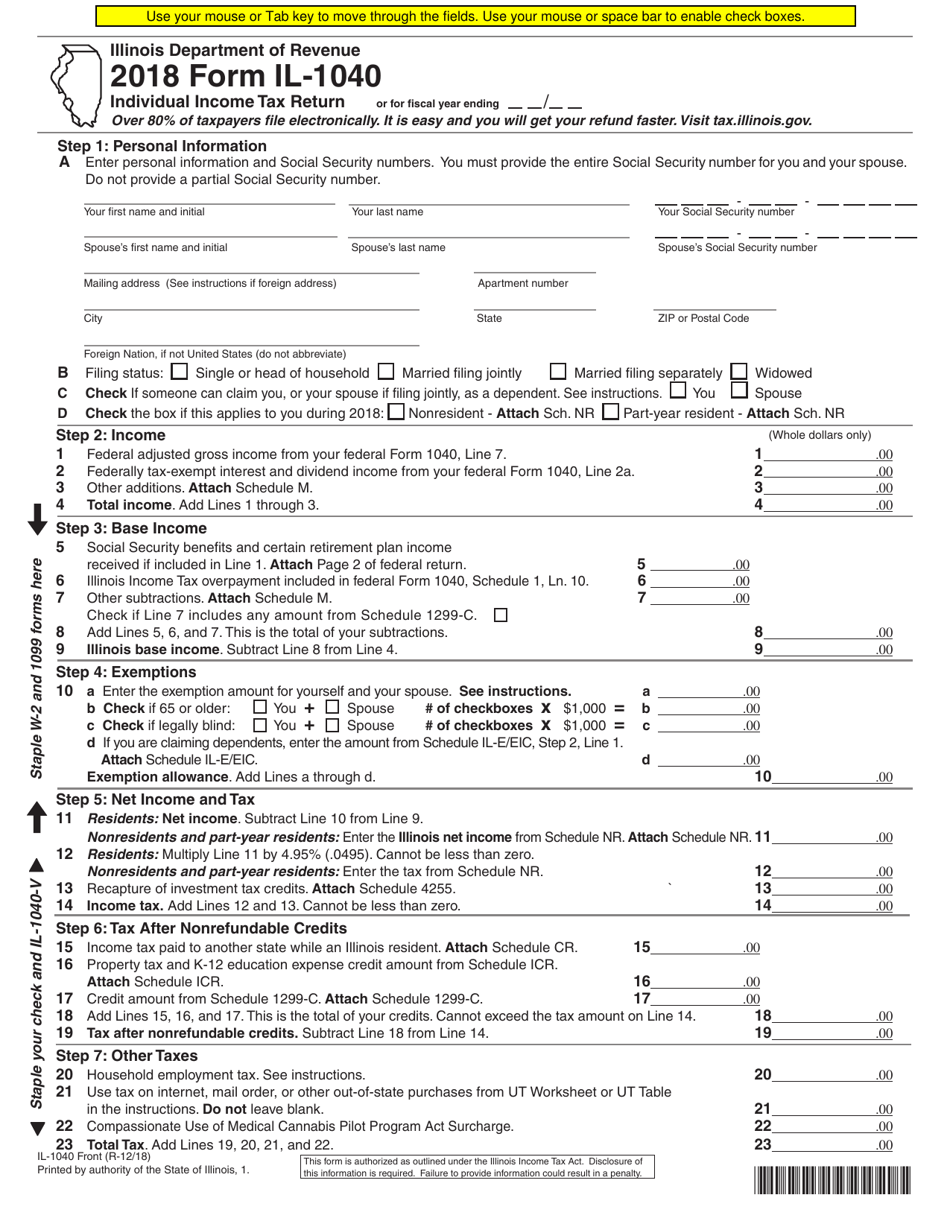

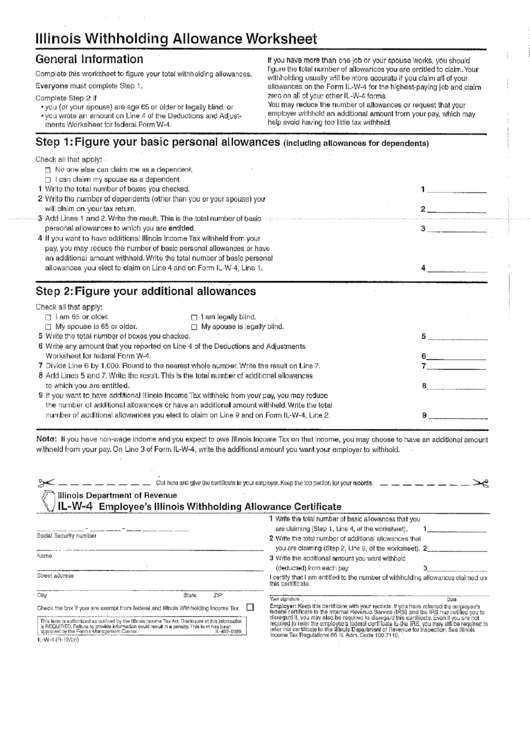

Illinois Withholding Allowance Worksheet - Complete step 2 if † you (or your spouse) are age 65 or. Figure your basic personal allowances (including allowances for. Figure your basic personal allowances (including allowances for dependents). Web illinois withholding allowance worksheet part 1: Web illinois income tax withholding. Web complete the worksheet on the back of this page to figure the correct number of allowances you are entitled to claim. Everyone must complete step 1. Do only one of the following. Web illinois withholding allowance worksheet general information if you have more than one job or your spouse works, you should. Web tax withheld =automated payroll method.

ILW4 App

Web illinois withholding allowance worksheet general information if you have more than one job or your spouse works, you should. Web complete this worksheet to figure your total withholding allowances. Web tax withheld =automated payroll method. You may reduce the number of allowances or request that your employer withhold an. Do only one of the following.

Illinois Withholding Allowance Worksheet Form Il W 4 Download

Web illinois withholding allowance worksheet step 1: Web tax withheld =automated payroll method. Figure your basic personal allowances (including allowances for. These instructions are written for employees to address. Everyone must complete step 1.

Illinois Withholding Allowance Worksheet Example

Web complete this worksheet to figure your total withholding allowances. Web tax withheld =automated payroll method. Web illinois withholding allowance worksheet step 1: Web illinois income tax withholding. Web complete this worksheet to figure your total withholding allowances.

️Illinois Withholding Allowance Worksheet Free Download Goodimg.co

Everyone must complete step 1. Web tax withheld =automated payroll method. You may reduce the number of allowances or request that your employer withhold an. Web complete the worksheet on the back of this page to figure the correct number of allowances you are entitled to claim. Web illinois withholding allowance worksheet step 1:

Illinois Withholding Allowance Worksheet Example

Web illinois withholding allowance worksheet step 1: Web complete this form if you are an employee so that the employer can withhold correct amount of your income tax from your pay. Figure your basic personal allowances (including allowances for. You must also have your employee. Web complete the worksheet on the back of this page to figure the correct number.

Illinois Withholding Allowance Worksheet Step 1 Line 4 Gettrip24

Wages — ((line 1 allowances x $2,425) + (line 2 allowances x $1,000))). Figure your basic personal allowances (including allowances for. Web illinois withholding allowance worksheet part 1: Web complete the worksheet on the back of this page to figure the correct number of allowances you are entitled to claim. Web the correct amount of withholding depends on income earned.

withholding allowance worksheet

Web 1 enter the total number of basic allowances that you are claiming(step 1, line 4, of the worksheet). Figure your basic personal allowances (including allowances for. Web tax withheld =automated payroll method. Web illinois income tax withholding. These instructions are written for employees to address.

Illinois Withholding Allowance Worksheet printable pdf download

Web illinois withholding allowance worksheet step 1: Figure your basic personal allowances (including allowances for dependents). You may reduce the number of allowances or request that your employer withhold an. Figure your basic personal allowances (including allowances for. Web illinois withholding allowance worksheet general information if you have more than one job or your spouse works, you should.

Illinois Withholding Allowance Worksheet Example Abbreviation Tripmart

Web tax withheld =automated payroll method. You may reduce the number of allowances or request that your employer withhold an. Web the correct amount of withholding depends on income earned from all of these jobs. Web complete this worksheet to figure your total withholding allowances. Web complete this worksheet to figure your total withholding allowances.

Illinois Withholding Allowance Worksheet / How Many Tax Allowances

Web illinois withholding allowance worksheet step 1: Web illinois withholding allowance worksheet general information if you have more than one job or your spouse works, you should. Everyone must complete step 1. These instructions are written for employees to address. Everyone must complete step 1.

Everyone must complete step 1. Web complete this worksheet to figure your total withholding allowances. 2 enter the total number of. Web the correct amount of withholding depends on income earned from all of these jobs. Complete step 2 if † you (or your spouse) are age 65 or. Web complete the worksheet on the back of this page to figure the correct number of allowances you are entitled to claim. Web illinois withholding allowance worksheet general information if you have more than one job or your spouse works, you should. Figure your basic personal allowances (including allowances for. Wages — ((line 1 allowances x $2,425) + (line 2 allowances x $1,000))). Web illinois withholding allowance worksheet step 1: Web tax withheld =automated payroll method. Web complete this worksheet to figure your total withholding allowances. Web illinois withholding allowance worksheet step 1: Figure your basic personal allowances (including allowances for dependents). These instructions are written for employees to address. Web illinois withholding allowance worksheet part 1: Figure your basic personal allowances (including allowances for. Do only one of the following. You must also have your employee. Web 2020 illinois w4 form illinois department of revenuers ilw4note:

Everyone Must Complete Step 1.

Web 2020 illinois w4 form illinois department of revenuers ilw4note: Web illinois withholding allowance worksheet step 1: Figure your basic personal allowances (including allowances for. Web illinois withholding allowance worksheet step 1:

Web Tax Withheld =Automated Payroll Method.

Figure your basic personal allowances (including allowances for. Everyone must complete step 1. Web illinois income tax withholding. Web 1 enter the total number of basic allowances that you are claiming(step 1, line 4, of the worksheet).

You Must Also Have Your Employee.

Web illinois withholding allowance worksheet part 1: Do only one of the following. Web complete the worksheet on the back of this page to figure the correct number of allowances you are entitled to claim. Complete step 2 if † you (or your spouse) are age 65 or.

These Instructions Are Written For Employees To Address.

Web the correct amount of withholding depends on income earned from all of these jobs. Web complete this worksheet to figure your total withholding allowances. 2 enter the total number of. Web illinois withholding allowance worksheet general information if you have more than one job or your spouse works, you should.