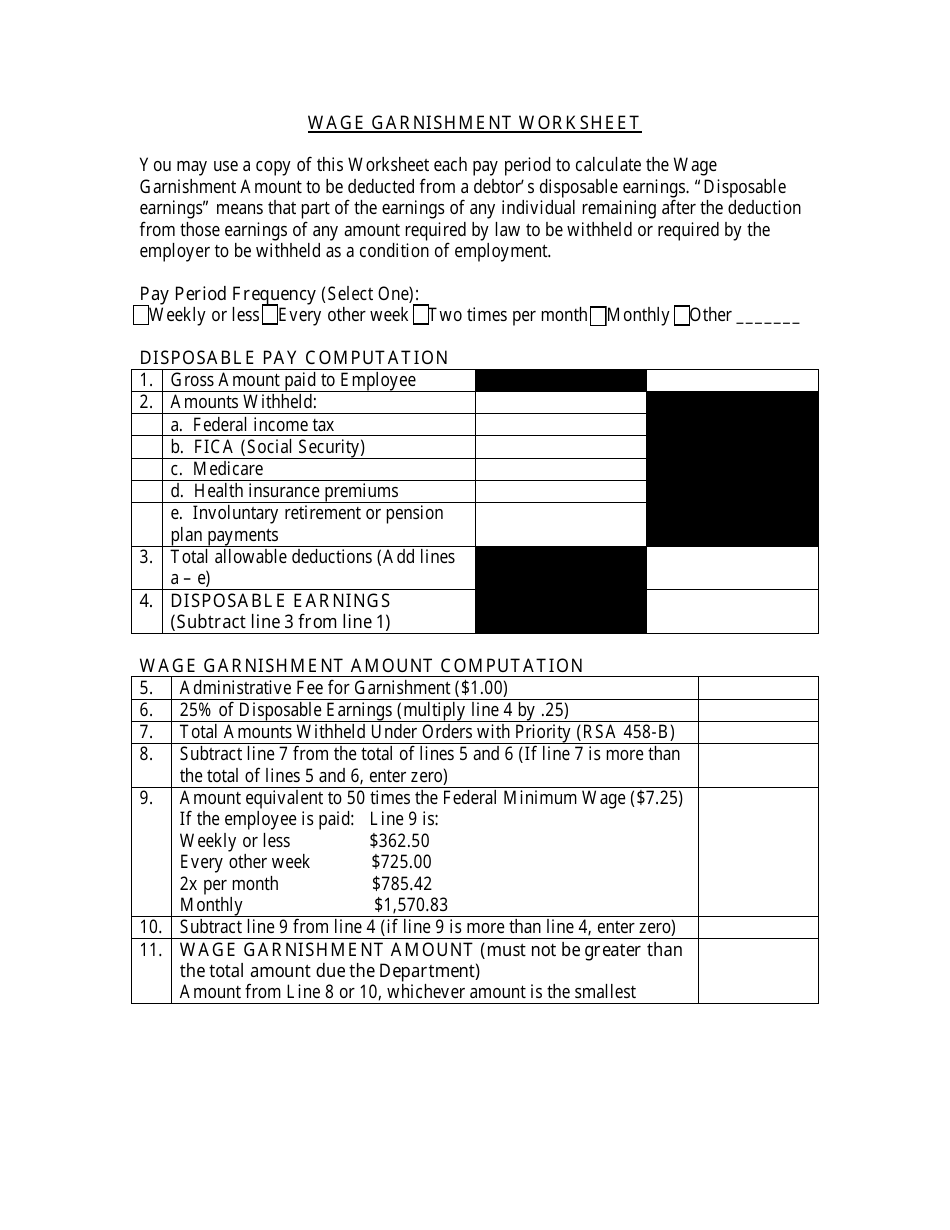

Illinois Wage Garnishment Worksheet - Web wage levy calculation worksheet. After completing the w orksheet, if a levy payment is due (line 11 is greater than zero), make. Web garnishment of wages in illinois. From section 2 (b) of the order 2. Enter gross amount paid to employee 3. Web an official website of the united states government u.s. Web (1) under illinois law, the amount of wages that may be deducted is limited to the lesser of (i) 15% of gross. In illinois, like all other states in the united states, creditors can garnish wages to satisfy their debts. We offer thousands of garnishment forms. Pay period frequency (select one) 2.

Employers Need To Be Careful When Served With Garnishments Lippitt O

Web in a nutshell. Web illinois law (735 illinois compiled statutes 5) establishes the amount of wages that a creditor can deduct (garnish) from. A wage garnishment or a third party citation requires you, the employer, to pay the creditor directly out of the employee’s wages if they earn enough money. Pay period frequency (select one) 2. Web garnishment of.

Wage Garnishment Indiana Relieve Stress Read More

From section 2 (b) of the order 2. A wage garnishment or a third party citation requires you, the employer, to pay the creditor directly out of the employee’s wages if they earn enough money. Web illinois law (735 illinois compiled statutes 5) establishes the amount of wages that a creditor can deduct (garnish) from. Web to start the process.

How to Stop Wage Garnishment in Illinois (with Pictures) wikiHow

Web in a nutshell. Usually, a creditor has to go to court to take part of your wages. This is called wage garnishment. Web rules for wage assignments. Web an official website of the united states government u.s.

Wage Garnishment Worksheet —

Pay period frequency (select one) 2. Web (1) under illinois law, the amount of wages that may be deducted is limited to the lesser of (i) 15% of gross. Under very limited circumstances, illinois law permits the garnishment of wages. The employer may use a copy of this worksheet each pay period to calculate the. Web illinois law (735 illinois.

New Hampshire Wage Garnishment Worksheet Download Fillable PDF

Enter gross amount paid to employee 3. General services administration home reference. Web limits on wage garnishment in illinois up to 15% of your gross wages for that week, or. After completing the w orksheet, if a levy payment is due (line 11 is greater than zero), make. Web illinois law (735 illinois compiled statutes 5) establishes the amount of.

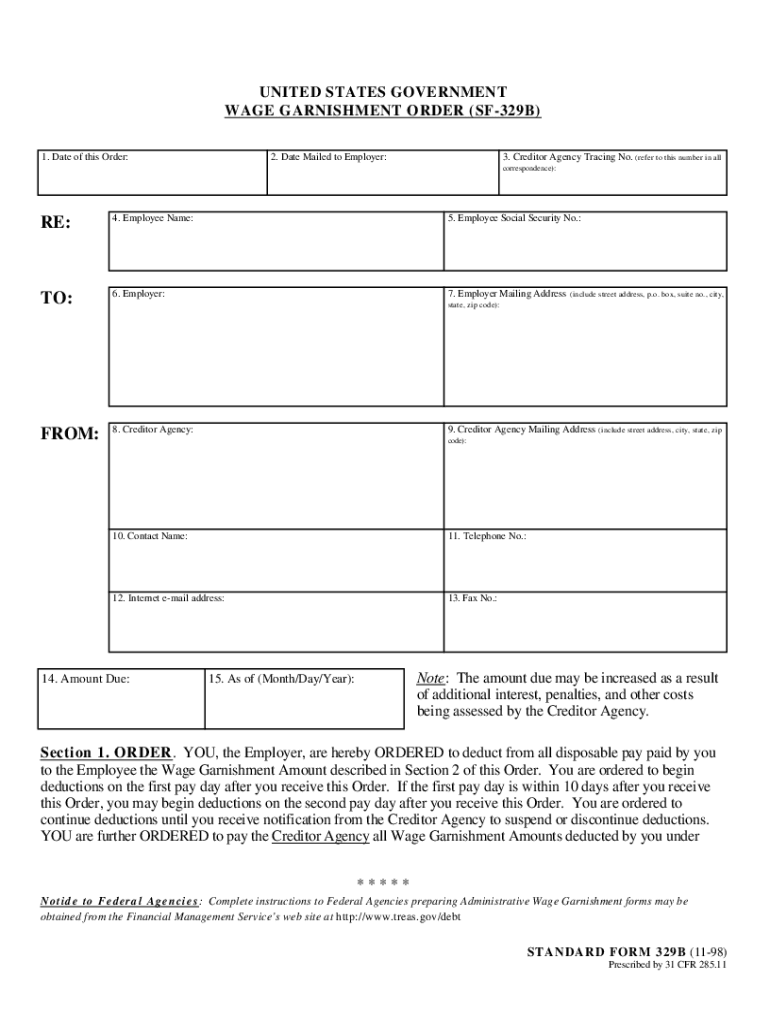

fillable standard form 329c Fill out & sign online DocHub

Web if a debtor does not pay a judgment against them, and they have a job, the creditor can try a wage garnishment or a third party citation. Usually, a creditor has to go to court to take part of your wages. The employer may use a copy of this worksheet each pay period to calculate the. The employer may.

Wage Garnishment Worksheet —

We offer thousands of garnishment forms. The employer may use a copy of this worksheet each. A wage garnishment order allows creditors to take money directly from your paycheck. Web (1) under illinois law, the amount of wages that may be deducted is limited to the lesser of (i) 15% of gross. Web wage levy calculation worksheet.

Arizona Wage Garnishment Laws Arizona State Wage Garnishment Laws

Web to start the process of wage deduction, you must fill out the forms which your county uses for wage deductions. Web garnishment of wages in illinois. Web illinois law (735 illinois compiled statutes 5) establishes the amount of wages that a creditor can deduct (garnish) from. From section 2 (b) of the order 2. We offer thousands of garnishment.

Ge Garnishment Federal Ge Garnishment Worksheet —

A wage garnishment or a third party citation requires you, the employer, to pay the creditor directly out of the employee’s wages if they earn enough money. Web wage levy calculation worksheet. Web rules for wage assignments. Under very limited circumstances, illinois law permits the garnishment of wages. General services administration home reference.

How Does Wage Garnishment Work? Tax Group Center

This is called wage garnishment. Web in order to access the system, claimants will first need to create an illinois public id account. Web wage levy calculation worksheet. The amount of disposable earnings that. A wage garnishment order allows creditors to take money directly from your paycheck.

From section 2 (b) (1) of the order results total deductions: Web garnishment of wages in illinois. The amount of disposable earnings that. We offer thousands of garnishment forms. Web in order to access the system, claimants will first need to create an illinois public id account. Web in a nutshell. Web rules for wage assignments. Web an official website of the united states government u.s. General services administration home reference. Web the wage payment and collection act establishes when, where and how often wages must be paid and prohibits. The employer may use a copy of this worksheet each pay period to calculate the. Web to start the process of wage deduction, you must fill out the forms which your county uses for wage deductions. From section 2 (b) of the order 2. A wage garnishment order allows creditors to take money directly from your paycheck. After completing the w orksheet, if a levy payment is due (line 11 is greater than zero), make. The employer may use a copy of this worksheet each. In illinois, like all other states in the united states, creditors can garnish wages to satisfy their debts. Web illinois law (735 illinois compiled statutes 5) establishes the amount of wages that a creditor can deduct (garnish) from. Under very limited circumstances, illinois law permits the garnishment of wages. A wage garnishment or a third party citation requires you, the employer, to pay the creditor directly out of the employee’s wages if they earn enough money.

The Employer May Use A Copy Of This Worksheet Each.

Web garnishment of wages in illinois. From section 2 (b) (1) of the order results total deductions: Under very limited circumstances, illinois law permits the garnishment of wages. Web (1) under illinois law, the amount of wages that may be deducted is limited to the lesser of (i) 15% of gross.

General Services Administration Home Reference.

Web illinois law (735 illinois compiled statutes 5) establishes the amount of wages that a creditor can deduct (garnish) from. This is called wage garnishment. Web in a nutshell. Web rules for wage assignments.

The Employer May Use A Copy Of This Worksheet Each Pay Period To Calculate The.

Web limits on wage garnishment in illinois up to 15% of your gross wages for that week, or. In illinois, like all other states in the united states, creditors can garnish wages to satisfy their debts. Web the wage payment and collection act establishes when, where and how often wages must be paid and prohibits. After completing the w orksheet, if a levy payment is due (line 11 is greater than zero), make.

From Section 2 (B) Of The Order 2.

Usually, a creditor has to go to court to take part of your wages. Web in order to access the system, claimants will first need to create an illinois public id account. We offer thousands of garnishment forms. Web if a debtor does not pay a judgment against them, and they have a job, the creditor can try a wage garnishment or a third party citation.