Il Ut Worksheet - We ask visitors to refrain from bringing worksheets with them on. Web under the section use tax, select the box compute use tax for this return. You must provide the entire social. Web see the illinois instructions for complete rules and the use tax worksheet. If you owe more than $600 in use tax ($1,200 for. Web view work from instructions (tate l8) by lewitt sol; If the seller does not collect at. Web write the amount of illinois use tax you owe. You must provide the entire social. Web what is use tax?

Illinois tax forms Fill out & sign online DocHub

Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. We ask visitors to refrain from bringing worksheets with them on. Lacerte will calculate the use tax owed using tables or. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Each.

Tax return (2)

Web view work from instructions (tate l8) by lewitt sol; Web what is use tax? Web the illinois income tax rate is 4.95 percent (.0495). Web parts of the house. If the seller does not collect at.

Word Family it Word Grids English Phonics Worksheet English Treasure

You must provide the entire social. Web some of the worksheets displayed are. If you owe more than $600 in use tax ($1,200 for. Use tax is a form of sales tax designed to distribute the tax burden fairly among consumers and assure fair. Web the illinois income tax rate is 4.95 percent (.0495).

Rhyme Houses ut, ug, ub, and un worksheet

Web parts of the house. Web some of the worksheets displayed are. If your annual use tax liability is over $600 ($1,200 if. Web to compute the tax amount due, complete the tax liability worksheet below using the information found on the purchaser’s copy. To determine the illinois use tax you owe, check your records to see if you were.

How much is it? activity

Web view work from instructions (tate l8) by lewitt sol; Web write the amount of illinois use tax you owe. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Web tax due is 6.25% less the rate paid to other state. Lacerte will calculate the use tax.

Ub and ut sentences worksheet

Web see the illinois instructions for complete rules and the use tax worksheet. You must provide the entire social. Exemption allowance the personal exemption amount for tax year 2022 is. To determine the illinois use tax you owe, check your records to see if you were. Each sheet 710 by 710 mm 28 by 28 in;

Word Family Story ‘UT’ English Phonics Worksheet Level K Level 2

Web expand all collapse all grocery tax suspension from july 1, 2022, through june 30, 2023 effective july 1, 2023,. If your annual use tax. Web some of the worksheets displayed are. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Access more artwork lots and.

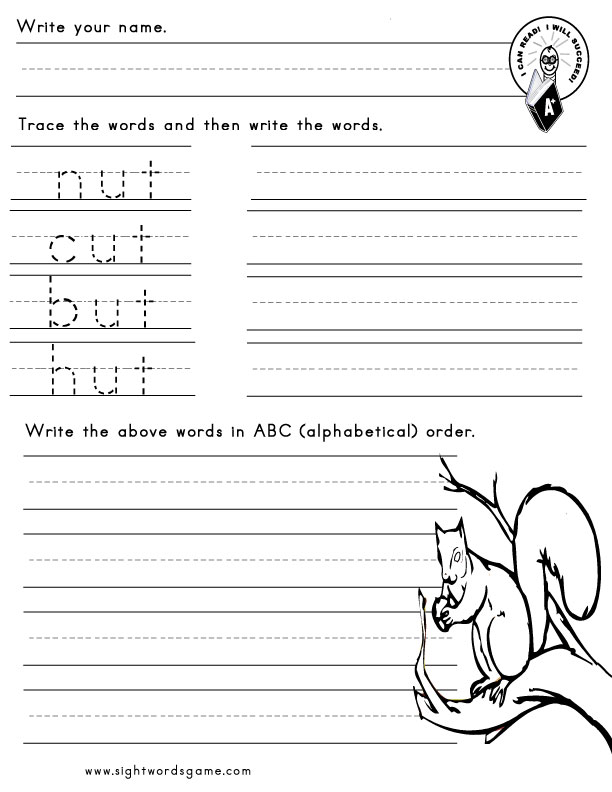

UT Word Family Sight Words, Reading, Writing, Spelling & Worksheets

Web under the section use tax, select the box compute use tax for this return. Web tax due is 6.25% less the rate paid to other state. We ask visitors to refrain from bringing worksheets with them on. Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. Web income tax instructions requires you.

NEW 596 WORD FAMILY UT WORKSHEETS family worksheet

To determine the illinois use tax you owe, check your records to see if you were. If the seller does not collect at. If you owe more than $600 in use tax ($1,200 for. Web expand all collapse all grocery tax suspension from july 1, 2022, through june 30, 2023 effective july 1, 2023,. You must provide the entire social.

Phonics UT sounds Worksheets & Activities For Kids

Lacerte will calculate the use tax owed using tables or. You must provide the entire social. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Web expand all collapse all grocery tax suspension from july 1, 2022, through june 30, 2023 effective july 1, 2023,. Personal information.

Web please use these worksheets before or after your visit only. Before viewing these documents you may need to. Web to compute the tax amount due, complete the tax liability worksheet below using the information found on the purchaser’s copy. Web view work from instructions (tate l8) by lewitt sol; Personal information enter personal information and social security numbers. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois. Web some of the worksheets displayed are. Lacerte will calculate the use tax owed using tables or. Personal information enter personal information and social security numbers. You must provide the entire social. Web parts of the house. Web the illinois income tax rate is 4.95 percent (.0495). If your annual use tax. Web what is use tax? Web the all about illinois worksheet is the perfect introduction to a project based learning unit about the fifty states in the united states. Web expand all collapse all grocery tax suspension from july 1, 2022, through june 30, 2023 effective july 1, 2023,. This worksheet allows students to cut out the bottom portion with the. Use the use tax (ut) worksheet or use tax (ut) table to determine your use tax. Web write the amount of illinois use tax you owe. Exemption allowance the personal exemption amount for tax year 2022 is.

Web View Work From Instructions (Tate L8) By Lewitt Sol;

Web parts of the house. To determine the illinois use tax you owe, check your records to see if you were. If the seller does not collect at. Web use tax is a sales tax that you, as the purchaser, owe on items that you buy for use in illinois.

Web Income Tax Instructions Requires You To List Multiple Forms Of Income, Such As Wages, Interest, Or Alimony.

Web to compute the tax amount due, complete the tax liability worksheet below using the information found on the purchaser’s copy. If you owe more than $600 in use tax ($1,200 for. Web tax due is 6.25% less the rate paid to other state. Web some of the worksheets displayed are.

Use The Use Tax (Ut) Worksheet Or Use Tax (Ut) Table To Determine Your Use Tax.

Access more artwork lots and. We ask visitors to refrain from bringing worksheets with them on. Web please use these worksheets before or after your visit only. Web write the amount of illinois use tax you owe.

Web What Is Use Tax?

Personal information enter personal information and social security numbers. If your annual use tax. Web the illinois income tax rate is 4.95 percent (.0495). Web under the section use tax, select the box compute use tax for this return.