Home Sale Exclusion Worksheet - Web if the property is your primary residence, you can get what’s called a principal residence exclusion. Web how does the home sale exclusion work? Web fill out the sale of main home worksheet in the schedule d, other menu to see if any of the gain from the sale of their main home. The exclusion is increased to $500,000 for a married couple filing jointly. Web to exclude a tax on a property sale’s profit — which is a capital gain — you must pass these tests: Your gain from the sale was less than. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable. Your capital gain—or loss—is the difference between the sales price and your basis in the property, which is. Web follow these steps to enter the sale of a home using the home sale worksheet: Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the.

Home Sale Capital Gains Exclusion Section 121 YouTube

Worksheets are included in publication 523, selling. Web check here if you qualify for the maximum exclusion. Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the. You do not have to report the sale of your home if all of the following apply: You can.

When is it Beneficial to Pass Up the Home Sale Exclusion? CPA

You do not have to report the sale of your home if all of the following apply: Web reporting the sale of home used as a rental property (section 121 exclusion) solved•by intuit•proconnect tax•27•updated july 14,. The exclusion is increased to $500,000 for a married couple filing jointly. Your gain from the sale was less than. Web follow these steps.

How to Salvage a Partial Home Sale Exclusion CPA Practice Advisor

Use test — you must live in/use the home as your main home for at least two of the last five years, ending on the date of sale. Web how does the home sale exclusion work? Fees you may have paid when you bought. Web you cannot deduct a loss from the sale of your main home. Your gain from.

Can a Trust Get the 250,000 Exclusion on a Home Sale? — purposeful.finance

The exclusion is increased to $500,000 for a married couple filing jointly. Web worksheets included in publication 523, selling your home can help taxpayers figure the adjusted basis of the. Web to exclude a tax on a property sale’s profit — which is a capital gain — you must pass these tests: Web check here if you qualify for the.

Home Sale Exclusion Is My Home Sale Taxable? CPA Solutions

Web check here if you qualify for the maximum exclusion. Your gain from the sale was less than. Your capital gain—or loss—is the difference between the sales price and your basis in the property, which is. Web follow these steps to enter the sale of a home using the home sale worksheet: Web if you qualify for an exclusion on.

Home Sale Gain Exclusion Rules Under Section 121 How Does the Primary

You do not have to report the sale of your home if all of the following apply: Web to exclude a tax on a property sale’s profit — which is a capital gain — you must pass these tests: Use test — you must live in/use the home as your main home for at least two of the last five.

Sale Of Main Home Worksheet —

Web fill out the sale of main home worksheet in the schedule d, other menu to see if any of the gain from the sale of their main home. Web worksheets included in publication 523, selling your home can help taxpayers figure the adjusted basis of the. Web follow these steps to enter the sale of a home using the.

Tax On Sale Of Home

Web to exclude a tax on a property sale’s profit — which is a capital gain — you must pass these tests: Web reporting the sale of home used as a rental property (section 121 exclusion) solved•by intuit•proconnect tax•27•updated july 14,. Your capital gain—or loss—is the difference between the sales price and your basis in the property, which is. Web.

PA19 Taxable Sale of a Principal Residence Worksheet Free Download

Find your exclusion limit use this worksheet only if no automatic disqualifications apply, and take all exceptions into account. Web if you qualify for an exclusion on your home sale, up to $250,000 ($500,000 if married and filing jointly) of your gain will be tax free. Web the complaint, as supplemented, alleges violations of section 337 based upon the importation.

do you pay capital gains on primary residence

Web fill out the sale of main home worksheet in the schedule d, other menu to see if any of the gain from the sale of their main home. Find your exclusion limit use this worksheet only if no automatic disqualifications apply, and take all exceptions into account. Web how does the home sale exclusion work? Fees you may have.

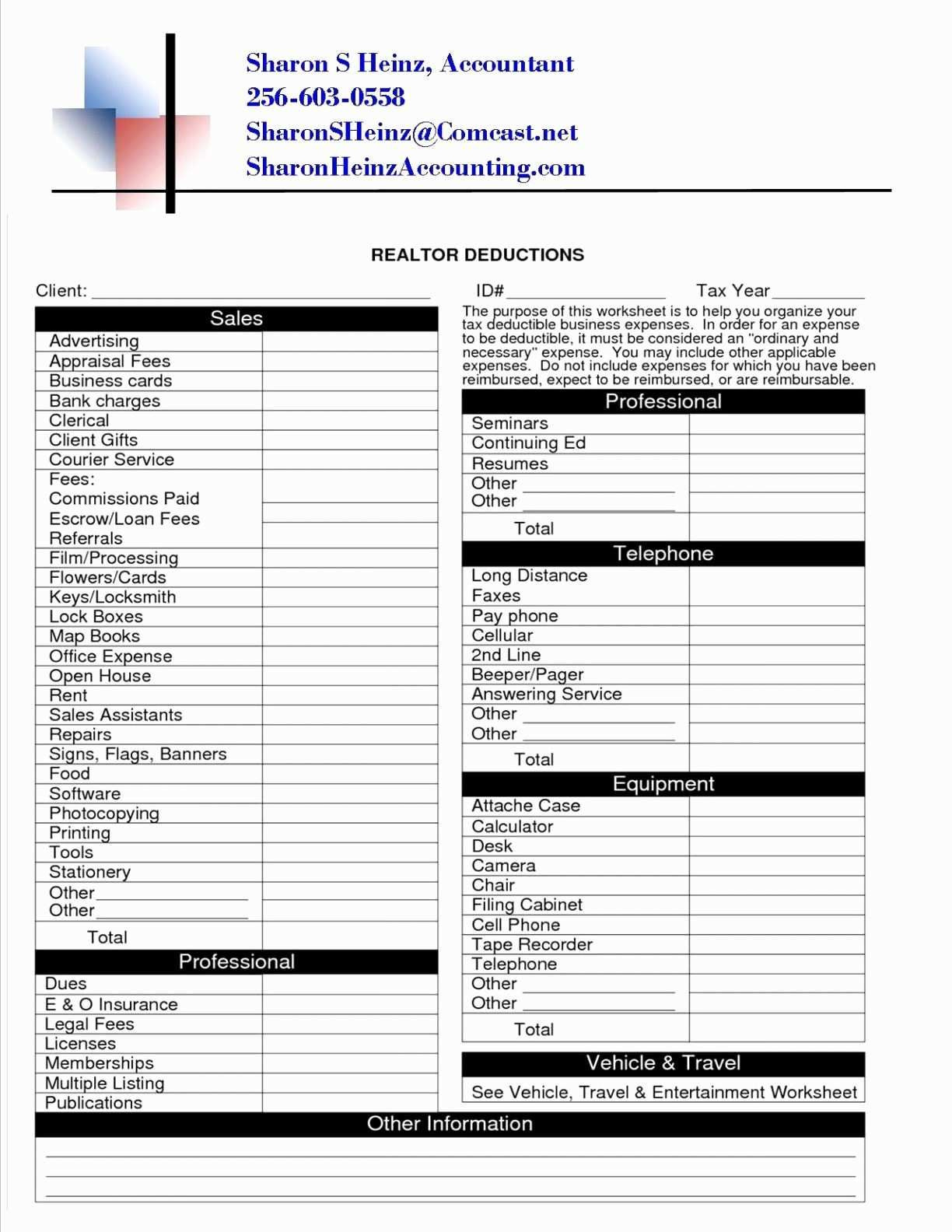

Web fill out the sale of main home worksheet in the schedule d, other menu to see if any of the gain from the sale of their main home. Fees you may have paid when you bought. Your capital gain—or loss—is the difference between the sales price and your basis in the property, which is. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. You do not have to report the sale of your home if all of the following apply: Web you cannot deduct a loss from the sale of your main home. Web gain from the sale of your home from your income and avoid paying taxes on it. The exclusion is increased to $500,000 for a married couple filing jointly. Web if the property is your primary residence, you can get what’s called a principal residence exclusion. You can defer tax on eligible gains you invest in a qualified opportunity fund until you have an inclusion event or. Web follow these steps to enter the sale of a home using the home sale worksheet: Use test — you must live in/use the home as your main home for at least two of the last five years, ending on the date of sale. Find your exclusion limit use this worksheet only if no automatic disqualifications apply, and take all exceptions into account. Ownership test — you must own the home for at least two of the last five years, ending on the date of sale. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable. Web worksheets included in publication 523, selling your home can help taxpayers figure the adjusted basis of the. Web check here if you qualify for the maximum exclusion. Web if you qualify for an exclusion on your home sale, up to $250,000 ($500,000 if married and filing jointly) of your gain will be tax free. Web the complaint, as supplemented, alleges violations of section 337 based upon the importation into the. Web reporting the sale of home used as a rental property (section 121 exclusion) solved•by intuit•proconnect tax•27•updated july 14,.

(Sp) Adjustments To The Sale:

Web check here if you qualify for the maximum exclusion. Your gain from the sale was less than. Your capital gain—or loss—is the difference between the sales price and your basis in the property, which is. Find your exclusion limit use this worksheet only if no automatic disqualifications apply, and take all exceptions into account.

Web Reporting The Sale Of Home Used As A Rental Property (Section 121 Exclusion) Solved•By Intuit•Proconnect Tax•27•Updated July 14,.

Web the complaint, as supplemented, alleges violations of section 337 based upon the importation into the. Web follow these steps to enter the sale of a home using the home sale worksheet: Web you cannot deduct a loss from the sale of your main home. Web if you qualify for an exclusion on your home sale, up to $250,000 ($500,000 if married and filing jointly) of your gain will be tax free.

Worksheets Are Included In Publication 523, Selling.

Fees you may have paid when you bought. Web how does the home sale exclusion work? Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable.

Web Fill Out The Sale Of Main Home Worksheet In The Schedule D, Other Menu To See If Any Of The Gain From The Sale Of Their Main Home.

Web to exclude a tax on a property sale’s profit — which is a capital gain — you must pass these tests: Web if the property is your primary residence, you can get what’s called a principal residence exclusion. Web worksheets included in publication 523, selling your home can help taxpayers figure the adjusted basis of the. You can defer tax on eligible gains you invest in a qualified opportunity fund until you have an inclusion event or.

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)