Home Office Deduction Worksheet - Web i’ll walk you through how to use my free home office deduction worksheet to track and calculate your. Web the home office tax deduction covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation. You exclusively and regularly use a portion of your home (house,. Web home office deduction at a glance. To use this method, multiply the square feet of your. Web $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website federal filing fee $0 state filing fee $0 3 Web business lunch tax deduction. If you work from home, you. Web 10 rows note: Web home office deduction worksheet there are two calculation methods to determine the home office deduction;

PBS Tax and Accounting

Expenses for business use of your home. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of. You exclusively and regularly use a portion of your home (house,. If you use part of your home exclusively and regularly for conducting. Department of the treasury internal revenue service.

Home Office Deduction Worksheet —

Web first, you need to meet one of two criteria: Complete a separate worksheet for each business/activity. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation of. To use this method, multiply the square feet of your. You exclusively and regularly use a portion of your home (house,.

Mortgage Insurance Premiums Deduction Worksheet Promotiontablecovers

To use this method, multiply the square feet of your. The biggest expenses such as mortgage interest and real estate taxes are already. Web home office deduction worksheet there are two calculation methods to determine the home office deduction; Web the simplified option has a rate of $5 a square foot for business use of the home. Department of the.

Home Office Deduction Worksheet HMDCRTN

Web your office is 10% (1 ÷ 10) of the total area of your home. This worksheet will help you track direct and indirect expenses for. Web 10 rows note: Web home office deduction worksheet there are two calculation methods to determine the home office deduction; Complete a separate worksheet for each business/activity.

CPA Prepared Home Office Deduction Worksheet Etsy

Expenses for business use of your home. To use this method, multiply the square feet of your. Web the home office tax deduction covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation. Web home office deduction worksheet please use this worksheet to give us information about your home office for preparation.

Home Office Deduction Worksheet —

This simplified option does not change the criteria for who may claim a home office. To use this method, multiply the square feet of your. If you use part of your home exclusively and regularly for conducting. If you work from home, you. Complete a separate worksheet for each business/activity.

️Firefighter Tax Deductions 2020 Worksheet Free Download Goodimg.co (2022)

Web home offices are not huge tax deductions. Web home office deduction at a glance. To use this method, multiply the square feet of your. Web first, you need to meet one of two criteria: Web your office is 10% (1 ÷ 10) of the total area of your home.

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

Web the simplified option has a rate of $5 a square foot for business use of the home. Web free home office deduction spreadsheet working from home? Web 10 rows note: Web the home office tax deduction covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation. The purpose of this publication.

Tax Deduction Worksheet 2014 Worksheet Resume Examples

Web your office is 10% (1 ÷ 10) of the total area of your home. The biggest expenses such as mortgage interest and real estate taxes are already. The maximum size for this. Your business percentage is 10%. This worksheet will help you track direct and indirect expenses for.

Simplified Home Office Deduction Worksheet worksheeta

Your business percentage is 10%. Web the simplified option has a rate of $5 a square foot for business use of the home. Complete a separate worksheet for each business/activity. Web home office deduction worksheet there are two calculation methods to determine the home office deduction; The purpose of this publication is to provide information on figuring and claiming the.

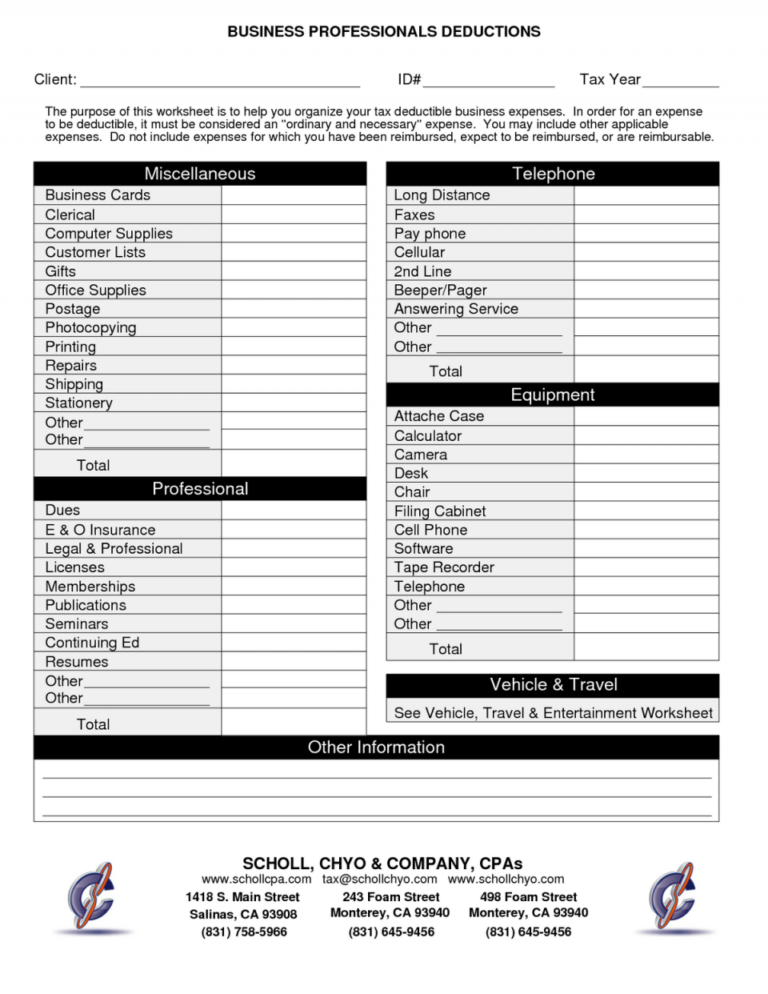

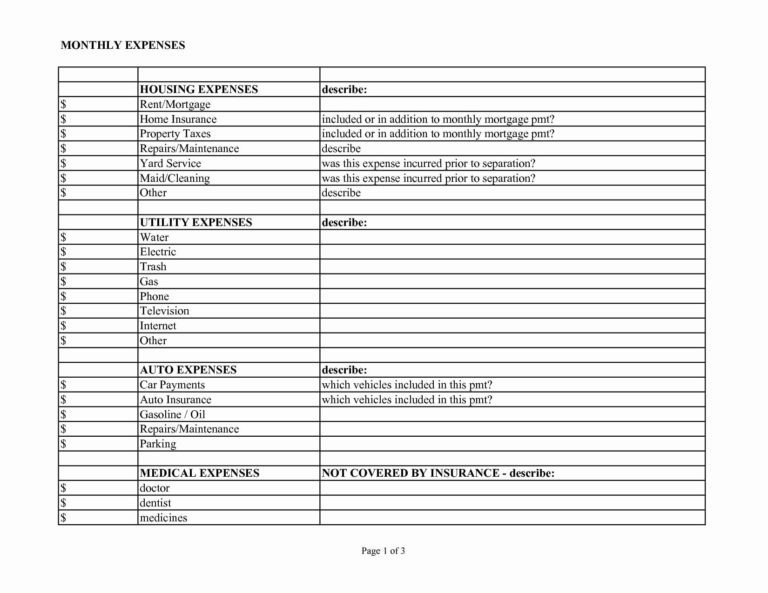

Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by. Yes, 2022 will be the last time people can deduct 100% of their business meals. This simplified option does not change the criteria for who may claim a home office. The biggest expenses such as mortgage interest and real estate taxes are already. Web home offices are not huge tax deductions. Web first, you need to meet one of two criteria: Expenses for business use of your home. You exclusively and regularly use a portion of your home (house,. Web business lunch tax deduction. This worksheet will help you track direct and indirect expenses for. Web home office deduction worksheet there are two calculation methods to determine the home office deduction; The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. Department of the treasury internal revenue service. Web the home office tax deduction covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation. If you use part of your home exclusively and regularly for conducting. Your business percentage is 10%. Web free home office deduction spreadsheet working from home? Web home office deduction worksheet instructions: Complete a separate worksheet for each business/activity. Web the simplified option has a rate of $5 a square foot for business use of the home.

Web First, You Need To Meet One Of Two Criteria:

Web $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website federal filing fee $0 state filing fee $0 3 Web home offices are not huge tax deductions. You exclusively and regularly use a portion of your home (house,. The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home.

If You Use Part Of Your Home Exclusively And Regularly For Conducting.

Your business percentage is 10%. Web your office is 10% (1 ÷ 10) of the total area of your home. Web the home office tax deduction covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation. If you work from home, you.

Web To Calculate The Simplified Home Office Deduction You Simply Multiply The Square Footage Of Your Home Used For Business By.

Yes, 2022 will be the last time people can deduct 100% of their business meals. Expenses for business use of your home. Web home office deduction worksheet instructions: Department of the treasury internal revenue service.

Web Home Office Deduction At A Glance.

This simplified option does not change the criteria for who may claim a home office. Web i’ll walk you through how to use my free home office deduction worksheet to track and calculate your. Web the simplified method is easier than the actual expense method. Web the simplified option has a rate of $5 a square foot for business use of the home.