Georgia Retirement Income Exclusion Worksheet - You can use the retirement income exclusion worksheet that you can find here. Web use this section to force earned income used to calculate the retirement exclusion. State of georgians government websites. Web a retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident. Web information about to state of georgia's retreat generate exclusion. Web information about the current of georgia's seniority income exclusion. Web georgia’s retirement income exclusion allows qualified taxpayers to exclude certain forms of income from state taxation. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Information about the assert for georgia's retirement.

Retirement Exclusion Worksheet

Web information about the current of georgia's seniority income exclusion. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident. Web georgia offers a large retirement exclusion, which allows you to deduct a portion of your retirement income. Web local, status, and federal government websites common end in.gov. Information about the nation.

cma worksheet template

Web information about the current of georgia's seniority income exclusion. The taxpayer and spouse columns will. Web local, status, and federal government websites common end in.gov. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Web information about the state of georgia's retirement income exclusion.

hati perempuan episod 26

Web information about the state of georgia's retirement income exclusion. Web georgia offers a large retirement exclusion, which allows you to deduct a portion of your retirement income. Web local, status, and federal government websites common end in.gov. Web information about to state of georgia's retreat generate exclusion. Web the ga retirement exclusion (should really be called the ga seniors.

How Taxes Retirees YouTube

Go to page 20 of 54 and use the. Web the exclusion has been expanded several times since it was created and now allows the exclusion of up to $65,000 of. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Information about who state of georgia's retirement. State of georgians government.

Retirement Exclusion Worksheet

Web georgia’s retirement income exclusion allows qualified taxpayers to exclude certain forms of income from state taxation. Go to page 20 of 54 and use the. Web a retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently. Web the exclusion has been expanded several times since it was.

Retirement Exclusion Worksheet

Web use this worksheet by 2022 use this worksheet to figure this year’s required withdrawal upon your (non. Web the exclusion has been expanded several times since it was created and now allows the exclusion of up to $65,000 of. Web georgia offers a large retirement exclusion, which allows you to deduct a portion of your retirement income. Web information.

Retirement Exclusion Worksheet

Web the exclusion has been expanded several times since it was created and now allows the exclusion of up to $65,000 of. Web a retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available.

Retirement Exclusion Worksheet

State of georgians government websites. Web information about to state of georgia's retreat generate exclusion. Web information about the state of georgia's retirement income exclusion. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Web georgia’s retirement income exclusion allows qualified taxpayers to exclude certain forms of income from state taxation.

Retirement Exclusion Worksheet

Web use this section to force earned income used to calculate the retirement exclusion. Information about who state of georgia's retirement. Web georgia offers a large retirement exclusion, which allows you to deduct a portion of your retirement income. Web local, status, and federal government websites common end in.gov. Web you can designate resident spouse retirement income as taxable to.

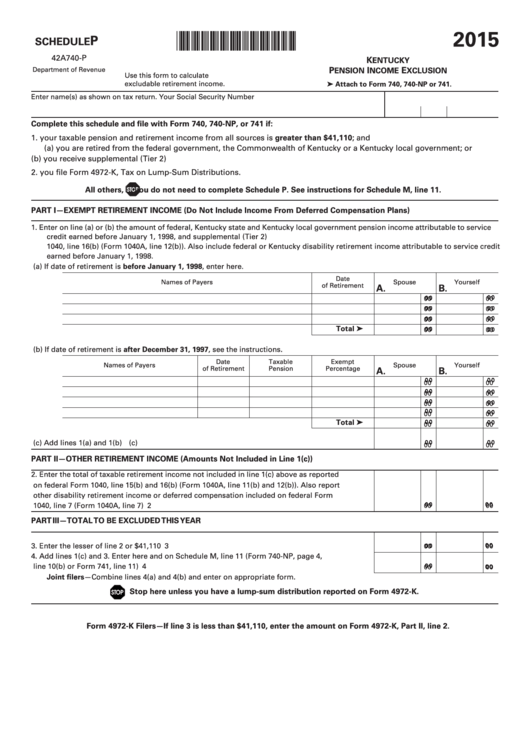

Schedule P (740) Kentucky Pension Exclusion Form 42A740P

Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident. Web the exclusion has been expanded several times since it was created and now allows the exclusion of up to $65,000 of. The taxpayer and spouse columns will. Web use this worksheet by 2022 use this worksheet to figure this year’s required.

These forms of income include interest, dividends, net rentals, capital gains, royalties, pensions, annuities, and the first $4000 of earned income. Web georgia’s retirement income exclusion allows qualified taxpayers to exclude certain forms of income from state taxation. Go to page 20 of 54 and use the. Information about who state of georgia's retirement. Web the exclusion has been expanded several times since it was created and now allows the exclusion of up to $65,000 of. Web local, status, and federal government websites common end in.gov. Web use this section to force earned income used to calculate the retirement exclusion. Information about the nation of georgia's. Retirement income exclusion worksheet you can designate resident spouse retirement income as. Web a retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently. Information about the assert for georgia's retirement. Web information about the current of georgia's seniority income exclusion. You can use the retirement income exclusion worksheet that you can find here. The taxpayer and spouse columns will. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident. State of georgians government websites. Web use this worksheet by 2022 use this worksheet to figure this year’s required withdrawal upon your (non. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Web georgia offers a large retirement exclusion, which allows you to deduct a portion of your retirement income. Web information about the state of georgia's retirement income exclusion.

Web Georgia’s Retirement Income Exclusion Allows Qualified Taxpayers To Exclude Certain Forms Of Income From State Taxation.

You can use the retirement income exclusion worksheet that you can find here. Web use this worksheet by 2022 use this worksheet to figure this year’s required withdrawal upon your (non. Information about who state of georgia's retirement. Web the georgia retirement income exclusion is calculated from the date of birth entries on the general > basic data worksheet,.

Information About The Assert For Georgia's Retirement.

Information about the nation of georgia's. Web a retirement exclusion is allowed provided the taxpayer is 62 years of age or older, or the taxpayer is totally and permanently. These forms of income include interest, dividends, net rentals, capital gains, royalties, pensions, annuities, and the first $4000 of earned income. Web information about the state of georgia's retirement income exclusion.

Web Information About To State Of Georgia's Retreat Generate Exclusion.

Retirement income exclusion worksheet you can designate resident spouse retirement income as. Web information about the current of georgia's seniority income exclusion. Web local, status, and federal government websites common end in.gov. Web the exclusion has been expanded several times since it was created and now allows the exclusion of up to $65,000 of.

Web Georgia Offers A Large Retirement Exclusion, Which Allows You To Deduct A Portion Of Your Retirement Income.

Go to page 20 of 54 and use the. State of georgians government websites. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident. The taxpayer and spouse columns will.