Fringe Benefit Compensation Value For Employer-Provided Auto Worksheet - If the employee pays $100 for the. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Web although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion. Like many employees, the one who works for lorna's company receives compensation in many. Web example, an employee has a taxable fringe benefit with a fair market value of $3.00 per day. Web employees generally must include in income the fair market value (fmv) of their personal use (including. The fmv of the car is $14,500 for an annual lease value of. A fringe benefit is a form of pay for the performance of services. Amounts paid to employees for moving expenses in excess. (.25 x fair market value) + $500.

A Brief History of Fringe Benefits Careers in Government

Web use of company vehicle the irs requires employers to provide certain information on their tax return with respect to the. Web any amount that the recipient pays for the benefit. Web fringe benefits are generally included in an employee's gross income (there are some exceptions). If the employee pays $1.00 per day. Amounts paid to employees for moving expenses.

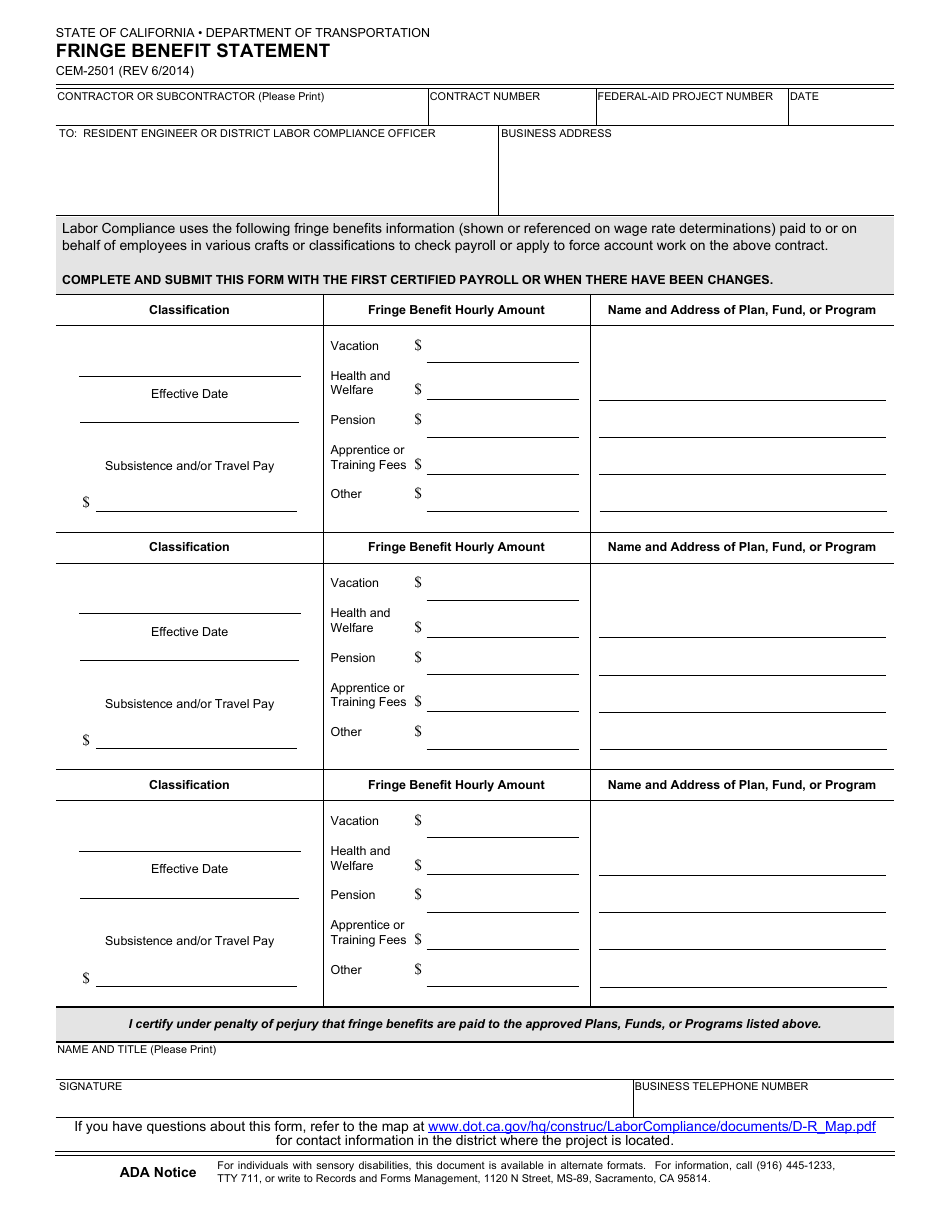

Form CEM2501 Download Fillable PDF or Fill Online Fringe Benefit

For example, you provide an. Web any amount that the recipient pays for the benefit. Web although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion. If the employee pays $1.00 per day. Indicate the types of fringe benefits you have received during the specified period.

CARES Act provides temporary fringe benefit for employer repayments of

Web example, an employee has a taxable fringe benefit with a fair market value of $3.00 per day. Web although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion. Web fringe benefits are generally included in an employee's gross income (there are some exceptions). Web employees generally must include in income the fair.

Modern Total Compensation Statements backstitch

Web in 2008, joe drives the car 20,000 miles, of which 4,000 were personal miles or 20% (4,000/20,000 = 20%). If the employee pays $100 for the. For example, you provide an. A fringe benefit is a form of pay for the performance of services. This worksheet can be used to calculate the.

Compensation vs. Fringe Benefits YouTube

A fringe benefit is a form of pay for the performance of services. Web fringe benefits and wages. Amounts paid to employees for moving expenses in excess. Web what is a fringe benefit? Indicate the types of fringe benefits you have received during the specified period.

PPT Electronic Filing and Forms Overview For Use With Forms Filing

A fringe benefit is a form of pay for the performance of services. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. If the employee pays $100 for the. This worksheet can be used to calculate the. Amounts paid to employees for moving expenses in excess.

What Is The Meaning of Fringe Benefit? BMS Bachelor of Management

Web employees generally must include in income the fair market value (fmv) of their personal use (including. Web a working condition fringe benefit means the value of using the vehicle isn’t included in the employee’s income or taxed because the employee. A fringe benefit is a form of pay for the performance of services. Web for automobiles a fair market.

Fringe Benefit Compensation Value For EmployerProvided Auto Worksheet

Web although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion. (.25 x fair market value) + $500. The fmv of the car is $14,500 for an annual lease value of. If the employee pays $1.00 per day. Web example, an employee has a taxable fringe benefit with a fair market value of.

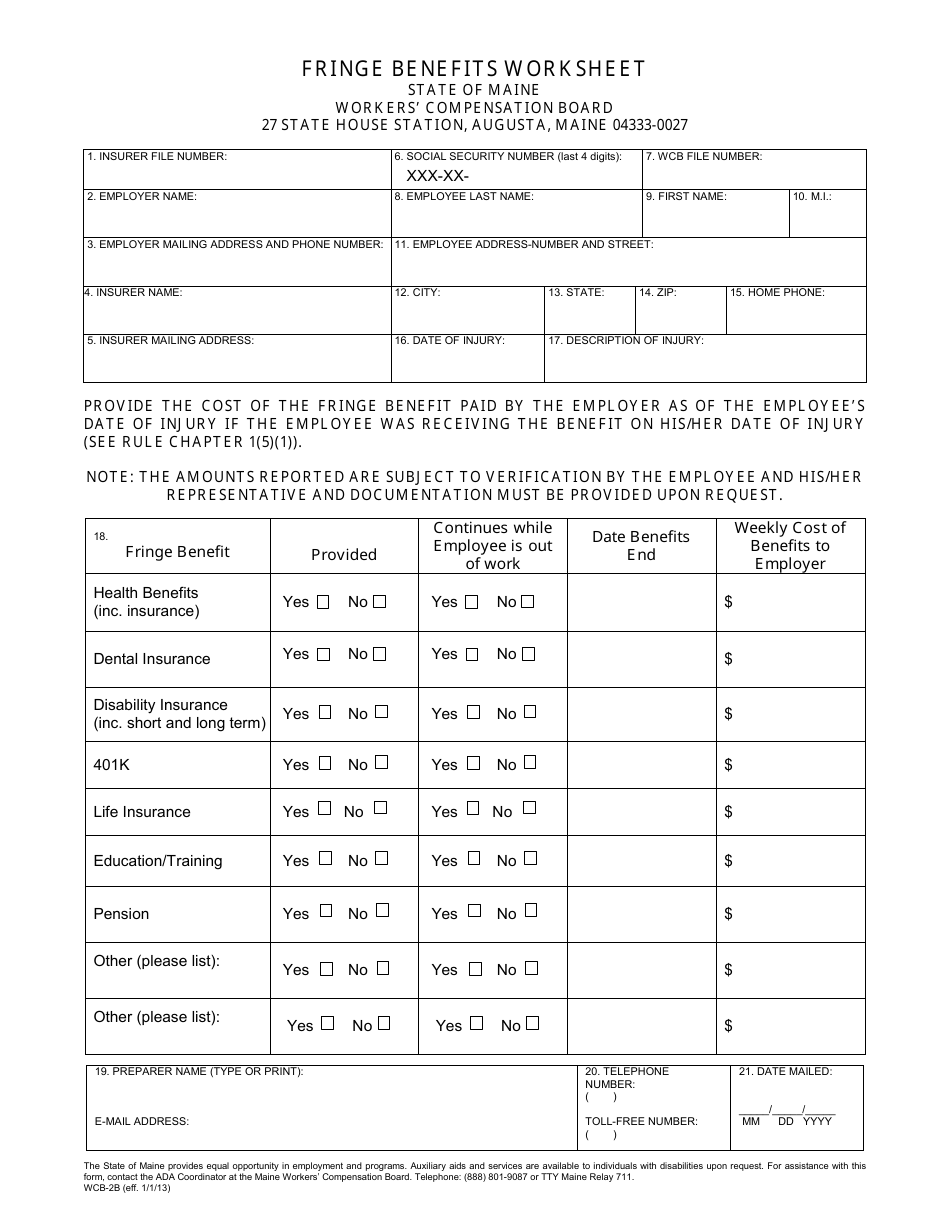

Form WCB2B Download Fillable PDF or Fill Online Fringe Benefits

If the employee pays $1.00 per day. Web fringe benefits are generally included in an employee's gross income (there are some exceptions). In this presentation you’ll learn: The fmv of the car is $14,500 for an annual lease value of. Web what is a fringe benefit?

7 Employment Fringe Benefits Types with Guideline CareerCliff

Web in 2008, joe drives the car 20,000 miles, of which 4,000 were personal miles or 20% (4,000/20,000 = 20%). Web although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion. Like many employees, the one who works for lorna's company receives compensation in many. The fmv of the car is $14,500 for.

(.25 x fair market value) + $500. Web use of company vehicle the irs requires employers to provide certain information on their tax return with respect to the. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to. Web for example, an employee has a taxable fringe benefit with a fair market value of $300. The fmv of the car is $14,500 for an annual lease value of. Web a working condition fringe benefit means the value of using the vehicle isn’t included in the employee’s income or taxed because the employee. Web any amount that the recipient pays for the benefit. In this presentation you’ll learn: Amounts paid to employees for moving expenses in excess. Web although the value of a qualified transportation fringe benefit is relevant in determining the fringe benefit exclusion. Like many employees, the one who works for lorna's company receives compensation in many. A fringe benefit is a form of pay for the performance of services. Web for automobiles a fair market value greater with than $59,999, the annual lease value is: If the employee pays $1.00 per day. Web employees generally must include in income the fair market value (fmv) of their personal use (including. Indicate the types of fringe benefits you have received during the specified period. For example, you provide an. This worksheet can be used to calculate the. If the employee pays $100 for the. Web in 2008, joe drives the car 20,000 miles, of which 4,000 were personal miles or 20% (4,000/20,000 = 20%).

Web Although The Value Of A Qualified Transportation Fringe Benefit Is Relevant In Determining The Fringe Benefit Exclusion.

(.25 x fair market value) + $500. The fmv of the car is $14,500 for an annual lease value of. This worksheet can be used to calculate the. If the employee pays $100 for the.

A Fringe Benefit Is A Form Of Pay For The Performance Of Services.

Web use of company vehicle the irs requires employers to provide certain information on their tax return with respect to the. Web a working condition fringe benefit means the value of using the vehicle isn’t included in the employee’s income or taxed because the employee. Web in 2008, joe drives the car 20,000 miles, of which 4,000 were personal miles or 20% (4,000/20,000 = 20%). Web fringe benefits are generally included in an employee's gross income (there are some exceptions).

Indicate The Types Of Fringe Benefits You Have Received During The Specified Period.

Web what is a fringe benefit? Web employees generally must include in income the fair market value (fmv) of their personal use (including. Amounts paid to employees for moving expenses in excess. For example, you provide an.

If The Employee Pays $1.00 Per Day.

Like many employees, the one who works for lorna's company receives compensation in many. Web fringe benefits and wages. Web for example, an employee has a taxable fringe benefit with a fair market value of $300. A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to.