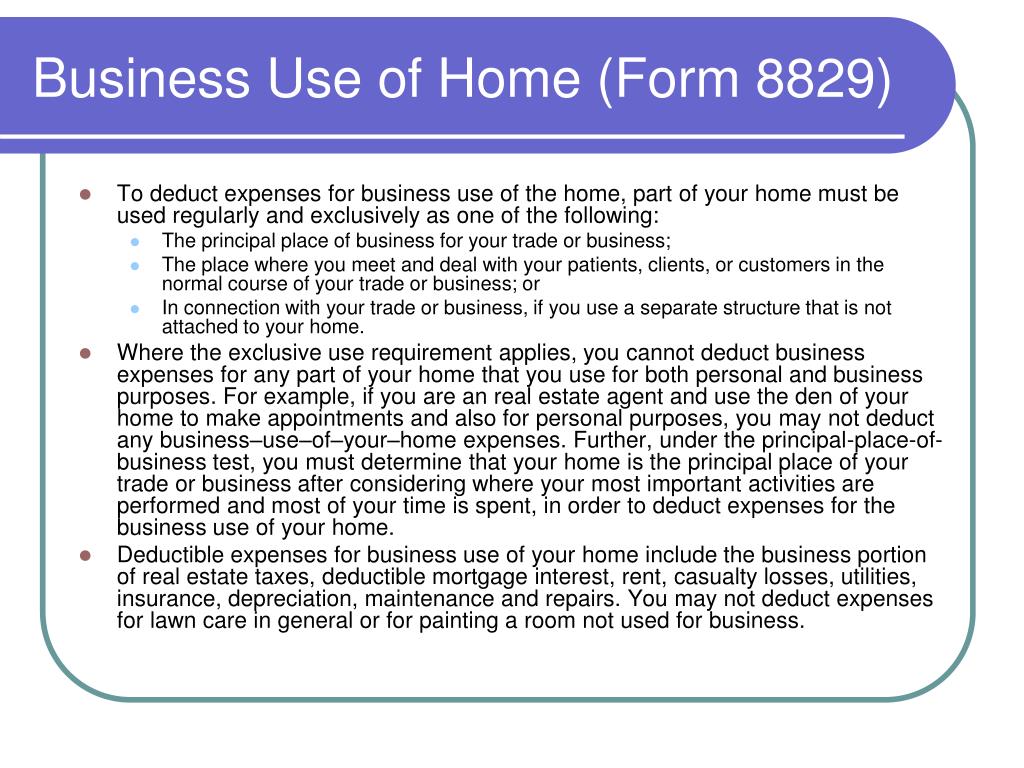

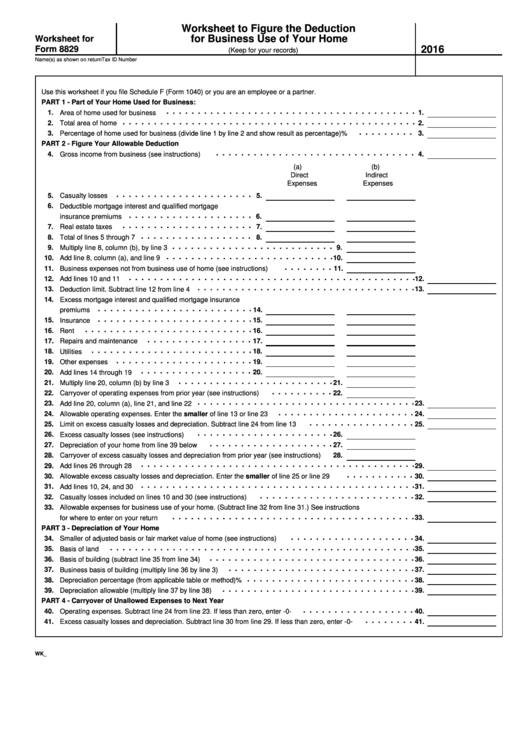

Form 8829 Worksheet - Web form 8829, expenses for business use of your home is the tax form that businesses use to itemize, calculate and claim their home office. Department of the treasury internal revenue service (99) expenses for business use of your home. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include:. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses. Web form 8829 and the worksheet to figure the deduction for business use of your home have separate columns for direct and. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the.

10 Tax Deductions & Benefits for the SelfEmployed Community Tax

Web form 8829 will be produced only if worksheet is attached to a schedule c business. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized..

FREE 9+ Sample Schedule C Forms in PDF MS Word

Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Department of the treasury internal revenue service. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Web.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

Get ready for this year\'s tax season quickly and safely with. Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Department of the treasury internal revenue service. Web form 8829 will be produced only if worksheet is attached to a schedule c business. Web taxpayers may use a.

worksheet. Form 8829 Worksheet. Worksheet Fun Worksheet Study Site

Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. Web taxpayers may use a simplified method when calculating the deduction for business use of their home for form 8829. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022.

Home Office Deduction Worksheet HMDCRTN

Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Web form 8829 will be produced only if worksheet is attached to a.

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Web form 8829, expenses for business use of your home is the tax form that businesses use to itemize, calculate and claim their home office. Department of the treasury internal revenue service (99) expenses for business use of your home. Web form 8829 will be produced only if worksheet is attached to a schedule c business. Web overview one of.

8829 Simplified Method (ScheduleC, ScheduleF)

Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on. Get ready for this year\'s tax season quickly and safely with. Web easily complete a printable irs 8829 form 2022 online. Web taxpayers may use a simplified method when calculating the deduction for business use of their home for.

Solved Trying to fix incorrect entry Form 8829

Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized. Web taxpayers may use a simplified method when calculating the deduction for business use of their home for form 8829. Department.

Irs 1040 Form C Checklist For Irs Schedule C Profit Of Loss From

Web there are two ways to claim the deduction: Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Department of the treasury internal revenue service (99) expenses for business use of your home. Expenses for business use of your home. Web common.

IRS 8821 2018 Fill and Sign Printable Template Online US Legal Forms

Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include:. Expenses for business use of your home. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Web there are two ways to claim the deduction: Web easily complete a printable irs 8829 form.

Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on. Web form 8829 will be produced only if worksheet is attached to a schedule c business. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses. Web form 8829, expenses for business use of your home is the tax form that businesses use to itemize, calculate and claim their home office. Department of the treasury internal revenue service (99) expenses for business use of your home. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Department of the treasury internal revenue service. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include:. Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Department of the treasury internal revenue service (99) expenses for business use of your home. Web taxpayers may use a simplified method when calculating the deduction for business use of their home for form 8829. Web form 8829 and the worksheet to figure the deduction for business use of your home have separate columns for direct and. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to. Web easily complete a printable irs 8829 form 2022 online. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Web there are two ways to claim the deduction:

Web Easily Complete A Printable Irs 8829 Form 2022 Online.

Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized. Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Web information about form 8829, expenses for business use of your home, including recent updates, related forms.

Department Of The Treasury Internal Revenue Service (99) Expenses For Business Use Of Your Home.

Department of the treasury internal revenue service. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include:. Web form 8829, expenses for business use of home, is a tax form you fill out to claim your home office expenses.

Web Form 8829 And The Worksheet To Figure The Deduction For Business Use Of Your Home Have Separate Columns For Direct And.

Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing. Expenses for business use of your home. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Web taxpayers may use a simplified method when calculating the deduction for business use of their home for form 8829.

Department Of The Treasury Internal Revenue Service (99) Expenses For Business Use Of Your Home.

Get ready for this year\'s tax season quickly and safely with. Web form 8829 will be produced only if worksheet is attached to a schedule c business. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Web form 8829, expenses for business use of your home is the tax form that businesses use to itemize, calculate and claim their home office.

:max_bytes(150000):strip_icc()/Screenshot58-cb1ceaa73b884957a1108ca88b1c2da8.png)