Form 8824 Worksheet - Web irs form 8824 is very complicated and uses terms with which most exchangers are not familiar. Ordinarily, when you sell something for more than what you paid to get. Below are the most popular. Web common questions for form 8824 in proseries. Open the car and truck expenses worksheet (vehicle expenses. Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for. Solved • by intuit • 3 • updated 1 year ago. Instructions to form 8824 worksheets List the address or legal description and type of.

1040 Completing a LikeKind Exchange of Business Property (103

Ordinarily, when you sell something for more than what you paid to get. Use part iii to figure the amount of gain. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. List the address or legal description and type of property relinquished (sold). Web form 8824 worksheets (xls).

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Web irs form 8824 is very complicated and uses terms with which most exchangers are not familiar. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Solved • by intuit • 3 • updated 1 year ago. Open the car and truck expenses worksheet (vehicle expenses. Use part iii to figure the amount.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Web irs form 8824 is very complicated and uses terms with which most exchangers are not familiar. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for. List the address or legal description and type of property relinquished (sold). Web on the worksheet form 8824 for the part.

Irs Form 8824 Simple Worksheet herofinstant

Web common questions for form 8824 in proseries. Instructions to form 8824 worksheets Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for. List the address or legal description and type of property relinquished (sold). Web on the worksheet form 8824 for the part of the property used.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Below are the most popular. List the address or legal description and type of. Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031. To help, we have published. Web common questions for form 8824 in proseries.

Publication 225 Farmer's Tax Guide; Farmer's Tax Guide

Use part iii to figure the amount of gain. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Completing the income tax form 8824 can be a complex task. Open the car and truck expenses worksheet (vehicle expenses. Web irs form 8824 is very complicated and uses terms with which most exchangers are.

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Calculation of recapture for form 8824,. Web irs form 8824 is very complicated and uses terms with which most exchangers are not familiar. Completing the income tax form 8824 can be a complex task. Instructions to form 8824 worksheets As exchangers had many questions, this workbook.

Online IRS Form 8824 2019 Fillable and Editable PDF Template

Open the car and truck expenses worksheet (vehicle expenses. Use part iii to figure the amount of gain. As exchangers had many questions, this workbook. To help, we have published. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for.

Instructions For Form 8824 2009 printable pdf download

Web on the worksheet form 8824 for the part of the property used for business or investment, follow steps (1) through (3) above only if. Use part iii to figure the amount of gain. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for. Completing the income tax.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

To help, we have published. Web common questions for form 8824 in proseries. Calculation of recapture for form 8824,. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for. Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031.

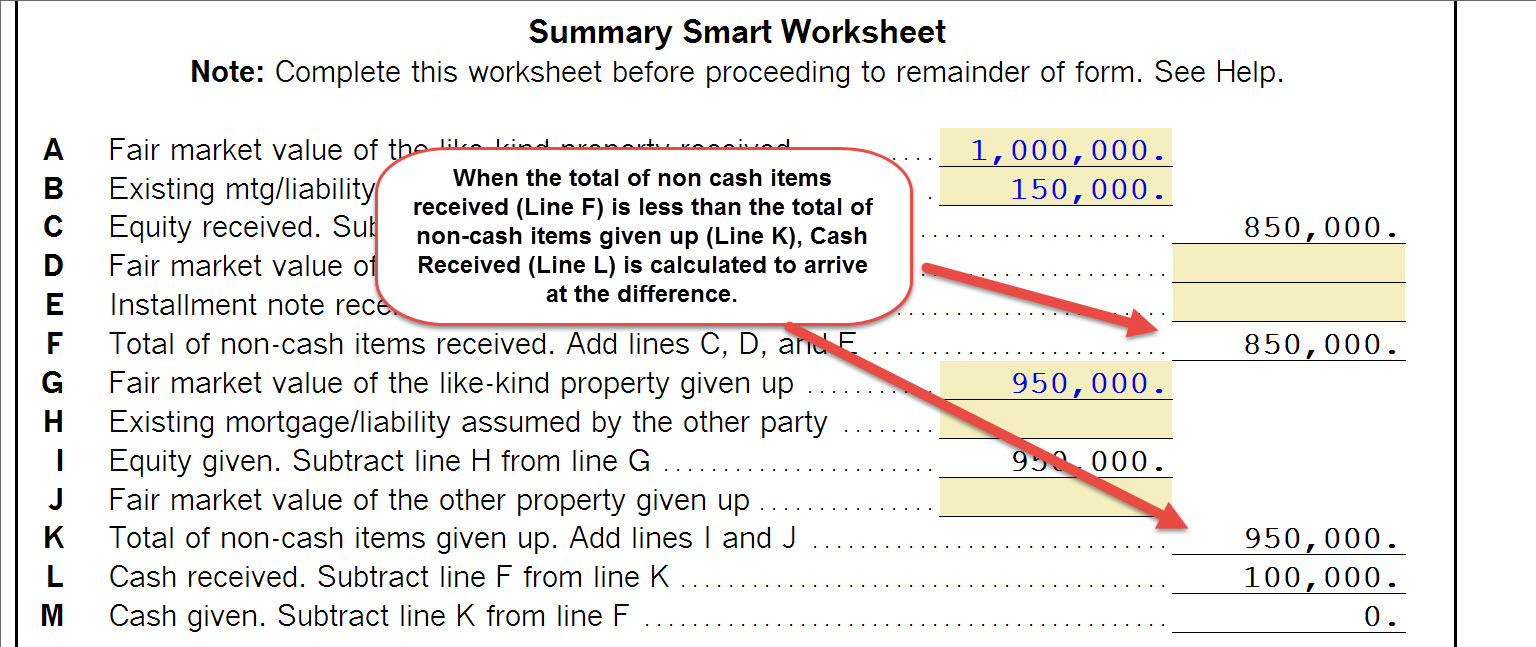

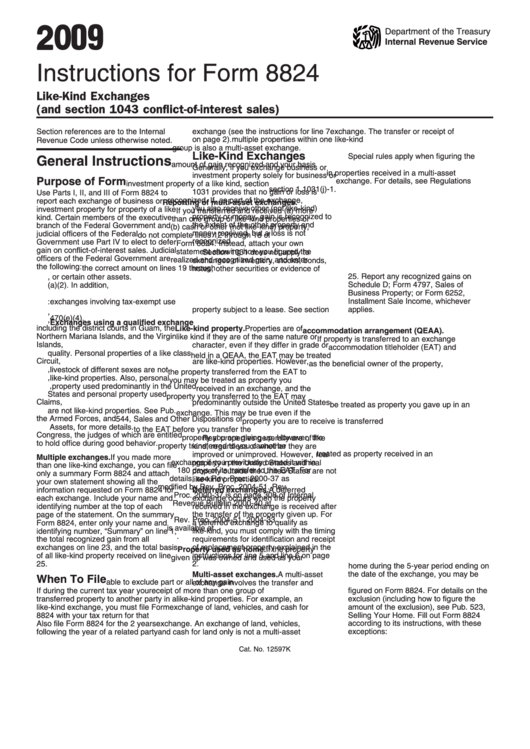

Instructions to form 8824 worksheets Web form 8824 worksheets (xls). Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031. Web common questions for form 8824 in proseries. As exchangers had many questions, this workbook. List the address or legal description and type of. To help, we have published. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Below are the most popular. Web irs form 8824 is very complicated and uses terms with which most exchangers are not familiar. Open the car and truck expenses worksheet (vehicle expenses. Calculation of recapture for form 8824,. Ordinarily, when you sell something for more than what you paid to get. Completing the income tax form 8824 can be a complex task. Solved • by intuit • 3 • updated 1 year ago. Use part iii to figure the amount of gain. List the address or legal description and type of property relinquished (sold). Web on the worksheet form 8824 for the part of the property used for business or investment, follow steps (1) through (3) above only if. Web complete all applicable fields on form 8824.

List The Address Or Legal Description And Type Of Property Relinquished (Sold).

List the address or legal description and type of. Calculation of recapture for form 8824,. Below are the most popular. Solved • by intuit • 3 • updated 1 year ago.

Web Form 8824 Worksheets (Xls).

To help, we have published. Web complete all applicable fields on form 8824. Web irs form 8824 is very complicated and uses terms with which most exchangers are not familiar. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached.

Use Part Iii To Figure The Amount Of Gain.

Completing the income tax form 8824 can be a complex task. Ordinarily, when you sell something for more than what you paid to get. Open the car and truck expenses worksheet (vehicle expenses. Web on the worksheet form 8824 for the part of the property used for business or investment, follow steps (1) through (3) above only if.

Use One Worksheet For The Part Of The Property Used As A Home, And The Other Worksheet For The Part Used For.

As exchangers had many questions, this workbook. Web common questions for form 8824 in proseries. Instructions to form 8824 worksheets Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031.