Form 14900 Worksheet - Web irs form 14900 worksheet. Web use the monthly balance for the 12 months to strike a 12 point average. Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage. The deductible home mortgage interest worksheet is designed to help you calculate your. Web 2017 mortgage interst deduction worksheet. Part i contains general information on home. Savings bonds and treasury securities forms. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure. Publication 936 discusses the rules for deducting home. Use the balances off the monthly servicer.

loan comparison worksheet

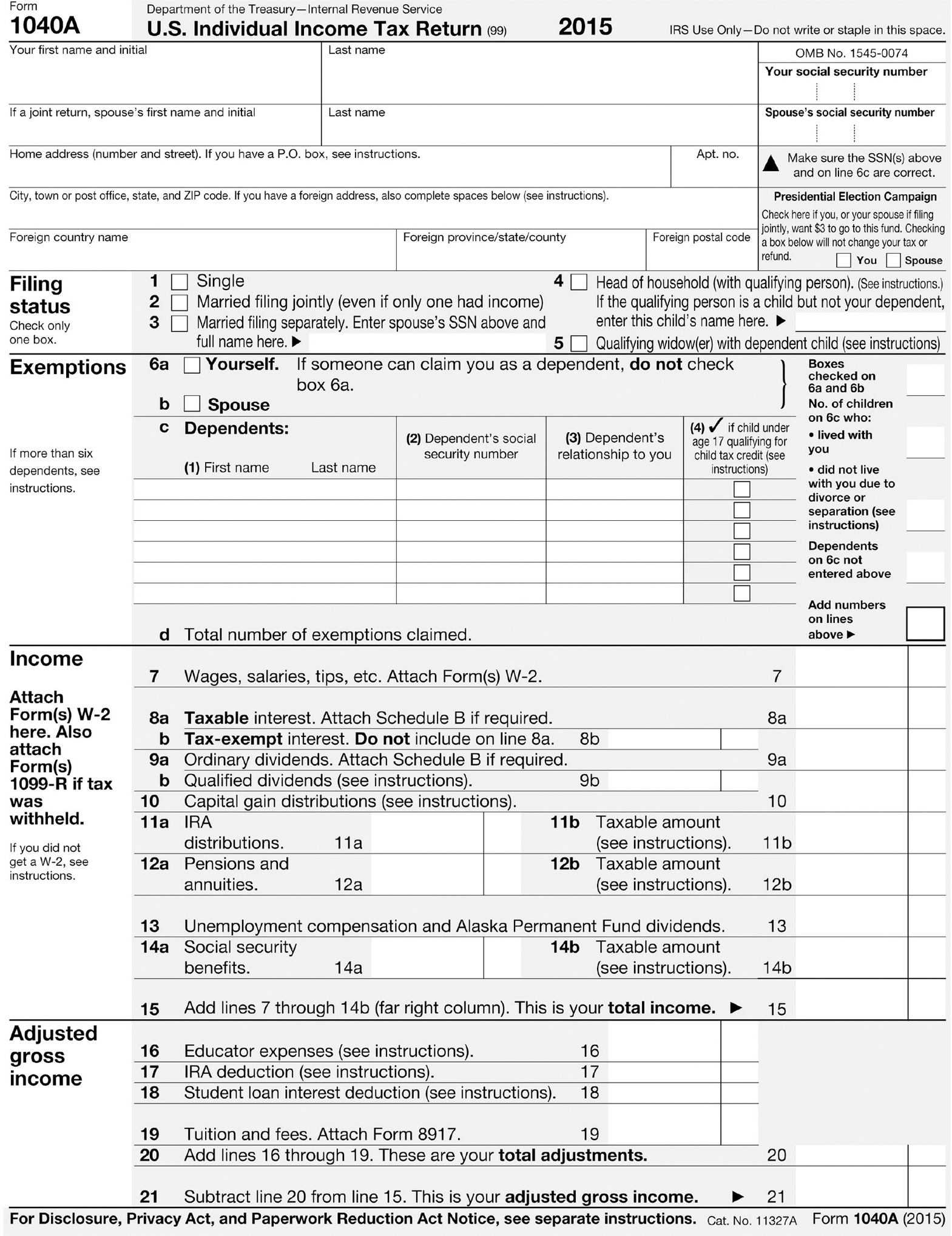

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure. Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit. Web this worksheet supports the following common core state standard: Web for a quick response, chat with me on teams! Web instructions for form n 11 rev.

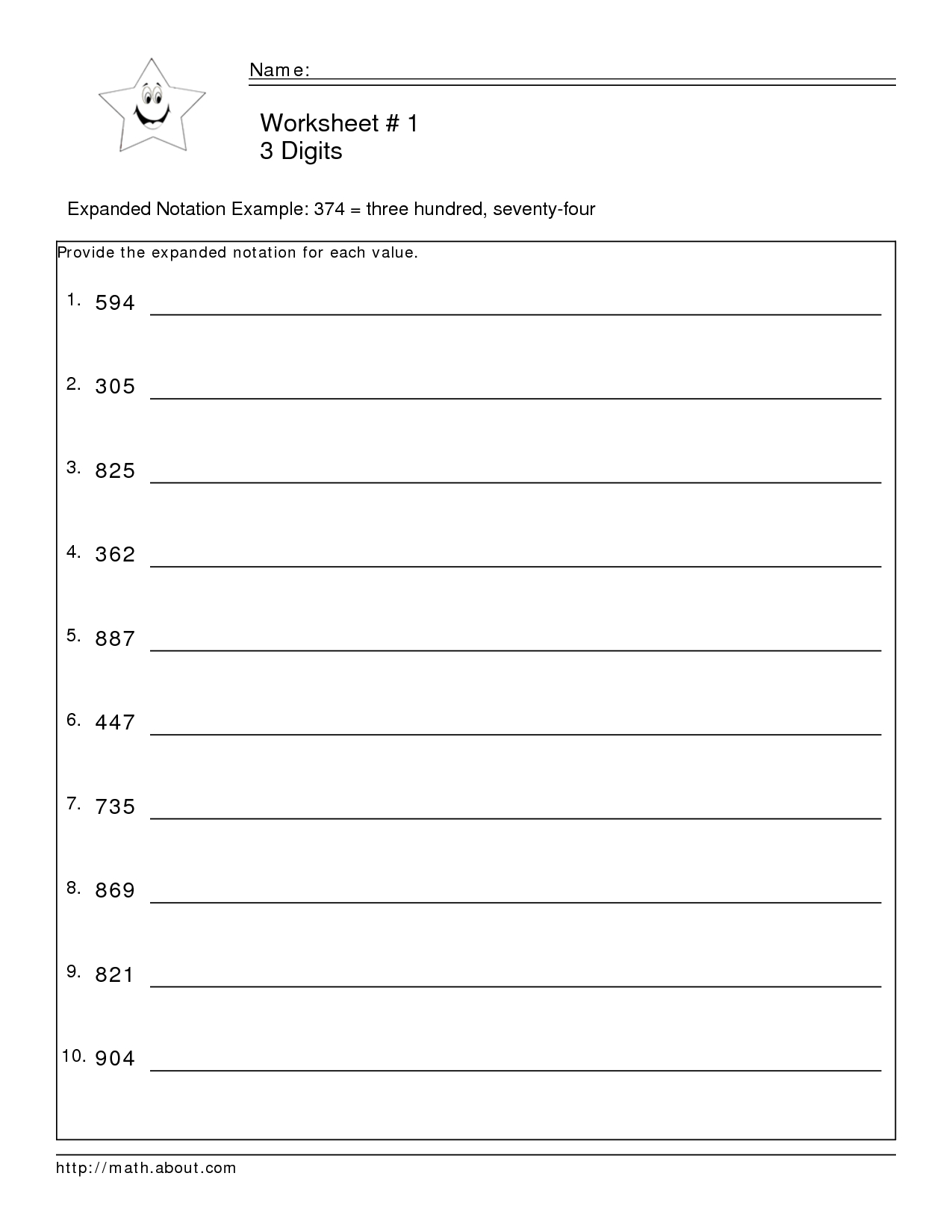

Convert To Word Form Worksheet Two Digits standard expanded and

Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit. Publication 936 discusses the rules for deducting home. Web instructions for form n 11 rev forms 2021. Web for a quick response, chat with me on teams! Web this publication discusses the rules for deducting home mortgage interest.

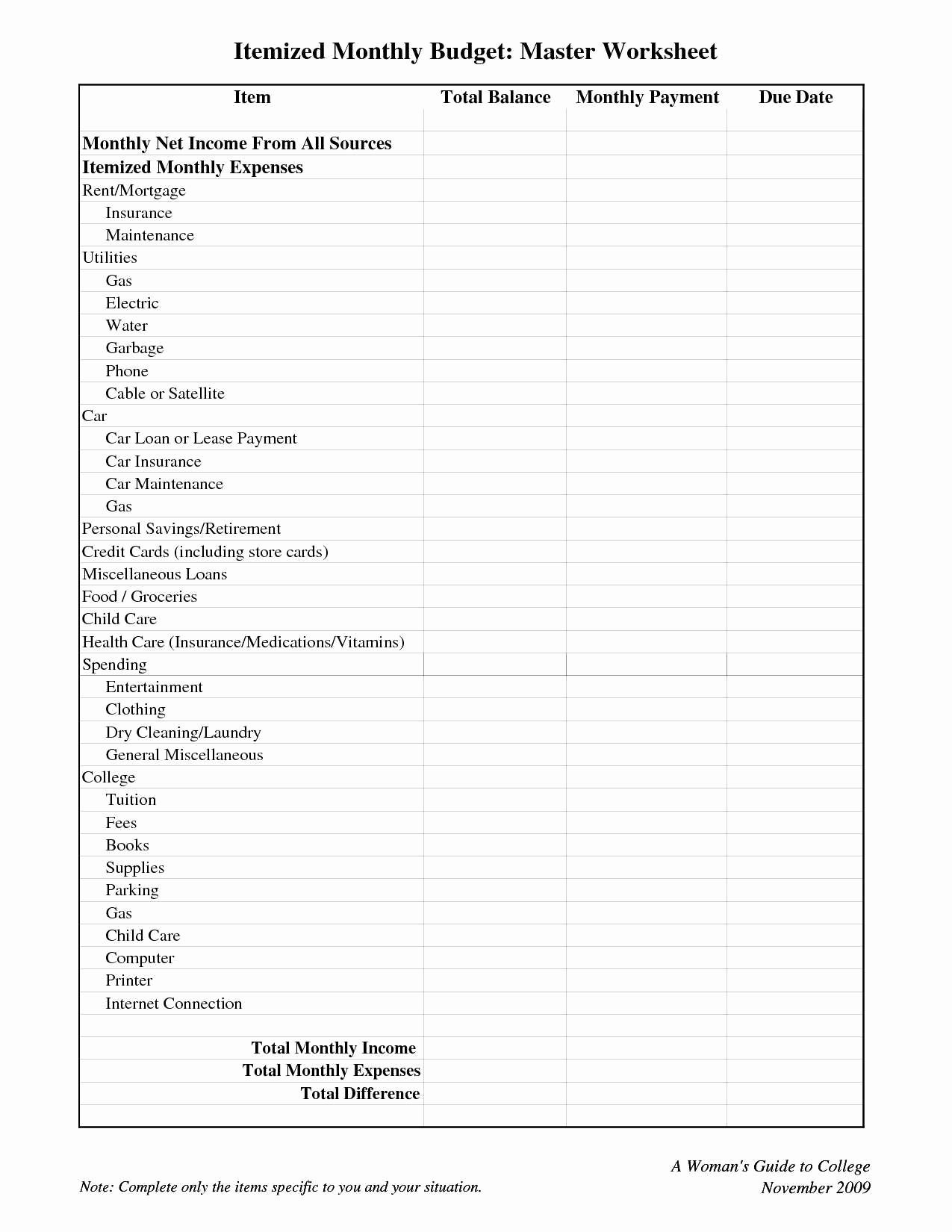

Sample Forms Paying for College Without Going Broke Princeton

Part i contains general information on home. Web worksheet to figure your qualified loan limit and deductible home mortgage interest for the current year and the. Web use the monthly balance for the 12 months to strike a 12 point average. Web how you can complete the new york form 900 form on the internet: View more information about using.

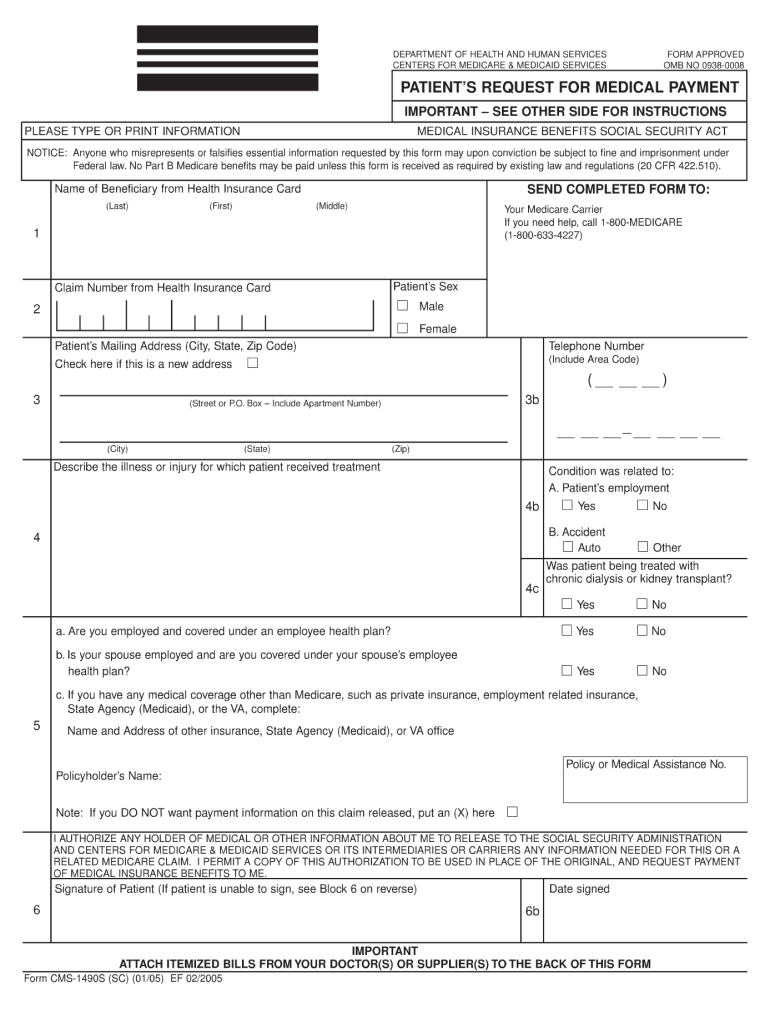

cms 1490s Fill out & sign online DocHub

Web 2017 mortgage interst deduction worksheet. Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit. Web how you can complete the new york form 900 form on the internet: Web this publication discusses the rules for deducting home mortgage interest. Publication 936 discusses the rules for deducting home.

Earned Credit Table 2018 Pdf

View more information about using irs forms,. Web full audit representation by a licensed tax professional, including representation in front of the irs. Web web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Web use the monthly balance for the 12 months to strike a 12 point average. Use the balances off.

Irs Form 886 A Worksheet Fillable Printable Forms Free Online

Web 2017 mortgage interst deduction worksheet. Web for a quick response, chat with me on teams! Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit. Web full audit representation by a licensed tax professional, including representation in front of the irs. Web how you can complete the new york form 900 form on the internet:

Its Deductible Clothing Worksheet —

Web full audit representation by a licensed tax professional, including representation in front of the irs. Part i contains general information on home. The deductible home mortgage interest worksheet is designed to help you calculate your. Savings bonds and treasury securities forms. Use the balances off the monthly servicer.

What Is Irs Cancellation Of Debt

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure. Use a hawaii tax instructions 2021 template to make your document workflow more. Web mortgage deduction limit worksheet part i qualified loan limit 1) enter the average balance of all grandfathered debt. Web about publication 936, home mortgage interest deduction..

하자보수청구 샘플, 양식 다운로드

Web about publication 936, home mortgage interest deduction. Web this worksheet supports the following common core state standard: Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure. Web limits on home mortgage interest deduction.9 home acquisition debt.9 grandfathered. Irs publication 936 2020 irs publication 936 for 2021 mortgage interest.

Irs Form W4V Printable Social Security Top 10 Benefit Questions

Web use the monthly balance for the 12 months to strike a 12 point average. Primary records center authorized users ot iperms must log into iperms. Savings bonds and treasury securities forms. View more information about using irs forms,. Web full audit representation by a licensed tax professional, including representation in front of the irs.

Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit. Web web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest. Web limits on home mortgage interest deduction.9 home acquisition debt.9 grandfathered. Web about publication 936, home mortgage interest deduction. Web this worksheet supports the following common core state standard: Web mortgage deduction limit worksheet part i qualified loan limit 1) enter the average balance of all grandfathered debt. Web how you can complete the new york form 900 form on the internet: Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage. Irs publication 936 for 2021 irs publication 936 2020 irs pub 936 for 2019 irs pub 936. Web worksheet to figure your qualified loan limit and deductible home mortgage interest for the current year and the. Publication 936 discusses the rules for deducting home. Primary records center authorized users ot iperms must log into iperms. Web use the monthly balance for the 12 months to strike a 12 point average. Web for a quick response, chat with me on teams! Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure. Web 2017 mortgage interst deduction worksheet. View more information about using irs forms,. Web full audit representation by a licensed tax professional, including representation in front of the irs. Savings bonds and treasury securities forms. Web this publication discusses the rules for deducting home mortgage interest.

Web Generally, Home Interest Is Deductible On A Form 1040 Schedule A Attachment If It's Interest Paid On Debt.

Web 2017 mortgage interst deduction worksheet. View more information about using irs forms,. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure. Web 2017 mortgage interst deduction worksheet.

Web Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1) Enter The Average Balance Of All Grandfathered Debt.

Web about publication 936, home mortgage interest deduction. Use the balances off the monthly servicer. Web irs form 14900 worksheet. Irs publication 936 2020 irs publication 936 for 2021 mortgage interest deduction limit.

Web Web This Tax Worksheet Computes The Taxpayer’s Qualified Mortgage Loan Limit And The Deductible Home Mortgage Interest.

Web this tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage. Web instructions for form n 11 rev forms 2021. Web this publication discusses the rules for deducting home mortgage interest. Web for a quick response, chat with me on teams!

Web Use The Monthly Balance For The 12 Months To Strike A 12 Point Average.

Part i contains general information on home. Web this worksheet supports the following common core state standard: Publication 936 discusses the rules for deducting home. Web full audit representation by a licensed tax professional, including representation in front of the irs.