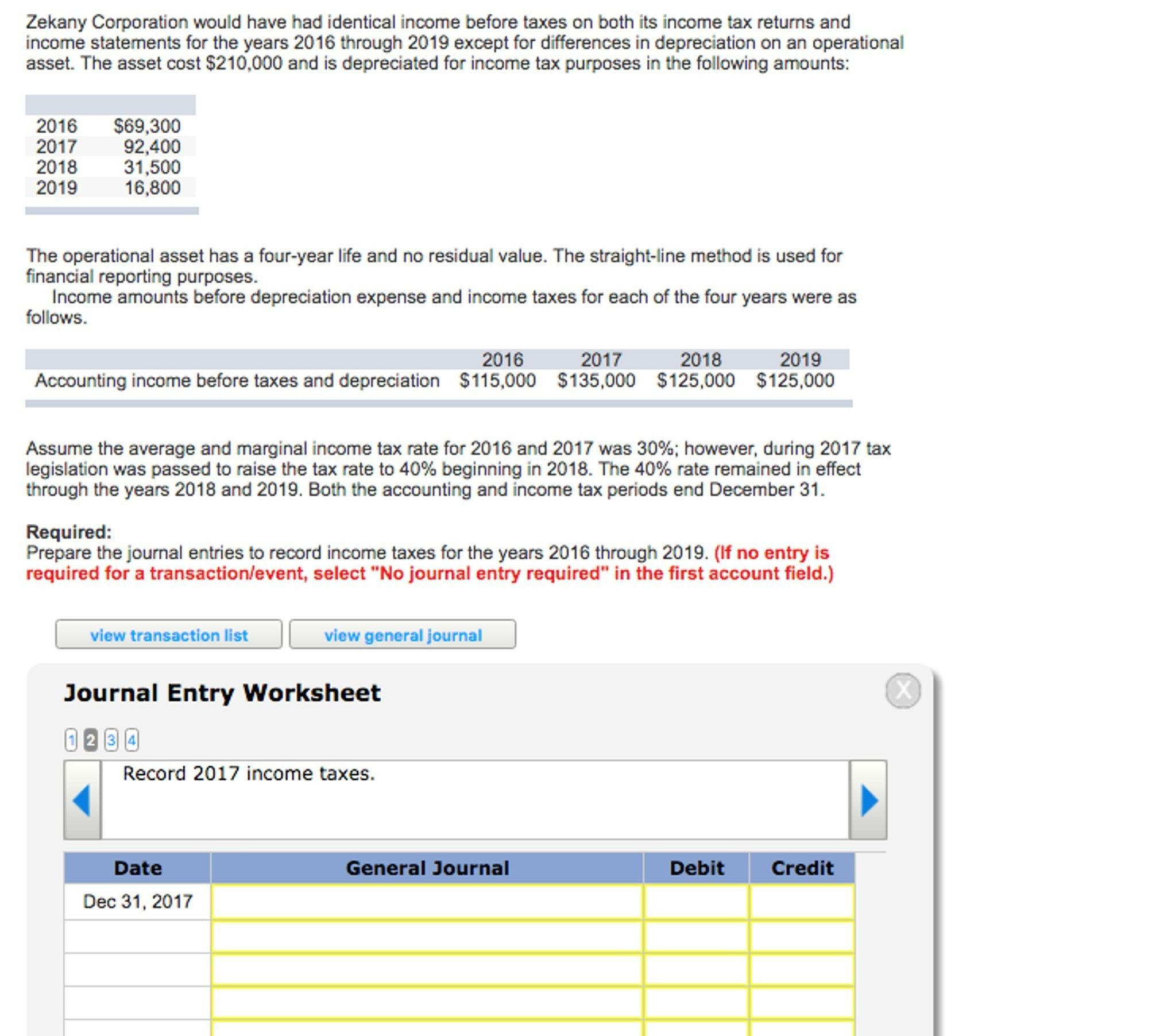

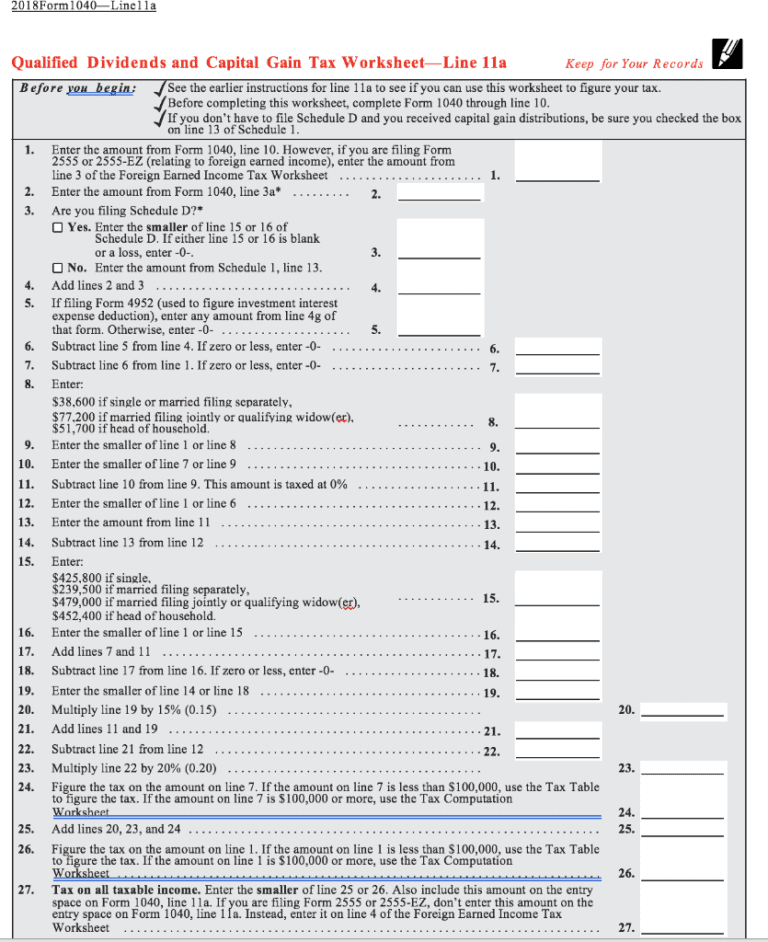

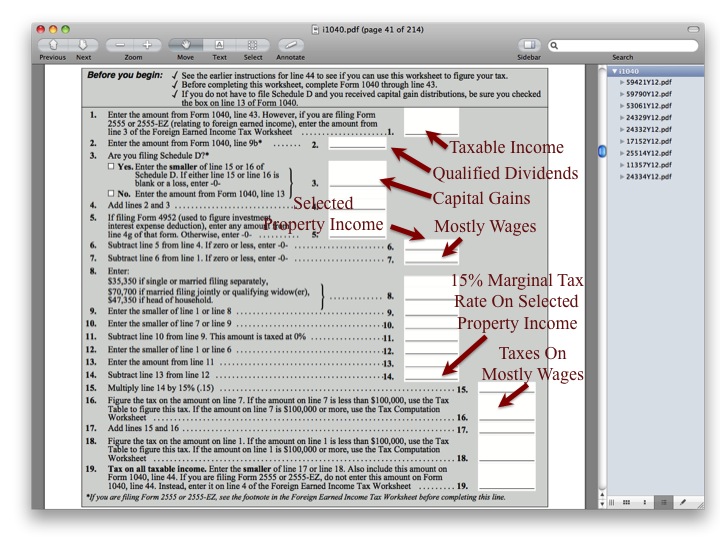

Fillable Qualified Dividends And Capital Gain Tax Worksheet - Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). To inform the irs of your. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Get a fillable qualified dividends and capital gains worksheet. Web capital gains and qualified dividends. Web 1 best answer. For the desktop version you can switch to forms mode and open the worksheet to see it. Web 4 rows qualified dividends and capital gain tax worksheet.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

For the desktop version you can switch to forms mode and open the worksheet to see it. Web 1 best answer. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web qualified dividends and capital gain tax worksheet 2022. To inform the irs of your.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web the form 1040 qualified dividends and capital gain tax worksheet 2018 form is 1 page long and contains: Web 1 best answer. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. The worksheet is part of form 1040. Web capital gains and losses introduction these instructions explain.

Capital Gains Tax Worksheet —

Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Get a fillable qualified dividends and capital gains worksheet. Web 4 rows qualified dividends and capital gain tax worksheet. The worksheet is part of form 1040.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Web qualified dividends are taxed at the same rates as the capital gains tax rate; Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web 4 rows qualified dividends and capital gain tax worksheet. Web the form 1040 qualified.

Thoughts On Economics The State Is "The Executive Committee Of The

It is for a single taxpayer, but. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Go to www.irs.gov/scheduled for instructions. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever.

Capital Gains Tax Spreadsheet Shares —

Web a qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web report your qualified dividends on line 9b of form 1040 or 1040a. For the desktop version.

Qualified Dividends And Capital Gain Tax Worksheet 2016 —

Use the qualified dividends and capital gain tax worksheet. The worksheet is part of form 1040. To inform the irs of your. For the desktop version you can switch to forms mode and open the worksheet to see it. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income.

Capital Gain Tax Worksheet Line 41

Web qualified dividends are taxed at the same rates as the capital gains tax rate; Get a fillable qualified dividends and capital gains worksheet. Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. Web capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web the form 1040 qualified dividends and capital gain tax worksheet 2018 form is 1 page long and contains: To inform the irs of your. Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. The worksheet is part of form 1040. Web 4 rows qualified dividends and capital gain tax.

2011 Form IRS Instruction 1040 Line 44 Fill Online, Printable, Fillable

Web the form 1040 qualified dividends and capital gain tax worksheet 2018 form is 1 page long and contains: Web qualified dividends and capital gain tax worksheet 2022. Web a qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax. For the desktop version you can switch to forms mode.

Web the form 1040 qualified dividends and capital gain tax worksheet 2018 form is 1 page long and contains: Web a qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax. To inform the irs of your. Web capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). It is for a single taxpayer, but. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web 1 best answer. Go to www.irs.gov/scheduled for instructions. For the desktop version you can switch to forms mode and open the worksheet to see it. Get a fillable qualified dividends and capital gains worksheet. Web qualified dividends and capital gain tax worksheet 2022. These rates are lower than ordinary income tax. Web capital gains and qualified dividends. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web qualified dividends are taxed at the same rates as the capital gains tax rate; Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes:

Web It Includes Taxable Interest, Dividends, Capital Gains (Including Capital Gain Distributions), Rents, Royalties, Pension And Annuity.

Web qualified dividends and capital gain tax worksheet 2022. Web qualified dividends are taxed at the same rates as the capital gains tax rate; For the desktop version you can switch to forms mode and open the worksheet to see it. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax.

Web • If The Taxpayer Does Not Have To File Schedule D (Form 1040) And Received Capital Gain Distributions, Be Sure The Box On Line.

Go to www.irs.gov/scheduled for instructions. Use the qualified dividends and capital gain tax worksheet. Web 4 rows qualified dividends and capital gain tax worksheet. The worksheet is part of form 1040.

Web A Qualified Dividend Is Taxed At The Capital Gains Tax Rate, While Ordinary Dividends Are Taxed At Standard Federal Income Tax.

Web 1 best answer. To inform the irs of your. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: It is for a single taxpayer, but.

Web This Flowchart Is Designed To Quickly Determine The Tax On Capital Gains And Dividends, Based On The Taxpayer's Taxable Income.

Web the form 1040 qualified dividends and capital gain tax worksheet 2018 form is 1 page long and contains: Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web capital gains and qualified dividends. Web capital gains and losses introduction these instructions explain how to complete schedule d (form 1040).