Erc Calculation Worksheet - For 2021, here are the time periods that correspond. Ad get up to $26k per employee from the irs with the erc tax credit. Determine if you qualify for erc in 2020 and 2021 gusto editors you may have heard. Web your erc eligibility calculator: Please read the following notes on the erc spreadsheet: Click on the appropriate tab at the bottom of the spreadsheet. If you determine that additional credits are. Web an erc calculation worksheet can help determine how much relief you can expect. The irs has created a worksheet. A simple, guided tool to help businesses calculate their potential erc.

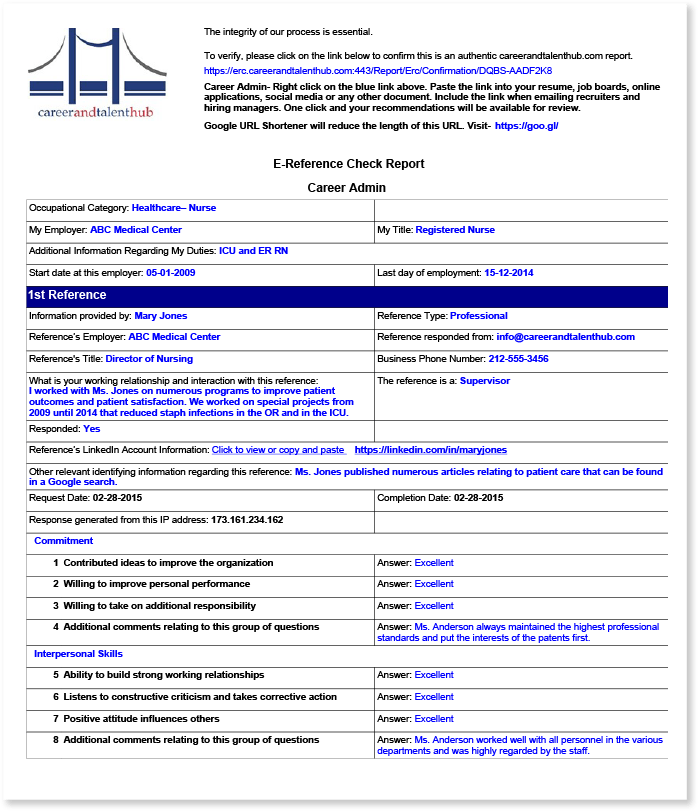

How does the ERC work? Career & Talent Hub

Web background section 2301 of the cares act allows a credit (employee retention credit or credit) against applicable employment. Web learn how to calculate the employee retention credit (erc) for your business, a refundable payroll tax credit that helps you lower your payroll taxes and keep your staff on the payroll. Web overview the employee retention tax credit is a.

Form 941 Erc Worksheet

Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients. Web calculating your 2021 erc 1. Web use the tool and erc calculator below to quickly find your estimated employee retention credit. Web learn how to calculate the employee retention credit (erc) for your business, a refundable payroll tax credit.

Worksheet 2 Adjusted Employee Retention Credit

For 2021, here are the time periods that correspond. Web washington — the internal revenue service today issued guidance for employers claiming the employee. Web background section 2301 of the cares act allows a credit (employee retention credit or credit) against applicable employment. Click on the appropriate tab at the bottom of the spreadsheet. Web erc worksheet 2021 was created.

Ertc Worksheet Excel

Increased the maximum per employee to $7,000 per employee per quarter in. Web your erc eligibility calculator: The irs has created a worksheet. Web learn how to calculate the employee retention credit (erc) for your business, a refundable payroll tax credit that helps you lower your payroll taxes and keep your staff on the payroll. Web background section 2301 of.

Employee Retention Credit (ERC) Calculator Gusto

Web background section 2301 of the cares act allows a credit (employee retention credit or credit) against applicable employment. Ad get up to $26k per employee from the irs with the erc tax credit. Web download this resource to help with next steps when your clients are claiming the employee retention credit. Web maximum credit of $5,000 per employee in.

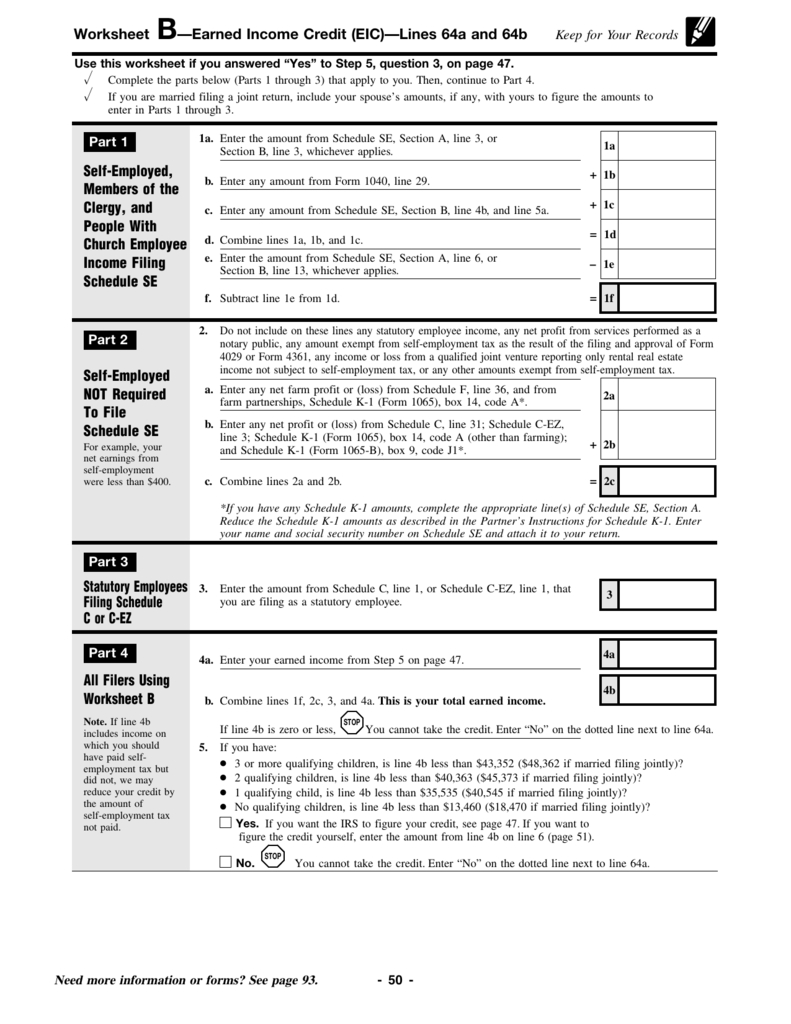

5 Printable EIC Worksheet /

Web overview the employee retention tax credit is a broad based refundable tax credit designed to. Increased the maximum per employee to $7,000 per employee per quarter in. Web use the tool and erc calculator below to quickly find your estimated employee retention credit. Our tax experts can help. Web employee retention credit worksheet 1 when will this form become.

erc form download romanholidayvannuys

This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc. Web overview the employee retention tax credit is a broad based refundable tax credit designed to. Ad get up to $26k per employee from the irs with the erc tax credit. Web download this resource to.

ReadyToUse Employee Retention Credit Calculator 2021 MSOfficeGeek

This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc. If you determine that additional credits are. Web your erc eligibility calculator: What is the erc tax. Web maximum credit of $5,000 per employee in 2020.

How do I record Employee Retention Credit (ERC) received in QB?

Our tax professionals can help determine if you qualify for the ertc from the irs Web calculating your 2021 erc 1. Web learn how to calculate the employee retention credit (erc) for your business, a refundable payroll tax credit that helps you lower your payroll taxes and keep your staff on the payroll. 70% of each retained employee's qualified wages.

Employee Retention Credit (ERC) Calculator Gusto

Our tax experts can help. This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc. Web background section 2301 of the cares act allows a credit (employee retention credit or credit) against applicable employment. Ad get up to $26k per employee from the irs with the.

Our tax experts can help. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. For 2021, here are the time periods that correspond. This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc. 70% of each retained employee's qualified wages (up to. Our tax professionals can help determine if you qualify for the ertc from the irs Web download this resource to help with next steps when your clients are claiming the employee retention credit. Web calculating your 2021 erc 1. Now you have your own version of the calculator. Web 2021 employee retention maximum tax credits. Click file > make a copy at the top right hand of your screen. Our tax experts can help. Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they. Determine if you qualify for erc in 2020 and 2021 gusto editors you may have heard. The irs has created a worksheet. Ad get up to $26k per employee from the irs with the erc tax credit. Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients. Web client did not pay any erc wages (see chart at end of worksheet for erc. Beginning january 1, 2021, the cap is increased to. Web overview the employee retention tax credit is a broad based refundable tax credit designed to.

Web 2021 Employee Retention Maximum Tax Credits.

Click on the appropriate tab at the bottom of the spreadsheet. Beginning january 1, 2021, the cap is increased to. Web annual cap of $5,000 aggregate ($10,000 in qualified wages x 50%). Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients.

Web Client Did Not Pay Any Erc Wages (See Chart At End Of Worksheet For Erc.

Web background section 2301 of the cares act allows a credit (employee retention credit or credit) against applicable employment. This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc. A simple, guided tool to help businesses calculate their potential erc. Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they.

Web Washington — The Internal Revenue Service Today Issued Guidance For Employers Claiming The Employee.

Web an erc calculation worksheet can help determine how much relief you can expect. The irs has created a worksheet. Our tax professionals can help determine if you qualify for the ertc from the irs Web learn how to calculate the employee retention credit (erc) for your business, a refundable payroll tax credit that helps you lower your payroll taxes and keep your staff on the payroll.

Please Read The Following Notes On The Erc Spreadsheet:

What is the erc tax. Increased the maximum per employee to $7,000 per employee per quarter in. Web the ey erc calculator: Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021.