Employer's Worksheet To Calculate Employee's Taxable - For 2020, the employee retention credit is equal to 50% of. Refund from 2022 designated as an. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the. You must deposit federal income tax and additional medicare tax. Web our employer tax calculator quickly gives you a clearer picture of all the payroll taxes you’ll owe when bringing on a new. Web find tax withholding information for employees, employers and foreign persons. An employee who owns a 1% or more equity, capital, or profits interest in your business. Web employers should withhold half (7.65%) of the 15.3% owed in fica (social security and medicare) taxes from an. Web the employer will use worksheet 3 and the withholding tables in section 3 to determine the income tax withholding for the. Web an employee whose pay is $265,000 or more.

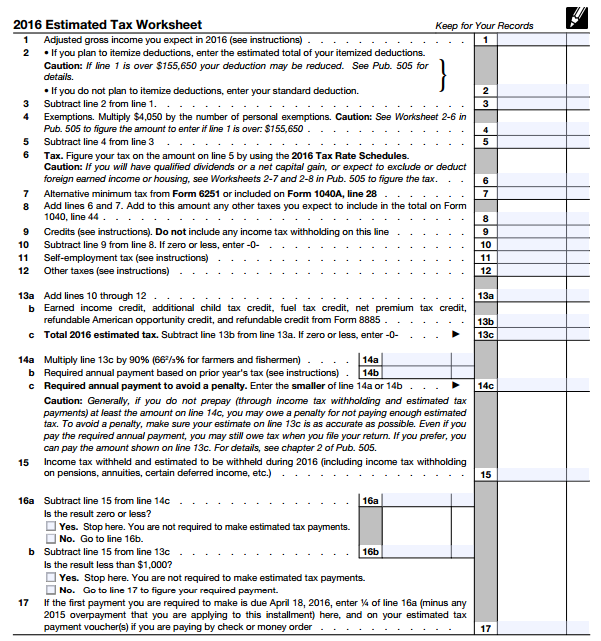

Great Tax Computation Sheet In Excel Format Stakeholder

Web employers should withhold half (7.65%) of the 15.3% owed in fica (social security and medicare) taxes from an. Web find tax withholding information for employees, employers and foreign persons. Web georgia withholding tax is the amount help from an employee’s wages and paid directly by the employer. Use 100% of the 2023 estimated total tax. Web an employee whose.

17+ Net Salary Calculator Template Template Invitations Template

Web find tax withholding information for employees, employers and foreign persons. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the. Web employers should withhold half (7.65%) of the 15.3% owed in fica (social security and medicare) taxes from an. Web depositing and reporting employment taxes. Web first,.

Payroll contribution calculator RomanaiBaran

For 2020, the employee retention credit is equal to 50% of. Web first, there are certain taxes you need to calculate and withhold from each employee's paycheck, including: Web depositing and reporting employment taxes. Web = x_______________% prorated annual lease value personal use % (personal/total miles, per statement from employee) personal. Web find tax withholding information for employees, employers and.

8 Payroll Tax Calculator Templates to Download Sample Templates

An employee who owns a 1% or more equity, capital, or profits interest in your business. Hourly & salary take home after taxes smartasset's hourly and salary paycheck calculator shows. Use 100% of the 2023 estimated total tax. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the..

Employee Retention Credit Worksheet 1

Web find tax withholding information for employees, employers and foreign persons. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the. For 2020, the employee retention credit is equal to 50% of. Church employee income, see instructions. Web first, there are certain taxes you need to calculate and.

10+ Employer Payroll Tax Calculator Ideas DOWNLOAD GKHW

30, 2021 and before jan. Web employers should withhold half (7.65%) of the 15.3% owed in fica (social security and medicare) taxes from an. Web georgia withholding tax is the amount help from an employee’s wages and paid directly by the employer. Web how to calculate the employee retention credit. You must deposit federal income tax and additional medicare tax.

How to Pay Taxes for Side Hustles and Extra Young Adult Money

Web = x_______________% prorated annual lease value personal use % (personal/total miles, per statement from employee) personal. Use 100% of the 2023 estimated total tax. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the. Web depositing and reporting employment taxes. Web georgia withholding tax is the amount.

21 Images Tax Deduction Template

Web this online tool helps employees withhold the correct amount of tax from their wages. 30, 2021 and before jan. For 2020, the employee retention credit is equal to 50% of. Web first, there are certain taxes you need to calculate and withhold from each employee's paycheck, including: Church employee income, see instructions.

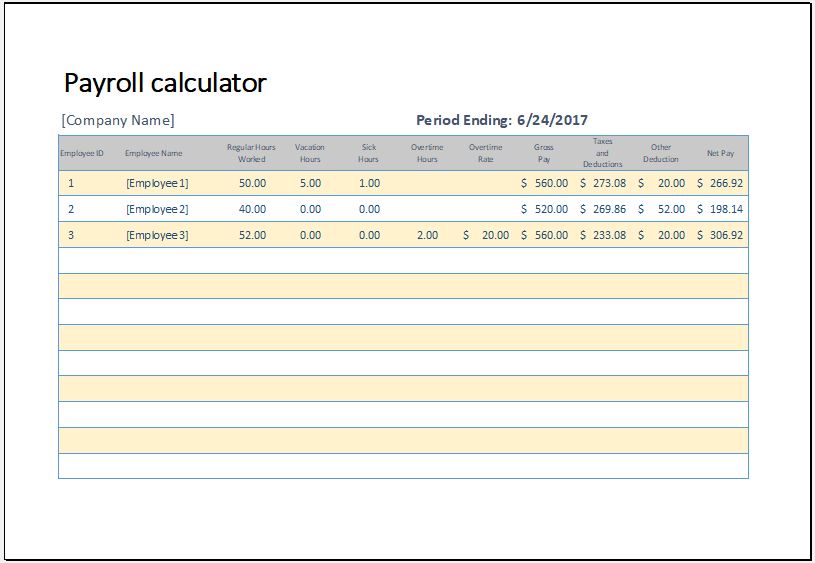

Payroll Calculator Template for MS Excel Word & Excel Templates

Refund from 2022 designated as an. Web employers should withhold half (7.65%) of the 15.3% owed in fica (social security and medicare) taxes from an. Web our employer tax calculator quickly gives you a clearer picture of all the payroll taxes you’ll owe when bringing on a new. Web depositing and reporting employment taxes. Church employee income, see instructions.

How To Calculate Your Taxable Wages For Unemployment Insurance Yuri

Web first, there are certain taxes you need to calculate and withhold from each employee's paycheck, including: Web the employer will use worksheet 3 and the withholding tables in section 3 to determine the income tax withholding for the. You must deposit federal income tax and additional medicare tax. Web employers should withhold half (7.65%) of the 15.3% owed in.

An employee who owns a 1% or more equity, capital, or profits interest in your business. Web our employer tax calculator quickly gives you a clearer picture of all the payroll taxes you’ll owe when bringing on a new. 30, 2021 and before jan. Web how to calculate the employee retention credit. Hourly & salary take home after taxes smartasset's hourly and salary paycheck calculator shows. Web this online tool helps employees withhold the correct amount of tax from their wages. Church employee income, see instructions. For 2020, the employee retention credit is equal to 50% of. You must deposit federal income tax and additional medicare tax. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the. Refund from 2022 designated as an. Web = x_______________% prorated annual lease value personal use % (personal/total miles, per statement from employee) personal. Web an employee whose pay is $265,000 or more. Web depositing and reporting employment taxes. Web use 100 % of 2022 's amount from the line above. Web georgia withholding tax is the amount help from an employee’s wages and paid directly by the employer. Web find tax withholding information for employees, employers and foreign persons. Web employers should withhold half (7.65%) of the 15.3% owed in fica (social security and medicare) taxes from an. Use 100% of the 2023 estimated total tax. Web first, there are certain taxes you need to calculate and withhold from each employee's paycheck, including:

Web The Employer Will Use Worksheet 3 And The Withholding Tables In Section 3 To Determine The Income Tax Withholding For The.

You must deposit federal income tax and additional medicare tax. Hourly & salary take home after taxes smartasset's hourly and salary paycheck calculator shows. Web employers should withhold half (7.65%) of the 15.3% owed in fica (social security and medicare) taxes from an. Church employee income, see instructions.

Web Find Tax Withholding Information For Employees, Employers And Foreign Persons.

Web depositing and reporting employment taxes. Use 100% of the 2023 estimated total tax. 30, 2021 and before jan. An employee who owns a 1% or more equity, capital, or profits interest in your business.

Web Use 100 % Of 2022 'S Amount From The Line Above.

Refund from 2022 designated as an. Web = x_______________% prorated annual lease value personal use % (personal/total miles, per statement from employee) personal. Web georgia withholding tax is the amount help from an employee’s wages and paid directly by the employer. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the.

For 2020, The Employee Retention Credit Is Equal To 50% Of.

Web this online tool helps employees withhold the correct amount of tax from their wages. Web an employee whose pay is $265,000 or more. Web our employer tax calculator quickly gives you a clearer picture of all the payroll taxes you’ll owe when bringing on a new. Web how to calculate the employee retention credit.