Employee Stock Transaction Worksheet - Employee stock option plans are offered at a price lower than the market. Web written by a turbotax expert • reviewed by a turbotax cpa. Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule. Employee stock purchase plans allow you to buy company stock at a discount, and the discount is considered ordinary income or capital gain income. Web in this activity, students have an imaginary $10,000 to invest in the stock market.they are to select at least three different stocks. Web 1 best answer willcasp level 1 i found the answer on another thread. Updated for tax year 2022 • june 2, 2023 08:44 am. If you received an option to buy or sell stock or other property as payment for your services, see pub. Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet. Last and previous years i went to the employee stock transaction worksheet.

Employee Stock Option Plan

Web if i understand the question correctly, go to the capital gain (loss) transaction worksheet, part 4 employer. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. Web in this activity, students have an imaginary $10,000 to invest in the stock market.they are to select at least three different stocks. Web employee stock.

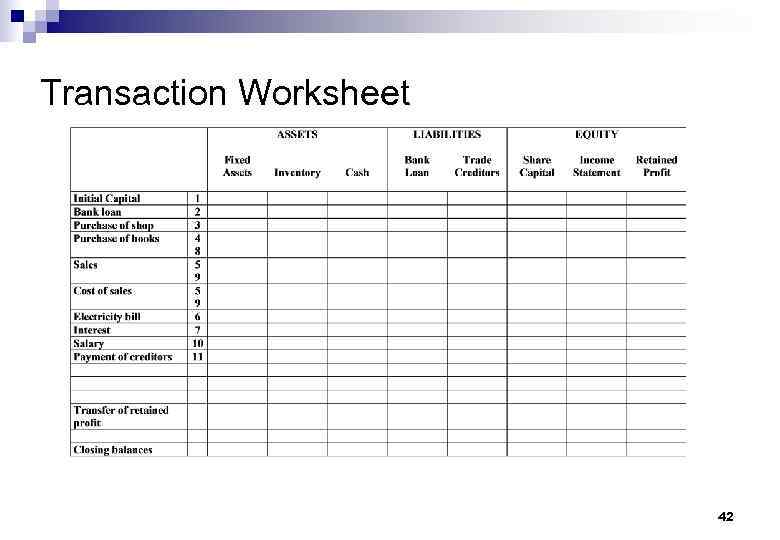

NES MSF 2016 FINANCIAL ACCOUNTING SESSION 1 Introduction

Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet. Web in this activity, students have an imaginary $10,000 to invest in the stock market.they are to select at least three different stocks. Web benefits of employee stock option plan. Web 1 best answer willcasp level 1 i found the.

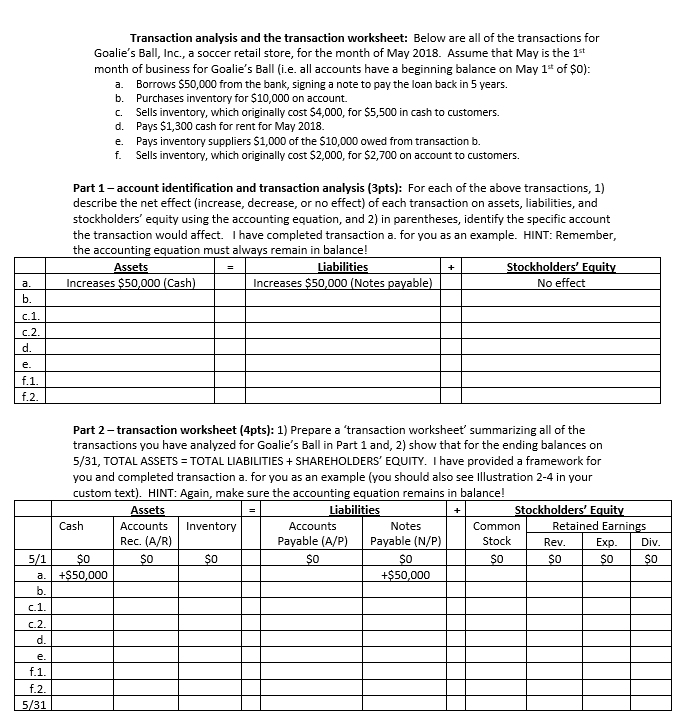

Solved Transaction analysis and the transaction worksheet

Web employer stock transaction worksheet fmv i am getting the following error on the employer stock transaction. Web instructions instructions for form 8949 (2022) sales and other dispositions of capital assets section references are to. Web benefits of employee stock option plan. Web written by a turbotax expert • reviewed by a turbotax cpa. Complete form 8949 before you complete.

Practice Transaction Worksheet and Financial Statement Exercises

Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet. Updated for tax year 2022 • june 2, 2023 08:44 am. Web written by a turbotax expert • reviewed by a turbotax cpa. Web introduction these instructions explain how to complete schedule d (form 1040). Web benefits of employee stock.

Fast food employee and customer hands in a transaction at the drive

Updated for tax year 2022 • june 2, 2023 08:44 am. If you received an option to buy or sell stock or other property as payment for your services, see pub. Web if i understand the question correctly, go to the capital gain (loss) transaction worksheet, part 4 employer. Web if you sold stock acquired by exercising an option granted.

LO 4.7 Use a 10column worksheet (optional step in the accounting cycle

If you received an option to buy or sell stock or other property as payment for your services, see pub. Complete form 8949 before you complete. Updated for tax year 2022 • june 2, 2023 08:44 am. Right click on line 2 in the worksheet. Web instructions instructions for form 8949 (2022) sales and other dispositions of capital assets section.

Transaction Worksheet Video YouTube

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. Employee stock purchase plans allow you to buy company stock at a discount, and the discount is considered ordinary income or capital gain income. Last and previous years i went to the employee stock transaction worksheet. Complete form 8949 before you complete. Web there.

the binary options experts review center katipunan Stock trading

Which of the following is like insurance for you in protecting you from losing excessive money from your. Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule. Web in this activity, students have an imaginary $10,000 to invest in the stock market.they are to select at least three different stocks..

Retirement Planning Spreadsheet Natural Buff Dog

Right click on line 2 in the worksheet. Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet. Web employer stock transaction worksheet fmv i am getting the following error on the employer stock transaction. Web in this activity, students have an imaginary $10,000 to invest in the stock market.they.

Financial Transaction Worksheet 2 EASY TO UNDERSTAND (Explained in

Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet. Updated for tax year 2022 • june 2, 2023 08:44 am. Employee stock purchase plans allow you to buy company stock at a discount, and the discount is considered ordinary income or capital gain income. Complete form 8949 before you.

Web if you sold stock acquired by exercising an option granted under an employee stock purchase plan, and you satisfy the holding. Web in this activity, students have an imaginary $10,000 to invest in the stock market.they are to select at least three different stocks. Web 1 best answer willcasp level 1 i found the answer on another thread. If you received an option to buy or sell stock or other property as payment for your services, see pub. Web written by a turbotax expert • reviewed by a turbotax cpa. Web instructions instructions for form 8949 (2022) sales and other dispositions of capital assets section references are to. Web employee stock ownership plan review worksheet use this worksheet as a tool to help design esop documents that meet. Complete form 8949 before you complete. Employee stock option plans are offered at a price lower than the market. Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule. Updated for tax year 2022 • june 2, 2023 08:44 am. Web benefits of employee stock option plan. Last and previous years i went to the employee stock transaction worksheet. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. Right click on line 2 in the worksheet. Web introduction these instructions explain how to complete schedule d (form 1040). Employee stock purchase plans allow you to buy company stock at a discount, and the discount is considered ordinary income or capital gain income. Web employer stock transaction worksheet fmv i am getting the following error on the employer stock transaction. Web if i understand the question correctly, go to the capital gain (loss) transaction worksheet, part 4 employer. Which of the following is like insurance for you in protecting you from losing excessive money from your.

Web Written By A Turbotax Expert • Reviewed By A Turbotax Cpa.

Web qualified an espp that qualifies under section 423 of the internal revenue code (irc) allows employees to purchase. Employee stock option plans are offered at a price lower than the market. Web if i understand the question correctly, go to the capital gain (loss) transaction worksheet, part 4 employer. Web benefits of employee stock option plan.

Web Introduction These Instructions Explain How To Complete Schedule D (Form 1040).

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. Which of the following is like insurance for you in protecting you from losing excessive money from your. Web if you sold stock acquired by exercising an option granted under an employee stock purchase plan, and you satisfy the holding. Web employer stock transaction worksheet fmv i am getting the following error on the employer stock transaction.

Right Click On Line 2 In The Worksheet.

Updated for tax year 2022 • june 2, 2023 08:44 am. Complete form 8949 before you complete. Web 1 best answer willcasp level 1 i found the answer on another thread. Web instructions instructions for form 8949 (2022) sales and other dispositions of capital assets section references are to.

If You Received An Option To Buy Or Sell Stock Or Other Property As Payment For Your Services, See Pub.

Web there are five primary ways of entering stock and other capitalized gain and waste transactions on the schedule. Web in this activity, students have an imaginary $10,000 to invest in the stock market.they are to select at least three different stocks. Employee stock purchase plans allow you to buy company stock at a discount, and the discount is considered ordinary income or capital gain income. Last and previous years i went to the employee stock transaction worksheet.