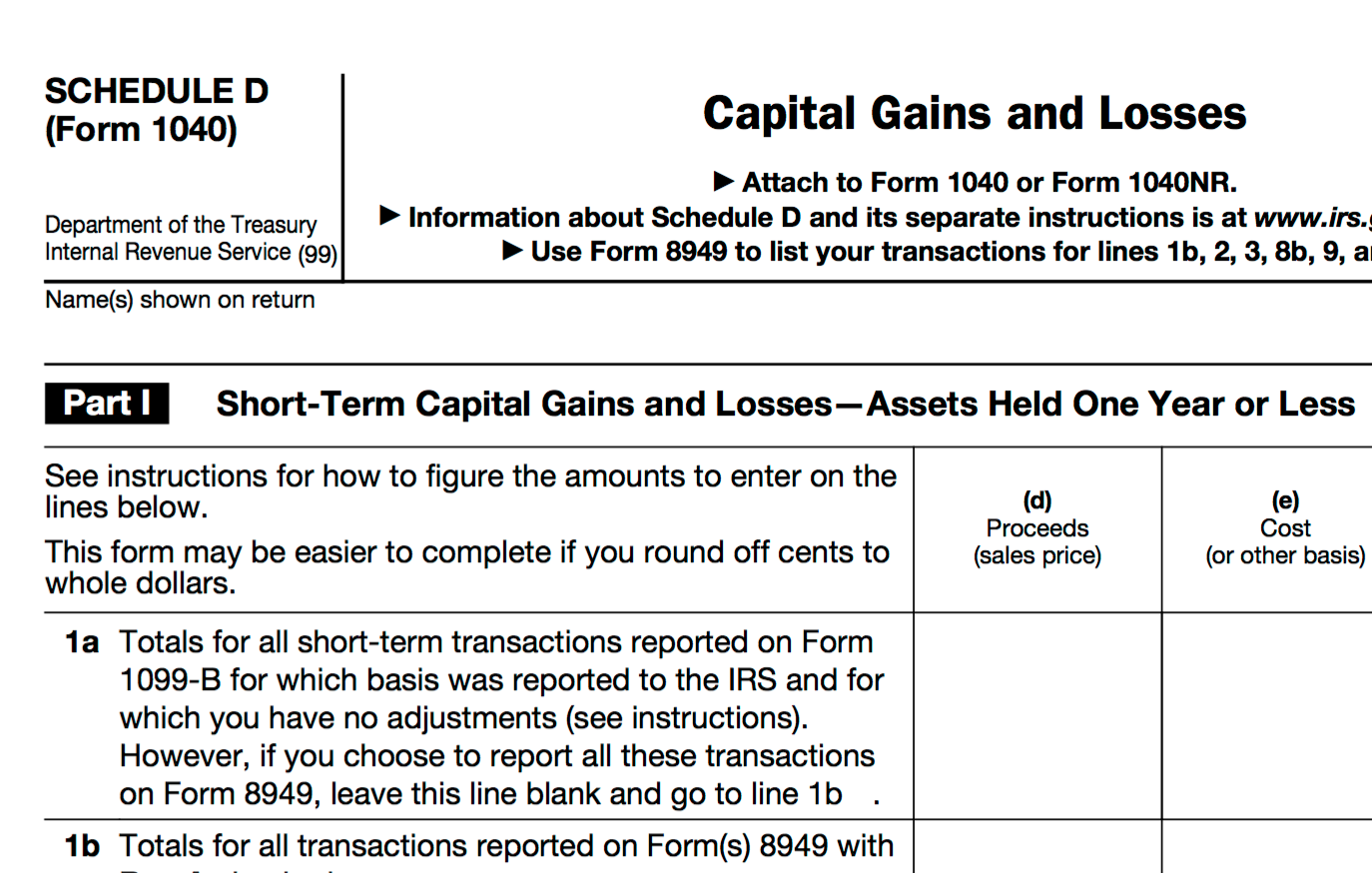

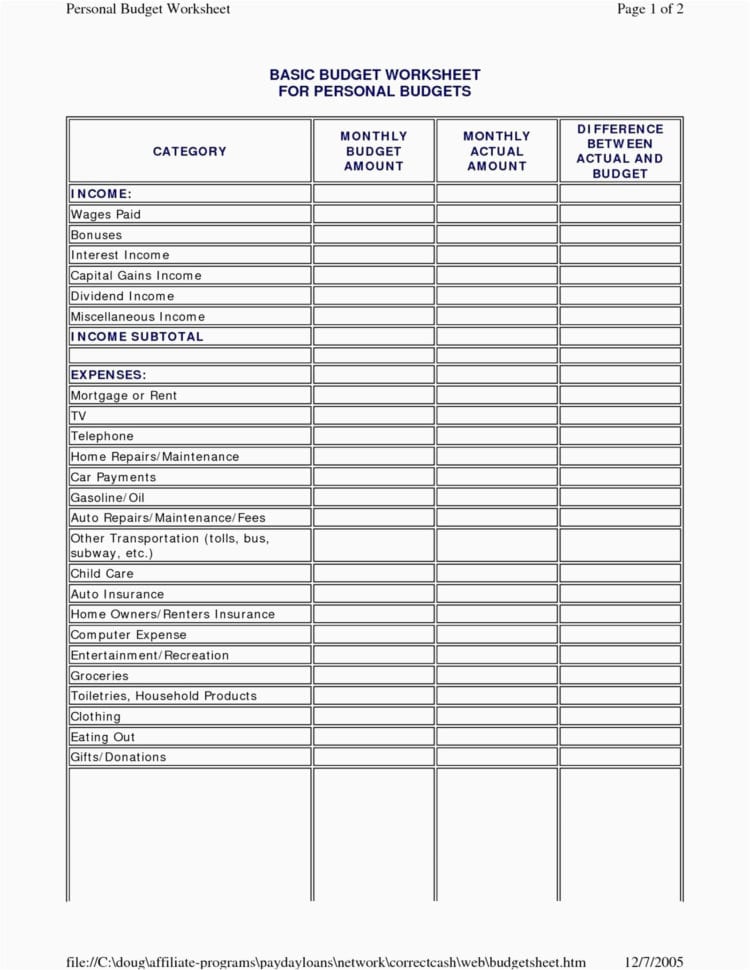

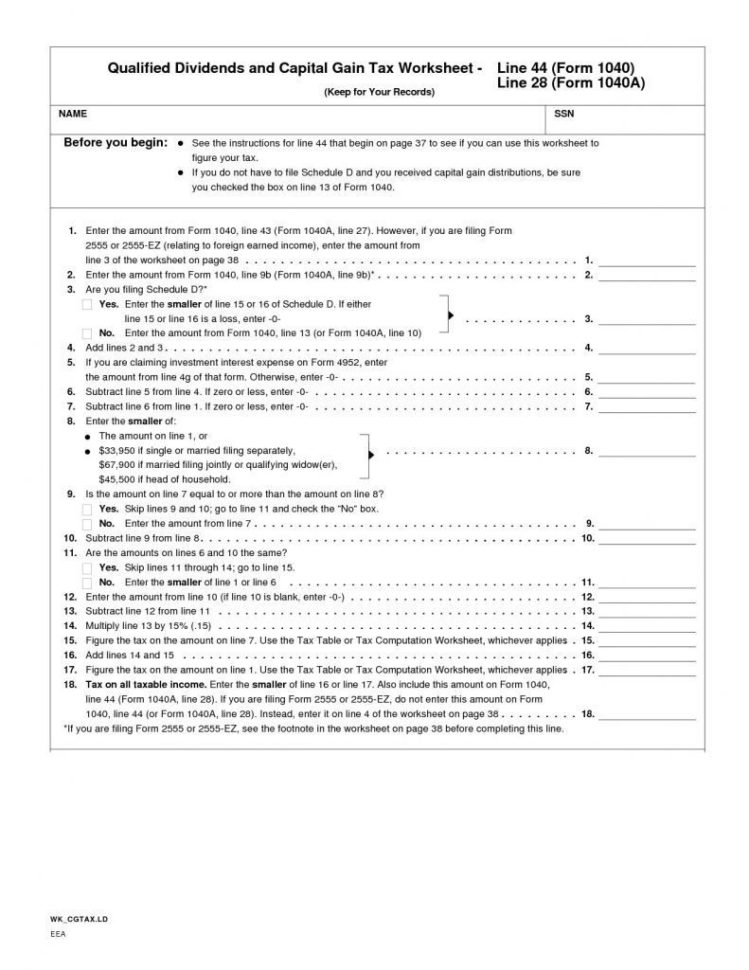

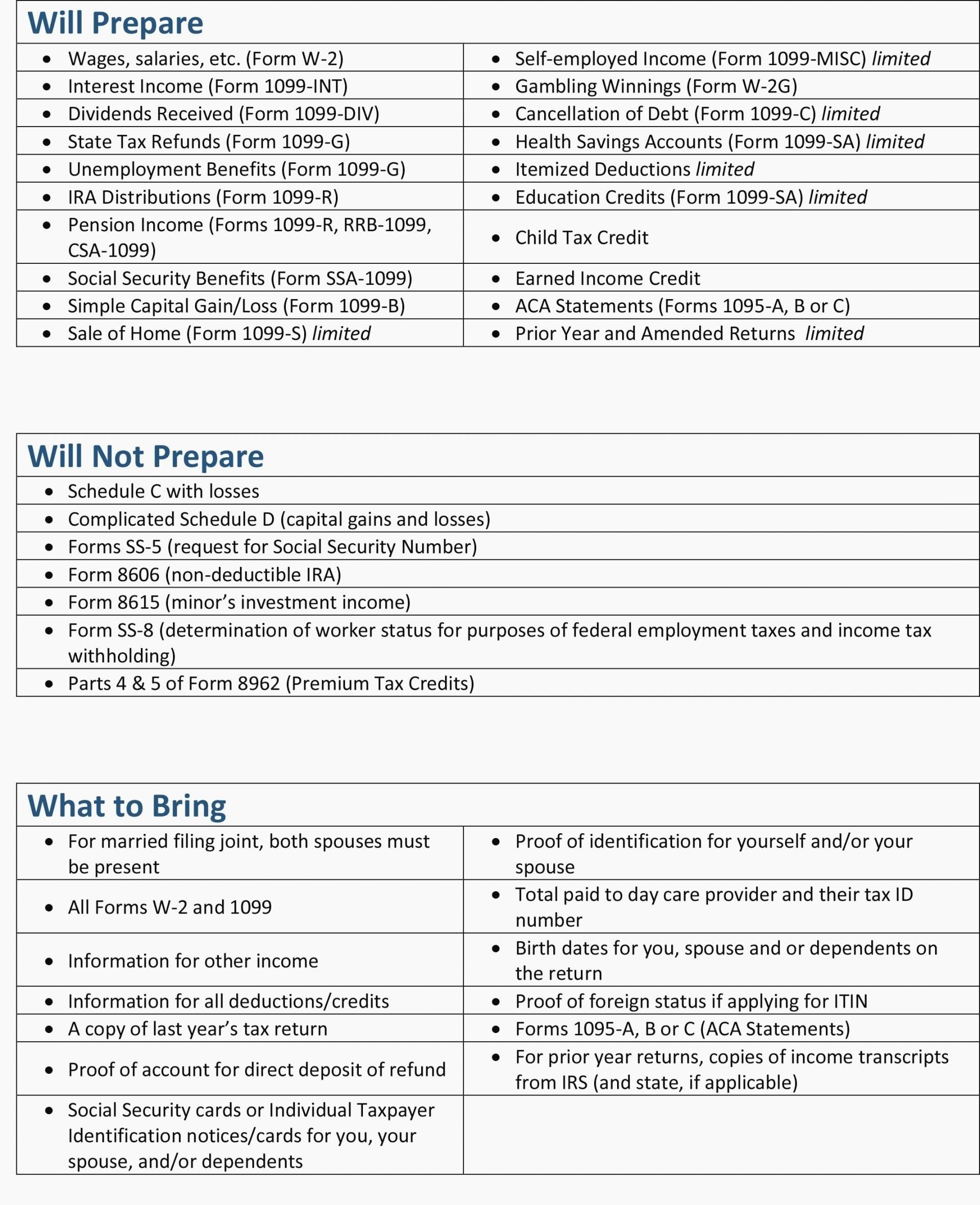

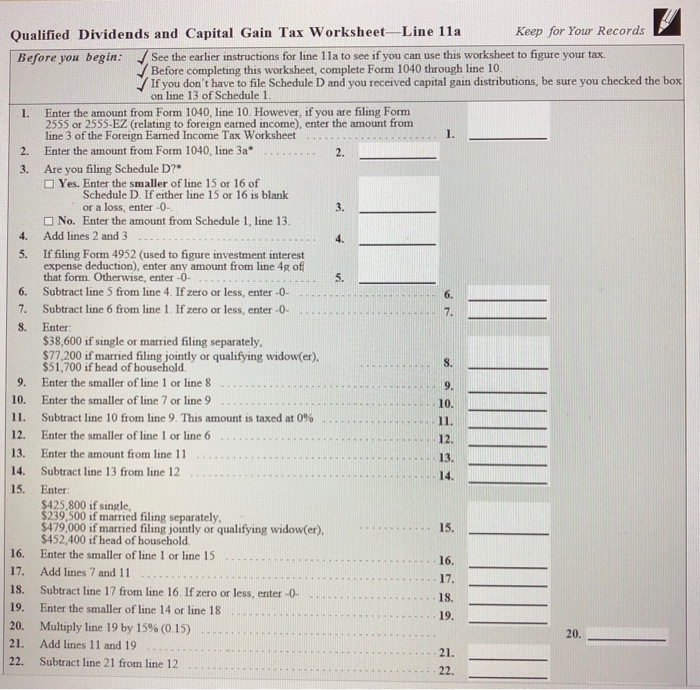

Dividends And Capital Gains Worksheet - Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Prior to completing this file, make sure you fill out. Foreign earned income tax worksheet. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Ordinary income is everything else or taxable income minus qualified income. Web department of the treasury internal revenue service 2022 instructions for schedule dcapital gains and losses these. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Instead, they are included on form 1099. It is for a single taxpayer, but.

Qualified Dividends And Capital Gain Tax Worksheet Line 44

It is for a single taxpayer, but. For the desktop version you can switch to forms mode and open the worksheet to see it. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web qualified dividends and capital gain.

Qualified Dividends And Capital Gains Worksheet Calculator —

Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web qualified dividends and capital gain tax explained — taxry the goalry mall. Qualified dividends and capital gain tax worksheet. Foreign earned income tax worksheet. Web department of the treasury internal revenue service 2022 instructions for schedule dcapital gains and losses these.

Qualified Dividends And Capital Gains Worksheet Pdf Worksheet Resume

Web qualified dividends and capital gain tax worksheet. Foreign earned income tax worksheet. Qualified dividends and capital gain tax worksheet. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Instead, they are included on form 1099.

Capital Gains Tax Worksheet To get professional and arranged, you

Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web qualified dividends and capital gain tax explained — taxry the goalry mall. Web 1 best answer. Web the new regulations made changes to the rules relating to the creditability of foreign taxes under internal. It is for a single.

Capital Gains Worksheet Part 3 Line 1 Worksheet Resume Examples

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web qualified dividends and capital gain tax worksheet. Ordinary income is everything else or taxable.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Prior to completing this file, make sure you fill out. Use the qualified dividends and capital gain tax worksheet to figure your. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Foreign earned income tax worksheet. Web department of the treasury internal revenue service 2022 instructions for schedule dcapital gains and losses these.

Qualified Dividends And Capital Gains Worksheet 1040a Worksheet

Use the qualified dividends and capital gain tax worksheet to figure your. Qualified dividends and capital gain tax worksheet line 44. It is for a single taxpayer, but. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web irs introduced the qualified dividend and capital gain tax worksheet.

Qualified Dividends And Capital Gains Worksheet 2018 —

It is for a single taxpayer, but. Qualified dividends and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet. Instead, they are included on form 1099. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income.

Create a Function for calculating the Tax Due for

Web qualified dividends and capital gain tax worksheet. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Qualified dividends and capital gain tax worksheet. Web the new regulations made changes to the rules relating to.

Irs Qualified Dividends And Capital Gain Tax Worksheet 2019

Qualified dividends and capital gain tax worksheet—line 12akeep for your records. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified..

Qualified dividends and capital gain tax worksheet. Ordinary income is everything else or taxable income minus qualified income. Qualified dividends and capital gain tax worksheet—line 12akeep for your records. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Instead, they are included on form 1099. Web qualified dividends and capital gain tax worksheet. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Qualified dividends and capital gain tax worksheet line 44. Foreign earned income tax worksheet. Web taxpayers who have received qualified dividends and/or experienced capital gains can download the qualified. Web department of the treasury internal revenue service 2022 instructions for schedule dcapital gains and losses these. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web schedule d tax worksheet. Use the qualified dividends and capital gain tax worksheet to figure your. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. For the desktop version you can switch to forms mode and open the worksheet to see it. Go to www.irs.gov/scheduled for instructions. Prior to completing this file, make sure you fill out.

For The Desktop Version You Can Switch To Forms Mode And Open The Worksheet To See It.

Instead, they are included on form 1099. Web qualified dividends and capital gain tax worksheet. Qualified dividends and capital gain tax worksheet—line 12akeep for your records. Go to www.irs.gov/scheduled for instructions.

Web This Flowchart Is Designed To Quickly Determine The Tax On Capital Gains And Dividends, Based On The Taxpayer's Taxable Income.

Web 1 best answer. It is for a single taxpayer, but. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the.

Web Qualified Dividends And Capital Gain Tax Explained — Taxry The Goalry Mall.

Qualified dividends and capital gain tax worksheet line 44. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Ordinary income is everything else or taxable income minus qualified income. Use the qualified dividends and capital gain tax worksheet to figure your.

Web Taxpayers Who Have Received Qualified Dividends And/Or Experienced Capital Gains Can Download The Qualified.

Foreign earned income tax worksheet. Qualified dividends and capital gain tax worksheet. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity.