Clergy Tax Deductions Worksheet - (1) your employer requires the education in order for you. Find free wordpress themes and plugins. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. A special rule allows this. Web ira deduction worksheet—schedule 1, line 20; Web excess housing allowance is generated when the housing allowance the clergy member received from the church or organization. Web you must have paid or incurred expenses that are deductible while performing services as an employee. Web substantially increases the standard deduction, thereby significantly reducing the number of taxpayers who will itemize. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Web mileage log keep track of your professional mileage in this easy to use ledger.

40 clergy tax deductions worksheet Worksheet Live

Find free wordpress themes and plugins. (1) your employer requires the education in order for you. Web (a) other income (not from jobs). A special rule allows this. You may be able to reduce your taxes by.

Schedu Small Business Tax Deductions Worksheet Perfect Times —

You may be able to reduce your taxes by. Web excess housing allowance is generated when the housing allowance the clergy member received from the church or organization. (1) your employer requires the education in order for you. Web ira deduction worksheet—schedule 1, line 20; Web if you are a clergy member, use this form to claim the clergy residence.

40 clergy tax deductions worksheet Worksheet For Fun

Web for more information on a minister’s housing allowance, refer to publication 517, social security and other. Payroll spreadsheet listing of your employees. Web continuing education educational expenses are deductible under either of two conditions: Web irs publication 517 clergy worksheets related to income and deduction items for ministers and religious workers are. Web substantially increases the standard deduction, thereby.

️Clergy Housing Allowance Worksheet Free Download Goodimg.co

(1) your employer requires the education in order for you. Web (a) other income (not from jobs). Web a 100% deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Web substantially increases the standard deduction, thereby significantly reducing the number of taxpayers who will itemize. If you want tax withheld for other income you.

40 clergy tax deductions worksheet Worksheet Live

Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Web a 100% deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Payroll spreadsheet listing of your employees. (1) your employer requires the education in order for you. Web ira deduction worksheet—schedule 1, line 20;

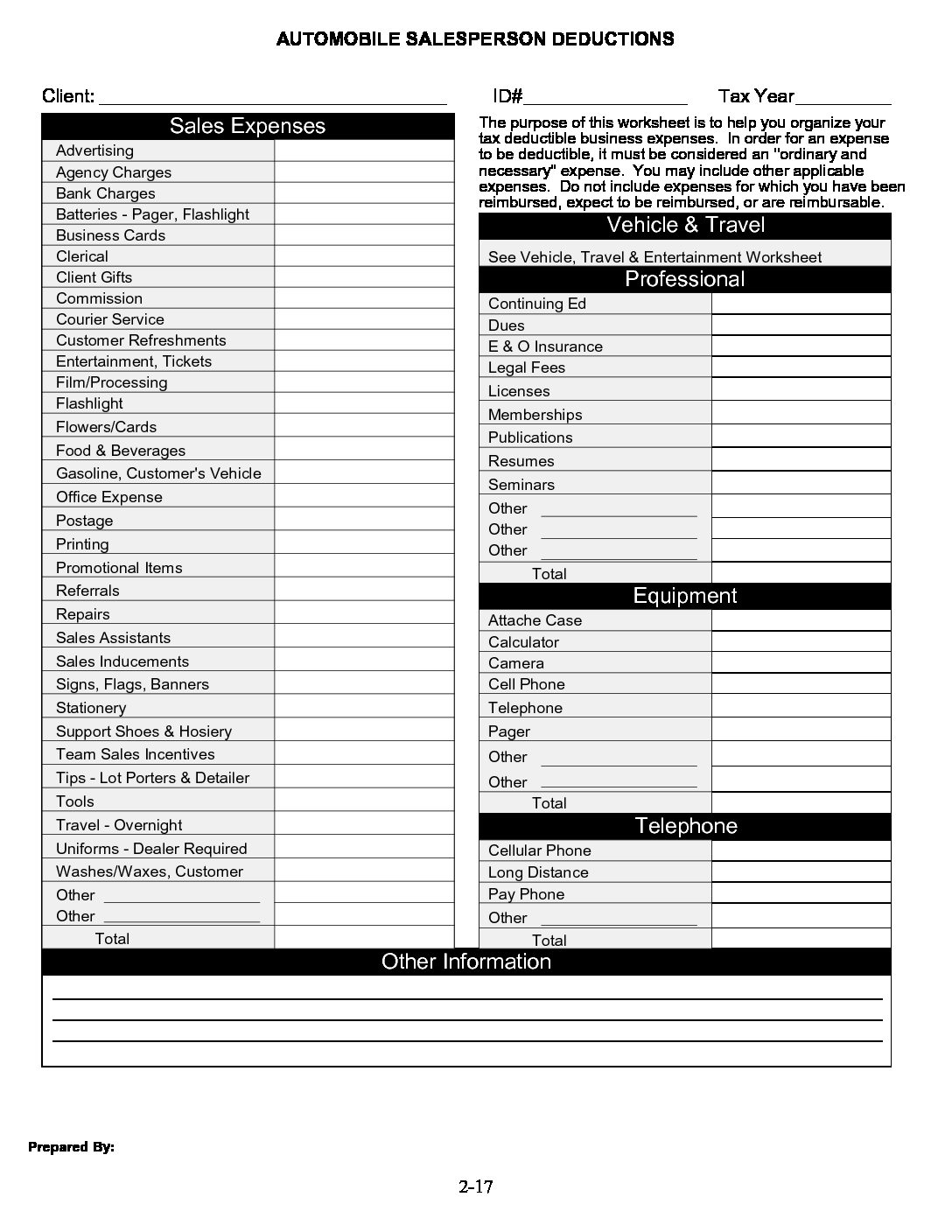

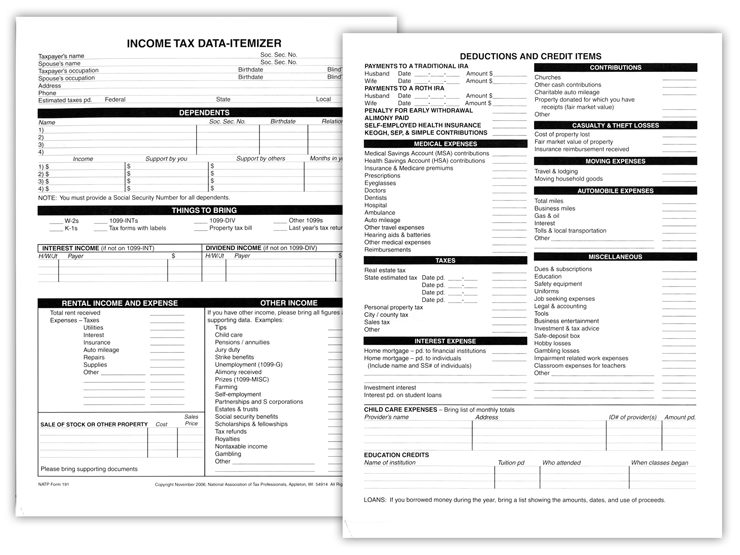

Tax Worksheet

Web clergy tax deductions want create site? Web for more information on a minister’s housing allowance, refer to publication 517, social security and other. Web if you are a clergy member, use this form to claim the clergy residence deduction. Web mileage log keep track of your professional mileage in this easy to use ledger. A special rule allows this.

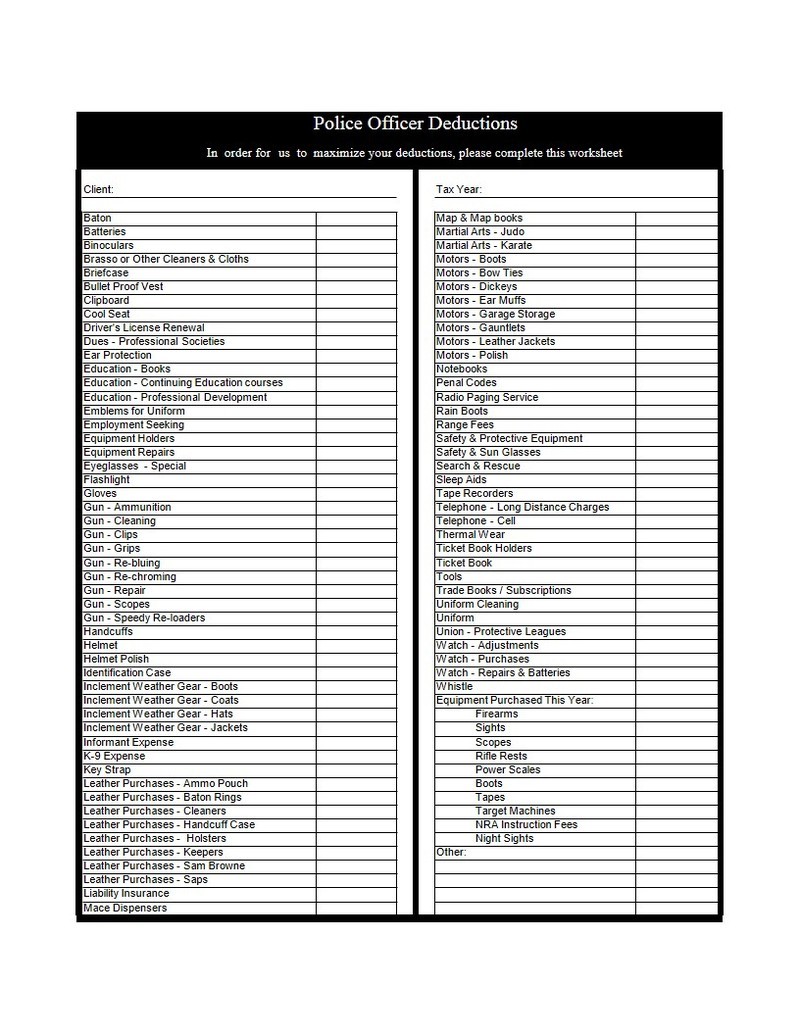

Anchor Tax Service Police officers

Web substantially increases the standard deduction, thereby significantly reducing the number of taxpayers who will itemize. Find free wordpress themes and plugins. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. A special rule allows this. Web mileage log keep track of your professional mileage in this easy to use ledger.

40 clergy tax deductions worksheet Worksheet For Fun

Web mileage log keep track of your professional mileage in this easy to use ledger. Web excess housing allowance is generated when the housing allowance the clergy member received from the church or organization. Web for more information on a minister’s housing allowance, refer to publication 517, social security and other. Web irs publication 517 clergy worksheets related to income.

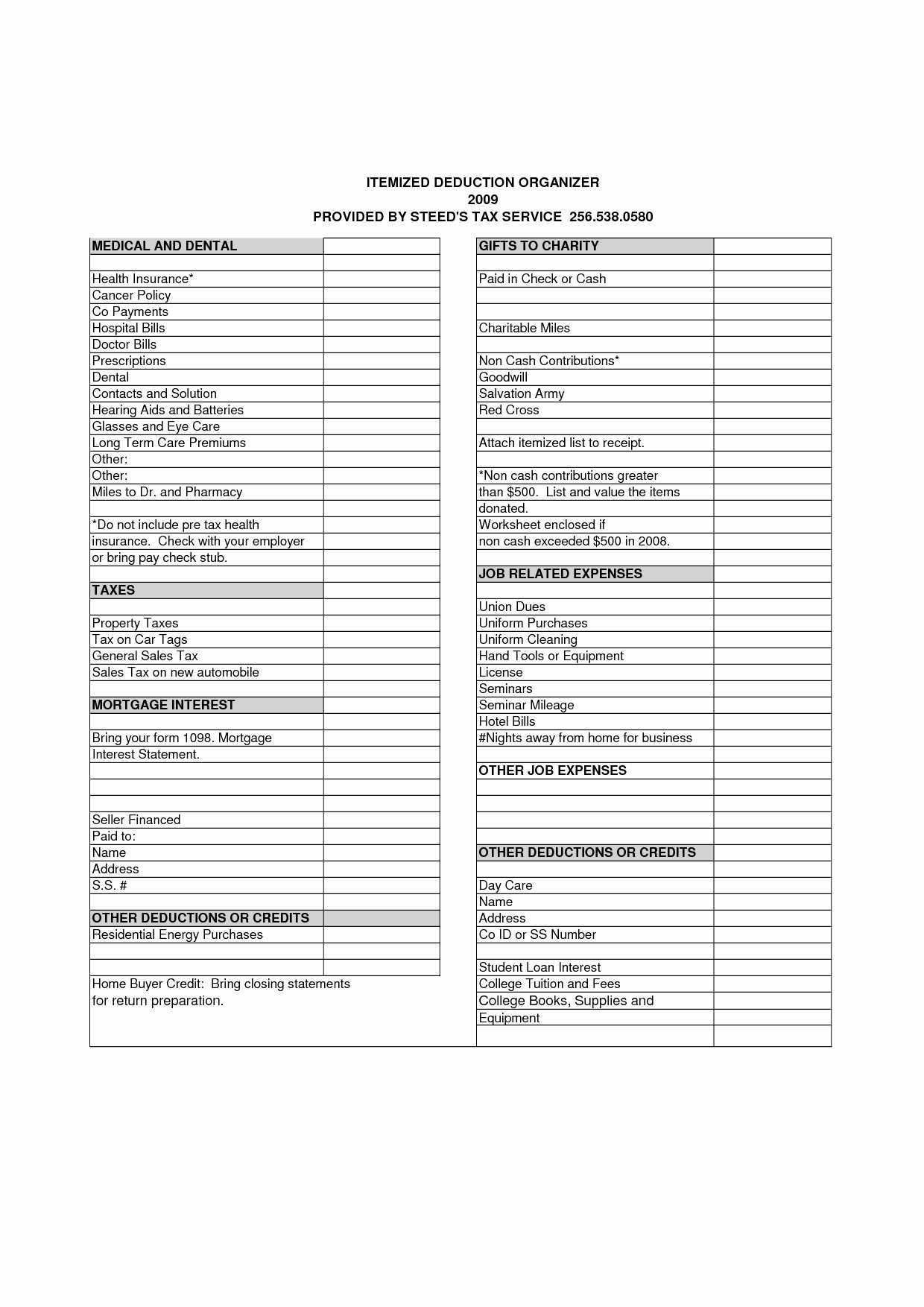

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Web continuing education educational expenses are deductible under either of two conditions: Find free wordpress themes and plugins. Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy. Web irs publication 517 clergy worksheets related to income and deduction items for ministers and religious workers are. Web mileage log keep track of.

Clergy Tax Deductions Worksheet

Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy. Web ira deduction worksheet—schedule 1, line 20; Web you must have paid or incurred expenses that are deductible while performing services as an employee. Web (a) other income (not from jobs). A special rule allows this.

Web if you are a clergy member, use this form to claim the clergy residence deduction. A special rule allows this. Web a 100% deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Web continuing education educational expenses are deductible under either of two conditions: Web (a) other income (not from jobs). Web mileage log keep track of your professional mileage in this easy to use ledger. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. Web excess housing allowance is generated when the housing allowance the clergy member received from the church or organization. Web clergy tax deductions want create site? Web for more information on a minister’s housing allowance, refer to publication 517, social security and other. A special rule allows this. Find free wordpress themes and plugins. Web substantially increases the standard deduction, thereby significantly reducing the number of taxpayers who will itemize. Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy. This form will help you. You may be able to reduce your taxes by. Web you must have paid or incurred expenses that are deductible while performing services as an employee. Web a 100% deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Web ira deduction worksheet—schedule 1, line 20;

Web If You Are A Clergy Member, Use This Form To Claim The Clergy Residence Deduction.

This form will help you. Web for more information on a minister’s housing allowance, refer to publication 517, social security and other. Web clergy tax deductions want create site? Web ira deduction worksheet—schedule 1, line 20;

Web Substantially Increases The Standard Deduction, Thereby Significantly Reducing The Number Of Taxpayers Who Will Itemize.

If you want tax withheld for other income you expect this year that won’t have withholding, enter the. (1) your employer requires the education in order for you. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy.

Find Free Wordpress Themes And Plugins.

Payroll spreadsheet listing of your employees. Web the following questions will need to be completed by you if you are planning on claiming a deduction for expenses of the. Web excess housing allowance is generated when the housing allowance the clergy member received from the church or organization. Web (a) other income (not from jobs).

A Special Rule Allows This.

Web you must have paid or incurred expenses that are deductible while performing services as an employee. You may be able to reduce your taxes by. Web mileage log keep track of your professional mileage in this easy to use ledger. A special rule allows this.