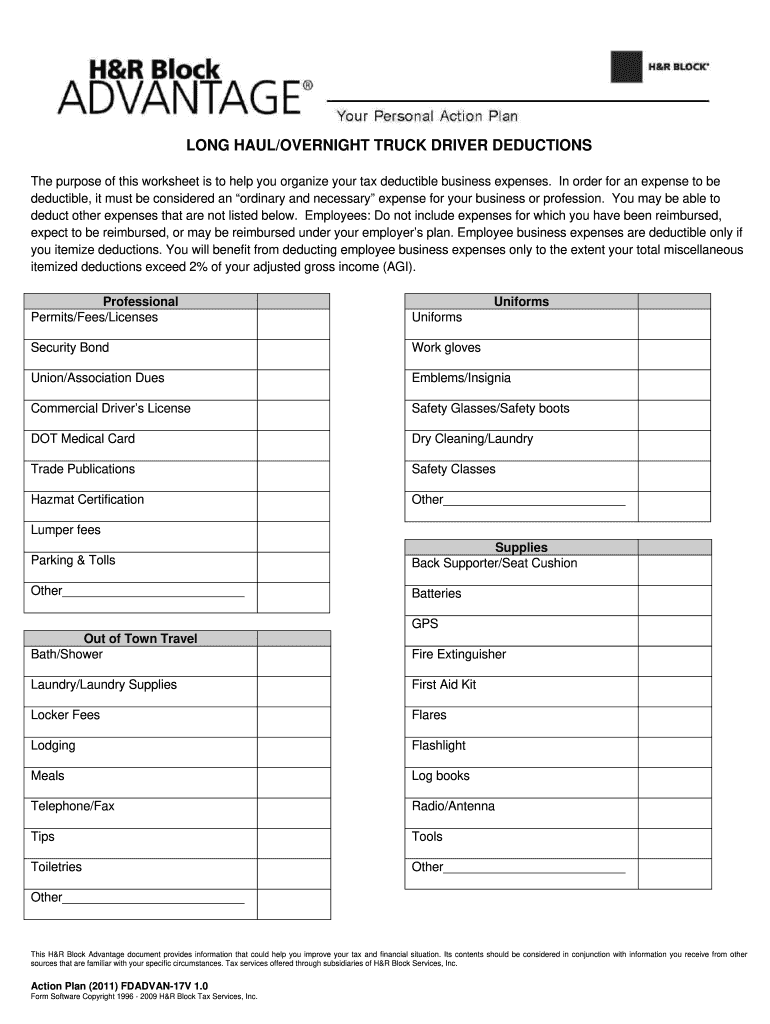

Car And Truck Expenses Worksheet - Web car and truck expenses worksheet says line 51 depreciation allowed or allowable and line 52 amt. Web how to fill out truck driver tax deductions: Web vehicle expense worksheet please use this worksheet to give us your vehicle expenses and mileage information for preparation of. Web 20212021 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete. Web car and truck expense worksheet general info * must have to claim standard mileage rate vehicle 1 vehicle 2 must use exact mileage calculated. Select one or more vehicles. Web step 1 of 2. You can add, edit, and remove vehicles at any time. The chart above shows the standard irs mileage rates for. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type.

Top Car Truck Expenses Worksheet Schedule C Price Design —

Web the 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to. Depreciation limits on cars, trucks, and vans. Web car and truck expenses (employees use org17 ' employee business expenses) org18 vehicle questions vehicle 1. Web by default,.

Turbotax Car And Truck Expenses Worksheet

Web car and truck expense worksheet general info * must have to claim standard mileage rate vehicle 1 vehicle 2 must use exact mileage calculated. Web car and truck expenses worksheet says line 51 depreciation allowed or allowable and line 52 amt. Web car and truck expenses (employees use org17 ' employee business expenses) org18 vehicle questions vehicle 1. Web.

Truck Expenses Worksheet Spreadsheet template, Printable worksheets

Web step 1 of 2. Car expenses and use of the. Web 2020 2020 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete for all vehicles) 1. Depreciation limits on cars, trucks, and vans. You can edit vehicles to personalize.

Car and Truck Expenses Worksheet

Use form ftb 3885, corporation depreciation and amortization, to calculate california depreciation and amortization. Depreciation limits on cars, trucks, and vans. Web vehicle expense worksheet please use this worksheet to give us your vehicle expenses and mileage information for preparation of. Web how to fill out truck driver tax deductions: Web car and truck expenses worksheet says line 51 depreciation.

Owner Operator Tax Deductions Worksheet Form Fill Out and Sign

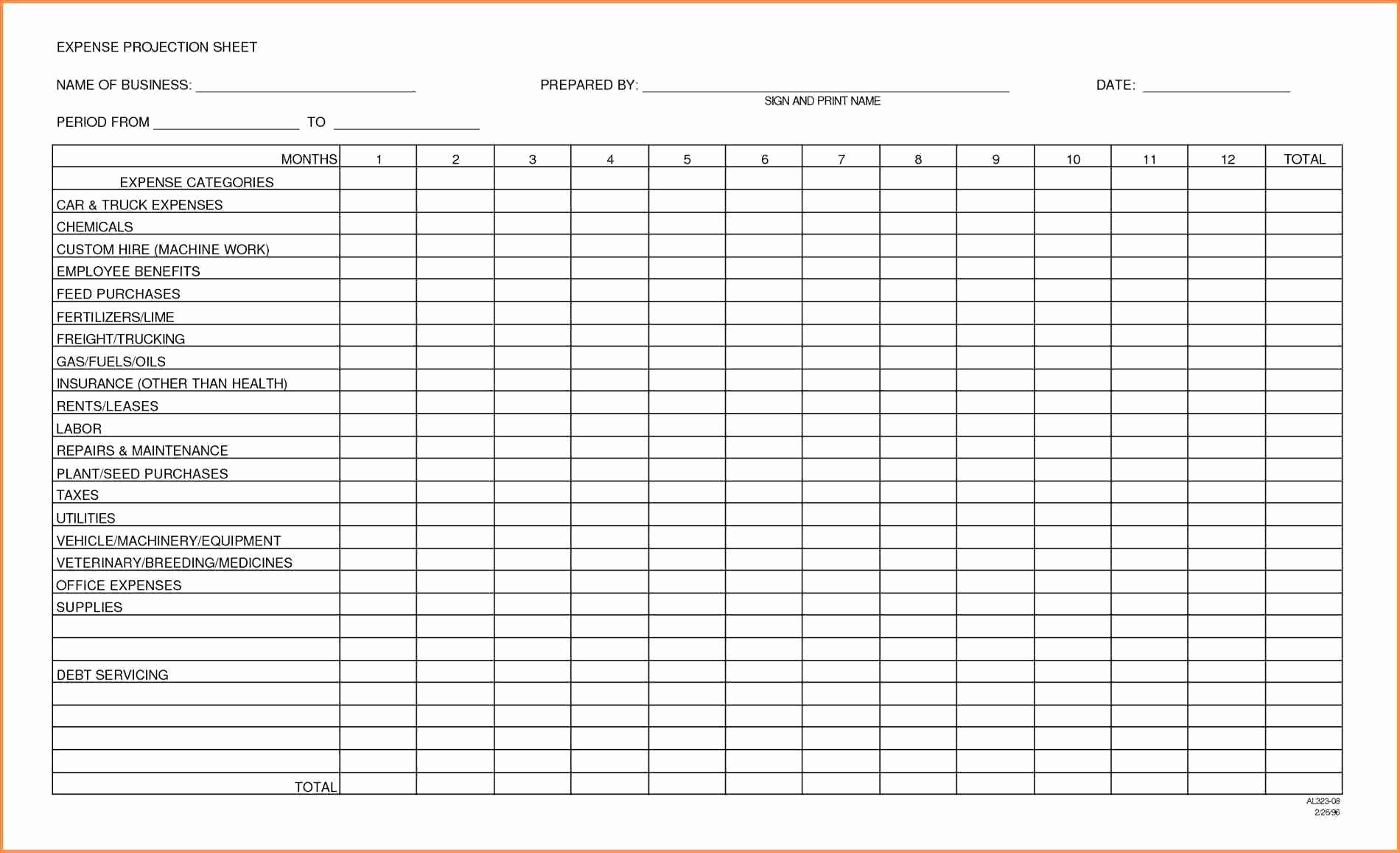

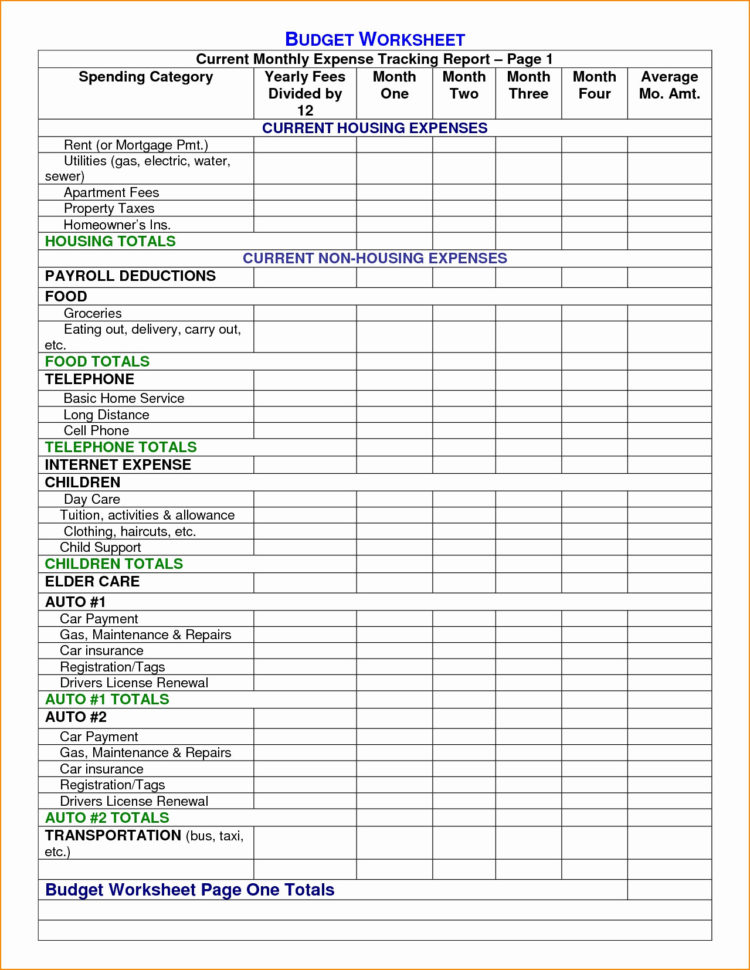

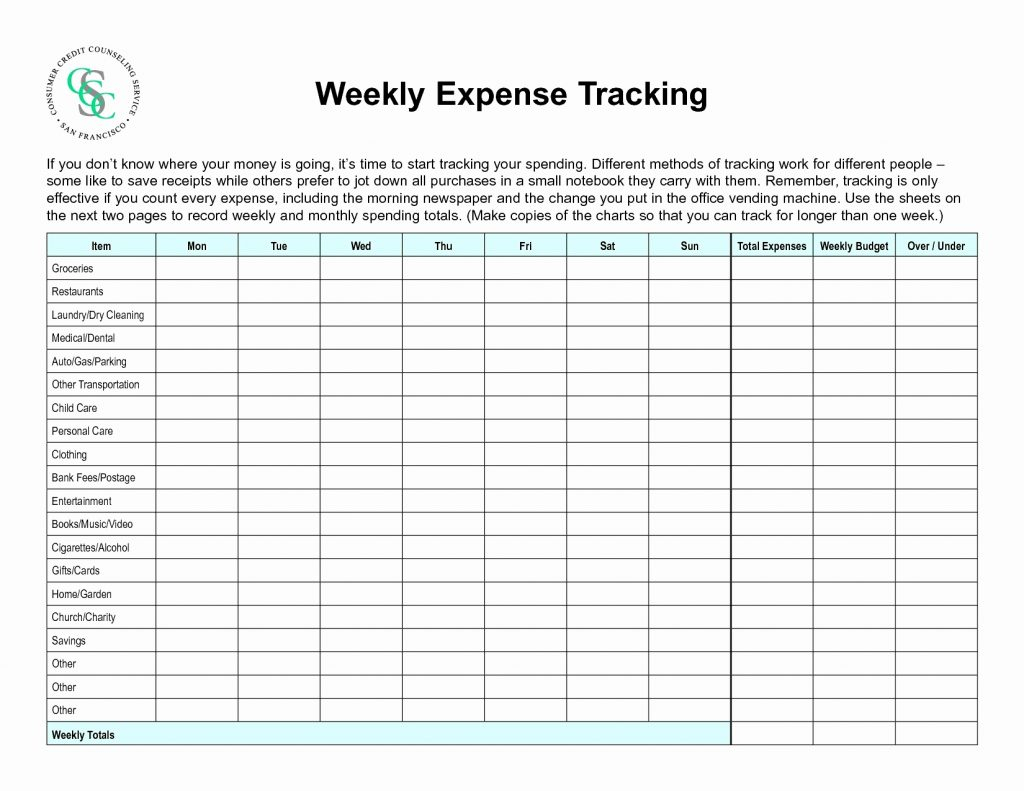

Web this printable small business expense report template offers an easy way to track company expenses. Web vehicle expense worksheet please use this worksheet to give us your vehicle expenses and mileage information for preparation of. Web car and truck expenses (employees use org17 ' employee business expenses) org18 vehicle questions vehicle 1. Web car expenses and use of the.

Truck Driver Expenses Worksheet —

Web by default, proconnect generates a vehicle expense worksheet that calculates the standard mileage deduction. Web the 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to. Web this printable small business expense report template offers an easy way.

The Car Truck Expenses Worksheet Price —

Web car & truck expenses worksheet (ford fusion): Web 2020 2020 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete for all vehicles) 1. Web how to fill out truck driver tax deductions: The chart above shows the standard irs mileage rates for. Web step 1 of 2.

20++ Car And Truck Expenses Worksheet

Web vehicle expense worksheet please use this worksheet to give us your vehicle expenses and mileage information for preparation of. Depreciation limits on cars, trucks, and vans. The chart above shows the standard irs mileage rates for. The internal revenue service reminds taxpayers to become familiar with the tax law before. Car expenses and use of the.

Car And Truck Expenses Worksheet —

Web car expenses and use of the standard mileage rate are explained in chapter 4. You can add, edit, and remove vehicles at any time. Web car and truck expense worksheet general info * must have to claim standard mileage rate vehicle 1 vehicle 2 must use exact mileage calculated. Web 2020 2020 tax year car and truck expense worksheet.

Schedule C Spreadsheet Google Spreadshee schedule c spreadsheet

Web car and truck expenses (employees use org17 ' employee business expenses) org18 vehicle questions vehicle 1. Use form ftb 3885, corporation depreciation and amortization, to calculate california depreciation and amortization. Web car and truck expenses worksheet says line 51 depreciation allowed or allowable and line 52 amt. Web level 1 car & truck expenses worksheet: Web 20212021 tax year.

Web car and truck expenses (employees use org17 ' employee business expenses) org18 vehicle questions vehicle 1. Web how to fill out truck driver tax deductions: Car expenses and use of the. Web car & truck expenses worksheet (ford fusion): Web step 1 of 2. Web the 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to. Web car and truck expenses worksheet says line 51 depreciation allowed or allowable and line 52 amt. Web car and truck expense worksheet general info * must have to claim standard mileage rate vehicle 1 vehicle 2 must use exact mileage calculated. Web 2020 2020 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete for all vehicles) 1. The internal revenue service reminds taxpayers to become familiar with the tax law before. Web level 1 car & truck expenses worksheet: Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type. Web vehicle expense worksheet please use this worksheet to give us your vehicle expenses and mileage information for preparation of. Use form ftb 3885, corporation depreciation and amortization, to calculate california depreciation and amortization. Select one or more vehicles. Web this printable small business expense report template offers an easy way to track company expenses. Web by default, proconnect generates a vehicle expense worksheet that calculates the standard mileage deduction. Web car expenses and use of the standard mileage rate are explained in chapter 4. Web 20212021 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete. You can edit vehicles to personalize.

Web Level 1 Car & Truck Expenses Worksheet:

Web step 1 of 2. You can add, edit, and remove vehicles at any time. Web 20212021 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete. Web car and truck expenses (employees use org17 ' employee business expenses) org18 vehicle questions vehicle 1.

Depreciation Limits On Cars, Trucks, And Vans.

The chart above shows the standard irs mileage rates for. Web vehicle expense worksheet please use this worksheet to give us your vehicle expenses and mileage information for preparation of. Web 2020 2020 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete for all vehicles) 1. Select one or more vehicles.

The Internal Revenue Service Reminds Taxpayers To Become Familiar With The Tax Law Before.

Use form ftb 3885, corporation depreciation and amortization, to calculate california depreciation and amortization. Car expenses and use of the. Web by default, proconnect generates a vehicle expense worksheet that calculates the standard mileage deduction. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type.

Web Car And Truck Expenses Worksheet Says Line 51 Depreciation Allowed Or Allowable And Line 52 Amt.

You can edit vehicles to personalize. Web this printable small business expense report template offers an easy way to track company expenses. Web car and truck expense worksheet general info * must have to claim standard mileage rate vehicle 1 vehicle 2 must use exact mileage calculated. Web the 2022 per mile rate for business use of your vehicle is 58.5 cents (0.585) from january 1, 2022, to june 30, 2022, and 62.5 cents (0.625) from july 1, 2022, to.