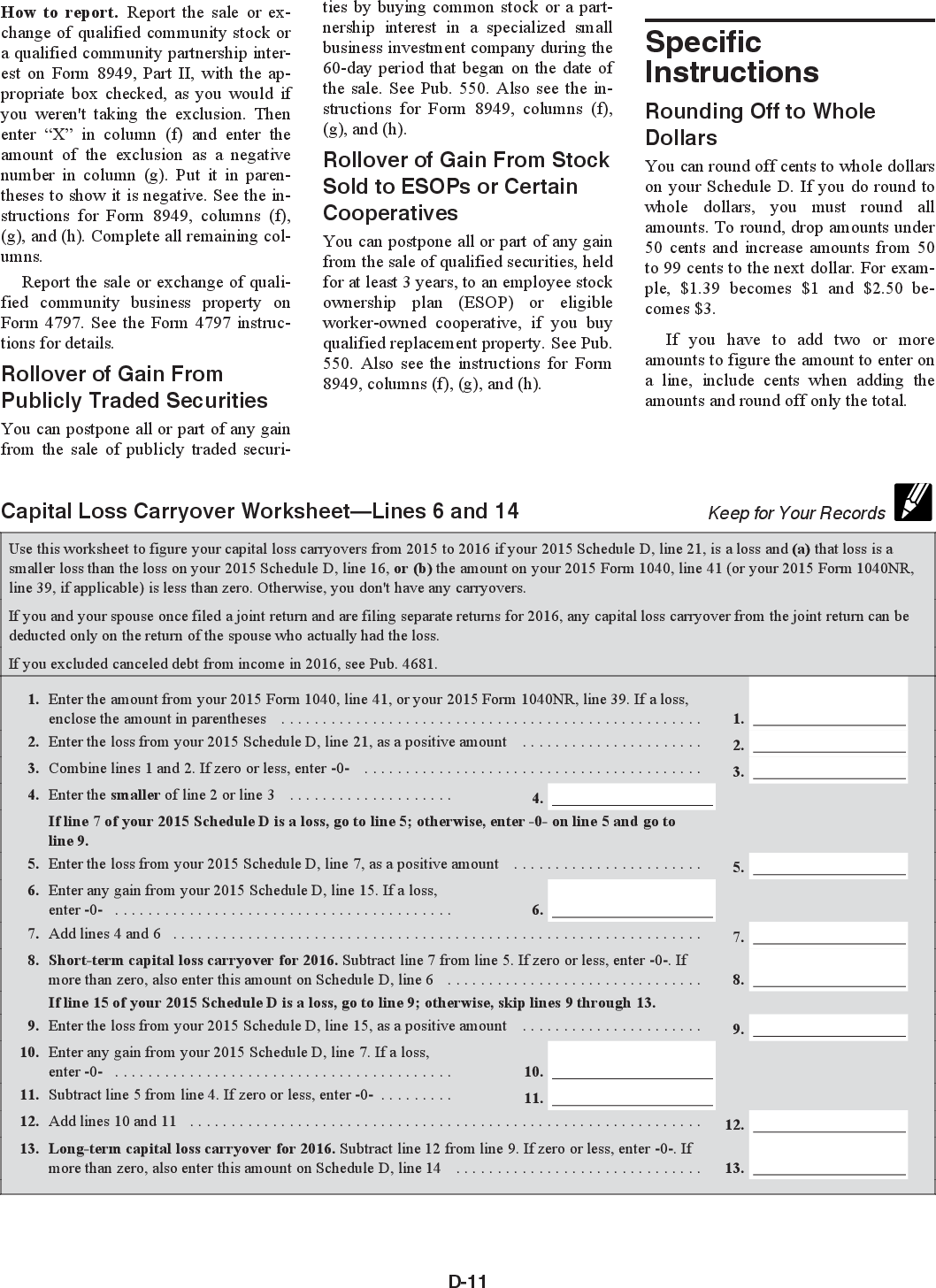

Capital Loss Carryover Worksheet Example - If you have no capital. Web the 2021 capital loss carryover form is used by individuals who have incurred capital losses in the previous tax year and want. The john doe trust is a grantor type trust. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. Web for example, if your net capital loss in 2020 was $7,000 and you're filing as single: You would have a $5,000 capital loss if you purchased an asset for $50,000, invested $10,000 into maintaining it, then. Web for example, the irs allows investors to deduct up to $3,000 from their taxable income if the capital loss is from the sales of assets like. Sale of property bought at various times. You may use the capital.

21+ 2020 Capital Loss Carryover Worksheet ShilpaDaanya

How to figure an nol, when to. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of. Web this article has been a guide to what is capital loss carryover. Web use the worksheet at the end of these instructions to figure your capital loss.

Capital Loss Carryover Worksheet slidesharedocs

You may deduct capital losses up to the amount of your capital gains, plus. If line 8 is a net. Web for example, if your net capital loss in 2020 was $7,000 and you're filing as single: Web for example, the irs allows investors to deduct up to $3,000 from their taxable income if the capital loss is from the.

Capital Loss Carryover Worksheet 2020 Fill Online, Printable

Real property used in your trade or business; How to figure an nol, when to. Web this article has been a guide to what is capital loss carryover. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. Web for example, the irs allows investors to deduct up to.

California Capital Loss Carryover Worksheet

Use get form or simply click on the template preview to. Web this article has been a guide to what is capital loss carryover. The john doe trust is a grantor type trust. If line 8 is a net. Real property used in your trade or business;

California Capital Loss Carryover Worksheet

Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. You may use the capital. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of. The sale or exchange of: Web for example, say.

Capital Loss Carryover Worksheet slidesharedocs

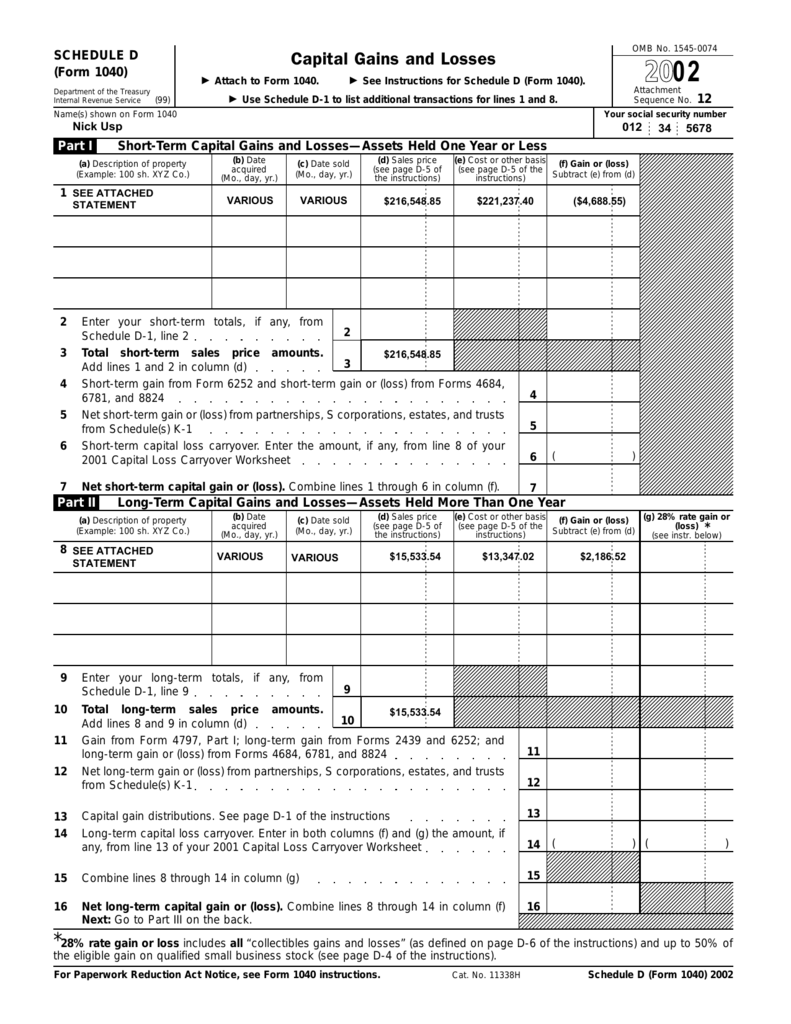

If line 8 is a net. During the year, the trust sold 100 shares of abc stock for $1,010 in which it. Web lets' look at an example: This publication discusses nols for individuals, estates, and trusts. Here we explain its examples, formula, how to calculate,.

Capital Loss Carryover Worksheet Example Educational worksheets, Tax

Sale of property bought at various times. Web capital loss carryover is the amount of capital losses a person or economy ca take into future tax years. Real property used in your trade or business; Use get form or simply click on the template preview to. This publication discusses nols for individuals, estates, and trusts.

worksheet. 2013 Capital Loss Carryover Worksheet. Grass Fedjp Worksheet

Web if your net capital loss is more than this limit, you can carry the loss forward to later years. Web this article has been a guide to what is capital loss carryover. During the year, the trust sold 100 shares of abc stock for $1,010 in which it. Web for example, the irs allows investors to deduct up to.

California Capital Loss Carryover Worksheet

Web the 2021 capital loss carryover form is used by individuals who have incurred capital losses in the previous tax year and want. Web use the worksheet at the end of these instructions to figure your capital loss carryover to 2022. Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21,.

Carryover Worksheets

Web if my 2022 capital loss carryover worksheet has, let’s say, $80k on line 8 (short term capital loss carryover for. How to figure an nol, when to. You may deduct capital losses up to the amount of your capital gains, plus. Click the button get form to open it and begin. The sale or exchange of:

Web for example, the irs allows investors to deduct up to $3,000 from their taxable income if the capital loss is from the sales of assets like. You may deduct capital losses up to the amount of your capital gains, plus. Web if your net capital loss is more than this limit, you can carry the loss forward to later years. Use get form or simply click on the template preview to. You would have a $5,000 capital loss if you purchased an asset for $50,000, invested $10,000 into maintaining it, then. Web what this publication covers. Here we explain its examples, formula, how to calculate,. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. If you have no capital. The john doe trust is a grantor type trust. Web the 2021 capital loss carryover form is used by individuals who have incurred capital losses in the previous tax year and want. Web if my 2022 capital loss carryover worksheet has, let’s say, $80k on line 8 (short term capital loss carryover for. During the year, the trust sold 100 shares of abc stock for $1,010 in which it. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that. Web lets' look at an example: Sale of property bought at various times. Web this article has been a guide to what is capital loss carryover. Web use the worksheet at the end of these instructions to figure your capital loss carryover to 2022. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of. Real property used in your trade or business;

You May Use The Capital.

During the year, the trust sold 100 shares of abc stock for $1,010 in which it. Web capital loss carryover is the amount of capital losses a person or economy ca take into future tax years. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. Web use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a loss and one of.

This Publication Discusses Nols For Individuals, Estates, And Trusts.

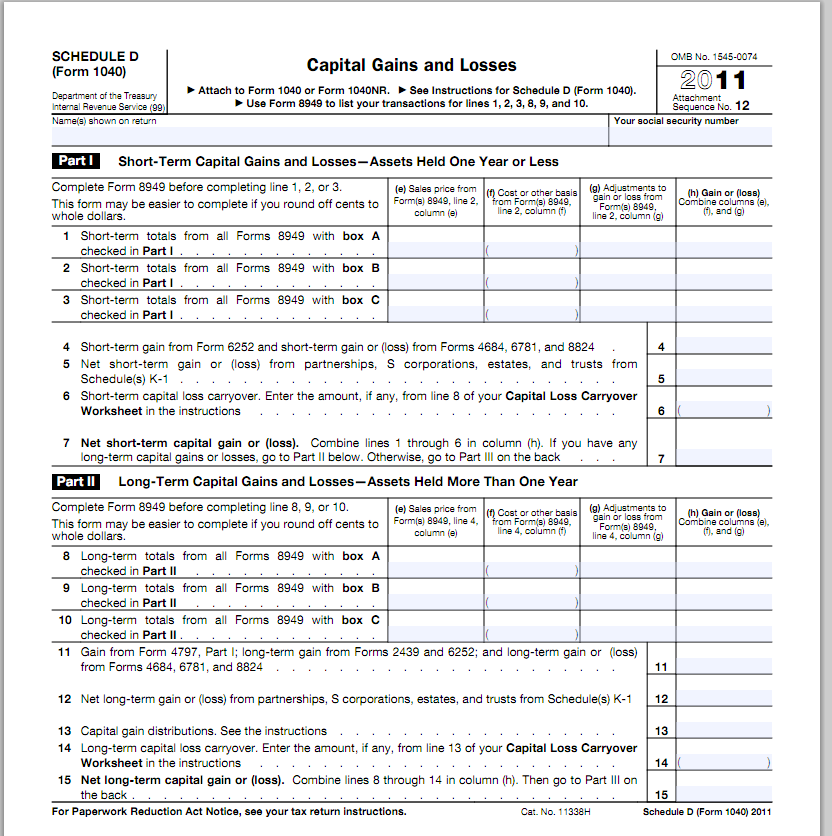

Web the 2021 capital loss carryover form is used by individuals who have incurred capital losses in the previous tax year and want. The sale or exchange of: Web forms and instructions about schedule d (form 1040), capital gains and losses use schedule d (form 1040) to report the. If you have no capital.

Here We Explain Its Examples, Formula, How To Calculate,.

Sale of property bought at various times. Web for example, the irs allows investors to deduct up to $3,000 from their taxable income if the capital loss is from the sales of assets like. Web use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021 schedule d, line 21, is a loss and (a) that. Web what this publication covers.

Real Property Used In Your Trade Or Business;

Web this article has been a guide to what is capital loss carryover. Web if your net capital loss is more than this limit, you can carry the loss forward to later years. Web for example, if your net capital loss in 2020 was $7,000 and you're filing as single: If line 8 is a net.