Capital Loss Carryforward Worksheet - Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Web any capital loss carryover to the next tax year will automatically be calculated in taxact ®. Federal loss on line 10 is: Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. Web entering a capital loss carryover in the corporate module. Go to screen 15, dispositions (sch. Web loss on line 10 and gain on line 11. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss. Web use the worksheet below to figure your capital loss carryover to 2023.

How Do Capital Loss Carryforwards Work? Fee Only, Fiduciary

Web entering a capital loss carryover in the corporate module. Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. Use get form or simply click on the template preview to. Go to screen 15, dispositions (sch. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018.

Capital Loss Carryover Worksheet Example Educational worksheets, Tax

Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the.

What Is A Federal Carryover Worksheet

Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of. Web instructions for form 6251 (2022) alternative minimum tax—individuals section references are to the.

California Capital Loss Carryover Worksheet

Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. Federal loss on line 10 is: If line 8 is a net capital loss, enter the smaller of. Go to screen 15, dispositions (sch. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital.

California Capital Loss Carryover Worksheet

Web use the worksheet below to figure your capital loss carryover to 2023. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss. Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. Web if the estate.

Capital Gains Loss Worksheet Worksheet Resume Examples

These instructions explain how to complete schedule d (form. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Web capital loss carryover worksheet—schedule d (form 1040) (2021).

Capital Loss Carryover Worksheet 2020 Fill Online, Printable

If line 8 is a net capital loss, enter the smaller of. Go to screen 15, dispositions (sch. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss. ($2,000) california gain on line 11 is: Web capital loss carryover is the net amount of capital losses.

What Is A Federal Carryover Worksheet

Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the capital loss carryover section using. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have.

Capital Loss Carryover Worksheet slidesharedocs

Web it also includes links to worksheets you can use to determine the amount you can carry forward. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the capital loss carryover section using. Carryover losses on your investments are. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your.

21+ 2020 Capital Loss Carryover Worksheet ShilpaDaanya

Web it also includes links to worksheets you can use to determine the amount you can carry forward. Use get form or simply click on the template preview to. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss. Web solved•by turbotax•2037•updated may 19, 2023. Web.

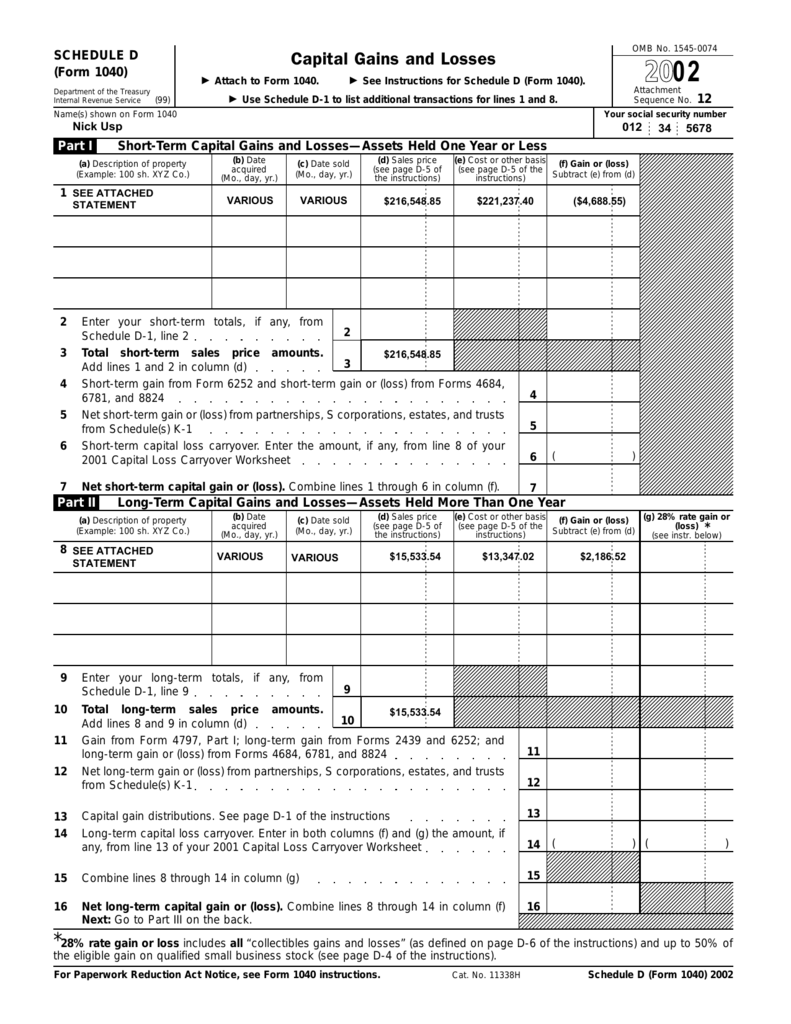

Web entering a capital loss carryover in the corporate module. Web it also includes links to worksheets you can use to determine the amount you can carry forward. Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. These instructions explain how to complete schedule d (form. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from. You may deduct capital losses up to the amount of your capital gains, plus. Web 2022 instructions for schedule dcapital gains and losses. Web the tax cuts and jobs act (tcja), section 11012, as amended by the cares act, section 2304, revised section 461 (l) to limit the amount of losses from. To access the capital loss. Use get form or simply click on the template preview to. Federal loss on line 10 is: Go to screen 15, dispositions (sch. Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. Web instructions for form 6251 (2022) alternative minimum tax—individuals section references are to the internal revenue. Web solved•by turbotax•2037•updated may 19, 2023. Web any capital loss carryover to the next tax year will automatically be calculated in taxact ®. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of. Web use the worksheet below to figure your capital loss carryover to 2023. Carryover losses on your investments are. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years.

If Line 8 Is A Net Capital Loss, Enter The Smaller Of.

Web tax loss carryforward, sometimes called capital loss carryover, is the process of carrying forward capital losses into future tax years. Web any capital loss carryover to the next tax year will automatically be calculated in taxact ®. Web 10 rows use this worksheet to figure your capital loss carryovers from 2021 to 2022 if your 2021. Web loss on line 10 and gain on line 11.

Carryover Losses On Your Investments Are.

Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may have a capital loss. Web entering a capital loss carryover in the corporate module. Web instructions for form 6251 (2022) alternative minimum tax—individuals section references are to the internal revenue. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from.

Web Use This Worksheet To Calculate Capital Loss Carryovers From 2019 To 2020 If 2019 Schedule D, Line 21, Is A Loss And One Of.

Federal loss on line 10 is: These instructions explain how to complete schedule d (form. Go to screen 15, dispositions (sch. Web capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years.

Web Solved•By Turbotax•2037•Updated May 19, 2023.

Web 2022 instructions for schedule dcapital gains and losses. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21,. Web use the worksheet below to figure your capital loss carryover to 2023. Web it also includes links to worksheets you can use to determine the amount you can carry forward.