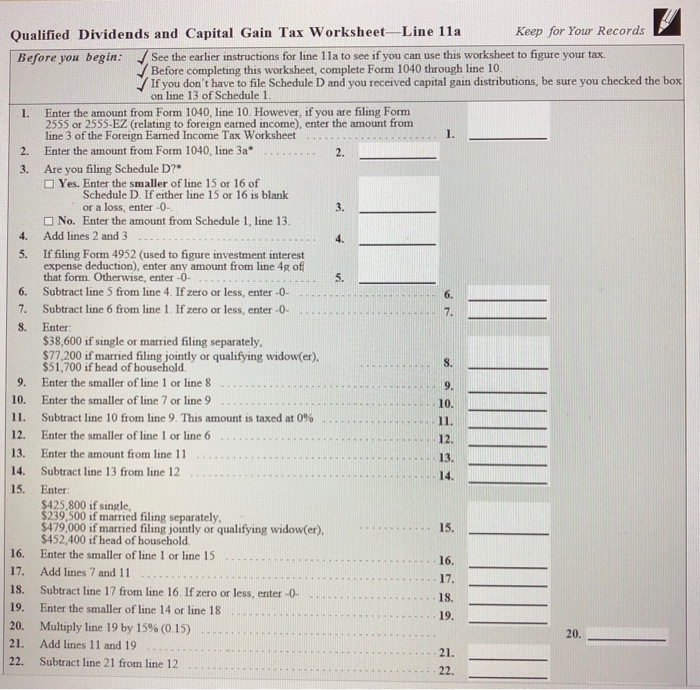

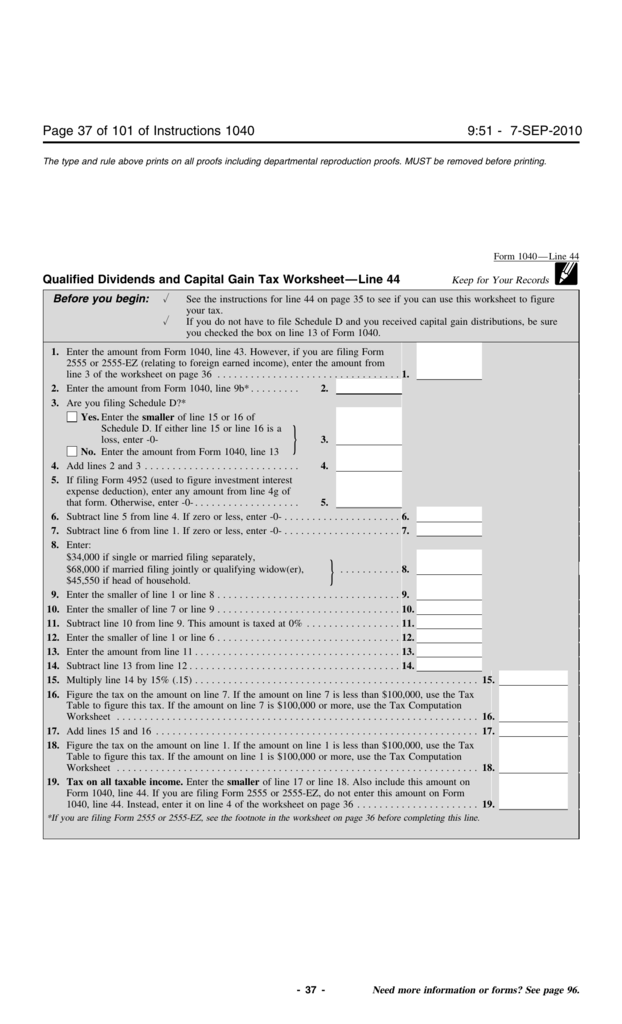

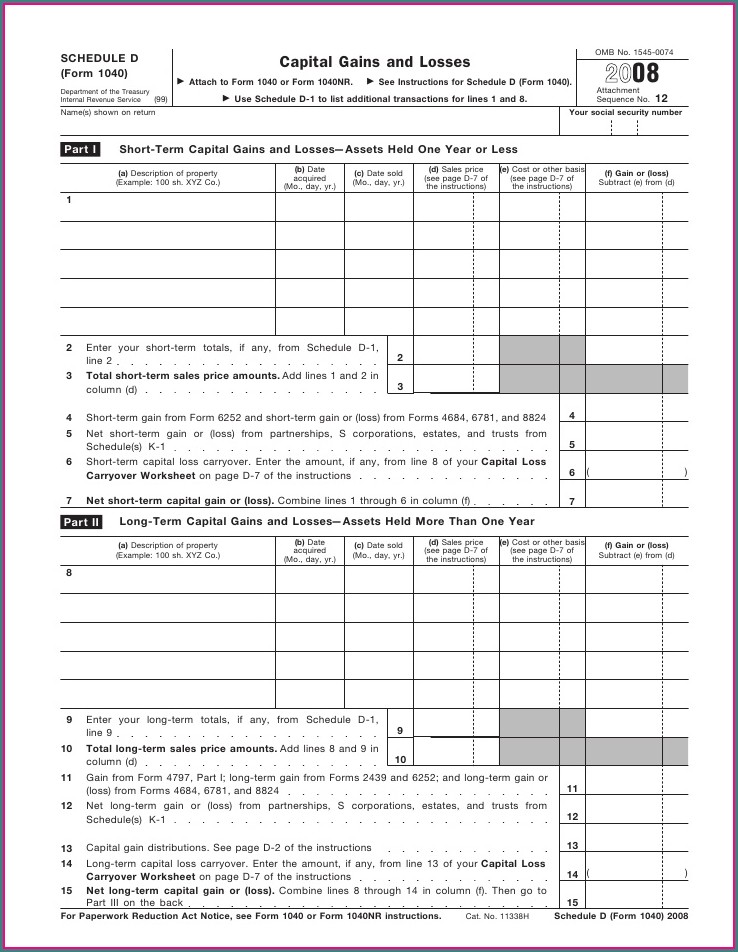

Capital Gains And Qualified Dividends Worksheet - Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Web report your qualified dividends on line 9b of form 1040 or 1040a. Web qualified dividends and capital gains rate differential adjustments the united states (u.s.) taxes its individual residents and. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. See the earlier instructions for line 12a to. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. Use the qualified dividends and capital gain tax worksheet.

Qualified Dividends And Capital Gains Worksheet 2010 —

Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Web 1 best answer. See the earlier instructions for line 12a to. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web on the turbotax form 1040/sr wks , between lines 15 and 16 “.

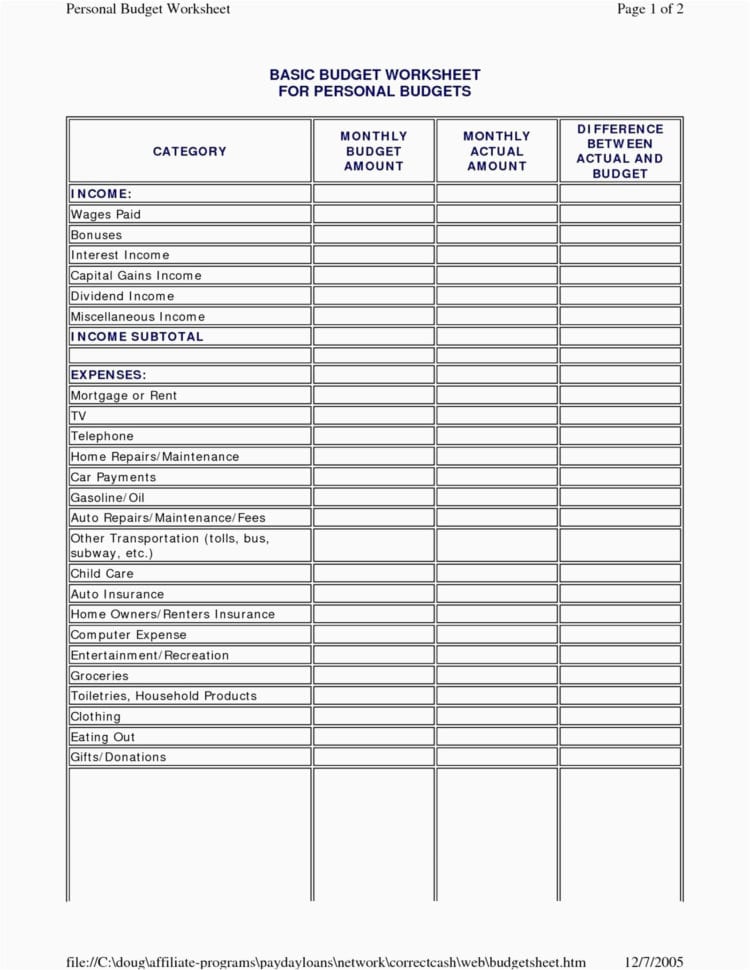

Create a Function for calculating the Tax Due for

See the earlier instructions for line 12a to. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Web taxes are taken out on both capital gains.

Qualified Dividends and Capital Gain Tax Worksheet

See the earlier instructions for line 12a to. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. For the desktop version you can switch to forms mode and open the worksheet to see it. Web report your qualified dividends on.

Qualified Dividends And Capital Gains Worksheet Calculator —

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. Web qualified dividends and capital gains rate differential adjustments the united states (u.s.) taxes its individual residents and. Web on the turbotax form 1040/sr wks , between lines 15 and 16 “ tax smart.

Capital Gain Tax Worksheet Line 41

Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Web.

Qualified Dividends And Capital Gains Worksheet Calculator —

Web on the turbotax form 1040/sr wks , between lines 15 and 16 “ tax smart worksheet” item 3: Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. Use the qualified dividends and capital gain tax worksheet. Web 1 best answer. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule.

2016 Qualified Dividends And Capital Gains Worksheet worksheet

Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web we will answer questions.

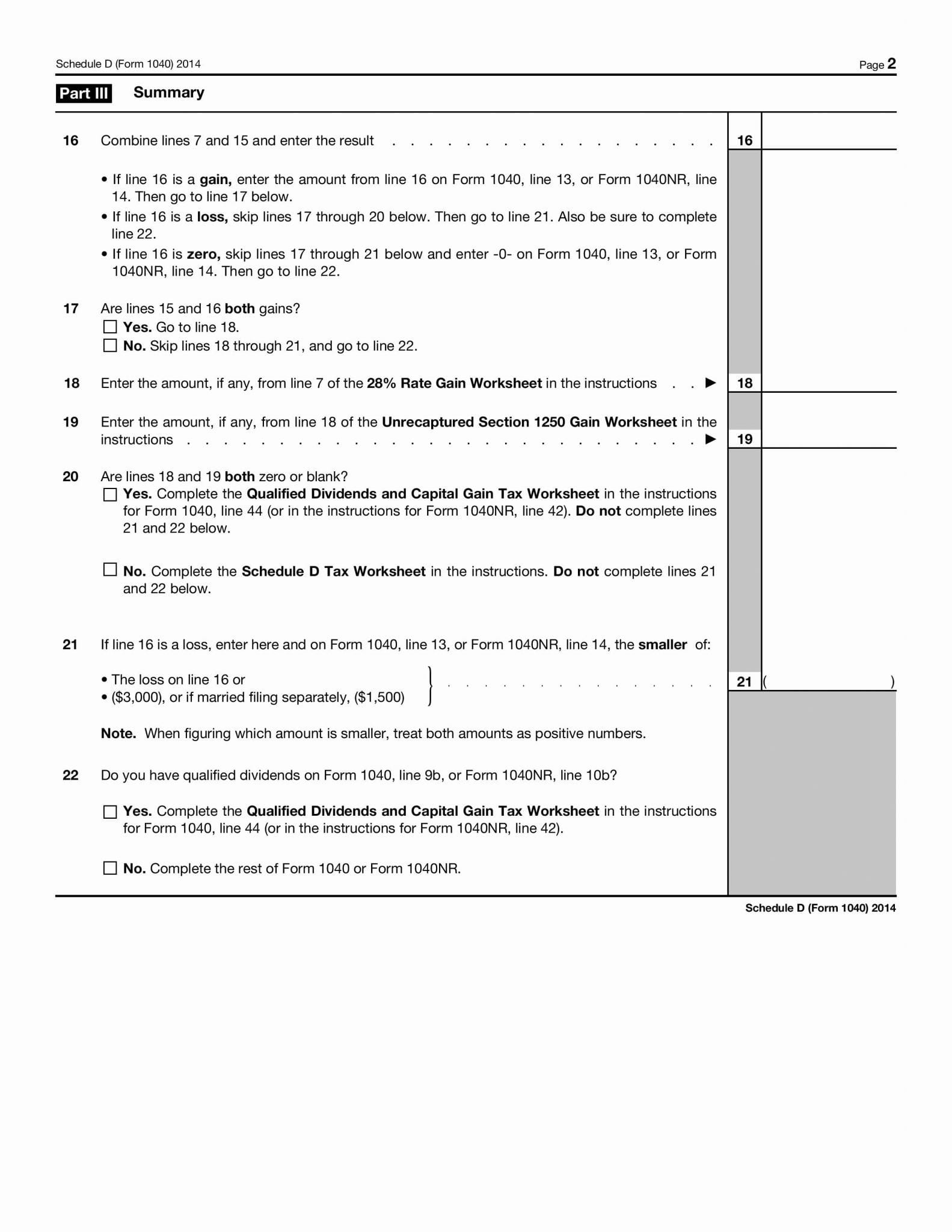

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Use the qualified dividends and capital gain tax worksheet. See the earlier instructions for line 12a to. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web 1 best answer.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

For the desktop version you can switch to forms mode and open the worksheet to see it. Yes no if “yes,” attach form 8949. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and.

Capital Gains Worksheet Part 3 Line 1 Worksheet Resume Examples

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Web report your qualified dividends on line 9b of form 1040 or 1040a. Use the qualified dividends and capital gain tax worksheet. See the earlier.

Web on the turbotax form 1040/sr wks , between lines 15 and 16 “ tax smart worksheet” item 3: Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. It is for a single taxpayer, but. Yes no if “yes,” attach form 8949. Use the qualified dividends and capital gain tax worksheet. Web qualified dividends and capital gains rate differential adjustments the united states (u.s.) taxes its individual residents and. For the desktop version you can switch to forms mode and open the worksheet to see it. Web 1 best answer. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web report your qualified dividends on line 9b of form 1040 or 1040a. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the. See the earlier instructions for line 12a to. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the. Web taxes are taken out on both capital gains and dividend income but it’s not the same as income tax. Web the worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if:

Web This Flowchart Is Designed To Quickly Determine The Tax On Capital Gains And Dividends, Based On The Taxpayer's Taxable Income.

Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Web qualified dividends and capital gains rate differential adjustments the united states (u.s.) taxes its individual residents and.

Web Use The Qualified Dividends And Capital Gain Tax Worksheet To Figure Your Tax If You Do Not Have To Use The.

Use the qualified dividends and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. Web on the turbotax form 1040/sr wks , between lines 15 and 16 “ tax smart worksheet” item 3: Web 1 best answer.

It Is For A Single Taxpayer, But.

Yes no if “yes,” attach form 8949. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records.

Web Irs Introduced The Qualified Dividend And Capital Gain Tax Worksheet As An Alternative To Schedule D And Added The.

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web taxes are taken out on both capital gains and dividend income but it’s not the same as income tax. See the earlier instructions for line 12a to.