Capital Gains And Dividends Worksheet - Qualified dividends and capital gain tax worksheet line 44. Gain or loss from sales of stocks or bonds : Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. Go to www.irs.gov/scheduled for instructions. Foreign earned income tax worksheet. Web schedule d tax worksheet. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. This is generally the purchase price plus any commissions or. Web the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the.

Capital Gains Worksheet For 2021 02/2022

Go to www.irs.gov/scheduled for instructions. Web schedule d tax worksheet. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Prior to completing this file, make sure you fill out. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates.

62 Final Project Two SubmissionQualified Dividends and Capital Gains

Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. Foreign earned income tax worksheet. Qualified dividends and capital gain tax worksheet. Web richard rubin april 8, 2021 2:40 pm et.

Create a Function for calculating the Tax Due for

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web capital gains and qualified dividends. Qualified dividends and capital gain tax worksheet. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend.

Qualified Dividends And Capital Gains Worksheet 2018 —

Qualified dividends and capital gain tax worksheet. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web richard rubin april 8, 2021 2:40 pm et listen (5 min) the tax rates on capital.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Web capital gain calculation in four steps. Web schedule d tax worksheet. Go to www.irs.gov/scheduled for instructions. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Prior to completing this file, make sure you fill out.

Amt Qualified Dividends And Capital Gains Worksheet Ivuyteq

Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Qualified dividends and capital gain tax worksheet line 44. Gain or.

2022 Qualified Dividends And Capital Gain Tax Worksheet

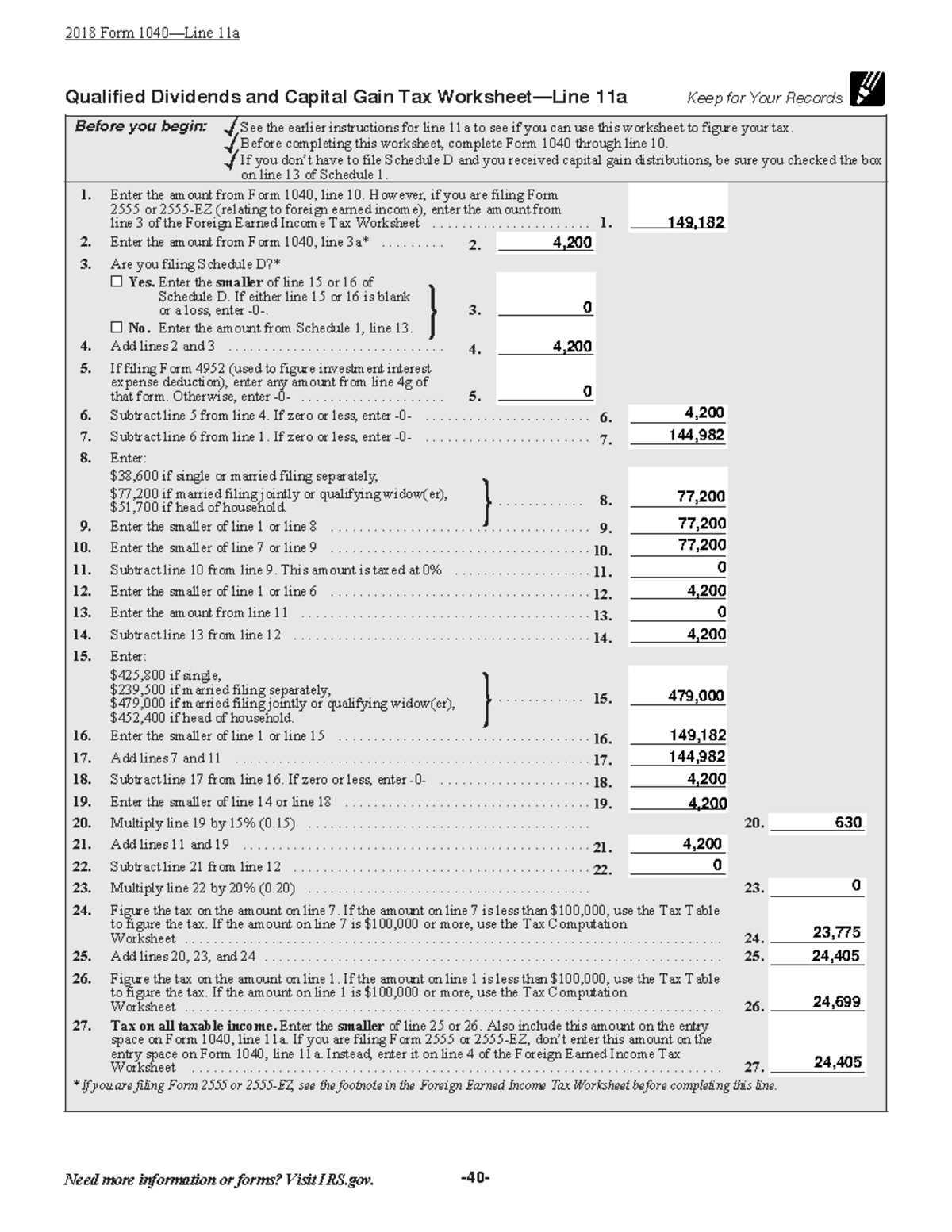

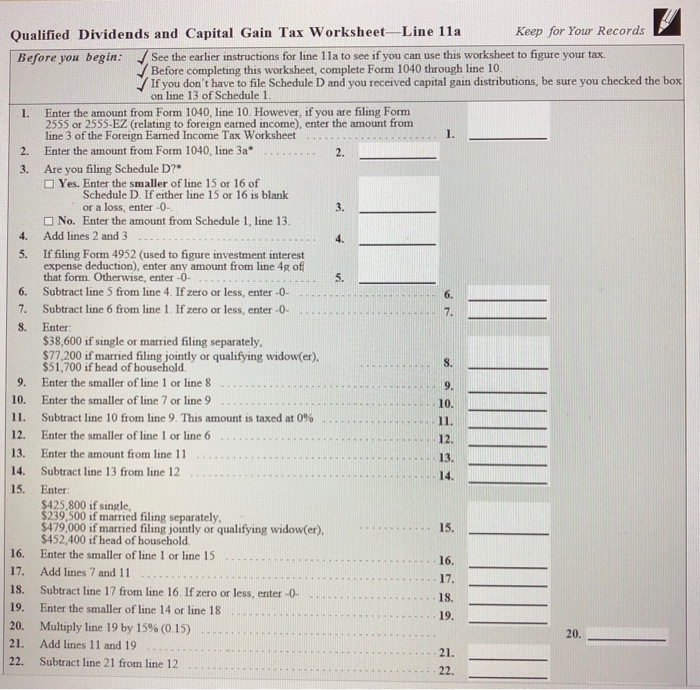

Qualified dividends and capital gain tax worksheet. Go to www.irs.gov/scheduled for instructions. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Qualified dividends and capital gain tax worksheet line 44. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep.

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Qualified dividends and capital gain tax worksheet. Foreign earned income tax worksheet. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Web the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Web complete this worksheet only if line 18 or line 19 of schedule d.

Qualified Dividends And Capital Gains Worksheet 2018 —

Qualified dividends and capital gain tax worksheet line 44. Qualified dividends and capital gain tax worksheet. Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. Go to www.irs.gov/scheduled for instructions. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan.

Qualified Dividends And Capital Gains Worksheet 2018 —

Web capital gain calculation in four steps. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Foreign earned income tax worksheet. Qualified dividends and capital gain tax worksheet. This is generally the purchase price plus any commissions or.

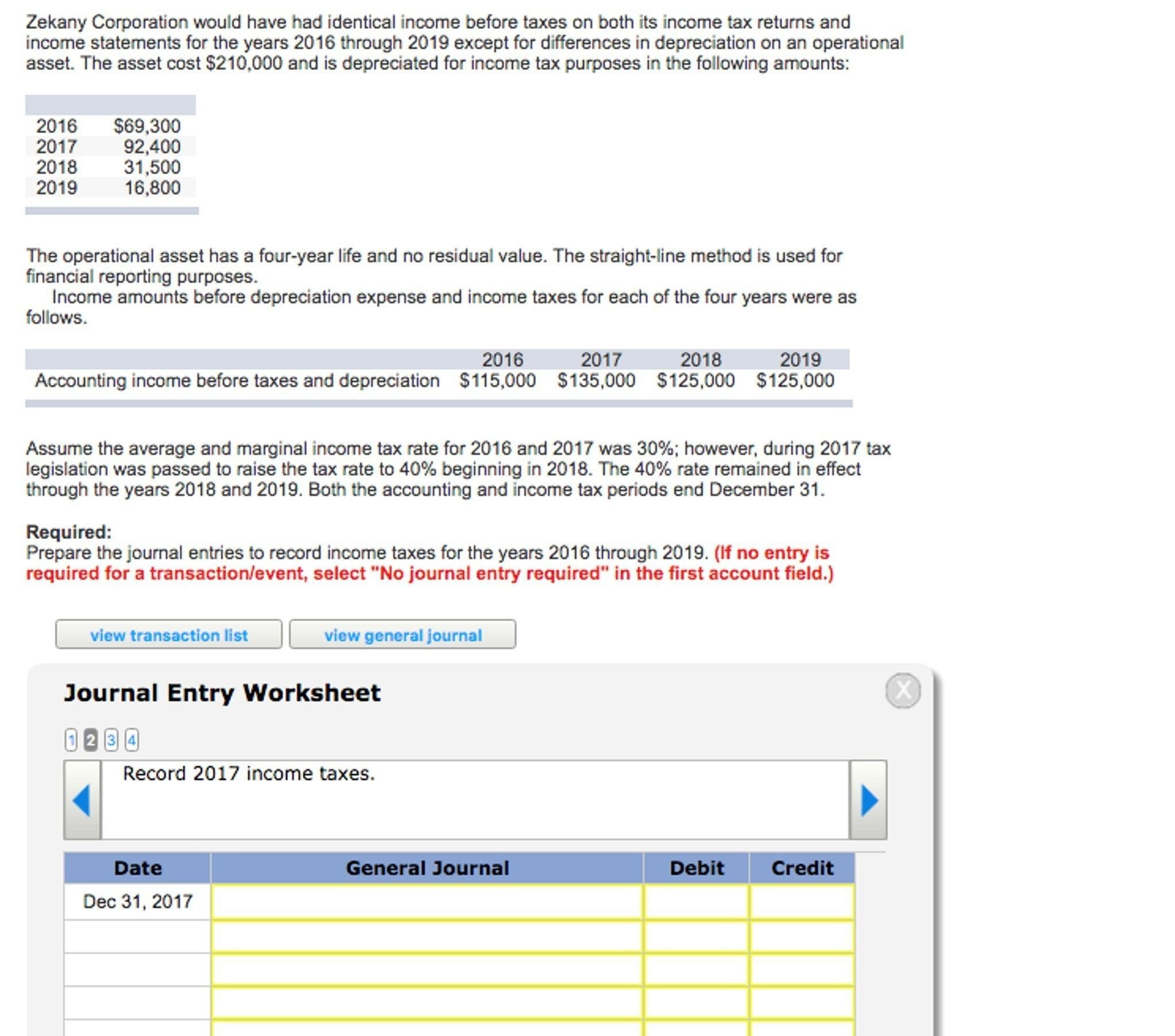

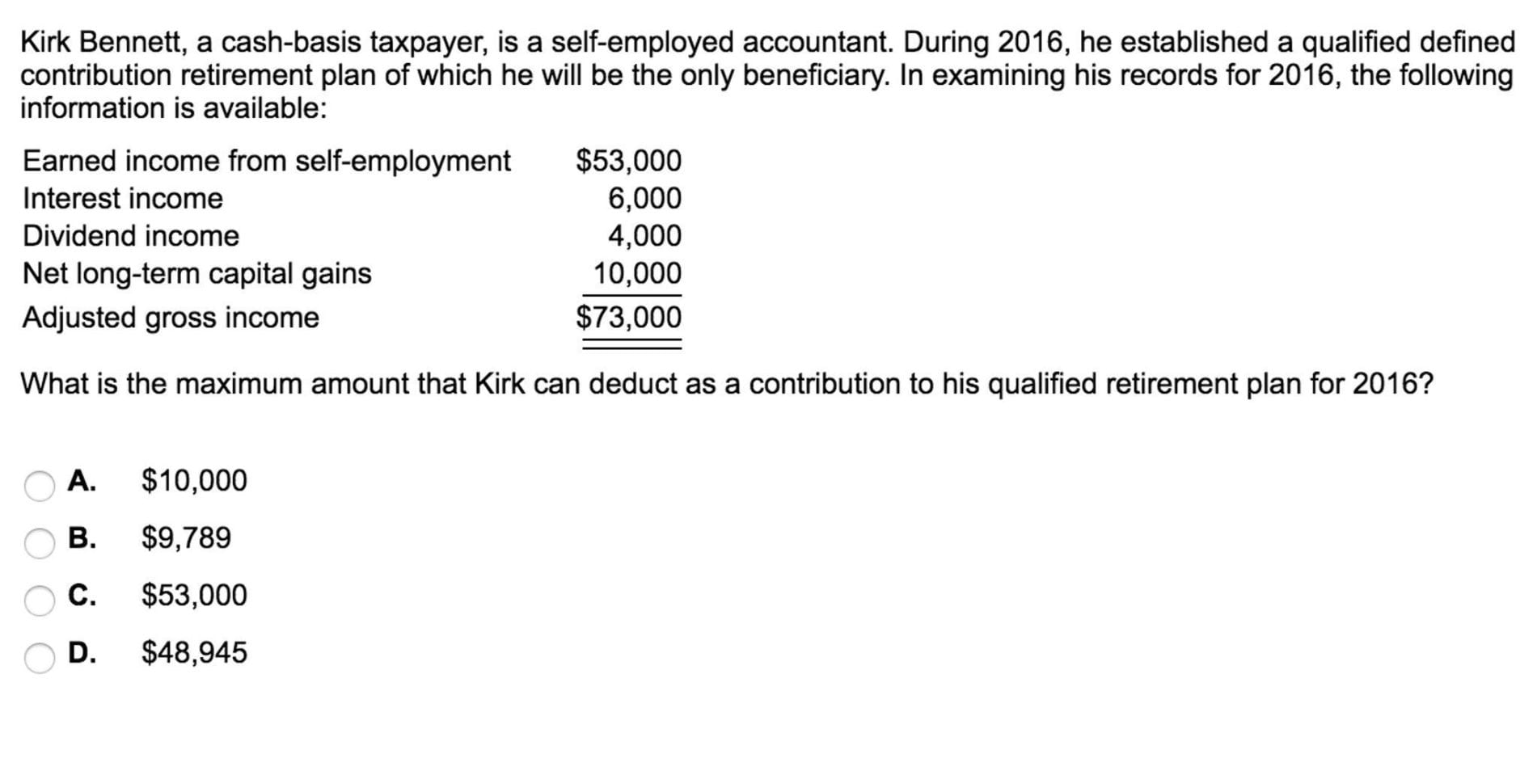

Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the. Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Go to www.irs.gov/scheduled for instructions. Web the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Gain or loss from sales of stocks or bonds : If you have never come across a qualified dividend worksheet, irs shows. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. Web capital gain calculation in four steps. Web we will answer questions about qualified dividends and how can the worksheet for reporting dividends and capital gain can be. Qualified dividends and capital gain tax worksheet. Qualified dividends and capital gain tax worksheet. Use the qualified dividends and capital gain tax worksheet. Foreign earned income tax worksheet. Web report your qualified dividends on line 9b of form 1040 or 1040a. Prior to completing this file, make sure you fill out. Qualified dividends and capital gain tax worksheet line 44. This is generally the purchase price plus any commissions or. Web schedule d tax worksheet.

Go To Www.irs.gov/Scheduled For Instructions.

Web capital gains and qualified dividends. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web capital gain calculation in four steps.

Web All About The Qualified Dividend Worksheet.

Qualified dividends and capital gain tax worksheet line 44. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the.

Gain Or Loss From Sales Of Stocks Or Bonds :

Qualified dividends and capital gain tax worksheet. Web richard rubin april 8, 2021 2:40 pm et listen (5 min) the tax rates on capital gains and dividends depend on how long you hold an. Prior to completing this file, make sure you fill out. Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of.

Web The Irs Recently Released The New Inflation Adjusted 2022 Tax Brackets And Rates.

Web schedule d tax worksheet. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or. If you have never come across a qualified dividend worksheet, irs shows. Foreign earned income tax worksheet.