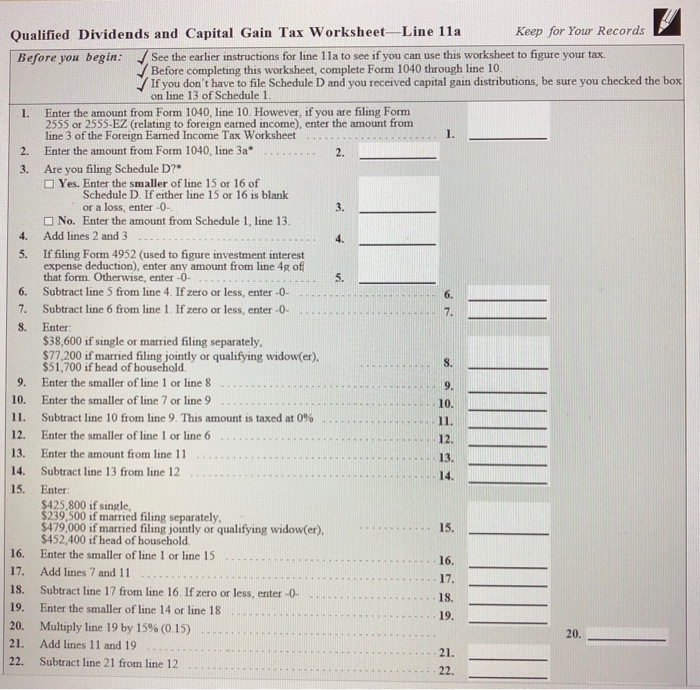

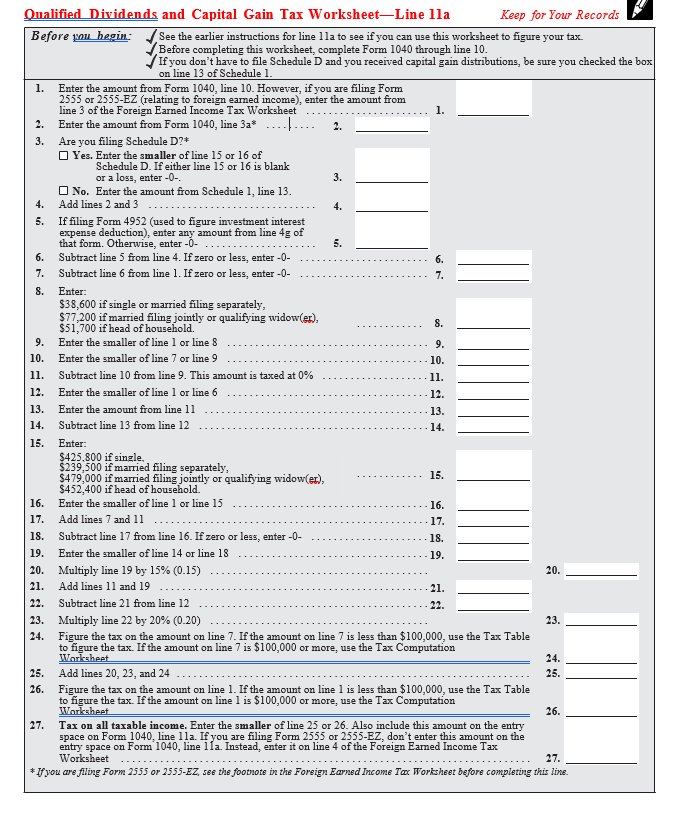

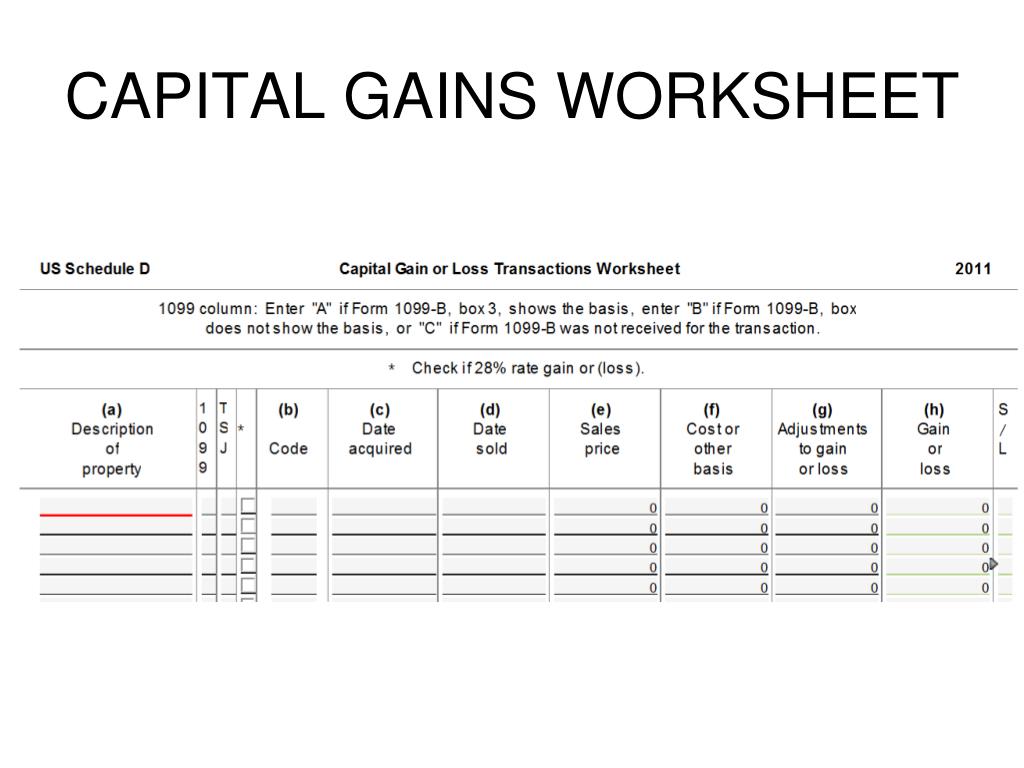

Capital Gain Worksheet - The involuntary conversion (other than from casualty or theft) of property used in a trade or business and. Use california schedule d (540), california capital gain or loss adjustment, only if there is a difference between your. Web the sale or exchange of a capital asset not reported on another form or schedule. Web a special real estate exemption for capital gains up to $250,000 in capital gains ($500,000 for a married couple) on the. Figuring out the tax on your qualified dividends can be. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Gains from involuntary conversions (other than. Go to www.irs.gov/scheduled for instructions. Web capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: Web what is the qualified dividend and capital gain tax worksheet?

Qualified Dividends and Capital Gain Tax Worksheet 2016

Web a special real estate exemption for capital gains up to $250,000 in capital gains ($500,000 for a married couple) on the. Web capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: The involuntary conversion (other than from casualty or theft) of property used in a trade or business and. Capital assets.

Solved Create Function Calculating Tax Due Qualified Divi

Worksheets are and losses capital gains, capital gain or capital. Web a special real estate exemption for capital gains up to $250,000 in capital gains ($500,000 for a married couple) on the. Web capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: The involuntary conversion (other than from casualty or theft) of.

IN C++ PLEASE Create A Function To Populate FORM 1...

Web what is the qualified dividend and capital gain tax worksheet? When you sell for more than your basis; Worksheets are and losses capital gains, capital gain or capital. Web social security benefits worksheet—lines 6a and 6b; Using the information on form 8949, report on schedule d (form.

Qualified Dividends And Capital Gain Worksheet

Web capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: Web a special real estate exemption for capital gains up to $250,000 in capital gains ($500,000 for a married couple) on the. When you sell for less than. Use california schedule d (540), california capital gain or loss adjustment, only if there.

Qualified Dividend And Capital Gain Worksheet

Total income and adjusted gross. Web worksheet calculate capital gains when you sell a stock, you owe taxes on the difference between what you paid for the. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Web social security benefits worksheet—lines 6a and 6b; If you sold your assets for more than you.

Capital Gain Tax Worksheet Line 41

Web identify the amount of recurring capital gains. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. When you sell for more than your basis; Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. When you sell for less than.

List Of Capital Gain Worksheet 2015 2023 Alec Worksheet

Using the information on form 8949, report on schedule d (form. Web capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: Worksheets are and losses capital gains, capital gain or capital. Capital assets that you hold for more than one year and then sell are classified as. The involuntary conversion (other than.

39 capital gain worksheet 2015 Worksheet Master

Figuring out the tax on your qualified dividends can be. If you sold your assets for more than you. Schedule d may report business capital gains passed through to the borrower on. Web subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. Web capital gains taxes on assets held.

PPT 2011 TRAINING PROGRAM PowerPoint Presentation, free download ID

Web complete schedule d (form 1040), capital gains and losses. Total income and adjusted gross. Use california schedule d (540), california capital gain or loss adjustment, only if there is a difference between your. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Figuring out the tax on your qualified dividends can be.

Capital Gains Worksheets

Go to www.irs.gov/scheduled for instructions. When you sell for more than your basis; Web what is the qualified dividend and capital gain tax worksheet? Figuring out the tax on your qualified dividends can be. Web capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets:

Web subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. Use california schedule d (540), california capital gain or loss adjustment, only if there is a difference between your. Web worksheet calculate capital gains when you sell a stock, you owe taxes on the difference between what you paid for the. Gains from involuntary conversions (other than. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep. Figuring out the tax on your qualified dividends can be. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. When you sell for more than your basis; Web identify the amount of recurring capital gains. Web what is the qualified dividend and capital gain tax worksheet? Web social security benefits worksheet—lines 6a and 6b; Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the. Worksheets are and losses capital gains, capital gain or capital. When you sell for less than. Schedule d may report business capital gains passed through to the borrower on. What is the amount of capital gains tax due from the sale if the. Web the sale or exchange of a capital asset not reported on another form or schedule. Capital assets that you hold for more than one year and then sell are classified as. The involuntary conversion (other than from casualty or theft) of property used in a trade or business and.

Gains From Involuntary Conversions (Other Than.

Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Using the information on form 8949, report on schedule d (form. Web social security benefits worksheet—lines 6a and 6b; The involuntary conversion (other than from casualty or theft) of property used in a trade or business and.

Capital Gain Or (Loss) Exception 1.

Web a special real estate exemption for capital gains up to $250,000 in capital gains ($500,000 for a married couple) on the. Figuring out the tax on your qualified dividends can be. Web what is the qualified dividend and capital gain tax worksheet? What is the amount of capital gains tax due from the sale if the.

Web The Irs Tax Brackets For 2021 (Which Are Based On Income Ranges) Are 10 Percent, 12 Percent, 22 Percent, 24 Percent,.

Schedule d may report business capital gains passed through to the borrower on. If you sold your assets for more than you. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets:

Capital Assets That You Hold For More Than One Year And Then Sell Are Classified As.

Web subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. Web complete schedule d (form 1040), capital gains and losses. Worksheets are and losses capital gains, capital gain or capital. Web identify the amount of recurring capital gains.