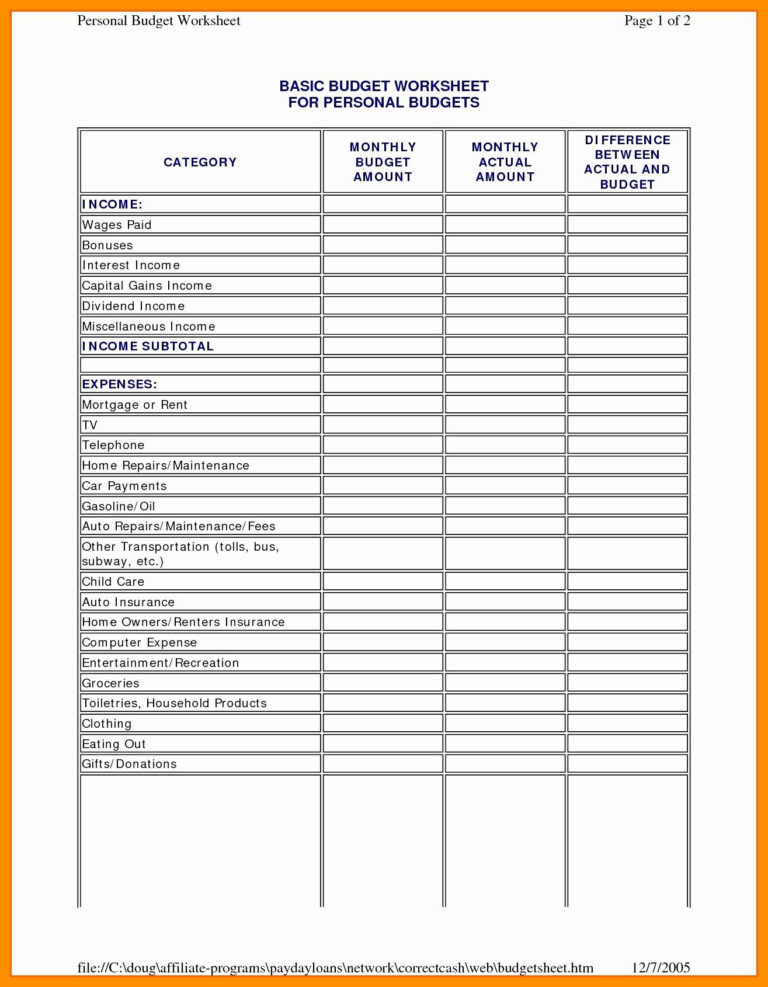

Business Use Of Home Worksheet - In the taxact program, the worksheet to figure. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web in general, you may not deduct expenses for the parts of your home not used for business, for example, lawn care or. Use this form to help determine the business ratio to be used. Use this worksheet if you file schedule f (form. Expenses for business use of your home written by a turbotax expert • reviewed by a turbotax cpa updated. The space must only be used for business. Web the space must be their principal place of business. Web what is irs form 8829: Web in the taxact program, the worksheet to figure the deduction for business use of your home shows the expenses used to.

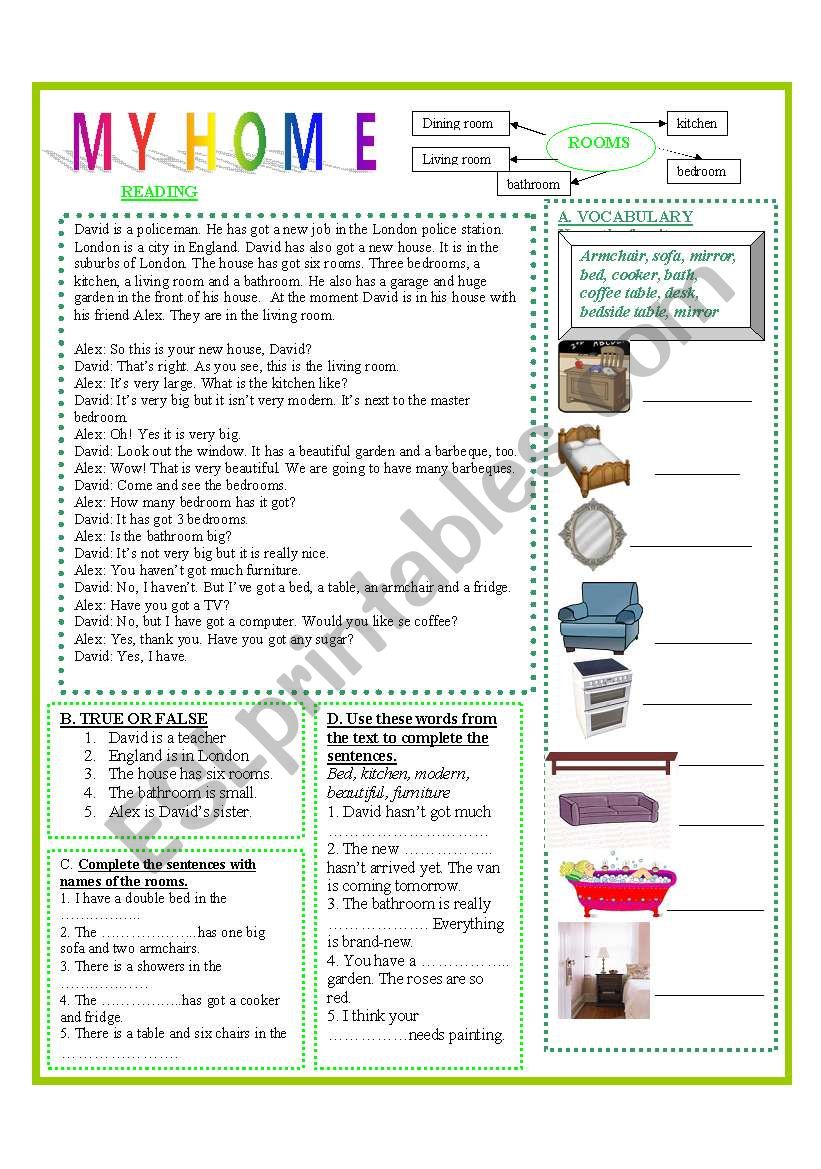

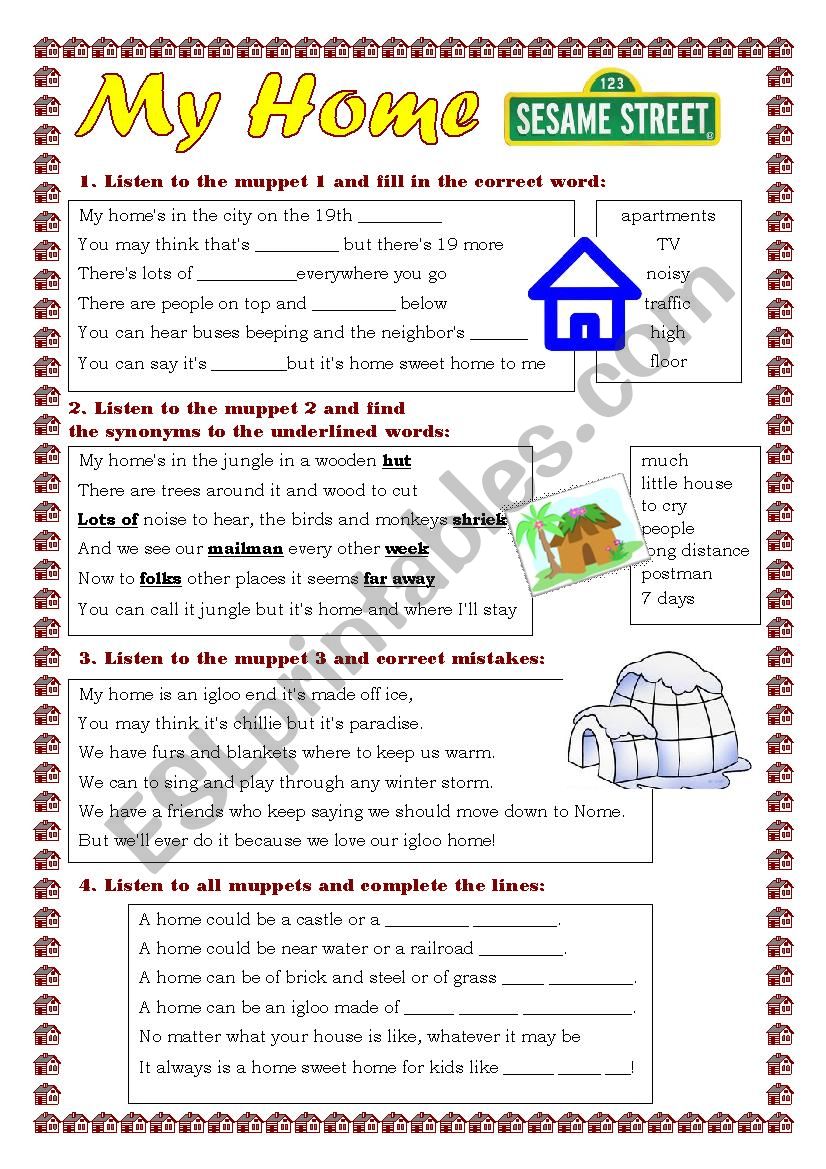

MY HOME ESL worksheet by Greek Professor

Web what is irs form 8829: Use this form to help determine the business ratio to be used. Web the space must be their principal place of business. Web worksheet to figure the deduction for business use of your home. Web there is a separate supporting worksheet to enter the business use of your home expenses.

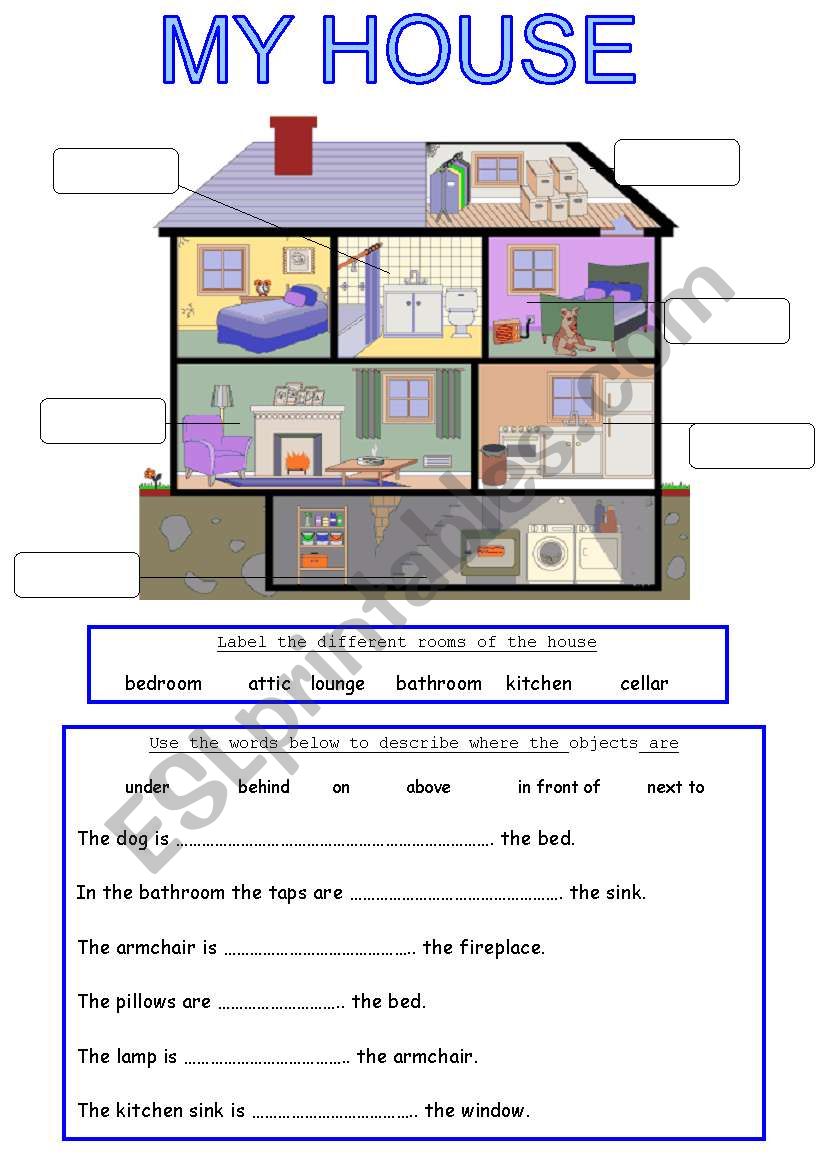

Home worksheet

Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. They must use the space regularly. Use this form to help determine the business ratio to be used. If you want an automatic way to. Web in general, you may not deduct expenses for the parts of.

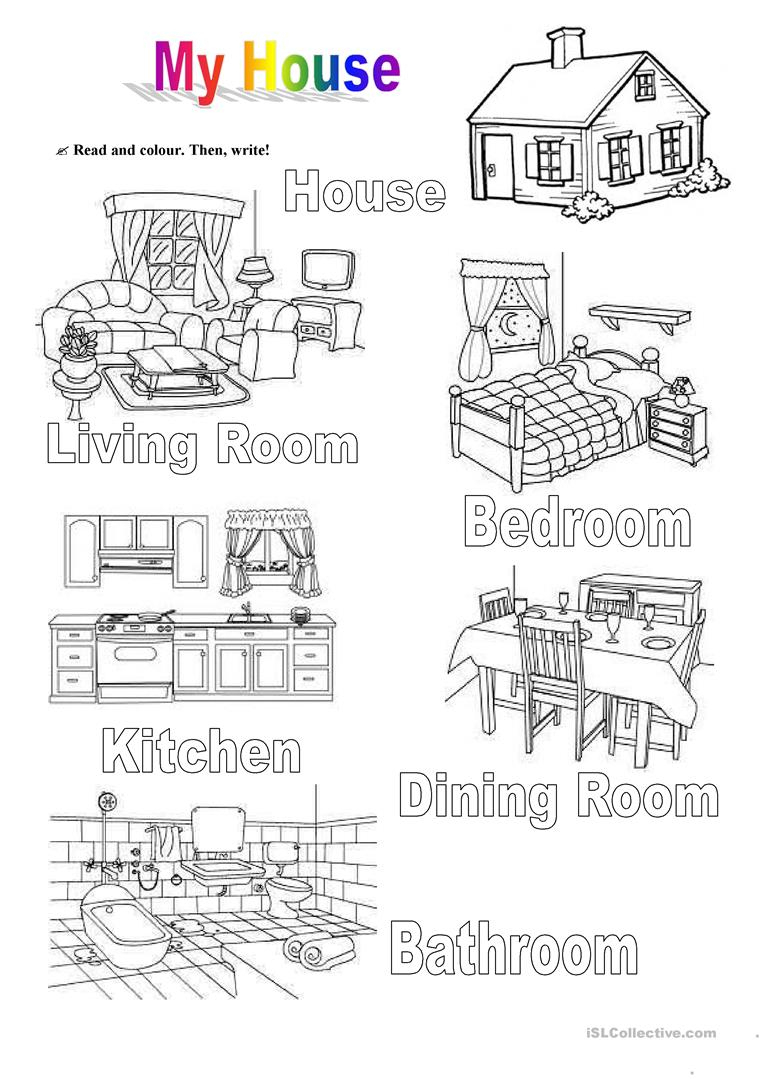

House And Furniture Worksheet Free Esl Printable Worksheets Made

Web in this lesson we've discussed the requirements you must meet to qualify for deduction for the business use of your. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Web business use of home worksheet instructions: Web expenses for business use of your home department.

Home Daycare And Expense Worksheet —

Use this form to help determine the business ratio to be used. Expenses for business use of your home written by a turbotax expert • reviewed by a turbotax cpa updated. Web 10 rows allowable square footage of home use for business (not to exceed 300 square feet) percentage of. Web information about form 8829, expenses for business use of.

Business Use Of Home (Form 8829) Organizer 2014 printable pdf download

Web in general, you may not deduct expenses for the parts of your home not used for business, for example, lawn care or. They must use the space regularly. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Web the space must be their principal place.

My Home ESL worksheet by Timea_H

Web what is irs form 8829: They must use the space regularly. Web if you have used part of the home (not within the home’s living area) for solely business or rental purposes for more than 2 of the last. Web in the taxact program, the worksheet to figure the deduction for business use of your home shows the expenses.

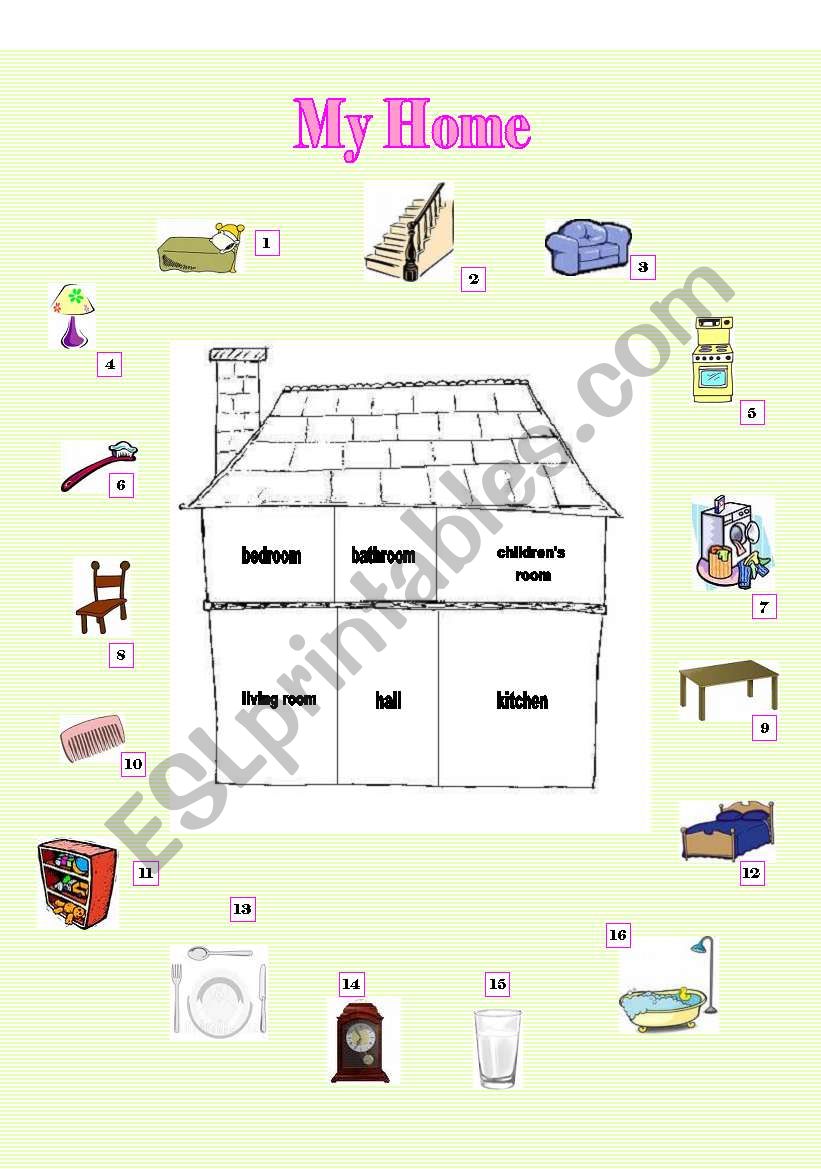

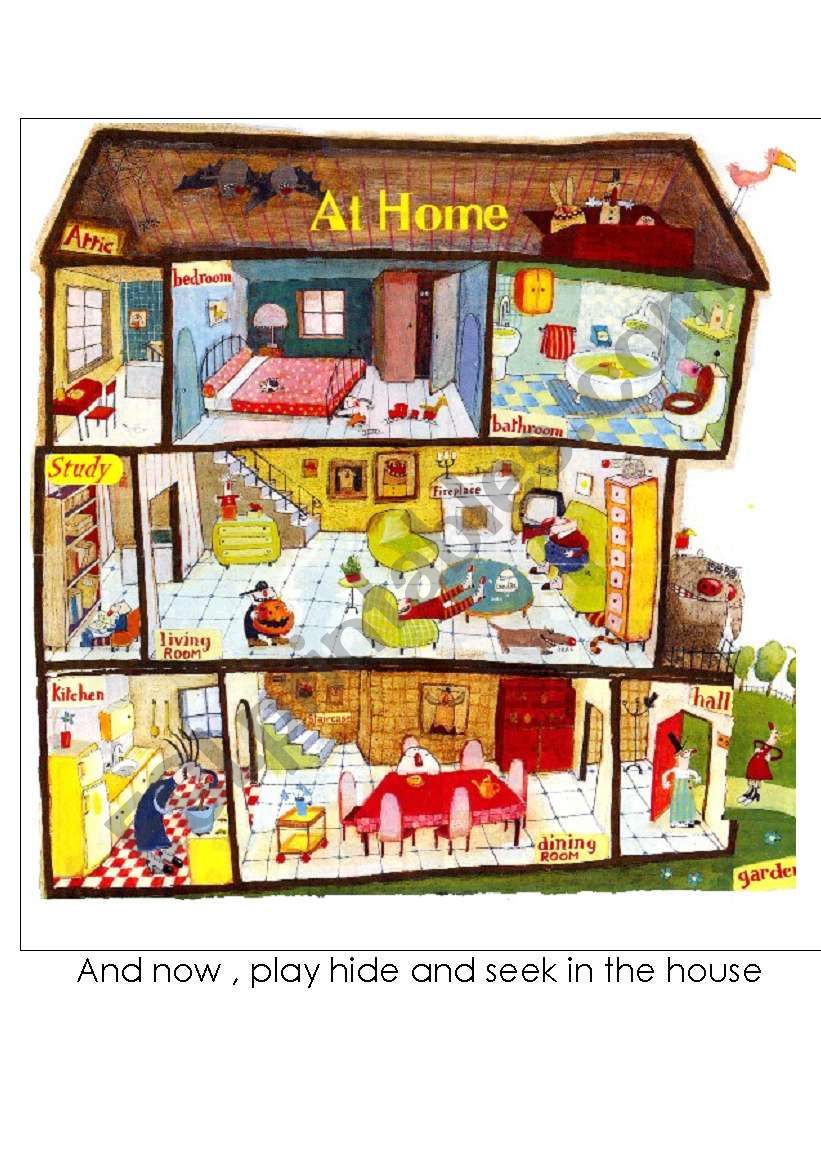

At home ESL worksheet by faranak.r

Web to view the business use of home worksheet (when the business use of home is linked to anything other than the sch. Use this worksheet if you file schedule f (form. Web the space must be their principal place of business. Expenses for business use of your home written by a turbotax expert • reviewed by a turbotax cpa.

My Home ESL worksheet by yuliya888

Web the space must be their principal place of business. In the taxact program, the worksheet to figure. Real estate taxes paid (for entire home). They must use the space regularly. Web most people turn to a home office deduction worksheet to simply the final calculations.

At Home ESL worksheet by RitaWi

Expenses for business use of your home written by a turbotax expert • reviewed by a turbotax cpa updated. Web in the taxact program, the worksheet to figure the deduction for business use of your home shows the expenses used to. Web expenses for business use of your home department of the treasury internal revenue service file only with schedule.

At home ESL worksheet by French bird

They must use the space regularly. Use this form to help determine the business ratio to be used. Web most people turn to a home office deduction worksheet to simply the final calculations. Use this worksheet if you file schedule f (form. Web there is a separate supporting worksheet to enter the business use of your home expenses.

Web there is a separate supporting worksheet to enter the business use of your home expenses. Web a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan,. Enter a 2 in the field 1=use actual expenses (default), 2=elect to use. They must use the space regularly. Web to view the business use of home worksheet (when the business use of home is linked to anything other than the sch. Web the space must be their principal place of business. Web business use of home worksheet instructions: Web in the taxact program, the worksheet to figure the deduction for business use of your home shows the expenses used to. Web if you have used part of the home (not within the home’s living area) for solely business or rental purposes for more than 2 of the last. If you want an automatic way to. The space must only be used for business. Web in this lesson we've discussed the requirements you must meet to qualify for deduction for the business use of your. Use this worksheet if you file schedule f (form. In the taxact program, the worksheet to figure. Real estate taxes paid (for entire home). Web go to screen 29, business use of home (8829). Web the simplified option allows qualifying taxpayers to use a prescribed rate of $5 per square foot of the portion of the home. Expenses for business use of your home written by a turbotax expert • reviewed by a turbotax cpa updated. Web worksheet to figure the deduction for business use of your home. Web most people turn to a home office deduction worksheet to simply the final calculations.

The Purpose Of This Publication Is To Provide Information On Figuring And Claiming The Deduction For.

Use this form to help determine the business ratio to be used. Web in general, you may not deduct expenses for the parts of your home not used for business, for example, lawn care or. The space must only be used for business. Web there is a separate supporting worksheet to enter the business use of your home expenses.

Web 10 Rows Allowable Square Footage Of Home Use For Business (Not To Exceed 300 Square Feet) Percentage Of.

Web go to screen 29, business use of home (8829). Web worksheet to figure the deduction for business use of your home. Web what is irs form 8829: Web if you have used part of the home (not within the home’s living area) for solely business or rental purposes for more than 2 of the last.

Web To View The Business Use Of Home Worksheet (When The Business Use Of Home Is Linked To Anything Other Than The Sch.

Use this worksheet if you file schedule f (form. Real estate taxes paid (for entire home). Web most people turn to a home office deduction worksheet to simply the final calculations. Web the simplified option allows qualifying taxpayers to use a prescribed rate of $5 per square foot of the portion of the home.

Web Business Use Of Home Worksheet Instructions:

In the taxact program, the worksheet to figure. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web the space must be their principal place of business. Expenses for business use of your home written by a turbotax expert • reviewed by a turbotax cpa updated.