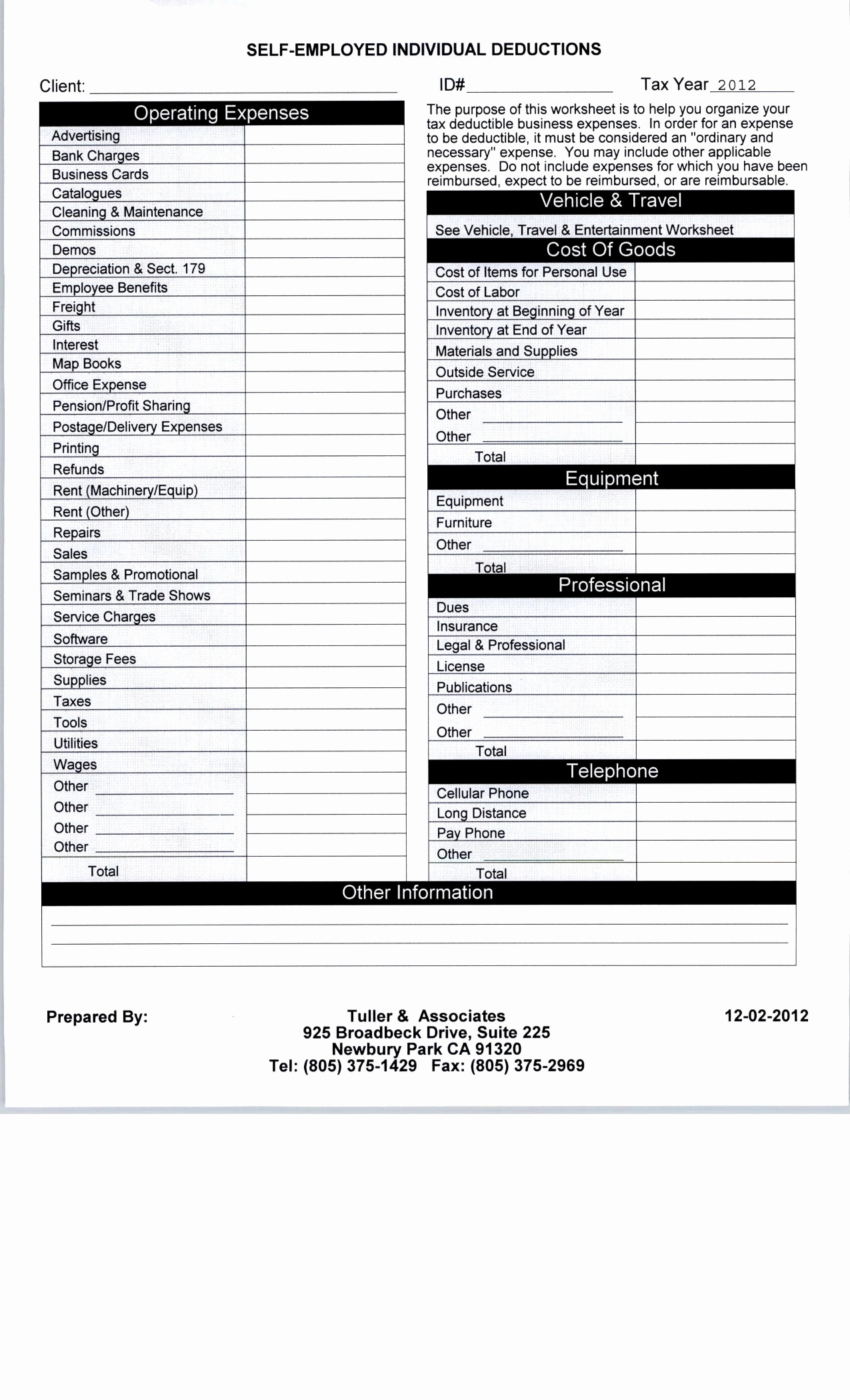

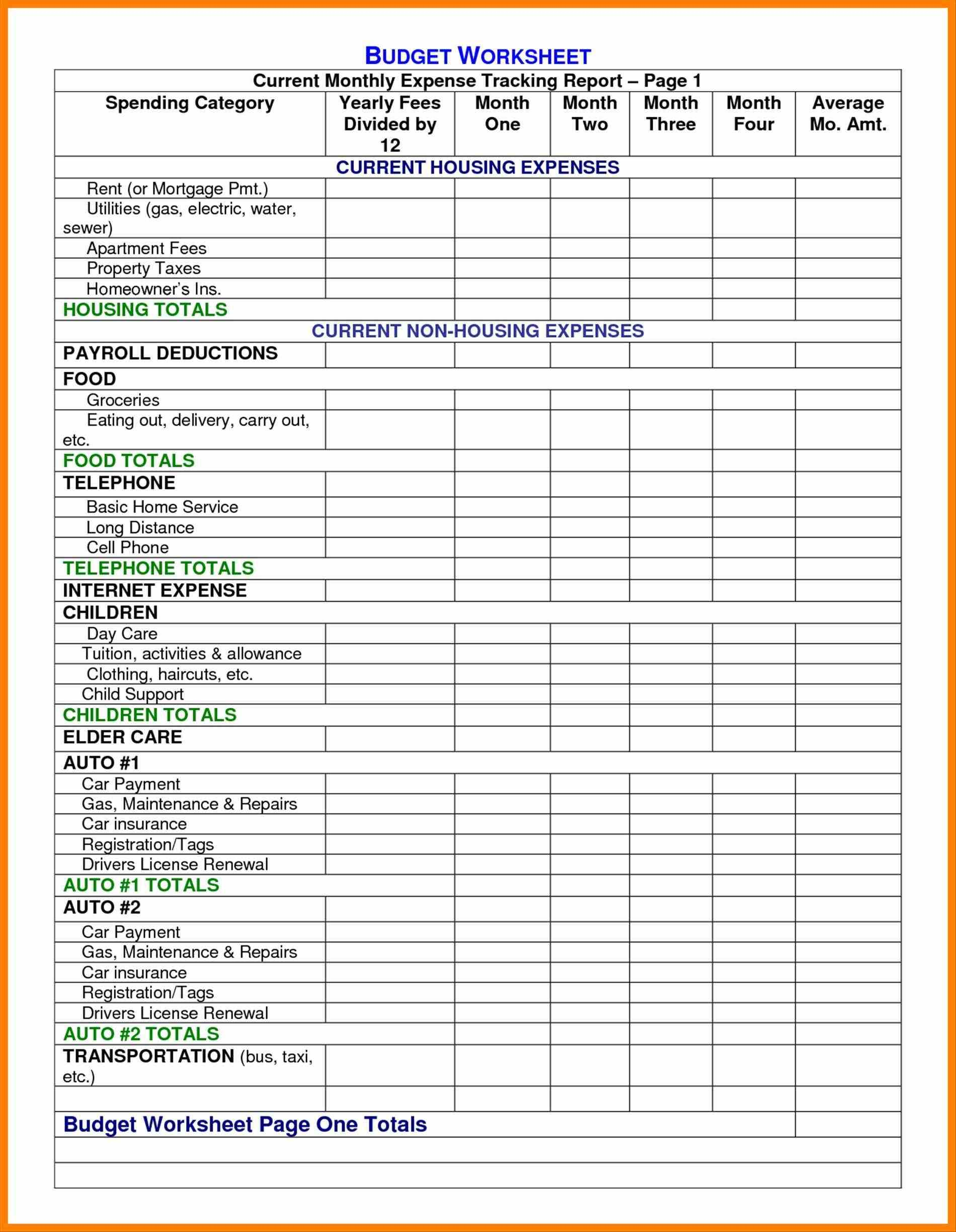

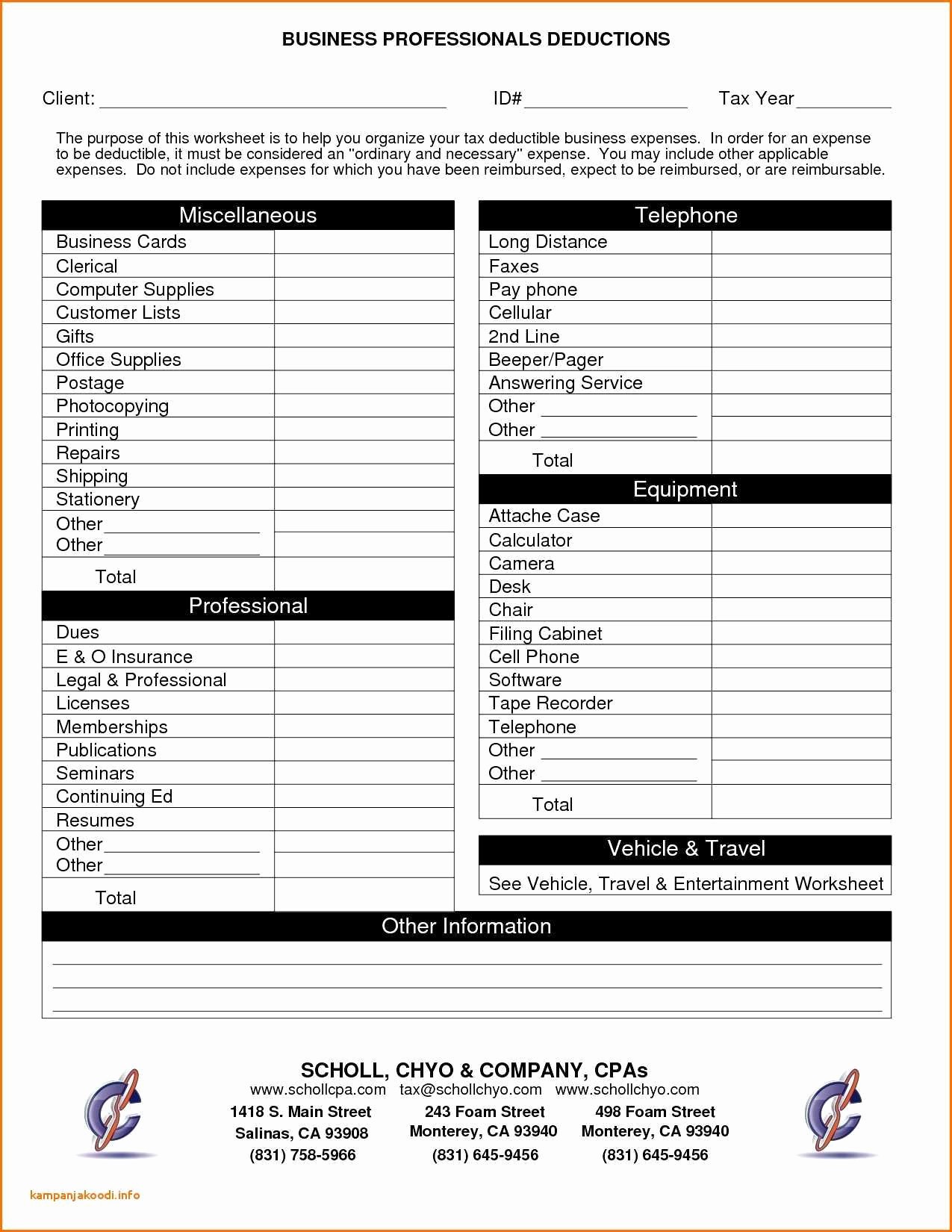

Business Tax Expense Worksheet - Web 5 examples of business expense sheets in excel. Web make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. Web what are the different types of spreadsheets for a business expense? Not all expense tracking spreadsheets are. When you file your taxes for your business, there are a. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Id # tax year ordinary suppliesthe purpose of this worksheet is to help you organize advertising your. Web we have created a business income & expense template that will help you navigate organizing your business. Creating new workbook you must be creating the new workbook for the business expense worksheet and the spreadshee t. Web a small business expense report template is a tool to track daily or weekly expenses.

8 Best Images of Tax Preparation Organizer Worksheet Individual

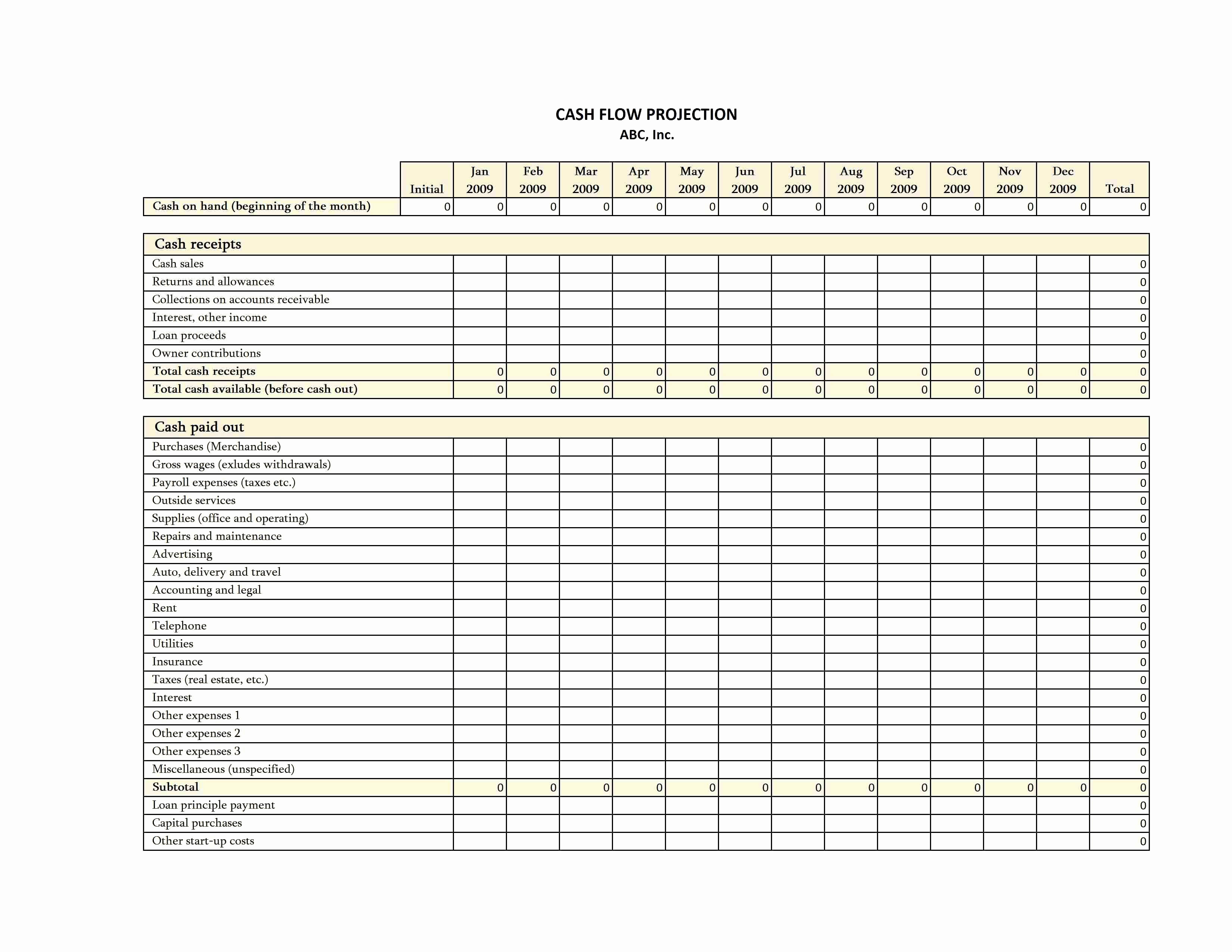

Web the decrease in expense was primarily driven by lower net losses on investments in equity securities in q2. Web what are the different types of spreadsheets for a business expense? Do not report these expenses elsewhere. Web by andy marker | november 28, 2016 (updated may 23, 2023) an expense report is commonly used for recording business travel expenses.

Worksheet For Taxes —

Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Web what you need to know for this free small business tax spreadsheet. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. When you file your taxes for your business, there are a. Web.

8 Best Images of Tax Itemized Deduction Worksheet IRS Form 1040

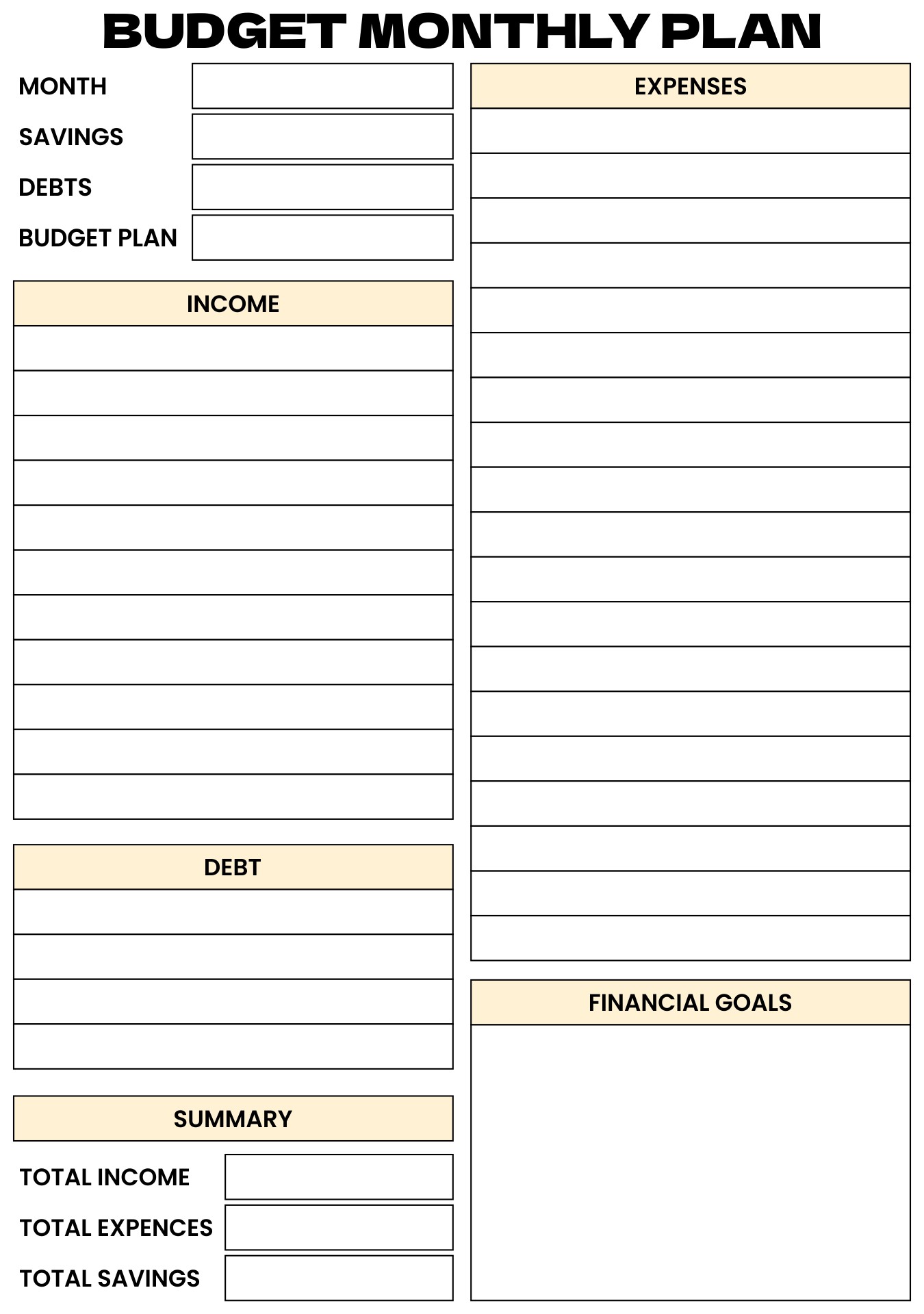

Creating new workbook you must be creating the new workbook for the business expense worksheet and the spreadshee t. Web this handout provides a simple worksheet for business owners to track expenses. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Web form your income projections and write those down.

17 Free And Expense Worksheet /

When you file your taxes for your business, there are a. Web by andy marker | november 28, 2016 (updated may 23, 2023) an expense report is commonly used for recording business travel expenses such as. Web what you need to know for this free small business tax spreadsheet. Web this publication has information on business income, expenses, and tax.

Small Business Tax Deductions Worksheet New Tax Deduction with Small

Not all expense tracking spreadsheets are. Web small business worksheet client: It can be used as a ledger or as. Web what does a tax worksheet do? Web the decrease in expense was primarily driven by lower net losses on investments in equity securities in q2.

Free Business And Expense Spreadsheet —

It can be used as a ledger or as. Creating new workbook you must be creating the new workbook for the business expense worksheet and the spreadshee t. Not all expense tracking spreadsheets are. Web make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025..

Small Business Deductions Worksheet petermcfarland.us

Web 5 examples of business expense sheets in excel. Web expenses for business use of your home. Id # tax year ordinary suppliesthe purpose of this worksheet is to help you organize advertising your. Web a small business expense report template is a tool to track daily or weekly expenses. Below are the different types of spreadsheets for.

Business Expense Spreadsheet For Taxes Awesome 50 Inspirational and

If you're facing an audit or filing taxes for the first time, complete our free small business. Web for 2023, the standard mileage rate is 65.5 cents per mile driven for business use. Not all expense tracking spreadsheets are. Web what does a tax worksheet do? Web make changes to your 2022 tax return online for up to 3 years.

Free Printable Expense Sheet Template

Web a small business expense report template is a tool to track daily or weekly expenses. Put this paper or spreadsheet. Web what are the different types of spreadsheets for a business expense? Attach form 8829 unless using the simplified. Web expenses for business use of your home.

Tax Spreadsheet For Small Business Spreadsheet Downloa tax worksheet

Put this paper or spreadsheet. Do not report these expenses elsewhere. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Not all expense tracking spreadsheets are. Web this publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file.

Do not report these expenses elsewhere. Web form your income projections and write those down outside of your budget template. Web this handout provides a simple worksheet for business owners to track expenses. Attach form 8829 unless using the simplified. Web small business worksheet client: Web what are the different types of spreadsheets for a business expense? Put this paper or spreadsheet. Web 5 examples of business expense sheets in excel. Web what does a tax worksheet do? Below are the different types of spreadsheets for. Id # tax year ordinary suppliesthe purpose of this worksheet is to help you organize advertising your. When you file your taxes for your business, there are a. Web see estimated payments worksheet on next page see per diem worksheet see equipment worksheet. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Web by andy marker | november 28, 2016 (updated may 23, 2023) an expense report is commonly used for recording business travel expenses such as. If you're facing an audit or filing taxes for the first time, complete our free small business. Web a small business expense report template is a tool to track daily or weekly expenses. Web the decrease in expense was primarily driven by lower net losses on investments in equity securities in q2. Web information about form 2106, employee business expenses, including recent updates, related forms and. Web make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025.

Web Information About Form 2106, Employee Business Expenses, Including Recent Updates, Related Forms And.

Web form your income projections and write those down outside of your budget template. Web a small business expense report template is a tool to track daily or weekly expenses. Web expenses for business use of your home. It can be used as a ledger or as.

Web What You Need To Know For This Free Small Business Tax Spreadsheet.

Attach form 8829 unless using the simplified. Web 5 examples of business expense sheets in excel. Web this publication has information on business income, expenses, and tax credits that may help you, as a small business owner, file. Do not report these expenses elsewhere.

Web By Andy Marker | November 28, 2016 (Updated May 23, 2023) An Expense Report Is Commonly Used For Recording Business Travel Expenses Such As.

Web see estimated payments worksheet on next page see per diem worksheet see equipment worksheet. Web what are the different types of spreadsheets for a business expense? Web make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. If you're facing an audit or filing taxes for the first time, complete our free small business.

Web For 2023, The Standard Mileage Rate Is 65.5 Cents Per Mile Driven For Business Use.

Web what does a tax worksheet do? Below are the different types of spreadsheets for. Web we have created a business income & expense template that will help you navigate organizing your business. Web the decrease in expense was primarily driven by lower net losses on investments in equity securities in q2.