Business Income Calculation Worksheet - Web learn how to complete the business income worksheet (cp 15 15), a worksheet that has frightened insurance practitioners for. Web the qualified business income deduction simplified worksheet. Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Located in the qbid folder in form view, this worksheet prints. Web proconnect tax uses entries throughout the program to calculate business income to be used for the section 179 limitation on. If you pay an irs or state penalty or. Web this simple small business income statement template calculates your total revenue and expenses, including advising,. Department of the treasury internal. Business income is a type of earned. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment.

Analysis Worksheet PDF Expense S Corporation

Web the tax cuts and jobs act (tcja), section 11012, as amended by the cares act, section 2304, revised section 461 (l) to limit the amount of losses from. Web it reduces the less of taxable income or business income and is generally 20% of a taxpayer's qualified business. Business income is a type of earned. Web about this quiz.

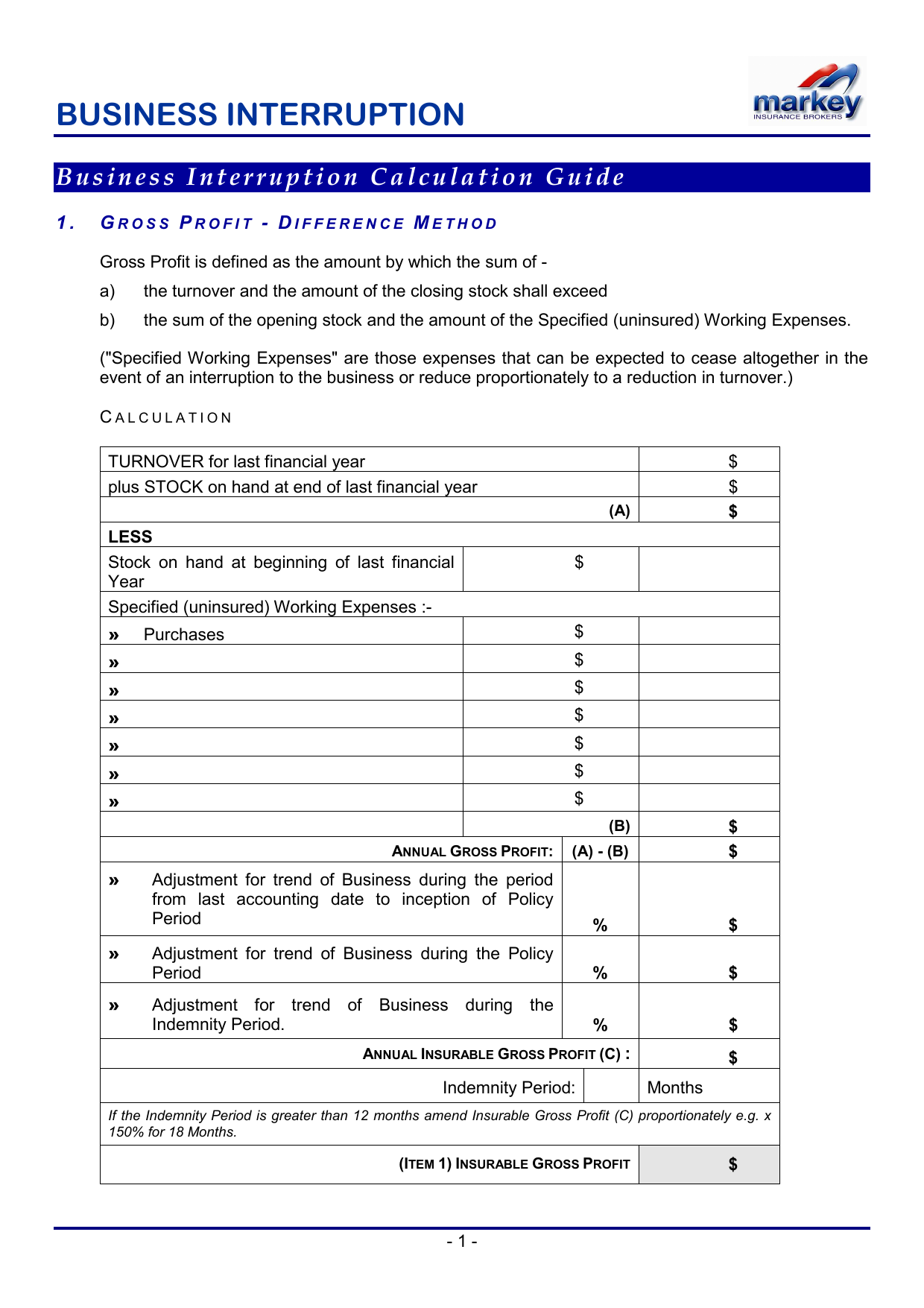

Business Interruption Calculation Sheet

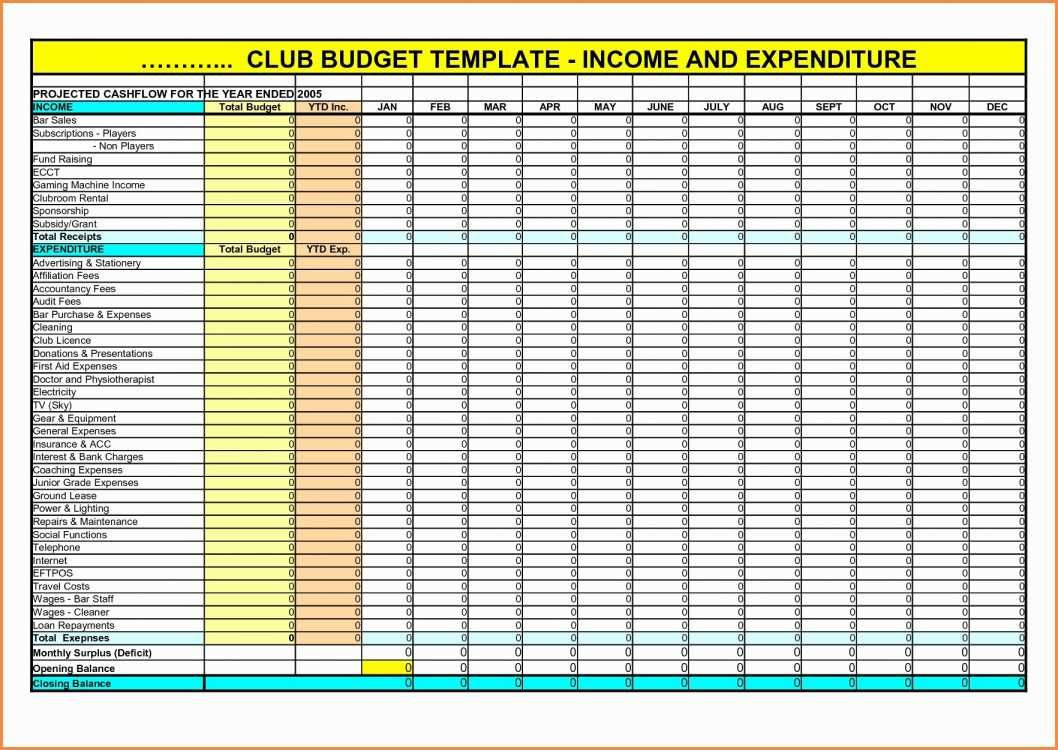

Web this simple small business income statement template calculates your total revenue and expenses, including advising,. Web proconnect tax uses entries throughout the program to calculate business income to be used for the section 179 limitation on. Enter your income in your budget template. Web the tax cuts and jobs act (tcja), section 11012, as amended by the cares act,.

Business Calculation Worksheet

Download the excel budget template. Web business income is any income realized as a result of business activity. Web this is a quick and simple way to determine how much business income insurance you need. Web learn how to complete the business income worksheet (cp 15 15), a worksheet that has frightened insurance practitioners for. Web the tax cuts and.

Acord Business Worksheet

Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Web about this quiz & worksheet. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web the qualified business income (qbi) deduction allows you to deduct up to 20.

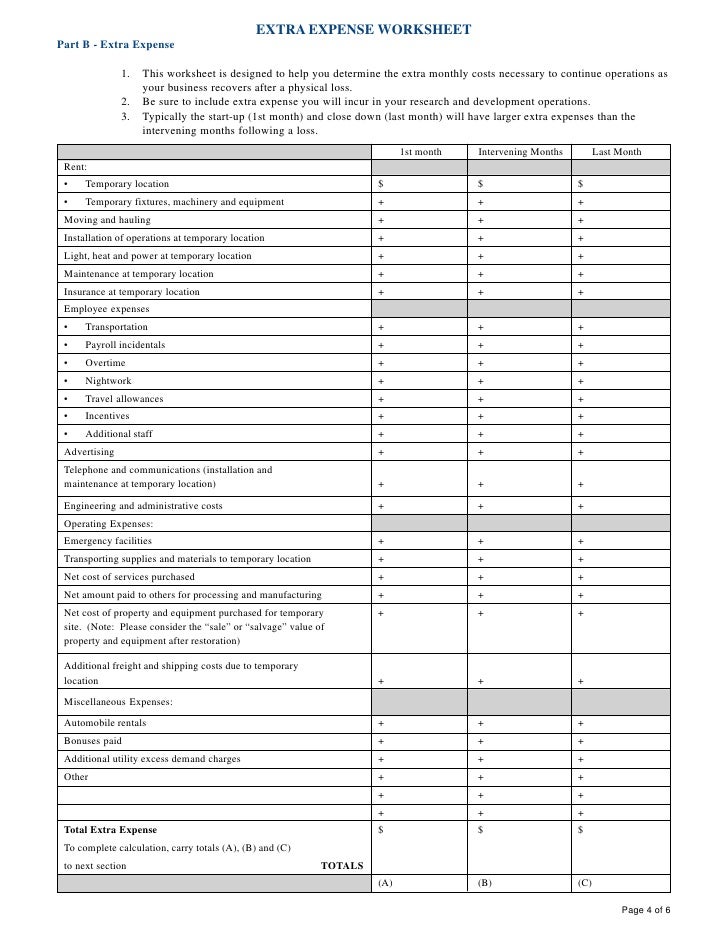

Business And Extra Expense Worksheet —

You can review your understanding of business income tax calculations by completing this quiz. Web learn how to complete the business income worksheet (cp 15 15), a worksheet that has frightened insurance practitioners for. Web this worksheet is a tool to help you estimate the amount of business income insurance you will need to cover your business. Web about this.

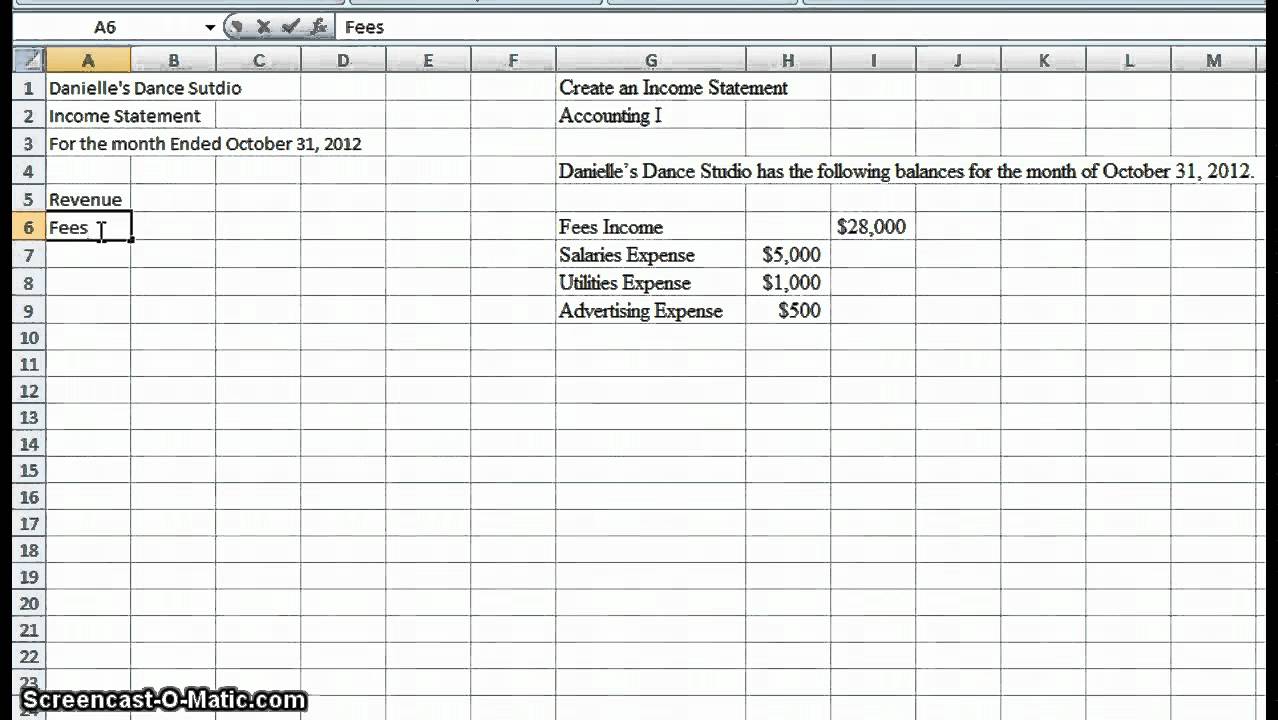

Statement Worksheet Example —

Web other income (expense) guidance was updated to the range of $75 million of expense to $25 million of. Web it reduces the less of taxable income or business income and is generally 20% of a taxpayer's qualified business. Web this simple small business income statement template calculates your total revenue and expenses, including advising,. Web from the start, the.

Calculation Worksheets

Business income is a type of earned. Web the qualified business income deduction simplified worksheet. Enter your income in your budget template. Web this worksheet is a tool to help you estimate the amount of business income insurance you will need to cover your business. Web about this quiz & worksheet.

8 Best Images of Free Printable Business Expense Worksheets Free

Web this simple small business income statement template calculates your total revenue and expenses, including advising,. Web from the start, the tool guides the user through a detailed step by step process, to complete a business income worksheet. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web.

Calculation Worksheets 2022

Web business income is any income realized as a result of business activity. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web 5 quick steps to calculate business income and expense in excel worksheet step 1: Web a worksheet is added to provide a reasonable method to track and compute.

Rental Calculation Worksheet Along with Investment Property

Located in the qbid folder in form view, this worksheet prints. Web the qualified business income deduction simplified worksheet. Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Web about this quiz & worksheet. Web once you know what’s covered by business income insurance, you will want to learn to.

Web proconnect tax uses entries throughout the program to calculate business income to be used for the section 179 limitation on. Web 5 quick steps to calculate business income and expense in excel worksheet step 1: Web qualified business income deduction simplified computation. If you pay an irs or state penalty or. Department of the treasury internal. Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Located in the qbid folder in form view, this worksheet prints. Download the excel budget template. Web this is a quick and simple way to determine how much business income insurance you need. Web this worksheet is a tool to help you estimate the amount of business income insurance you will need to cover your business. Web once you know what’s covered by business income insurance, you will want to learn to calculate your overall business income. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment. Web a business income worksheet iso is a comprehensive form or template provided by the insurance services office (iso) to help. Enter your income in your budget template. Web it reduces the less of taxable income or business income and is generally 20% of a taxpayer's qualified business. Web from the start, the tool guides the user through a detailed step by step process, to complete a business income worksheet. Web the qualified business income deduction simplified worksheet. Web business income is any income realized as a result of business activity. Web learn how to complete the business income worksheet (cp 15 15), a worksheet that has frightened insurance practitioners for.

Web About This Quiz & Worksheet.

Web from the start, the tool guides the user through a detailed step by step process, to complete a business income worksheet. Enter your income in your budget template. Web proconnect tax uses entries throughout the program to calculate business income to be used for the section 179 limitation on. Web 5 quick steps to calculate business income and expense in excel worksheet step 1:

Web This Is A Quick And Simple Way To Determine How Much Business Income Insurance You Need.

Department of the treasury internal. Web it reduces the less of taxable income or business income and is generally 20% of a taxpayer's qualified business. Web business income is any income realized as a result of business activity. You can review your understanding of business income tax calculations by completing this quiz.

Business Income Is A Type Of Earned.

Located in the qbid folder in form view, this worksheet prints. Web a business income worksheet iso is a comprehensive form or template provided by the insurance services office (iso) to help. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed. If you pay an irs or state penalty or.

Web Qualified Business Income Deduction Simplified Computation.

Download the excel budget template. Web this worksheet is a tool to help you estimate the amount of business income insurance you will need to cover your business. Web other income (expense) guidance was updated to the range of $75 million of expense to $25 million of. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,.