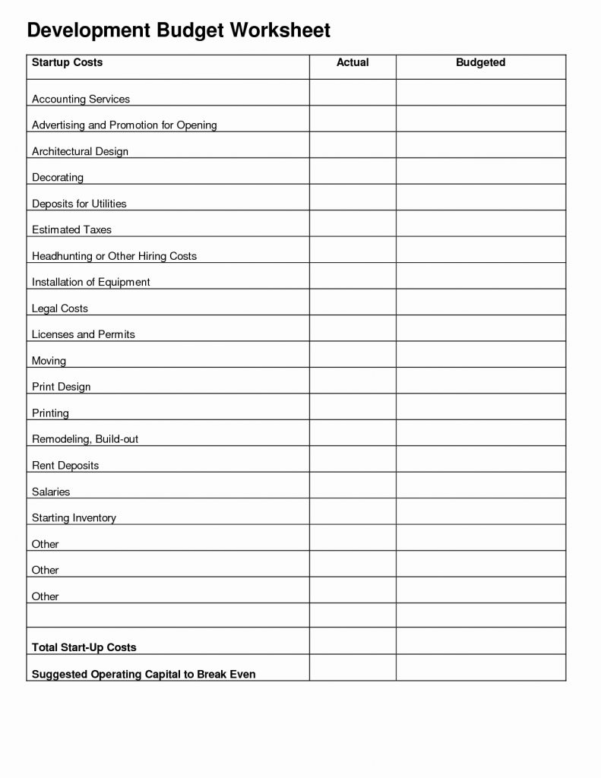

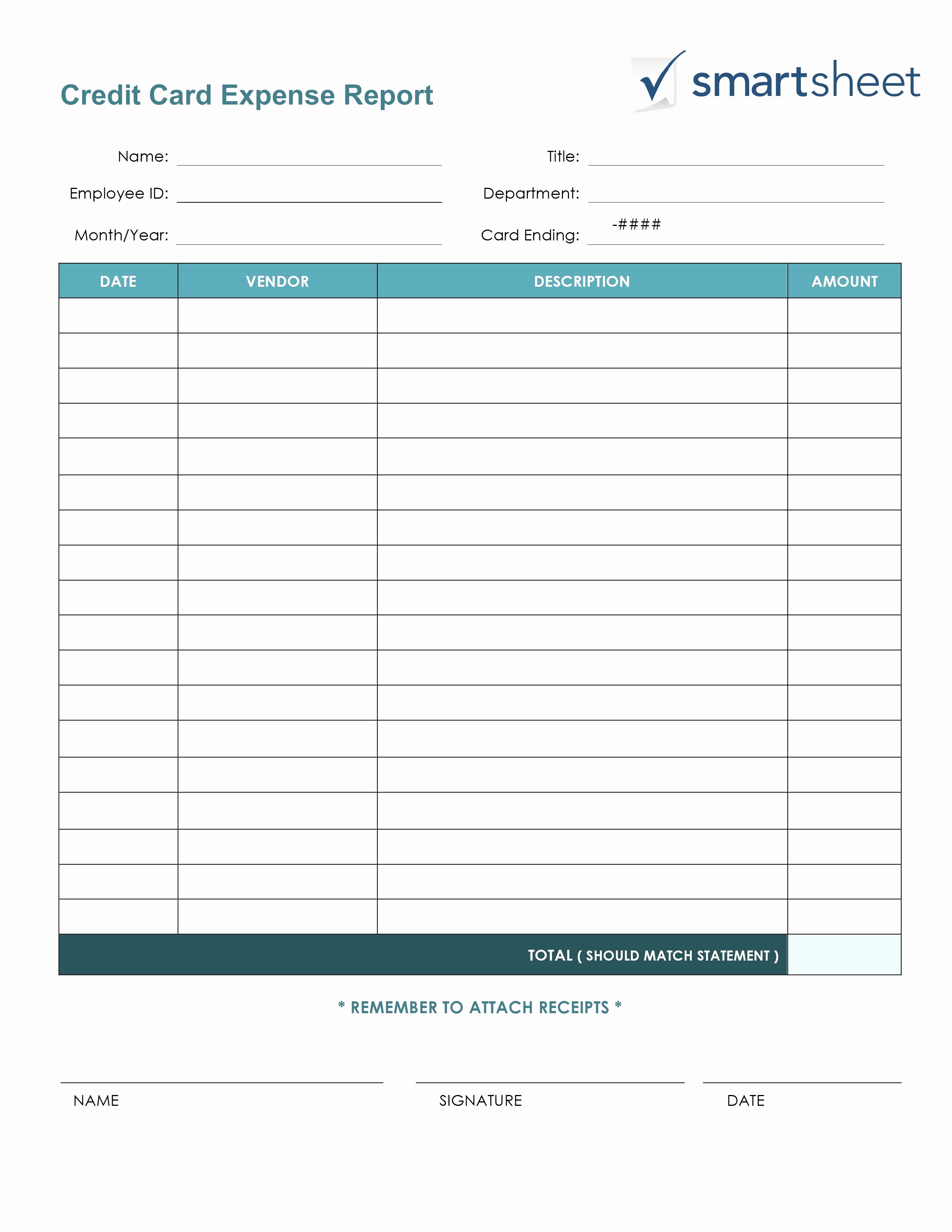

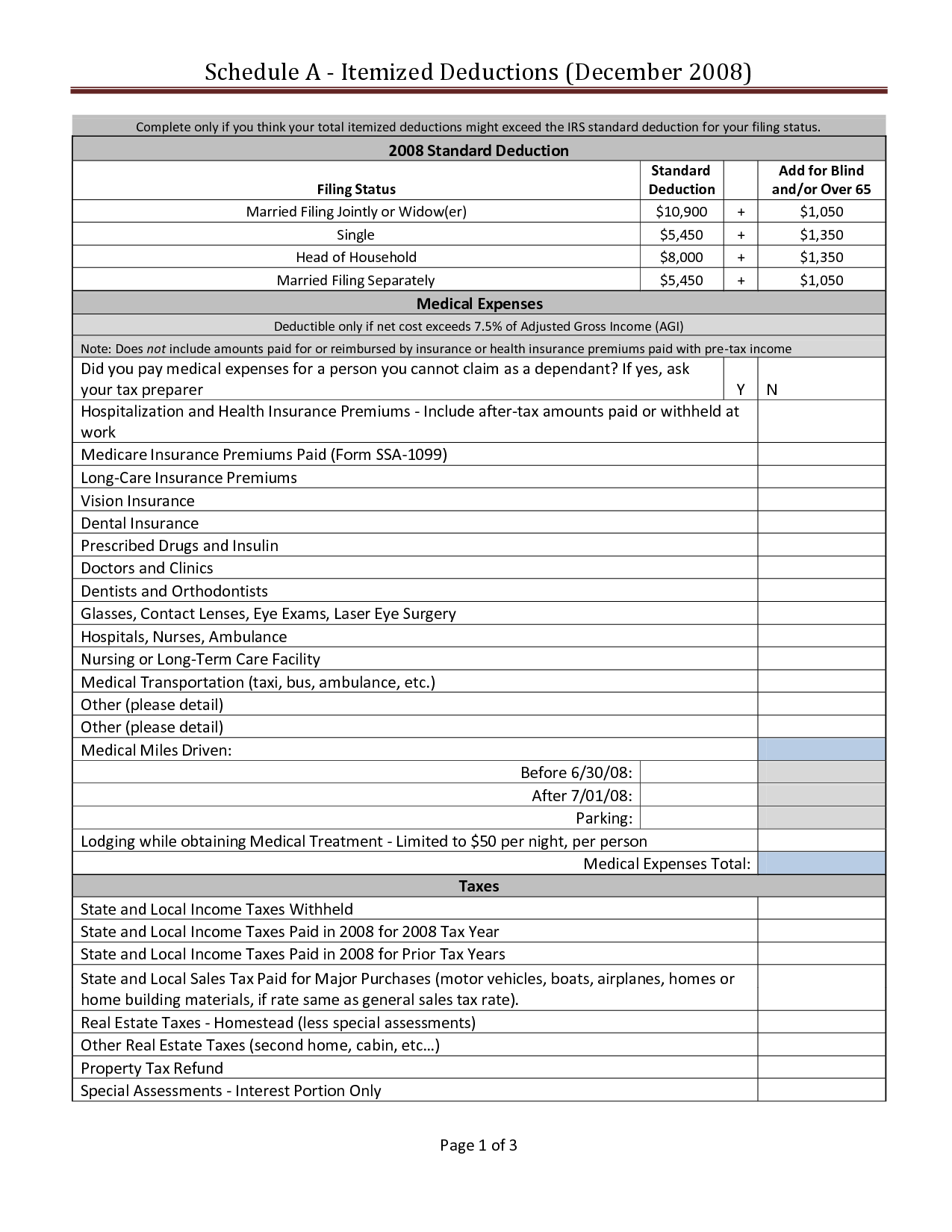

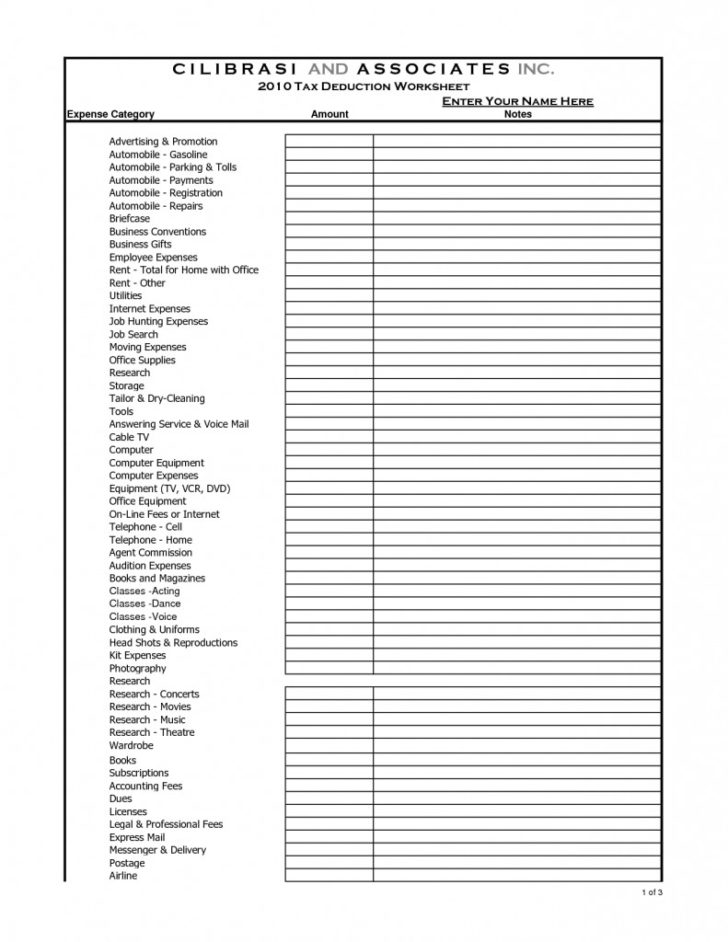

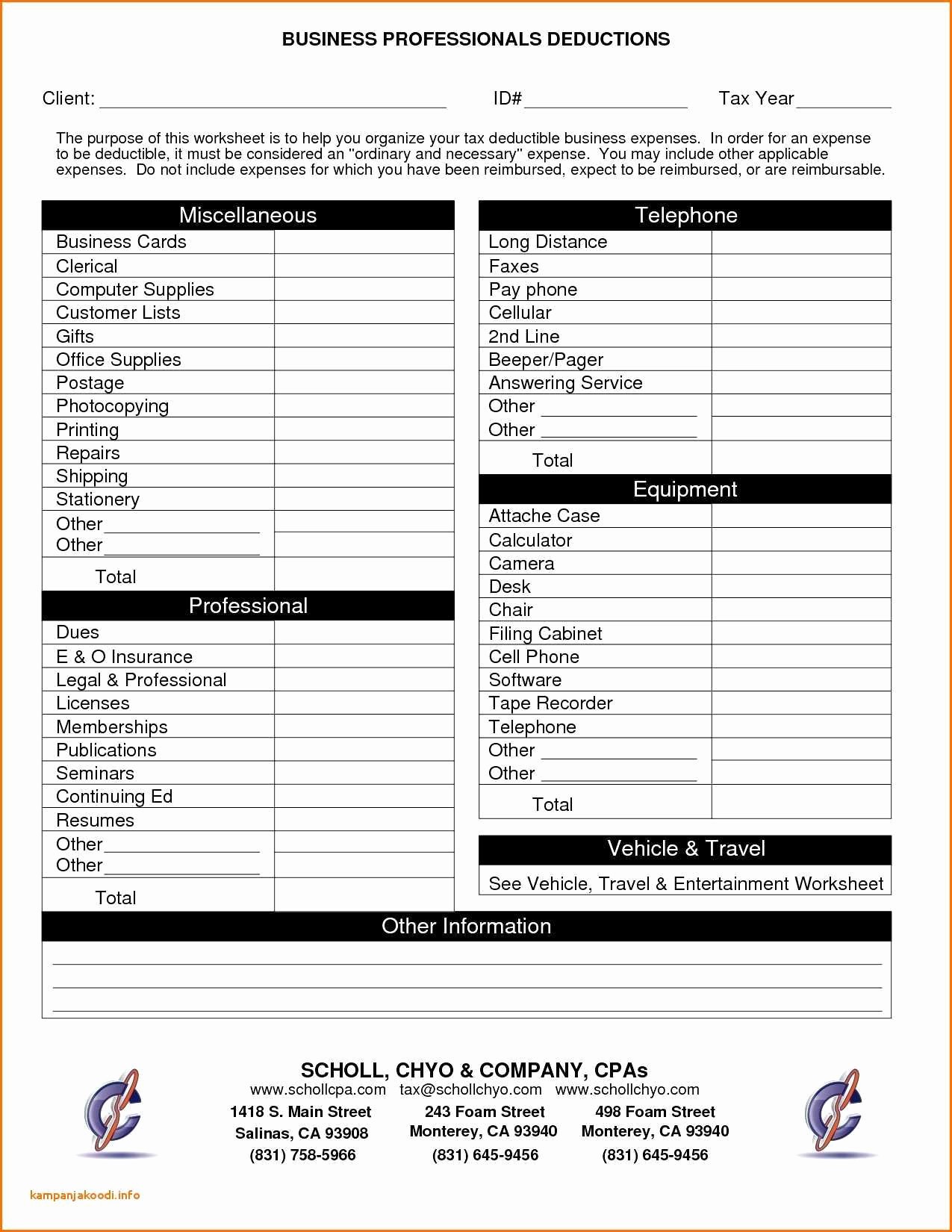

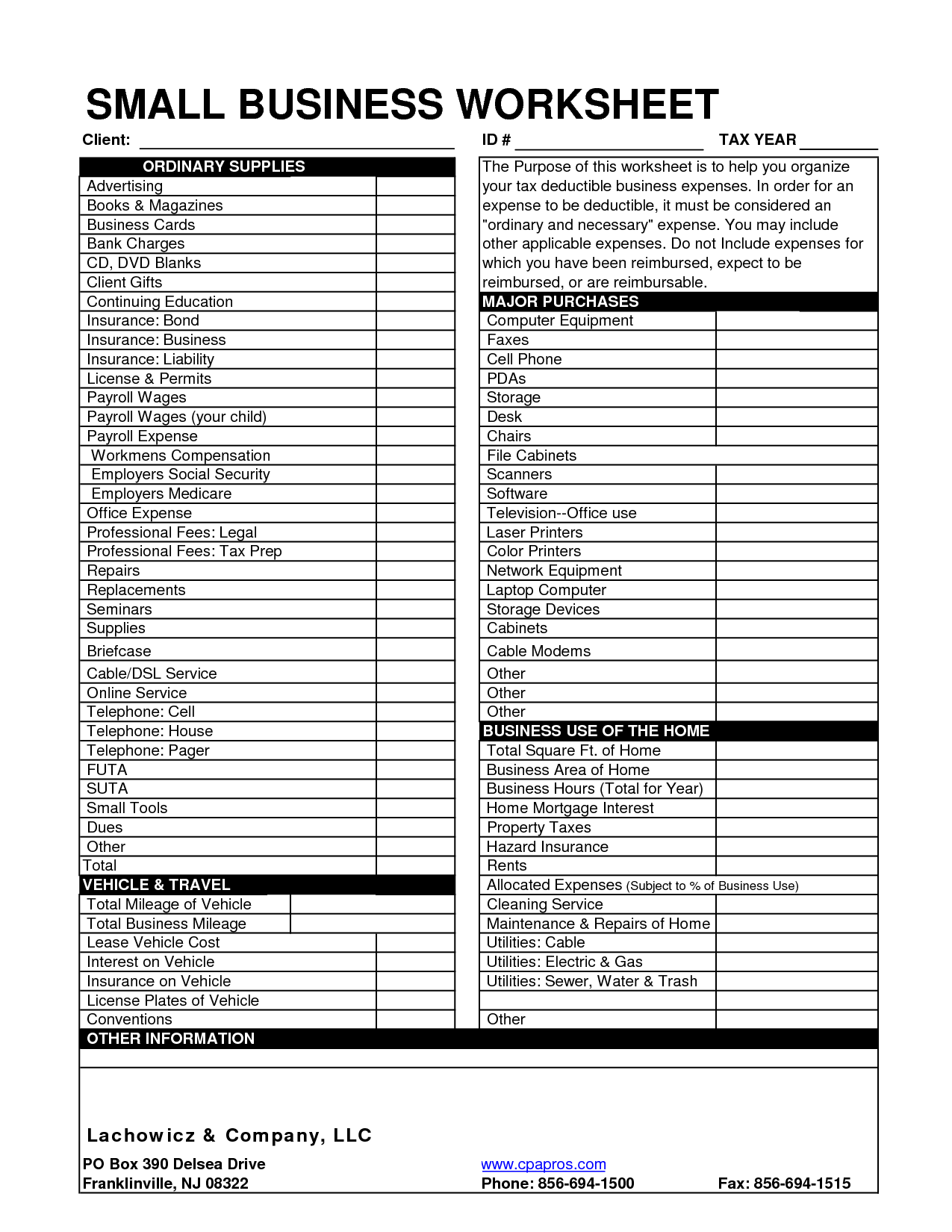

Business Deduction Worksheet - Web you can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business,. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. Id # tax year ordinary suppliesthe purpose of. Standard deduction of $5 per square foot of home used for business (maximum. Using the simplified worksheet or the complex. Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Check it twice, and make sure you're claiming. Web highlights of the simplified option: Web should itemize if their total allowable deductions are higher than the standard deduction amount. Web 31t *certified specialist in taxation law, state bar of california board of legal specialization †also licensed in idaho, illinois and texas tax year 2022.

Assisted Living Budget Spreadsheet with regard to Clothing Donation Tax

Using the simplified worksheet or the complex. Check it twice, and make sure you're claiming. Id # tax year ordinary suppliesthe purpose of. This list is a great quick reference guide. Web should itemize if their total allowable deductions are higher than the standard deduction amount.

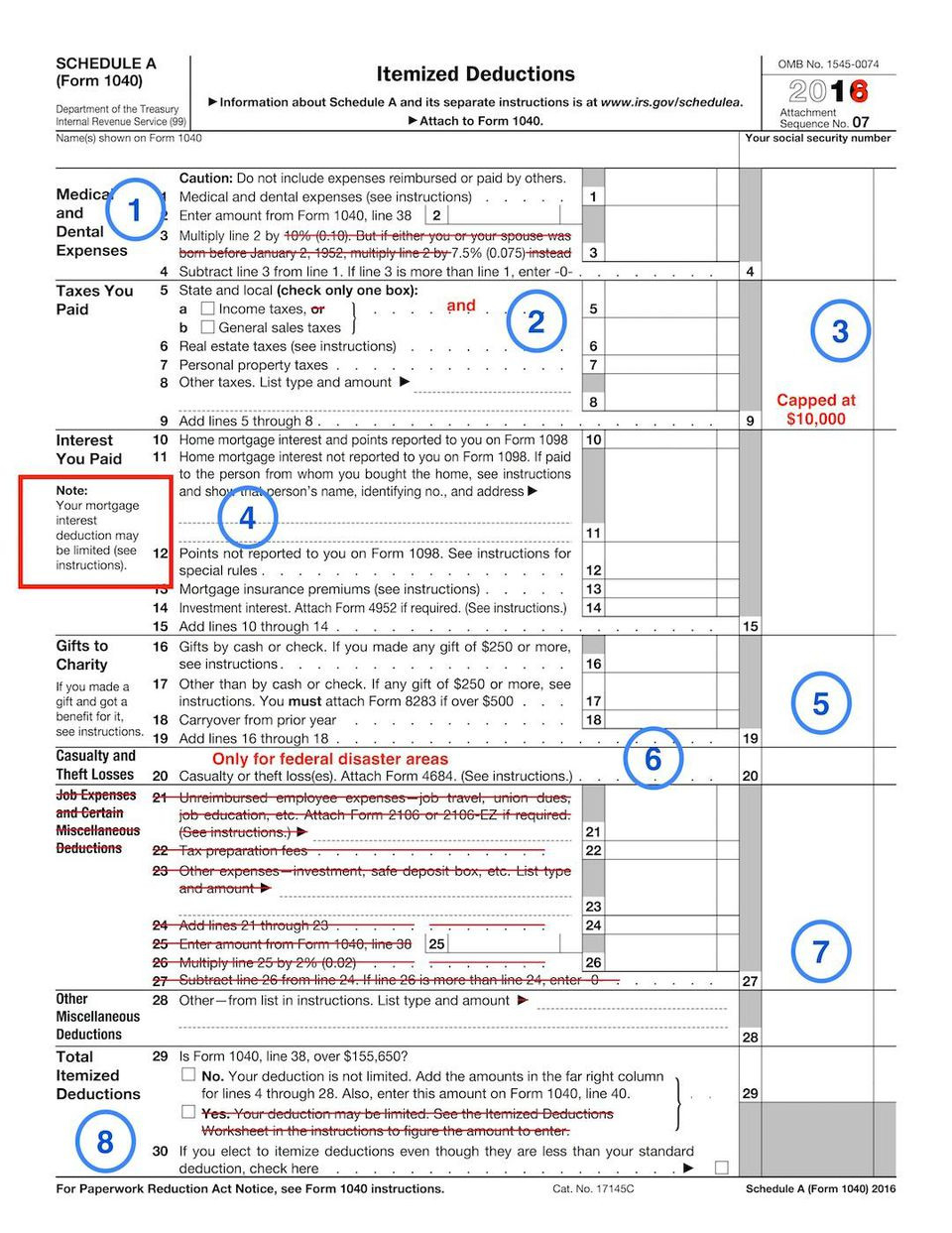

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web there are two ways to calculate the qbi deduction: Id # tax year ordinary suppliesthe purpose of. Web download your free copy of our business expense categories worksheet. Web you can claim the qualified business income deduction only if you have.

️Safe Worksheet Free Download Goodimg.co

Web highlights of the simplified option: Web there are two ways to calculate the qbi deduction: Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. Web should itemize if their total allowable deductions are higher than the standard deduction amount. Web introduction this publication provides general information.

Small Business Deductions Worksheet petermcfarland.us

Web 2022 small business tax deductions checklist. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Id # tax year ordinary suppliesthe purpose of. Web small business worksheet client: Using the simplified worksheet or the complex.

10 Best Images of 2014 Itemized Deductions Worksheet 1040 Forms

Id # tax year ordinary suppliesthe purpose of. Objectives at the end of this lesson, using your. Web you can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Check it twice, and make sure you're claiming. Web if you are filing schedule c (form 1040) to report a business use of your.

Itemized Deduction Worksheet —

Web should itemize if their total allowable deductions are higher than the standard deduction amount. Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Using the simplified worksheet or the complex. Web you can claim the qualified business income deduction only if you have qualified business income from a qualified trade.

What Your Itemized Deductions On Schedule A Will Look Like —

Web a method to track losses or deductions suspended by other provisions. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. A worksheet is added to provide a reasonable method to. Id # tax year ordinary suppliesthe purpose of. Web the qualified business income (qbi) deduction allows.

Itemized Deductions Worksheet

Home based business tax deductions. Web should itemize if their total allowable deductions are higher than the standard deduction amount. Web a method to track losses or deductions suspended by other provisions. Web a sample worksheet to use when organizing your home based business tax deductions. Web download your free copy of our business expense categories worksheet.

Small Business Deductions Worksheet petermcfarland.us

A worksheet is added to provide a reasonable method to. Id # tax year ordinary suppliesthe purpose of. Web highlights of the simplified option: As a small business owner, you’ve been busy all year trying to grow your business and make. Web small business worksheet client:

8 Best Images of Tax Preparation Organizer Worksheet Individual

Web highlights of the simplified option: Web should itemize if their total allowable deductions are higher than the standard deduction amount. A worksheet is added to provide a reasonable method to. This list is a great quick reference guide. Web there are two ways to calculate the qbi deduction:

Objectives at the end of this lesson, using your. Web 31t *certified specialist in taxation law, state bar of california board of legal specialization †also licensed in idaho, illinois and texas tax year 2022. Web small business worksheet client: Web if you are filing schedule c (form 1040) to report a business use of your home in your trade or business and you are using the. Using the simplified worksheet or the complex. Web highlights of the simplified option: Web download your free copy of our business expense categories worksheet. This list is a great quick reference guide. Web 2022 small business tax deductions checklist. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. Web there are two ways to calculate the qbi deduction: Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Check it twice, and make sure you're claiming. Standard deduction of $5 per square foot of home used for business (maximum. Web introduction this publication provides general information about the federal tax laws that apply to you if you are a self. Web a method to track losses or deductions suspended by other provisions. Web should itemize if their total allowable deductions are higher than the standard deduction amount. Id # tax year ordinary suppliesthe purpose of. A worksheet is added to provide a reasonable method to. Web a sample worksheet to use when organizing your home based business tax deductions.

Web Introduction This Publication Provides General Information About The Federal Tax Laws That Apply To You If You Are A Self.

Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year,. Standard deduction of $5 per square foot of home used for business (maximum. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Check it twice, and make sure you're claiming.

Using The Simplified Worksheet Or The Complex.

Web small business worksheet client: Web the qualified business income (qbi) deduction allows you to deduct up to 20 percent of your qbi. Web should itemize if their total allowable deductions are higher than the standard deduction amount. Web a sample worksheet to use when organizing your home based business tax deductions.

Web You Can Generally Deduct The Amount You Pay Or Reimburse Employees For Business Expenses Incurred For Your Business.

Id # tax year ordinary suppliesthe purpose of. Web highlights of the simplified option: This list is a great quick reference guide. Web a method to track losses or deductions suspended by other provisions.

Web 31T *Certified Specialist In Taxation Law, State Bar Of California Board Of Legal Specialization †Also Licensed In Idaho, Illinois And Texas Tax Year 2022.

Web 2022 small business tax deductions checklist. Home based business tax deductions. Web you can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business,. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,.